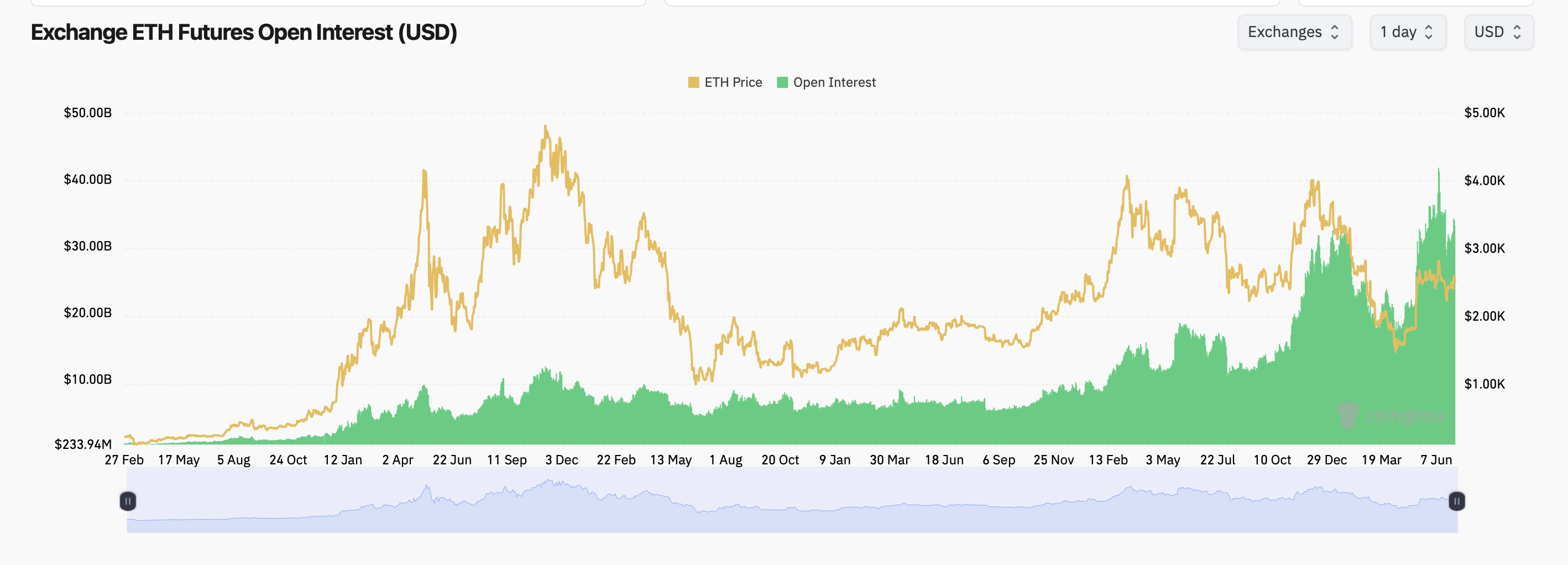

Ethereum futures essentially allow speculation on ETH’s future price without owning the asset outright. Current OI, reflecting active contracts’ total value, stood at $33.09 billion (13.29 million ETH) across exchanges.

Source: Coinglass.

The market saw a 2.79% aggregate decline over 24 hours, though Gate.io and Bitget posted gains of 1.17% and 0.86%, respectively. CME Group and Binance lead the futures market. CME held $3.19 billion (9.64% market share), while Binance maintained the largest position at $6.26 billion (18.9%).

The open interest-to-daily-volume ratio of 0.6366 indicates moderate trading activity relative to outstanding contracts. Most platforms recorded OI decreases, with Kucoin down 17.37% and OKX falling 6.27%.

In options trading, which provides rights to buy (calls) or sell (puts) ETH at set prices, open interest heavily favors calls. These represent 65.87% of all open options contracts (1,717,477 ETH), signaling bullish long-term expectations. The most notable contracts include the December 25, 2025 $6,000 call and July 25, 2025 $3,000 call.

However, 24-hour options trading volume revealed stronger put activity. Puts accounted for 55.58% of volume (527,705 ETH traded), suggesting near-term hedging or bearish positioning. This contrast between open interest and trading volume creates market tension.

The most actively traded contracts featured nearer-term expirations like the July 25, 2025 $3,000 call and December 25, 2025 $4,000 call. Futures data indicates a substantial though slightly contracting market. Options open interest shows pronounced bullish sentiment for late 2025, epitomized by the December $6,000 call.

However, the dominance of put trading volume (55.58%) introduces a counter-narrative of near-term caution for ethereum. Objectively, while long-term expectations lean bullish, heightened put activity reflects significant hedging or bearish bets, preventing a definitive bullish outlook.

Futures data shows a large, slightly retreating market. Options OI leans strongly bullish, especially for late 2025 ($6,000 Dec calls). However, the surge in put trading volume (55.58%) introduces prudence.

Objectively, the high call OI suggests dominant bullish expectations, but elevated put trading implies significant near-term hedging or bearish bets, preventing a purely bullish verdict.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。