Key Summary

Katana Network is a Layer-2 blockchain focused on DeFi, aiming to integrate fragmented liquidity and provide sustainable yields.

The native token KAT is used for governance voting, fee sharing, and liquidity incentives, with a total supply of 10 billion and a lock-up period of 9 months.

Core on-chain applications include spot trading with Sushi, lending protocol Morpho, and perpetual contract platform Vertex, all supported by on-chain self-operated liquidity.

Users can obtain KAT through Polygon POL airdrops, early Krates deposits, or ongoing vaults; however, they should be aware of the risks associated with contract complexity and unlocking volatility.

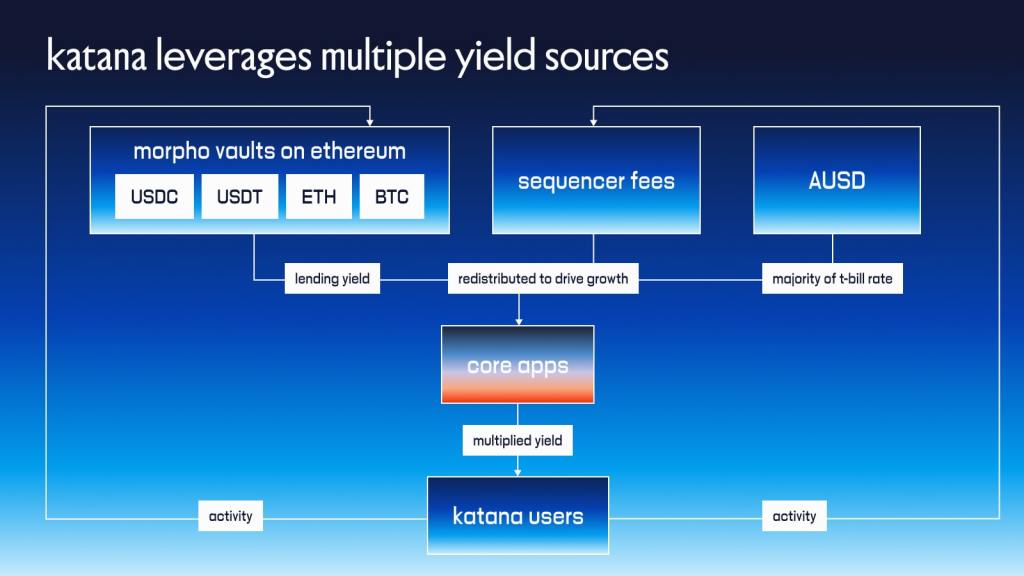

Katana Network (KAT) is a Layer-2 blockchain designed specifically for DeFi, co-developed by Polygon Labs and GSR, with the goal of addressing the liquidity fragmentation issue on Ethereum. Imagine a unified liquidity pool shared by an integrated AMM like Sushi, a unified lending protocol like Morpho, and a perpetual contract platform like Vertex. This means lower slippage and more stable sources of yield, including sequencer fees, VaultBridge strategies, and core protocol revenues.

KAT is the native token of Katana, driving platform governance, fee distribution, and incentive mechanisms. Want to understand what Katana Network is, the uses of the KAT token, and how to participate? Keep reading!

Table of Contents:

Introduction to Katana Network

KAT Token Economic Model, Distribution, and Destruction Mechanism

Core Applications and Ecological Projects of Katana Network

How to Participate in the Katana Ecosystem and Obtain KAT

Competitive Landscape Analysis of Katana Network

Risks and Precautions of KAT Token

Future Prospects of the Katana Project

Overview of Katana Network (KAT) Project

Katana Network is a Layer-2 network focused on DeFi, co-developed by Polygon Labs and GSR. Its core philosophy is to no longer let liquidity be fragmented across dozens of protocols, but to concentrate it into three key modules:

Sushi v3 for spot trading

Morpho providing lending functionality

Vertex focusing on perpetual contract trading

This "liquidity concentration" architecture brings deeper capital pools, lower slippage, and a more stable trading experience.

Image Credit: Katana Network dApp Interface

Core Design Principles:

Unified Liquidity: One AMM (Sushi v3), one lending protocol (Morpho), and one perpetual contract DEX (Vertex) to avoid liquidity fragmentation.

On-chain Self-operated Liquidity (CoL): Sequencer fees and core application revenues are pooled into an on-chain treasury, ensuring sufficient liquidity even during market fluctuations.

Embedded Yield (VaultBridge): Assets can earn yield in Yearn or Morpho vaults on Ethereum before bridging into Katana, achieving "earn upon deposit."

At the underlying architecture level, Katana uses Polygon's AggLayer for seamless cross-chain bridging and accelerates transaction finality and asset withdrawal speed through Optimism-based Rollup combined with Succinct Labs' zero-knowledge proof technology. Each transaction fee and part of the core protocol revenue will be injected into the on-chain treasury to provide market volatility protection. Meanwhile, VaultBridge allows bridged assets to start "working" before entering Katana, helping you earn from the moment it goes live.

Image Credit: Katana Network Blog

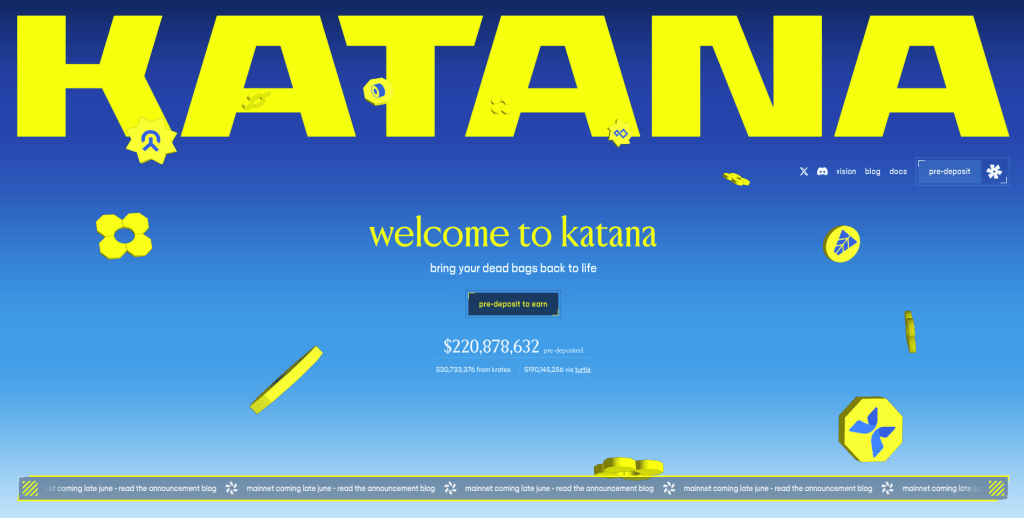

Katana launched its private mainnet in May 2025 and plans to fully open by the end of June. The native token KATANA has been distributed to POL stakers and early liquidity providers, primarily for governance voting, fee sharing, and ecological incentives. Katana uses ETH as Gas, and its governance mechanism is more aligned with long-term interests, aiming to serve DeFi traders, liquidity providers, and dApp developers seeking sustainable yields.

Image Credit: Katana Network Blog

Katana (KAT) Token Economic Model, Distribution, and Destruction Mechanism

Total Supply and Uses

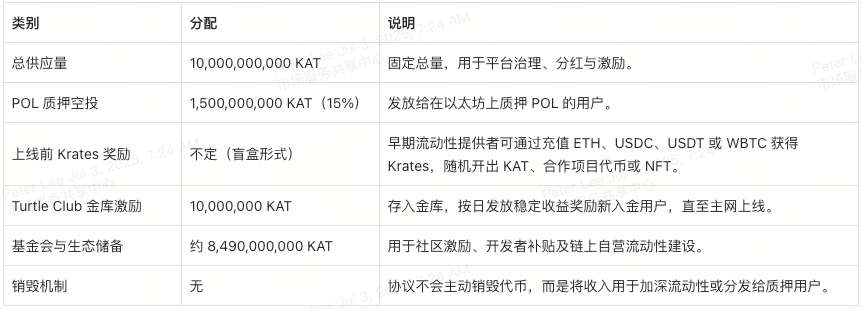

KATANA (token abbreviation: KAT) has a total issuance of 10 billion tokens, primarily used for governance voting, fee sharing, and ecological incentives.

Distribution Methods

15% airdropped to POL stakers: Approximately 1.5 billion KAT will be distributed to users staking POL on Ethereum.

Krates Reward Program: Users who provide liquidity before launch can obtain KAT, partner project tokens, and NFTs through "Krates blind boxes."

Ongoing Incentive Program: 10 million KAT are reserved in the Turtle Club treasury to provide daily fixed yields for new funds.

Ecological Reserves and Foundation: The remaining tokens mainly support developer incentives, community subsidies, and market liquidity maintenance.

Lock-up Period Explanation

All KAT distributed at launch will be locked for 9 months to avoid initial selling pressure and encourage long-term participation in the ecosystem. The earliest unlocking is expected in February 2026, but it may be opened earlier if the community reaches a consensus.

Token Uses and Governance Mechanism

vKAT Governance Voting: Locking KAT can be exchanged for vKAT, which is used to participate in governance proposals and voting based on the ve(3,3) model.

Fee Sharing: Users staking vKAT can receive a share of platform fees, lending interest spreads, and treasury income.

Incentive Flow Decisions: Community governance can decide how KAT rewards are distributed among protocols like Sushi, Morpho, and Vertex.

Destruction Mechanism Explanation

Katana does not have a native destruction mechanism. The project team emphasizes that this is not a project that maintains value through a "deflationary narrative," but rather through reinvesting protocol revenues into liquidity or returning to staked users, achieving what is called a real yield model.

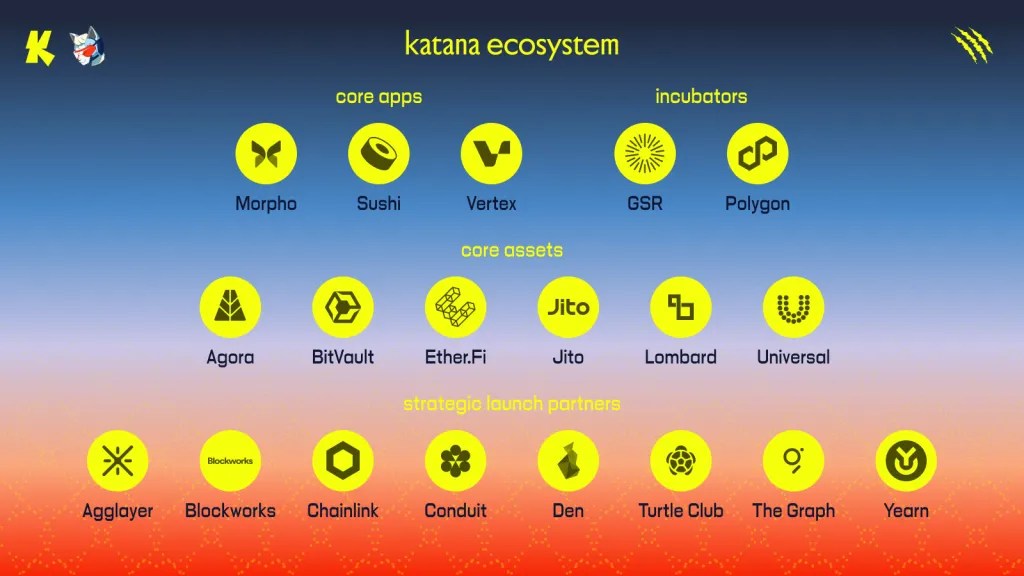

Core Applications and Ecological dApp Analysis of Katana Network

Three Core Applications

Katana's design philosophy is to concentrate liquidity into three flagship applications rather than letting protocols compete with each other and dilute capital pools.

Sushi v3 (Spot AMM)

The only automated market maker (AMM) on Katana, trading pairs such as KATANA/USDT, ETH, USDC, WBTC, etc., are all aggregated here.

With deep liquidity and low slippage, users can enjoy better buying prices, and liquidity providers can earn more stable exchange fees.

Morpho (Lending Protocol)

Provides optimized lending rates through a combination of peer-to-peer matching and shared liquidity pools.

A single market aggregates both borrowers and lenders, resulting in more stable interest rates and stronger market depth.

Vertex (Perpetual Contract DEX)

Offers high-leverage perpetual contract trading, supporting a comprehensive margin management and risk control system.

Leveraging the same on-chain self-operated liquidity support ensures deep liquidity even for high-leverage trades.

Image Credit: Katana Network Blog

Native Asset Protocol

In addition to core dApps, Katana natively supports multiple asset types:

AUSD (Agora USD): A stablecoin backed by real assets, with stability fees returned to users.

LBTC (Lombard Bitcoin): An interest-earning wrapped asset for BTC, allowing your Bitcoin to "work for you."

Liquid Staking Assets: Such as stETH from Ether.fi and stSOL from Jito, which can bring Ethereum and Solana staking yields into the Katana network for cross-chain yield integration.

Yield Infrastructure

VaultBridge bridging strategy: Users' cross-chain assets can first be directed into Yearn or Morpho vaults on Ethereum before arriving at Katana, starting to earn yield upon deposit.

On-chain self-operated liquidity (CoL): Protocol fees and treasury income are automatically injected into the core liquidity pool, maintaining market stability and alleviating volatility.

Ecological Integration Projects

Katana is integrating with several top projects to build a robust DeFi infrastructure:

Turtle Club: Provides transparent treasury strategies and continues to reward users with KATANA.

Chainlink and The Graph: Provide price oracle and data indexing support.

Den: Used for the governance interface frontend; Blockworks provides media exposure to continuously expand Katana's market awareness.

Katana is building an interconnected, focused DeFi ecosystem where all applications and assets converge into a single "liquidity flywheel," allowing for a more efficient, predictable, and profitable user experience.

Image Credit: Katana Network

How to Participate in the Katana Ecosystem and Obtain KAT Tokens

To obtain KAT tokens, there are several ways to participate, whether you are an early supporter or a later user, there is a suitable path for you:

1. POL Airdrop Claim

- Stake your POL on Ethereum before the snapshot date to automatically receive 15% of the total KAT supply proportionally.

2. Pre-launch Krates Activity (Ended)

Early users deposited ETH, USDC, USDT, or WBTC into Katana's Krates contract to receive "blind box" rewards.

Each Krate contains KAT and partner project tokens, which will be unlocked upon mainnet launch, with a 9-month token lock-up period.

3. Turtle Club Treasury

Before the mainnet launch, users can still deposit the aforementioned assets into the Katana treasury provided by Turtle Club.

The treasury yield is publicly transparent, and KAT rewards can be claimed daily after the mainnet launch.

4. Free Trading After Launch

Once KAT is unlocked and transferable, it can be traded on Sushi for KAT/USDT, and can also be bought and sold on centralized exchanges (such as XT.com).

– You can also add liquidity for KAT to earn exchange fees and incentive rewards.

5. Staking for Governance Participation

– Lock your transferable KAT to mint vKAT.

vKAT can be used to participate in community governance proposal voting and enjoy platform fee sharing.

Whether you are a DeFi player or an ecosystem builder, KAT is an important pass for you to participate in the Katana network.

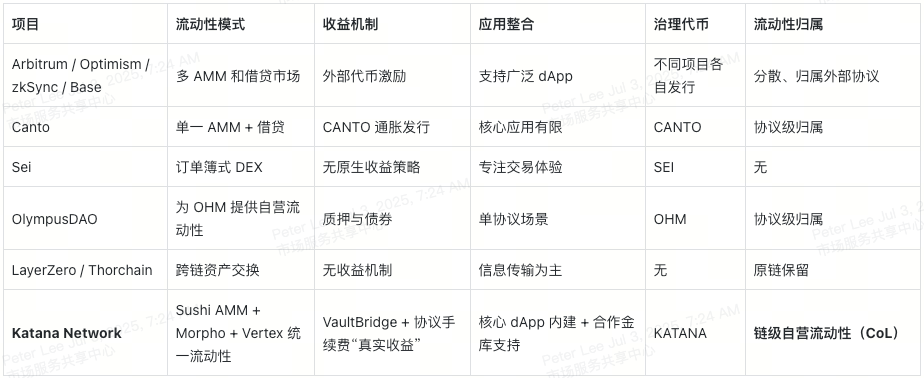

Competitive Landscape Analysis of Katana Network

In the increasingly competitive landscape of DeFi and Layer-2, Katana Network takes a different approach, focusing on "unified liquidity" and "real yield," distinguishing itself from the incentive logic and liquidity architecture of mainstream projects. Below is a comparison of major competing projects:

General Layer-2 Projects:

Mainstream Model: Projects like Arbitrum, Optimism, zkSync, and Base typically integrate multiple AMMs and lending protocols, with liquidity divided among various platforms and tokens, resulting in lower capital efficiency.

Katana's Advantage: Katana only provides one AMM (Sushi), one lending protocol (Morpho), and one perpetual contract platform (Vertex), concentrating liquidity to form deeper capital pools. At the same time, through on-chain self-operated liquidity (CoL) and the VaultBridge cross-chain yield mechanism, it offers users a more sustainable real yield experience.

DeFi-focused Public Chains:

Canto: Issues incentives based on an inflation model, only integrating AMM and lending, lacking a long-term yield model.

Sei: Focuses on high-performance order book DEX but lacks native yield distribution.

Katana: Integrates spot trading, lending, perpetual contracts, and cross-chain yields, providing a one-stop solution for all core DeFi needs.

Comparison of Protocol Self-operated Liquidity Models:

OlympusDAO: Focuses on OHM self-held liquidity but is limited to a single protocol scope.

Katana: Expands "protocol self-operated liquidity" to "chain-level self-operated liquidity," continuously injecting depth into core applications across the entire network.

Cross-chain Liquidity Aggregation:

LayerZero and Thorchain: Provide cross-chain asset exchanges, but liquidity remains dispersed in the original chains.

Katana: Bridges cross-chain assets into the ecosystem through VaultBridge, achieving liquidity retention and efficient utilization.

Polygon Ecological Synergy:

As a strategically supported project by Polygon Labs, Katana airdrops 15% of its tokens to POL stakers. Additionally, it fills functional gaps in other Rollup projects like Polygon zkEVM, becoming a DeFi hub within the Polygon ecosystem.

Risks and Precautions of KAT Token

When participating in the Katana network and its tokens, users should be aware of the following key risks:

1. Security Complexity

Katana integrates multiple protocols (VaultBridge, Sushi, Morpho, Vertex), and although it has been audited, the overall attack surface is large.

Some system revenues come from off-chain vaults like Yearn and Morpho; if external protocols experience vulnerabilities, it may affect asset security.

2. Insufficient Decentralization

Currently, the sequencing service is provided by Conduit, and the cross-chain bridge relies on Polygon's AggLayer, which presents certain centralization and single point of failure risks.

The project team has planned for complete decentralization in the future, but it has not yet been realized.

3. Liquidity and Withdrawal Issues

User assets may earn yield off-chain; if large-scale withdrawals occur, it may put pressure on the reserve pool and on-chain self-operated liquidity (CoL).

In extreme market conditions, withdrawals may experience delays.

4. Economic and Market Risks

Yields depend on DeFi activities and the performance of external strategies; if the market is sluggish, returns will be compressed.

The KAT tokens from airdrops and treasury rewards are locked for 9 months (expected to unlock in February 2026), and unlocking may cause price volatility.

5. Regulatory Uncertainty

- – Katana manages liquidity and yield at the chain level, and some regions may view it as a security or banking-related business, potentially facing regulatory pressure.

Katana (KAT) Development Prospects

Positive Signals

Support from Polygon Labs and GSR: Brings funding, resources, and early liquidity to the project.

POL airdrop establishes a foundational user base: A natural community foundation helps the network launch quickly.

Real yield mechanism: Combining VaultBridge and on-chain self-operated liquidity (CoL), if it can continuously provide competitive annual yields, it will become a core advantage of Katana.

Image Credit: Katana Network

Future Challenges

Unlocking period volatility: After unlocking in early 2026, a large circulation of KAT may trigger price fluctuations.

Security and execution: The system integration is complex, requiring assurance of security and stability while advancing development milestones according to the roadmap.

Competitive pressure: Other Layer-2 projects may replicate its incentive mechanisms, making continuous innovation crucial.

Summary

The market's overall attitude towards Katana is cautiously optimistic. If it can maintain stable yields, keep liquidity deep, and strengthen governance mechanisms, it is expected to attract TVL from the Ethereum mainnet, neutral Rollups, and other DeFi public chains. The ultimate success or failure of the project depends on execution capability, security assurance, and community governance participation.

Frequently Asked Questions about Katana (KAT)

Q1: What is Katana Network (KATANA)?

Katana Network is a Layer-2 blockchain focused on DeFi, jointly developed by Polygon Labs and GSR. It integrates spot trading from Sushi, lending features from Morpho, and perpetual contracts from Vertex, while providing on-chain self-operated liquidity and built-in yield strategies, aiming to build deeper market liquidity and more stable return mechanisms.

Q2: What is the KATANA token? What is it used for?

KATANA (abbreviated as KAT) is the native token of the platform, with a fixed total supply of 10 billion. Users can lock KAT to generate vKAT, which can be used to participate in community governance voting, receive protocol fee sharing, and determine the incentive direction for Sushi, Morpho, and Vertex. All tokens are distributed through airdrops or early liquidity incentives, with no private rounds or institutional allocations.

Q3: How can I check the real-time price of KATANA?

Once KAT is tradable, you can check the real-time market for KATANA/USDT on Katana's Sushi DEX or centralized exchanges like XT.com. Data platforms like CoinGecko and CoinMarketCap will also display price charts and historical trends.

Q4: How do I trade KATANA/USDT on Katana? Visit the official website app.katana.network, connect your wallet (supports MetaMask, WalletConnect), and import assets through the AggLayer cross-chain bridge, then you can exchange KAT and USDT on Sushi.

Q5: Where can I follow official updates from Katana?

You can follow the official account on X (formerly Twitter) @katana, read the project blog, or join the Discord community through links on katana.network to get first-hand information and updates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。