The secondary market sees big fish eating small fish, but even big fish are powerless in the face of a tsunami.

Written by: Bright, Foresight News

Currently, Bitcoin's volatility has reached a very low point, making the market seem "dry."

However, there is always a group of contract leverage experts in the market looking for opportunities to gamble on Bitcoin's potential future trends. Each of them is a trading powerhouse who has made huge profits in major market movements, with positions often exceeding hundreds of millions of dollars. But recently, several on-chain whales who have been closely watched by the market and have stirred up market fluctuations have chosen to "forge ahead in turbulent waters when they should not have."

James Wynn: From 100 Million to 10,000

On the night of July 2, at 11 PM, according to Lookonchain monitoring, James Wynn's long position in Bitcoin on Hyperliquid has been liquidated four times in a row, leaving only $10,600 in his account. His downfall serves as a warning to all contract traders.

James Wynn was undoubtedly a star in the first half of the year. He started trading on Hyperliquid in March 2025, and in the early days, he preferred to hold positions for a relatively longer time (over 3 days), accepting both mainstream coins and meme coins. He excelled at making one-way profits during high volatility driven by major market movements; for example, on May 13, his long position in Pepe had over $23 million in unrealized profits. James Wynn himself stated that at his peak, the total value of his account exceeded $100 million.

However, at the end of May, after suffering massive losses, James Wynn fell into a "sage mode." In the previous week, he had withdrawn over $96 million as Bitcoin retraced due to geopolitical factors and pressure from new highs, resulting in an overall loss of $14.03 million in his account.

At that time, James Wynn was very outspoken, posting on X that "it's just $100 million, a drop in the ocean of the money world." "I never thought about closing my position."

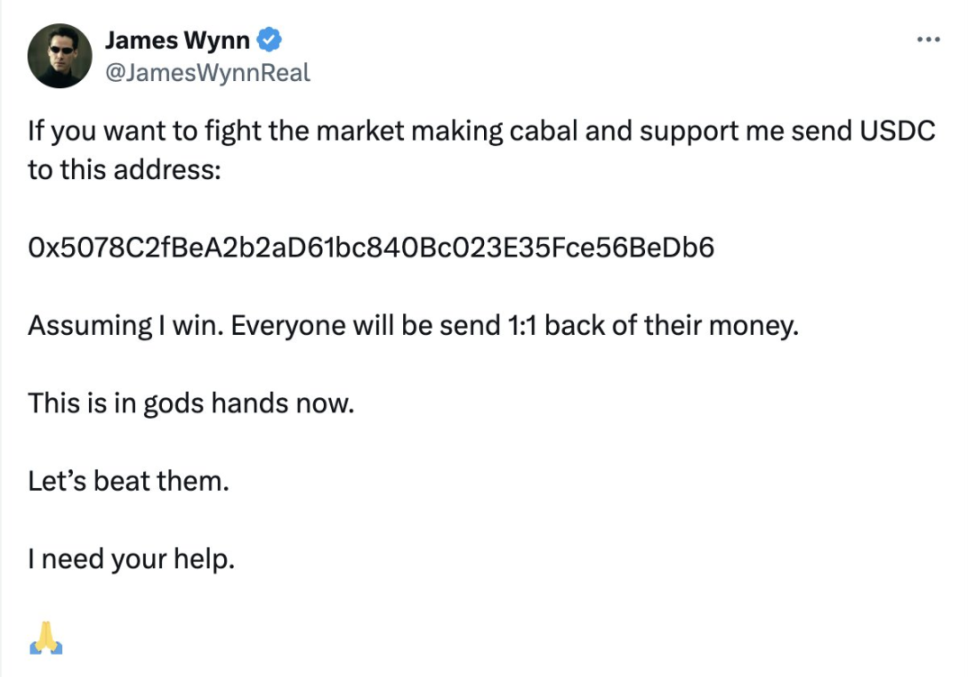

On June 2, when faced with another liquidation, James Wynn even publicly "begged" the entire network for help, waving a flag against the "market-making group."

Although this position ultimately turned profitable due to the help of kind-hearted individuals and a relief in market sentiment, just a few days later, following a fallout between Trump and Musk, James Wynn lost everything overnight.

Since then, James Wynn has not recharged large amounts into Hyperliquid to reopen positions, but he still boldly declared, "If Hyperliquid adjusts the leverage back to 50 times, I will deposit $75 million to go long. Let's do it again; this time I am ready." "If a black swan event occurs, I will invest all my funds to position myself."

"Insider Bro": A Single Misstep Leads to Eternal Regret

"Insider Bro" @qwatio also achieved great results in on-chain contract trading in the first half of the year. He is skilled at "extreme all-in" strategies, usually selecting the highest leverage when opening positions, with the liquidation price very close to the current market price, demonstrating keen market insight.

His classic "battles" include: around the Federal Reserve's interest rate decision on March 20, 2025, he shorted when BTC was priced at $84,566, closed his position for profit when the price dropped to $82,000, and then went long at $82,200, closing again for profit when the price rebounded to $85,000. His ability to profit from both long and short positions earned him the nickname "Insider Bro." Subsequently, he accurately judged the bottom for Ethereum and made profits by shorting based on the results of US-China trade negotiations. During this period, he even prompted other large players to form "whale hunting teams" to target him.

However, in the second half of June, "Insider Bro's" short positions faced a collapse. On the night of June 25, his positions of $122 million in Bitcoin and $68.3 million in Ethereum shorts faced partial forced liquidation, resulting in a floating loss of $8.32 million. After multiple forced liquidations and reductions, on the afternoon of July 1, he increased his short position again during a slight retracement of BTC and ETH, even adding another $50 million in short positions, bringing his total short position to $250 million.

The market did not favor this one-sided trader. On the night of July 2, as Bitcoin rebounded, "Insider Bro" was liquidated for another $50 million. On-chain data showed that when BTC retraced to about $105,500, he was actually close to breaking even, but he did not stop-loss and close his position.

AguilaTrades: The Poor Big Shot Bombarded by Events

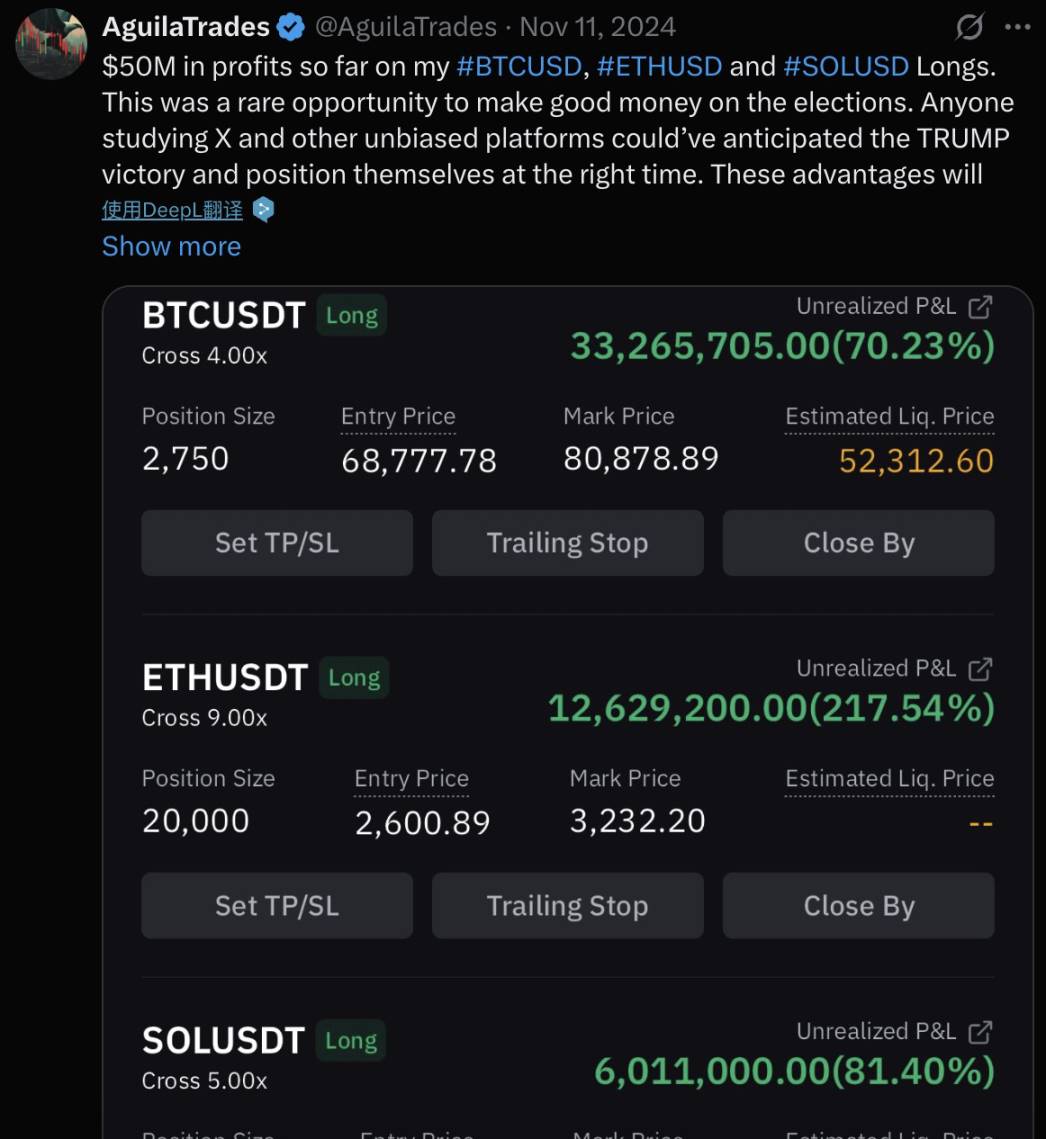

AguilaTrades describes himself on X as a seasoned swing trader who started trading in 2013, originally trading contracts on Bybit. He successfully bet on the upward trend during the 2024 US elections, making $50 million and gaining fame in one battle.

In January 2025, AguilaTrades showcased a performance chart showing nearly $100 million in profits over the past six months, demonstrating his sharp trading skills.

However, even such an OG was powerless in the face of market volatility caused by geopolitical events. On June 8, AguilaTrades withdrew 39.18 million USDC from Bybit and transferred it to Hyperliquid, using 40X leverage to go long on Bitcoin.

Initially, his long position was profitable by $5.6 million, but he did not secure the profits. Following Israel's strikes on Iranian nuclear facilities, he hurriedly closed his position, resulting in an actual loss of $12.47 million.

On June 15 and 20, AguilaTrades made a comeback and went long again. The second time he made a maximum profit of $10 million, and the third time a maximum profit of $3.2 million, but he did not close any positions. Subsequently, due to news of direct US military strikes on Iran and a vote to close the Strait of Hormuz, Bitcoin's price fell below $100,000. As a result, both trades were forcibly liquidated, totaling a loss of $20 million.

Ironically, when Bitcoin fell below $100,000, AguilaTrades attempted to open a short position in retaliation, but when Bitcoin rebounded, he lost another $2.33 million, bringing his total losses to $35 million. This shows that even a big player who has made over $100 million can still lose their cool in the face of losses, just like small retail traders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。