In early July, Robinhood announced the launch of tokenized stocks for OpenAI and SpaceX, opening subscriptions to its European users and offering each person a €5 credit, marking the beginning of tokenized private equity.

However, almost simultaneously, OpenAI's official Twitter account refuted this: "These OpenAI Tokens are not OpenAI equity, we have not participated in or endorsed this plan, and any transfer of equity must be approved by us."

Tokenized private equity touts the banner of "equality," opening its doors to retail investors, yet it was slapped down by OpenAI. Is "equity tokenization" truly a breakthrough in future financial innovation, or is it a scam disguised as "equality"?

What Exactly is "Tokenized Equity"

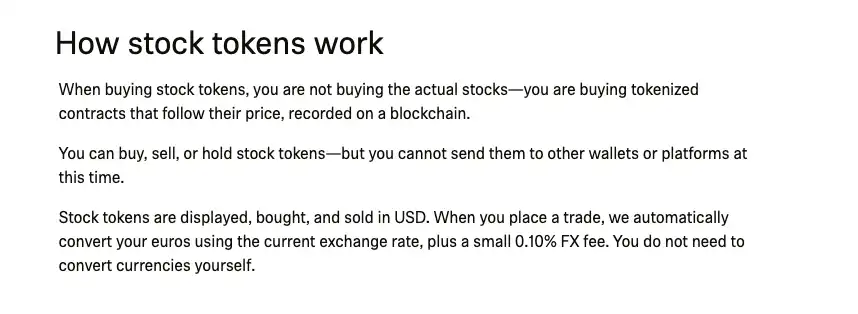

Tokenized equity does not equal equity itself; rather, it is a type of on-chain contract product anchored to stocks.

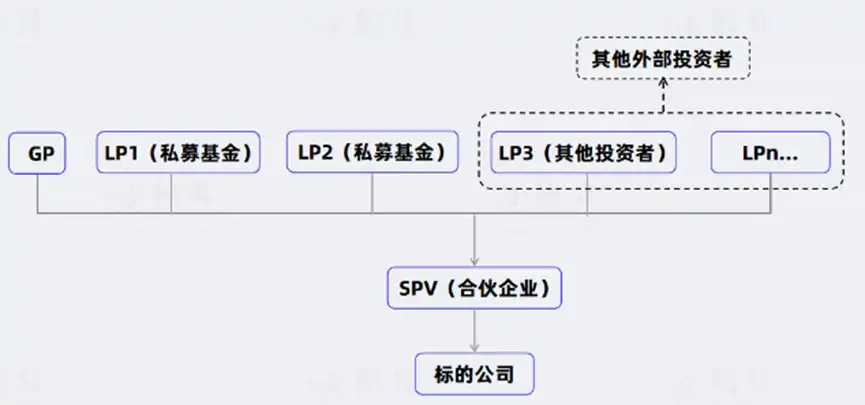

Taking Robinhood's operation as an example: it does not directly own equity in OpenAI but holds a share of an SPV (Special Purpose Vehicle) that possesses OpenAI shares. Robinhood then tokenizes this portion of indirect ownership's "economic rights," linking it to the valuation changes of OpenAI, and circulates it on its crypto trading platform.

In the structure of tokenized equity, the SPV is an unavoidable core intermediary. Simply put, an SPV is a specially established "shell company" or "channel" used to hold the actual equity of the target company. The platform does not sell company stocks directly; instead, it allows the SPV to hold shares first, then "packages" the SPV's rights into tokens issued to users. The benefit of this approach is that it circumvents the legal and regulatory restrictions of direct equity transfer, but it also means that the tokens purchased by users do not represent shareholder status in companies like OpenAI or SpaceX, but rather indirect ownership of this intermediary.

In other words, what users are purchasing is not OpenAI stock, nor shares of the SPV, but a token contract based on the performance of OpenAI's stock price. Robinhood explicitly states in its help documentation: "What you are buying is not real stock, but a contract recorded on the blockchain."

Legally speaking, these tokens do not possess any voting rights, information rights, nor do they represent actual ownership of OpenAI. They are more like a "valuation tracker," similar to structured products in over-the-counter trading—only this time, the trading platform is blockchain.

In fact, Robinhood is not the first to venture into this territory. Prior to it, several platforms had attempted to bring "primary market rights" onto the blockchain.

Investment platform Republic launched the Mirror Token product in June this year, with the inaugural project rSpaceX, using the Solana chain as a vehicle, anchored to SpaceX's valuation performance. The minimum threshold for the token is $50, and users can purchase it via Apple Pay or stablecoins. The Mirror Token is not equity and does not represent ownership; rather, it is a debt instrument linked to the dynamic valuation of the target company. When the company goes public, is acquired, or experiences other "liquidity events," Republic will return stablecoins to investors based on the token ratio.

Another platform, Jarsy, adopts a "traceable on-chain, physical off-chain" approach. It first purchases the target company's equity in the actual primary market and maps the economic rights 1:1 onto the blockchain as tokens. The total amount, flow, and holding information of these tokens are fully visible on-chain, and users can participate using USDC or credit cards, with a minimum investment threshold of just $10. This is not a simple securities mapping but a substantial transfer of economic rights.

A Struggle Over Equity Pricing?

Under the tweet where OpenAI denied any collaboration with Robinhood, Elon Musk commented, "Your equity is fake," clearly indicating that different ideological camps have emerged behind this financial equality movement.

The robotics company Figure AI has sent cease and desist letters to two brokerage platforms promoting its stock in the secondary market, stating that they had not obtained board approval to promote the company's stock. A spokesperson for Figure stated that the company "will continue to protect itself from interference by third-party brokerage platforms" and emphasized that all stock transactions must be authorized by the board.

Several secondary market platforms that received Figure's legal letters believe that some CEOs are opposed to secondary market trading for other reasons. According to these brokers, some shareholders are attempting to sell stocks at prices below the company's new target valuation, which may cause the company to worry that lower-priced secondary market transactions could impact its upcoming new round of financing.

It is against this backdrop that Robinhood's tokenization attempt appears particularly bold. Vlad Tenev initially stated that the token "is technically not equity," but "provides retail investors with the opportunity to access private assets." He defined this action as "planting a seed" and revealed that several private companies have expressed a willingness to join the "tokenization revolution."

Robinhood stated that the token does not truly represent shares but is an indirect mapping based on the SPV's holdings in OpenAI. In other words, users do not directly hold OpenAI stock but gain an indirect exposure to the price of shares within the SPV.

However, this structure of "indirect equity exposure" is not transparent and can easily be misunderstood as holding OpenAI shares. Under the banner of financial democratization, is Robinhood truly promoting the innovative liberation of capital markets, or is it blurring the lines between real assets and digital derivatives? This has become the core of the controversy.

Comments from the community show a clear divide. Supporters argue that Robinhood's OpenAI token grants ordinary people unprecedented rights to participate: they do not have to wait for an IPO, navigate complex venture capital structures, or be limited by the "accredited investor" threshold. They have obtained a digital asset linked to the valuation of a world-changing company, which can be traded instantly and freely, somewhat realizing the ideal of "countering elite capital monopoly."

However, critics point out that this product does not possess true equity attributes—no voting rights, no profit sharing, no shareholder status, and certainly not officially recognized shares by the company. More importantly, if investors misunderstand the essence of the token, they may bear risks beyond their expectations without sufficient disclosure.

In a context where decentralized asset trading is not yet mature and regulatory gray areas remain unclear, whether this "financial equality movement" can continue to maintain its idealistic color or ultimately falter due to compliance and trust issues remains to be tested by both the market and the law.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。