In early July, the well-known brokerage Robinhood announced its "stock tokenization" plan, which sparked heated discussions. In addition, they also revealed plans to open "equity derivatives" for two unlisted companies, OpenAI and SpaceX. However, prior to them, on June 25, the crowdfunding investment platform Republic announced that it would issue the Mirro Token, which is linked to the performance of SpaceX's unlisted stock, along with options from dozens of other well-known "unlisted companies."

What is the difference between the mirror tokens from this established crowdfunding platform, which has been operating for nearly 10 years, and Robinhood's "equity derivatives"? How can we find opportunities on this platform?

What is Republic?

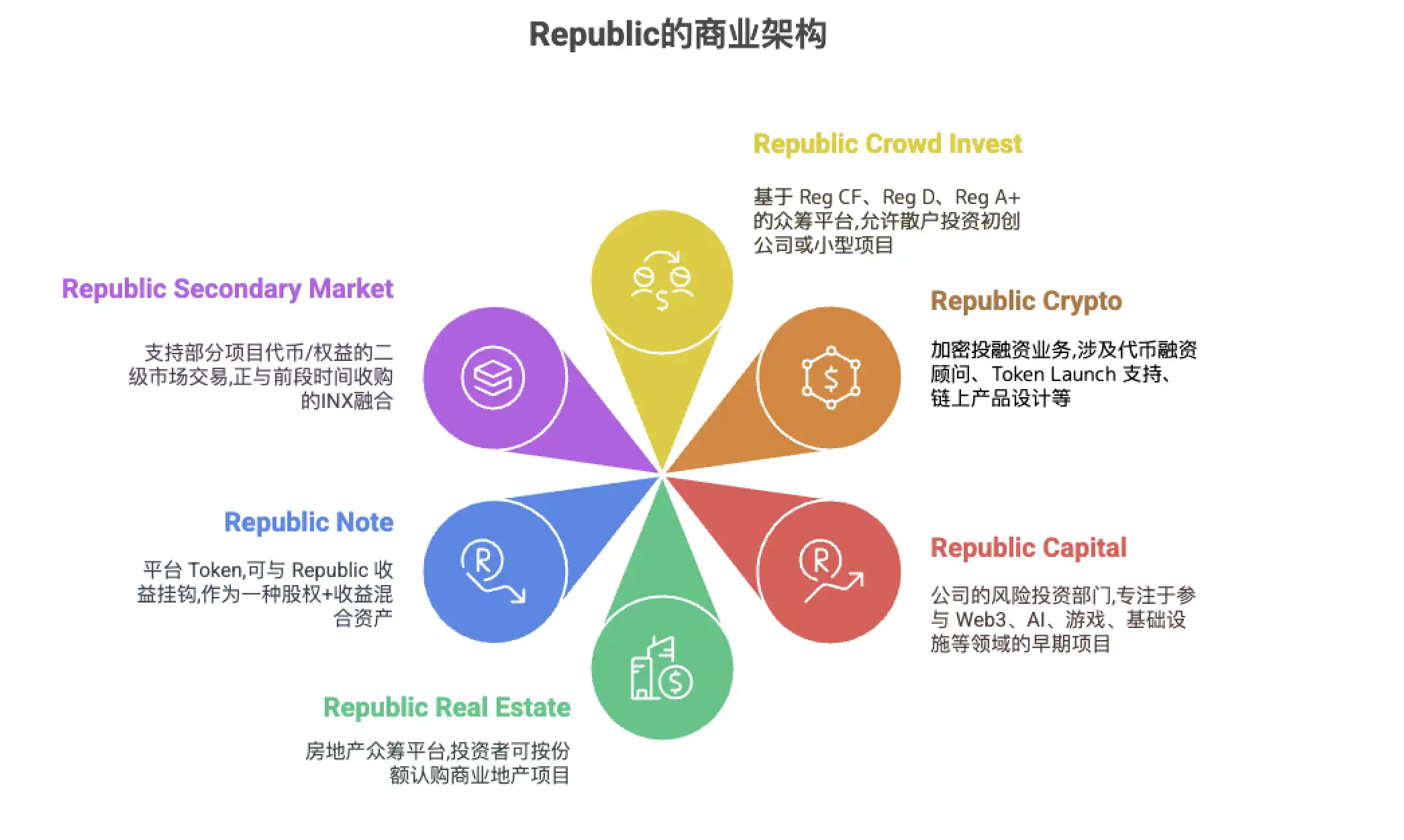

Founded in 2016 and headquartered in New York, Republic is a fintech platform focused on private equity and alternative asset investments. Its core philosophy is to "open investment opportunities in unlisted companies to retail investors," significantly lowering the threshold for ordinary investors to participate in risk assets through compliance innovation and technological means. Since the implementation of the JOBS Act and the era of equity crowdfunding, Republic has developed a full-stack private investment ecosystem covering diverse asset classes over nine years of exploration.

Its structure includes a crowdfunding financing platform for startups and small projects, Republic Crowd Invest, which operates based on U.S. Regulation Crowdfunding (Reg CF) rules; Republic Crypto, which provides investment and consulting services in the blockchain field and acquired the regulated digital asset trading platform INX for a maximum valuation of $60 million; Republic Capital, a venture capital department focused on early-stage project investments in Web3, artificial intelligence, gaming, fintech, and other fields; and Republic Real Estate, which holds real estate assets using an SPV structure, allowing investors to subscribe to RWA real estate projects in shares.

Through this diverse business layout, Republic has created a closed-loop ecosystem that spans from primary market fundraising to secondary market trading. It serves both startups (providing fundraising channels and value-added services) and global investors (offering innovative investment products and exit routes). As Republic states in its introduction, its mission is to integrate traditional finance with blockchain innovation within a compliant framework, opening the previously closed private market to the public.

Are Mirror Tokens just air?

Mirror Tokens are a new product category launched by Republic this year, which can be seen as an on-chain derivative linked to the performance of unlisted company equity. Unlike directly holding private equity, Mirror Token holders do not enjoy voting rights or ownership in the company; instead, they receive a tradable debt certificate (promissory note) that grants them rights to future "liquidity event" earnings of the target company through a specially designed contract. Issuers like Republic LLC hold relevant rights or reference indicators of the target company on behalf of investors, and when the company undergoes an IPO, is acquired, or experiences other exit events, Token holders will receive cash returns equivalent to the appreciation of their shares based on their holdings.

For example, the first token launched by Republic, rSpaceX, initially anchors its value to the price of SpaceX stock in the secondary market (reported to be in the range of $225 to $275 per share, with SpaceX's latest valuation around $350 billion to $420 billion). After purchasing rSpaceX at this price, if the future IPO pricing or acquisition valuation of SpaceX exceeds this level, Republic will return the price difference to token holders in the form of stablecoins. Additionally, in the event of company dividends, profits may also be distributed proportionally. Throughout this process, investors do not need to actually hold SpaceX stock but can obtain almost "equivalent shareholder" economic benefits.

It is important to emphasize that Mirror Tokens are not officially issued by the target company and do not have its endorsement; investors are not purchasing any shares or rights of SpaceX, and their claims can only be made against the issuer, RepublicX LLC. On July 1, Republic's Co-CEO Andrew Durgee was interviewed by well-known business host Liz Claman on Fox News, where Liz expressed concern upon hearing that Mirror Tokens do not represent share ownership, saying, "That makes me a bit worried; it reminds me of that 'Brooklyn Bridge scam,'" and half-jokingly asked, "How do you ensure that investors are not playing with 'air'?"

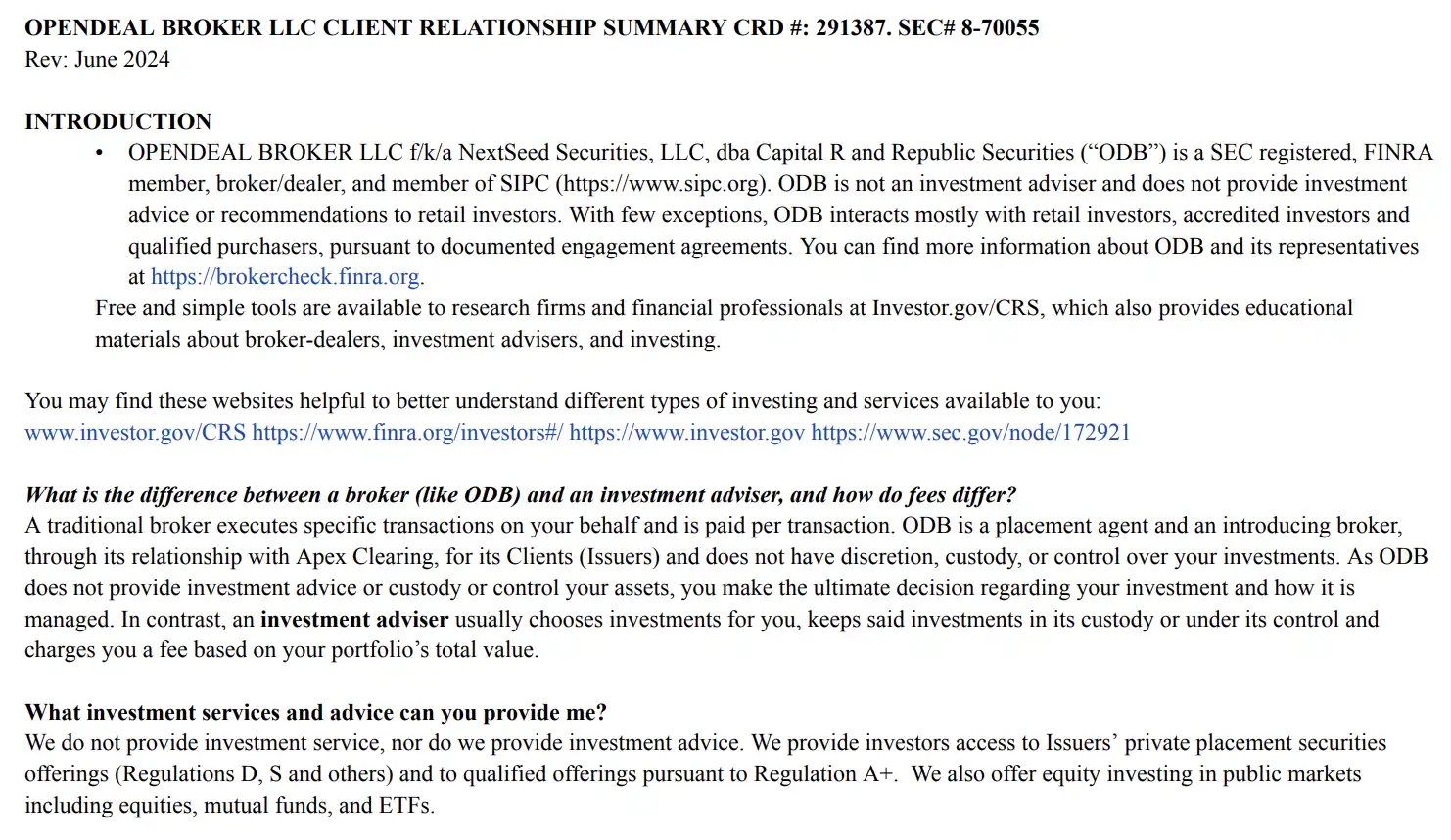

Indeed, this form may sound too much like "air" at first glance. In response, Republic's Co-CEO Andrew Durgee stated, "All details are publicly disclosed in the Form C documents submitted to the SEC. The entire process is fully compliant and filed; we are regulated by FINRA and the SEC. Moreover, we have been doing this model for eight years, and no one has more experience than us. Now we are combining this mechanism with tokenization, which is an unprecedented structure."

According to the ongoing process of rAnthropic, the entire path begins with Republic establishing a dedicated issuing entity (in this case, Opendeal Broker LLC), which exists as a special purpose vehicle (SPV) responsible for externally carrying the indirect economic rights related to the target company. Republic will launch a reservation page for the project on its platform, where investors can register their interest but cannot actually invest at this stage.

Once the reservation phase ends and formal financing is ready to start, Republic will formally submit Form C documents to the SEC in accordance with Regulation Crowdfunding (Reg CF) regulations, detailing the project's financing cap, token price, contract terms, potential risks, and funding usage plans. Once Form C receives valid approval, investors can pay their investment amounts through the Republic platform using Apple Pay, credit cards, bank transfers, or USDC, with funds temporarily held in a third-party escrow account to ensure they are only released once the project meets the minimum financing requirements.

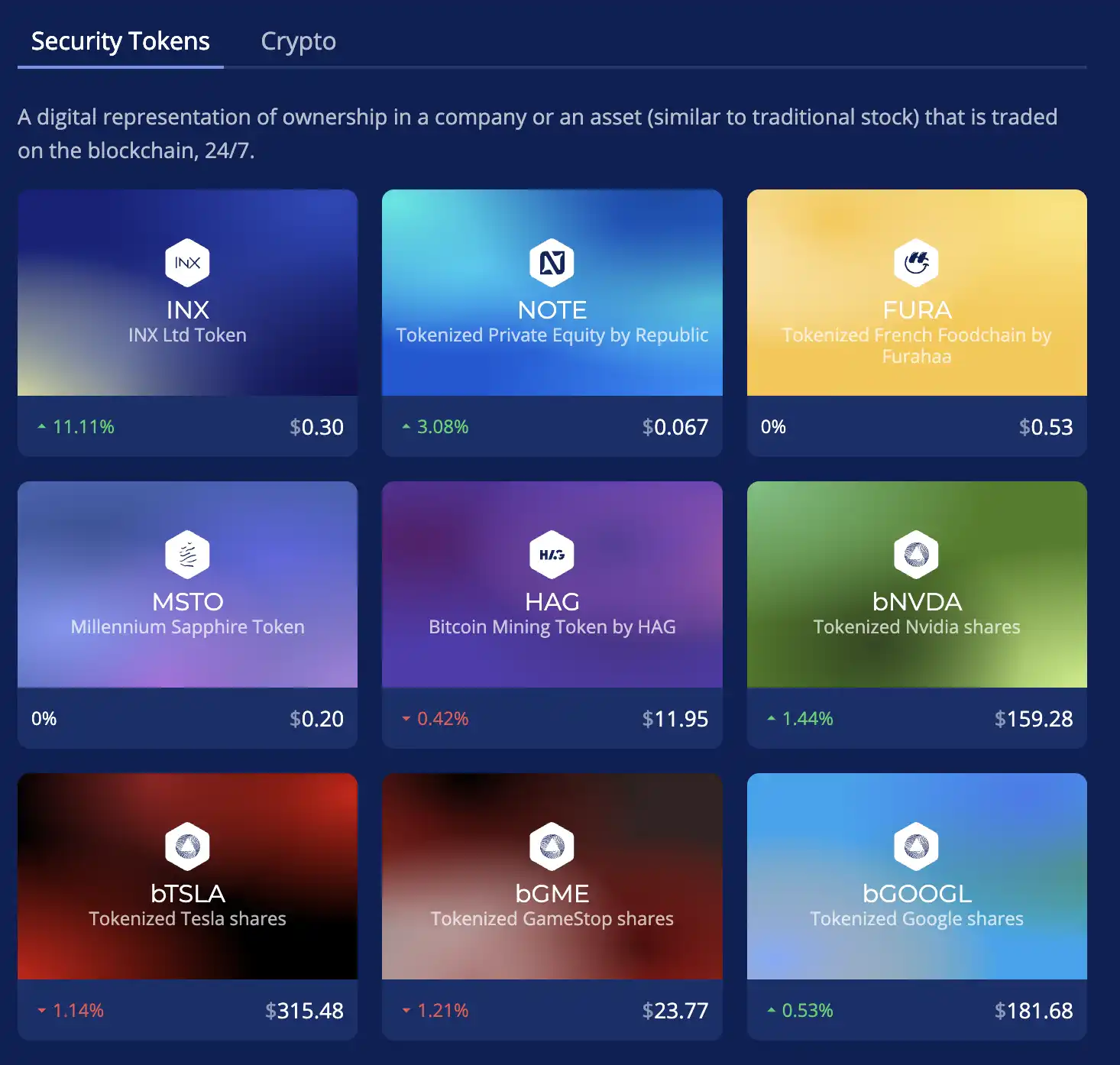

After confirming the receipt of funds, Republic will mint a corresponding number of Mirror Tokens on-chain that match the investment amount, which will immediately enter a 12-month lock-up period (as stipulated by the Reg CF Act). After the lock-up period ends, holders can choose to transfer their tokens to regulated secondary markets like the INX exchange (acquired by Republic for $60 million in April this year) for free trading.

When the target company undergoes an IPO, is acquired, or experiences other liquidity events, the issuing SPV will trigger a redemption mechanism, returning earnings to investors in the form of stablecoins based on the number of Mirror Tokens they hold. The advantage of this mechanism is that it maximizes the ability of global retail investors (including those in the U.S.) to enjoy the growth dividends of unlisted star companies while ensuring legal compliance.

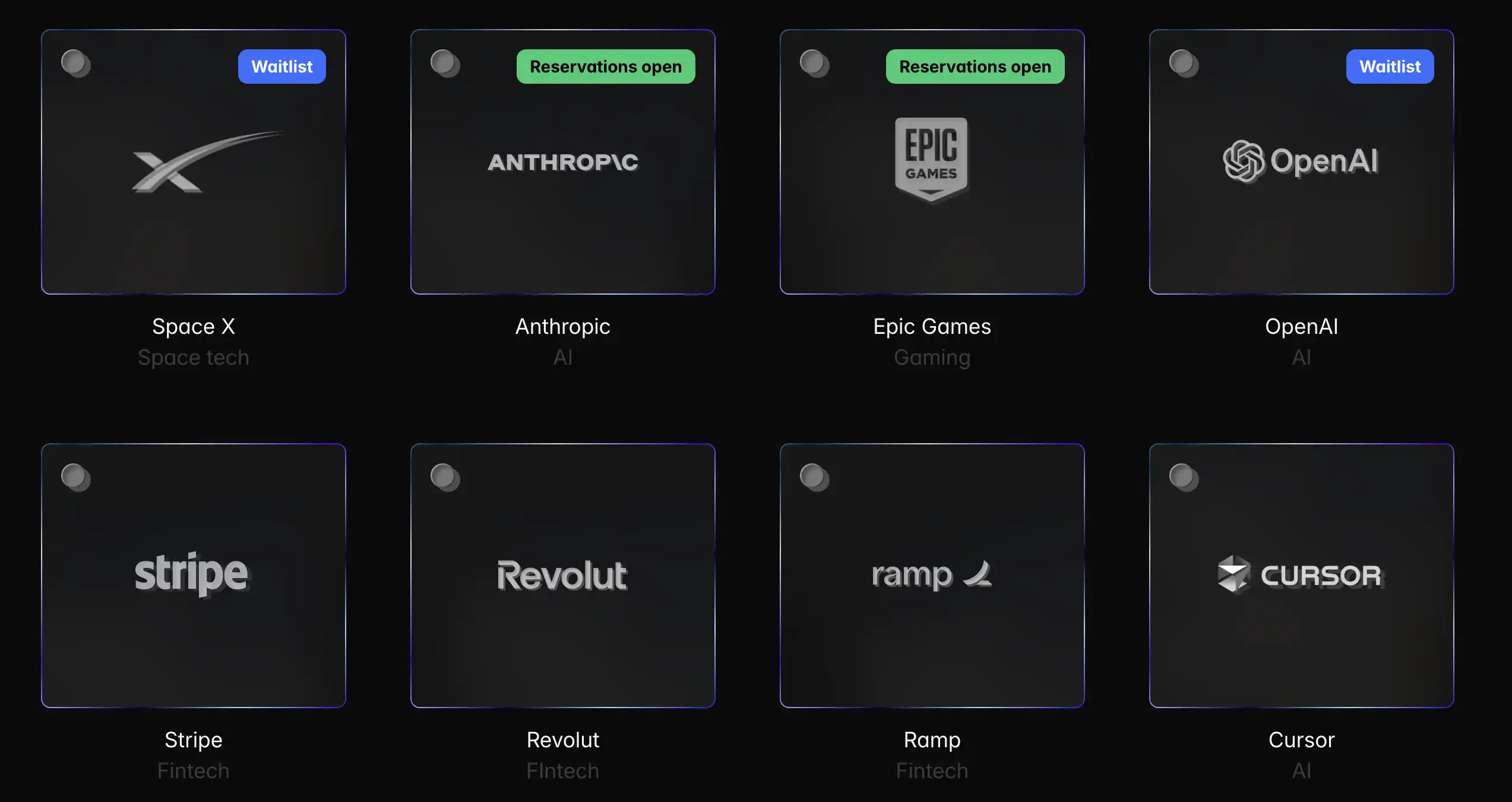

Can you still buy the "highest valued" tech company Figma on Republic that will IPO this year?

The current platform has opened or pre-heated targets including SpaceX, OpenAI, Anthropic, Epic Games, and other globally prominent unlisted giants, representing core assets in key future industries such as space technology, artificial intelligence, and gaming entertainment. Among them, SpaceX's valuation in the private market has soared to between $350 billion and $420 billion, while OpenAI and Anthropic lead the industry competition in generative AI technology and have received strategic backing from tech giants like Amazon and Google. Epic Games is well-known among global players for its Unreal Engine and gaming matrix.

Notably, Figma, as a leader in collaborative design software, was originally one of the targets that Republic claimed could be "mirrored." As of an internal stock buyback in May 2024, Figma's valuation was approximately $12.5 billion, a 25% increase from its $10 billion valuation in 2021. The company's annual revenue is growing rapidly, with an ARR of $600 million in 2024, and it has achieved breakeven. However, unlike many unicorns that choose long-term privatization, Figma decided to go public after its acquisition plan by Adobe, which had a valuation of $20 billion in 2023, fell through.

In April 2025, Figma secretly submitted its IPO application, expecting to raise $1.5 billion. It may soon be able to exit through an IPO, but it is unclear whether this has caused communication issues with the "intermediate equity holder" company. Although previously promoted multiple times, Figma has not appeared on the latest Mirror Token page. However, Figma's case highlights the dilemma faced by current unicorn companies: either remain private for a long time, leaving retail investors longing, or risk an IPO for liquidity. Regardless of the path taken, the emergence of platforms like Republic provides these companies with a third option and builds a bridge for investors between the two states.

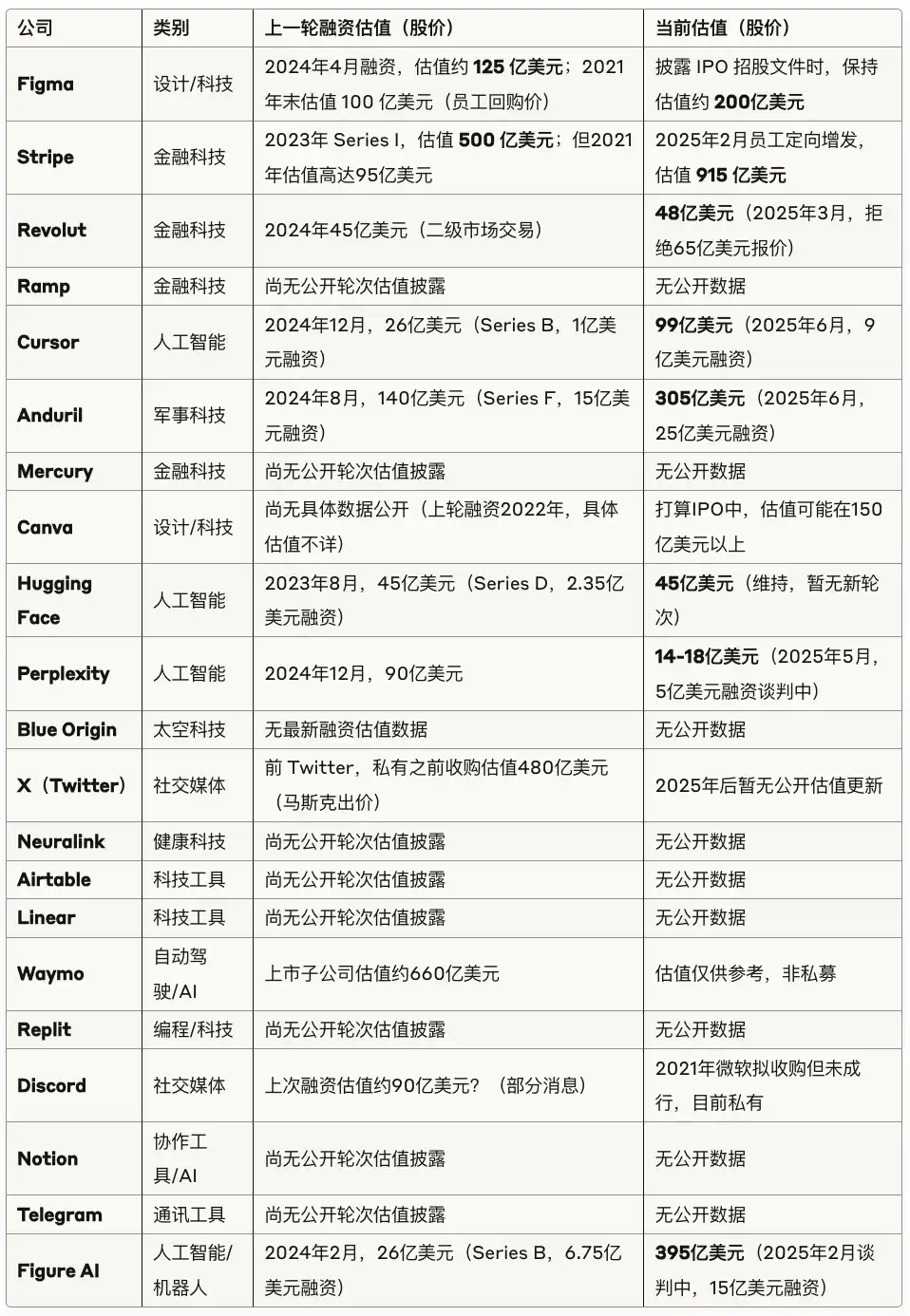

In addition to the aforementioned companies, Republic is actively expanding its list of investable targets. Republic has revealed plans to launch Mirror Tokens covering over 20 companies, including Ramp (a fintech unicorn), Cursor, Perplexity (AI), Stripe (a payment unicorn), and Waymo (autonomous driving). Some of these companies have valuations reaching tens of billions of dollars, while others are still in the early stages of rapid growth. Through the Mirror Token mechanism, investors may obtain corresponding returns from Republic as these companies develop rapidly.

Robinhood VS Republic: When Financing Platforms Meet Brokerages?

Robinhood and Republic have both turned their attention to the on-chain securitization of unlisted unicorns, but they have chosen entirely different paths: one is testing the waters in the European market outside of U.S. regulation, while the other is skillfully maneuvering within the existing compliance framework in the U.S. The differences between the two are reflected not only in their technological and compliance designs but also in their business strategies and target users. Republic has its own venture capital department and network, which may allow it to secure earlier and more exclusive project resources; Robinhood, on the other hand, has the potential advantage of attracting popular companies to collaborate due to its brand recognition and user base. For investors, this means more choices, but it also tests their judgment: they need to discern which companies have reasonable valuations and bright prospects among the many options.

Overseas Exemptions vs. Domestic Regulation

Robinhood's stock token program is currently only open to EU users, due to the strict restrictions on investments in unlisted securities in the U.S. Only accredited investors who meet asset/income thresholds can participate in private placements, and companies must comply with information disclosure requirements. By deploying its business in Europe, Robinhood has taken advantage of the relatively relaxed regulatory environment there, making it possible to offer private equity exposure to ordinary users. These tokens are issued in collaboration with the blockchain company Arbitrum and operate on the Ethereum Layer 2 network, extending trading hours to 24/7. The ambition to expand the number of tradable tokens to "thousands" reflects Robinhood's desire to bypass U.S. regulations and lead the on-chain securities revolution globally.

In contrast, Republic is taking an almost opposite route, fully adhering to the exemption clauses of current U.S. securities laws (such as Reg CF/D) to design its products, making Mirror Tokens legally classified as regulated securities. This means that each Mirror Token from Republic must submit disclosure documents (such as Form C) to the SEC and undergo FINRA review. Although the Reg CF model limits the amount of funds raised in a single round and has a longer lock-up period (which undoubtedly restricts scale and liquidity), it allows retail investors in the U.S. and some overseas markets to participate legally. The "compliance first, expansion later" approach reflects Republic's cautious handling of regulatory boundaries and its deep experience in this field (its team has been deeply involved since the JOBS Act was passed).

In comparison, Robinhood has chosen a fast track of regulatory arbitrage, while Republic dances within the regulatory cage. The former may advance more quickly in the short term and has a larger potential market, but it carries high compliance uncertainty; the latter moves slightly slower but solidifies legality with each step, laying the groundwork for future widespread promotion.

Equity Holding vs. Income Bonds

Robinhood's stock tokens are essentially equity certificates, where Robinhood itself or through an SPV holds shares of the target company and then issues on-chain tokens to users, corresponding to a certain proportion of economic rights. According to a Robinhood spokesperson, these tokens provide retail investors with "indirect exposure to the private market," backed by the SPV equity controlled by Robinhood. Therefore, it can be understood that Robinhood is acting as a "custodian broker," and users are purchasing a "slice of income rights" from Robinhood's holdings. Once the target company goes public or is sold, Robinhood may realize profits by liquidating the SPV's holdings and then distributing them to token holders.

In contrast, Republic's Mirror Tokens are closer to a pre-agreed income bond or "contract," which does not require Republic to hold an equivalent amount of underlying stock; it only needs to pay the agreed amount upon triggering events based on the number and proportion of token holders. Republic has not explicitly stated that it will hold sufficient underlying stock on a 1:1 basis; theoretically, it can choose to hedge or hold partially, giving it greater flexibility.

However, this design also means that investors need to bear the credit risk of the issuer, trusting that Republic has the ability to fulfill its obligations in the future. This is also reflected in the legal nature of the relationship between both parties and users: under the Robinhood model, users may indirectly become trust beneficiaries with shareholder rights through the SPV, while under the Republic model, users are merely creditors of Republic, with no direct legal connection to the target company.

Robinhood's model is closer to the traditional sense of "holding shares on behalf of others," which may be more intuitive in terms of aligning interests and credibility but could be more challenging to comply with legally in most countries. Republic's model cleverly bypasses direct equity issuance through innovative contracts, posing lower regulatory risks but requiring higher credibility from the issuer.

Brokerage Expansion vs. Private Equity Ecosystem

After experiencing the crypto bull market and the retail trading frenzy in U.S. stocks, Robinhood has seen a decline in user trading activity in recent years. Introducing stock/equity tokenization can help increase user engagement and revenue sources. Following the announcement, Robinhood's stock price surged nearly 10%, reaching a new high since its IPO. Robinhood CEO Vlad Tenev views stock tokenization as the "seed of a larger plan," claiming that several unicorn companies have expressed interest in joining the "tokenization revolution."

Clearly, Robinhood's ambition is to create a globally connected on-chain securities trading platform, upgrading its position from a traditional brokerage to an innovator in crypto finance. With its status as a publicly traded company, Robinhood has gained extensive support from traditional financial institutions on Wall Street, with institutional investors holding 59-63% of its shares, including asset management giants like Vanguard and BlackRock. This enables it to quickly access stocks of previously publicly traded unicorn companies.

In contrast, the launch of Mirror Tokens by Republic seems like a natural progression, as Republic is already focused on private equity and has been serving startups in financing and early-stage investments. With the prolonged IPO winter in recent years and many star startups delaying their public offerings, the disconnect between the primary and secondary markets has left ordinary investors feeling "marginalized." Republic has identified this pain point and opened its existing ecosystem's "IPO resources" directly to retail investors. Through the Mirror model, Republic can issue corresponding products without needing company authorization or participation, allowing it to design investment products around popular unicorns without having to persuade these companies to raise funds on its platform. Therefore, Mirror Tokens represent not only product innovation for Republic but also a breakthrough in its business model, shifting from merely facilitating project financing to actively packaging and selling investment opportunities.

Republic has built a unique private equity ecosystem through its deep roots in AngelList Alumni (similar to the PayPal Mafia, but not a specific organization), along with a star advisory team that includes DFJ founder Tim Draper, whose investment portfolio spans Tesla, SpaceX, Coinbase, and even Robinhood itself. This has created a rare cross-platform influence, with notable figures like Randi Zuckerberg, Mark Zuckerberg's sister, and Peter Diamandis, founder of the XPrize Foundation promoting private space travel (like SpaceX) and cutting-edge technology competitions, giving it relatively abundant early-stage unicorn equity resources.

The Future of Investment Democratization

The current trend in the investment market is increasingly moving towards "liberalization," but challenges also exist. Brokerage giants like Robinhood, with their large existing user base and brand appeal, attract significant attention from retail investors as soon as their products are launched, even prompting OpenAI to issue an official statement. However, if most "stock tokenization" projects are similar, the challenge lies in whether their models can gain long-term regulatory approval, as the U.S. SEC has never explicitly allowed ordinary retail investors to invest in unlisted equity.

On the other hand, Republic has consistently worked closely with the SEC/FINRA over the years, exploring the regulatory gray areas with relative caution and stability. The Mirror Token utilizes rules like Reg CF to achieve breakthroughs, which seems "safer" to some extent, but its investment market size limit of "$5,000" also imposes significant restrictions.

From an industry trend perspective, compliant crypto institutions, including Kraken, have begun to offer similar stock token trading to non-U.S. users this year, indicating that "on-chain securities" are gradually emerging. However, the improvement of the regulatory framework will still take time. A former SEC official has publicly stated that allowing retail investors to participate in the private market is an inevitable trend, with the key being to balance innovation and investor protection.

The specific regulations for the future remain uncertain, but it is clear that the competition between the two will drive the financial market towards a more open and efficient direction, with the boundaries between traditional secondary markets and emerging crypto markets becoming increasingly blurred. A battle for the future financial paradigm has just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。