Don't just sit on the sidelines waiting for Powell to "bless" the bull market.

Author: Arthur Hayes

Translation: Deep Tide TechFlow

(This article represents the author's personal views and does not constitute the basis for investment decisions, nor should it be considered as investment trading advice or recommendations.)

Equity investors have been shouting: "Stablecoins, stablecoins, stablecoins; Circle, Circle, Circle."

Why are they so optimistic? Because the U.S. Treasury Secretary (BBC) said so:

The result is this chart:

This is a chart comparing the market capitalization of Circle and Coinbase. Remember, Circle has to hand over 50% of its net interest income to its "parent" Coinbase. However, Circle's market cap is nearly 45% of Coinbase's. This raises some questions…

Another result is this heartbreaking chart (because I hold Bitcoin instead of $CRCL):

This chart shows the price of Circle divided by the price of Bitcoin, indexed to 100 at the time of Circle's IPO. Since the IPO, Circle has outperformed Bitcoin by nearly 472%.

Crypto enthusiasts should ask themselves: Why is the BBC so optimistic about stablecoins? Why does the "Genius Act" receive bipartisan support? Do American politicians really care about financial freedom? Or is there something else going on?

Perhaps politicians do care about financial freedom on an abstract level, but hollow ideals do not drive actual action. There must be other more pragmatic reasons for their sudden shift in attitude towards stablecoins.

Looking back to 2019, Facebook attempted to integrate the stablecoin Libra into its social media empire but was forced to shelve it due to opposition from politicians and the Federal Reserve. To understand the BBC's enthusiasm for stablecoins, we need to examine the main issues he faces.

The main issue facing U.S. Treasury Secretary Scott "BBC" Bessent is similar to that faced by his predecessor Janet "Bad Girl" Yellen. Their bosses (the U.S. President and Congress) like to spend money but are unwilling to raise taxes. Thus, the burden of raising funds falls on the Treasury Secretary, who needs to provide funding for the government through borrowing at reasonable interest rates.

However, the market soon showed a lack of interest in long-term government bonds from highly indebted developed economies—especially in a high price/low yield environment. This is the "fiscal dilemma" that BBC and Yellen have witnessed over the past few years:

The trampoline effect of global government bond yields:

Here is a comparison of 30-year government bond yields: UK (white), Japan (gold), U.S. (green), Germany (pink), France (red).

If rising yields weren't bad enough, the real value of these bonds is even worse:

Real Value = Bond Price / Gold Price

TLT US is an ETF that tracks government bonds with maturities of over 20 years. The following chart shows TLT US divided by the gold price, indexed to 100. Over the past five years, the real value of long-term government bonds has plummeted by 71%.

If past performance isn't enough to raise concerns, Yellen and current Treasury Secretary Bessent also face the following constraints:

The Treasury's bond sales team must design an issuance plan to meet the following demands:

Approximately $2 trillion in federal deficit each year

$3.1 trillion in debt maturing in 2025

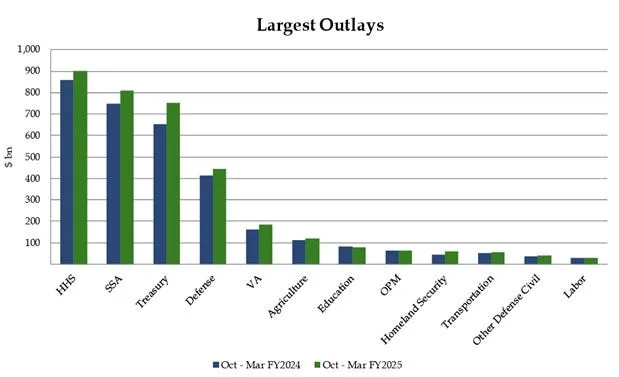

This is a chart detailing the major expenditure items of the U.S. federal government and their year-on-year changes. Note that the growth rate of each major expenditure item is on par with or faster than the growth rate of U.S. nominal GDP.

The previous two charts show that the weighted average interest rate on current debt is lower than all points on the government bond yield curve.

The financial system issues credit backed by nominally risk-free government bonds. Therefore, interest must be paid; otherwise, the government faces nominal default risk, which would destroy the entire fiat financial system. As the maturing debt is refinanced at higher rates, interest expenses will continue to rise since the yield curve is overall higher than the current debt's weighted average interest rate.

The defense budget will not decrease, especially since the U.S. is currently involved in wars in Ukraine and the Middle East.

Healthcare spending will continue to rise, especially in the early 2030s when the baby boomer generation enters a peak period of requiring extensive medical services, primarily funded by large pharmaceutical companies supported by the U.S. government.

Control the 10-year government bond yield to not exceed 5%

- When the 10-year yield approaches 5%, the MOVE index (which measures bond market volatility) spikes, often leading to a financial crisis.

Issue debt in a way that stimulates financial markets

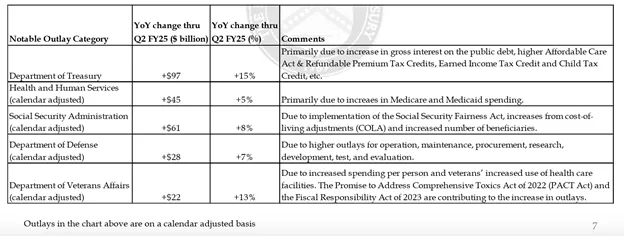

According to the U.S. Congressional Budget Office, although the data is only up to 2021, the U.S. stock market has continued to rise since the 2008 global financial crisis, and capital gains tax revenue has soared.

The U.S. government needs to tax the stock market's year-on-year gains to avoid massive fiscal deficits.

U.S. government policies consistently favor wealthy asset owners. In the past, only property-owning white males had the right to vote. Although modern America has achieved universal suffrage, power still derives from a small number of people who control the wealth of publicly traded companies. Data shows that about 10% of households control over 90% of stock market wealth.

A notable example is during the 2008 global financial crisis when the Federal Reserve bailed out banks and the financial system by printing money, yet banks were still allowed to foreclose on people's homes and businesses. This phenomenon of "the rich enjoying socialism while the poor bear capitalism" is why mayoral candidate Mamdani is so popular among the poor—who also wish to share in some of the benefits of "socialism."

When the Federal Reserve implemented quantitative easing (QE), the Treasury Secretary's job was relatively simple. The Federal Reserve bought bonds by printing money, allowing the U.S. government to borrow at low costs while also boosting the stock market. However, now the Federal Reserve must at least superficially show a stance against inflation, unable to lower interest rates or continue QE, leaving the Treasury to bear the burden alone.

In September 2022, the market began to marginally sell off bonds due to concerns about the sustainability of the largest peacetime deficit in U.S. history and the Federal Reserve's hawkish stance. The 10-year government bond yield nearly doubled within two months, and the stock market fell nearly 20% from its summer peak. At this time, former Treasury Secretary Yellen introduced a policy referred to by Hudson Bay Capital as "Aggressive Debt Issuance" (ATI), which reduced the Federal Reserve's reverse repurchase (RRP) balance by $2.5 trillion by issuing more short-term government bonds (Treasury bills) instead of interest-bearing bonds, injecting liquidity into the financial market.

This policy successfully achieved the goals of controlling yields, stabilizing the market, and stimulating the economy. However, the current RRP balance is nearly depleted, and the current Treasury Secretary Bessent faces the problem of how to find trillions of dollars to purchase government bonds in a high price, low yield environment.

The market performance in the third quarter of 2022 was extremely challenging. The following chart shows the comparison between the Nasdaq 100 index (green) and the 10-year government bond yield (white). As yields soared, the stock market experienced significant declines.

The ATI policy effectively reduced the RRP (red) and drove up financial assets such as the Nasdaq 100 (green) and Bitcoin (magenta). The 10-year government bond yield (white) never broke above 5%.

The large U.S. "Too Big To Fail" (TBTF) banks have two pools of funds ready to purchase trillions of dollars in government bonds whenever there is sufficient profit potential. These two pools are:

Demand/Time Deposits

Reserves held by the Federal Reserve

This article focuses on eight TBTF banks, as their existence and profitability depend on the government's guarantee of their liabilities, and banking regulatory policies tend to favor these banks over non-TBTF banks. Therefore, as long as they can achieve a certain level of profit, these banks will comply with government requests. If the Treasury Secretary (BBC) asks them to purchase government bonds, he will offer risk-free returns in exchange.

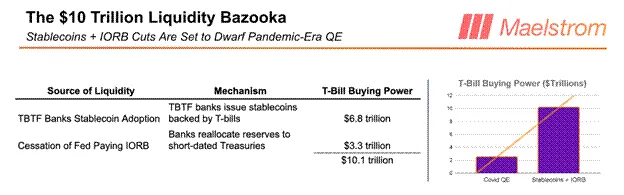

The BBC's enthusiasm for stablecoins may stem from the fact that through the issuance of stablecoins, TBTF banks could unlock up to $6.8 trillion in Treasury bond purchasing power. These dormant deposits can be re-leveraged in the fiat financial system, thereby driving the market upward. The following sections will detail how Treasury bond purchases can be achieved through the issuance of stablecoins and how it can enhance the profitability of TBTF banks.

Additionally, it will briefly explain how the Federal Reserve stopping the payment of interest on reserves could potentially release up to $3.3 trillion for purchasing government bonds. This would become another policy that, while technically not quantitative easing (QE), has a similar positive impact on fixed-supply monetary assets like Bitcoin.

Now, let’s delve into the BBC's new favorite—stablecoins, the "heavy artillery of currency."

Stablecoin Liquidity Model

My predictions are based on the following key assumptions:

Full or Partial Exemption of Treasury Bonds from Supplementary Leverage Ratio (SLR)

Meaning of Exemption: Banks would not need to hold equity capital for their Treasury bond portfolios. If fully exempt, banks could purchase Treasury bonds with unlimited leverage.

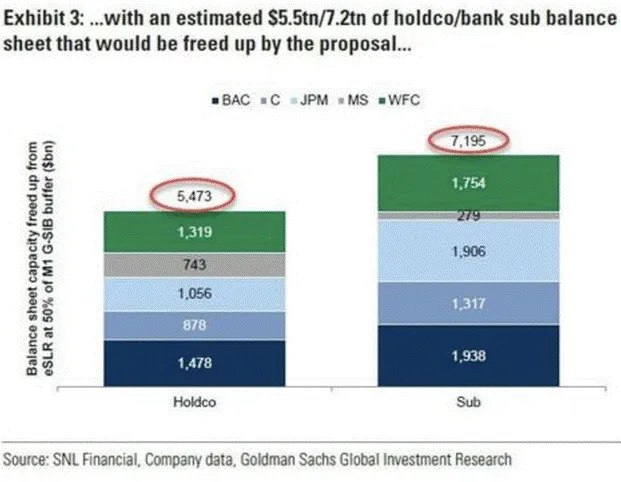

Recent Policy Changes: The Federal Reserve has just voted to reduce capital requirements for banks on Treasury bonds, and this proposal is expected to release up to $5.5 trillion in bank balance sheet capacity for purchasing Treasury bonds over the next three to six months. The market is forward-looking, and this purchasing power may flood into the Treasury bond market in advance, thereby lowering yields under otherwise unchanged conditions.

Banks are Profit-Oriented, Loss-Minimizing Organizations

Risk Lessons from Long-Term Treasury Bonds: From 2020 to 2022, the Federal Reserve and the Treasury urged banks to purchase large amounts of Treasury bonds, leading banks to buy higher-yielding long-term bonds. However, by April 2023, due to the fastest rise in the Federal Reserve's policy rates since the 1980s, these bonds incurred massive losses, resulting in the failure of three banks within a week.

Safety Net for TBTF Banks: In the TBTF banking sector, the losses on U.S. Bank's "held to maturity" bond portfolio have exceeded its entire equity capital. If forced to mark to market, the bank would face bankruptcy. To resolve the crisis, the Federal Reserve and the Treasury effectively nationalized the entire U.S. banking system through the Bank Term Funding Program (BTFP). Non-TBTF banks may still incur losses, and if they go bankrupt due to Treasury bond losses, their management will be replaced, and the bank may be sold cheaply to Jamie Dimon or other TBTF banks. Therefore, the Chief Investment Officers (CIOs) of banks are cautious about purchasing large amounts of long-term Treasury bonds, fearing that the Federal Reserve will "pull the rug out" again through rate hikes.

Attractiveness of Treasury Bonds: Banks will purchase Treasury bonds because they are effectively high-yield, zero-maturity cash-like instruments.

High Net Interest Margin (NIM) is Key: Banks will only purchase Treasury bonds with deposits if they can generate a high net interest margin and require little or no capital support.

JP Morgan recently announced plans to launch a stablecoin called JPMD. JPMD will operate on Coinbase's Layer 2 network, Base, developed on Ethereum. As a result, JP Morgan's deposits will be divided into two types:

Regular Deposits

Although also digital deposits, their liquidity in the financial system requires banks to interface using traditional outdated systems, necessitating significant manual oversight.

Regular deposits can only be transferred during business hours (Monday to Friday) from 9 AM to 4:30 PM.

The yield on regular deposits is extremely low; according to the Federal Deposit Insurance Corporation (FDIC), the average yield on regular savings accounts is only 0.07%, while the yield on one-year time deposits is 1.62%.

Stablecoin Deposits (JPMD)

JPMD operates on a public blockchain (Base), allowing customers to use it 24/7 year-round.

By law, JPMD cannot pay interest, but JP Morgan may attract customers to convert traditional deposits into JPMD by offering generous cash-back rewards for spending.

It is currently unclear whether staking yields will be allowed.

Staking Yield: Customers will earn a certain return by locking JPMD with JP Morgan.

Customers will transfer funds from traditional deposits to JPMD because JPMD is more practical, and the bank also offers cash-back and other spending rewards. Currently, the total amount of demand and time deposits at TBTF banks is approximately $6.8 trillion. Due to the superior nature of stablecoin products, traditional deposits will quickly be converted into JPMD or similar stablecoins issued by other TBTF banks.

If all traditional deposits were converted to JPMD, JP Morgan would be able to significantly reduce costs in compliance and operations. Here are the specific reasons:

**The first reason is to **reduce costs. If all traditional deposits were converted to JPMD, JP Morgan could effectively eliminate its compliance and operations departments. Let me explain why Jamie Dimon would be so excited when he learned how stablecoins actually work.

From a high-level perspective, compliance work is a set of rules established by regulators and executed by a group of humans using technology from the 1990s. The structure of these rules is similar to: if a certain situation occurs, then take a certain action. This "if/then" relationship can be explained by a senior compliance officer and written into a set of rules for AI agents to execute perfectly. Since JPMD provides fully transparent transaction records (all public addresses are disclosed), an AI agent trained in relevant compliance regulations can ensure that certain transactions are never approved. AI can also prepare any reports required by regulators instantly. Regulators can verify the accuracy of the data because all data exists on a public blockchain. Overall, TBTF banks spend $20 billion annually on compliance and the operations and technology required to adhere to banking regulations. By converting all traditional deposits into stablecoins, this cost would be nearly reduced to zero.

The second reason JP Morgan promotes JPMD is that it allows the bank to purchase billions of dollars in Treasury bills (T-bills) risk-free using custodial stablecoin assets (AUC). This is because Treasury bills have almost no interest rate risk, but their yields are close to the Federal Funds Rate. Remember, under the new leverage ratio requirements (SLR), TBTF banks have $5.5 trillion in Treasury bond purchasing capacity. Banks need to find a pool of idle cash reserves to purchase this debt, and stablecoin custodial deposits are the perfect choice.

Some readers may argue that JP Morgan can already purchase Treasury bonds with traditional deposits. My response is that stablecoins are the future because they not only create a better customer experience but also allow TBTF banks to save $20 billion in costs. This cost saving alone is enough to incentivize banks to adopt stablecoins; the additional net interest margin (NIM) gains are just icing on the cake.

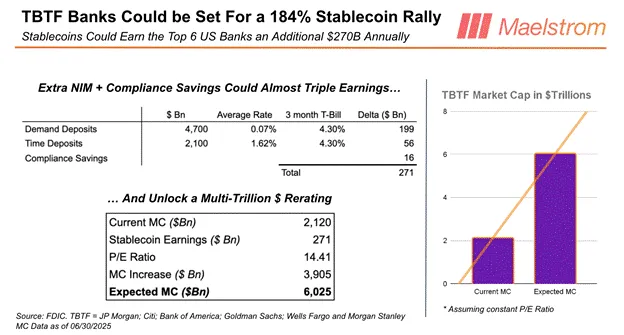

I know many readers may want to invest their hard-earned money in Circle ($CRCL) or the next shiny stablecoin issuer. But do not underestimate the profit potential of TBTF banks in the stablecoin space. If we base it on the average price-to-earnings (P/E) ratio of TBTF banks at 14.41 times and multiply it by the cost savings and stablecoin net interest margin (NIM) potential, the result is $3.91 trillion.

The total market capitalization of the eight TBTF banks is approximately $2.1 trillion, which means stablecoins could potentially cause TBTF bank stock prices to rise by an average of 184%. If there is a non-consensus investment strategy in the market that can be scaled, it is to go long an equally weighted portfolio of TBTF bank stocks based on this stablecoin theory.

How is the Competition?

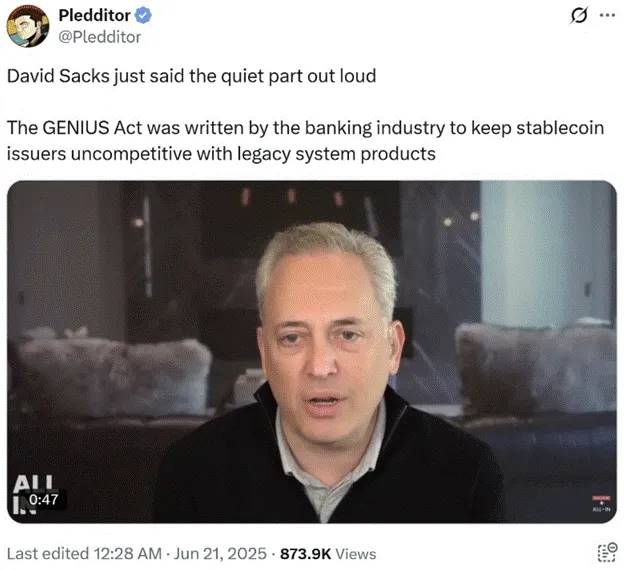

Don't worry, the Genius Act ensures that non-bank issued stablecoins cannot compete on a large scale. The act explicitly prohibits tech companies like Meta from issuing their own stablecoins; they must partner with banks or fintech companies. Of course, theoretically anyone can obtain a banking license or acquire an existing bank, but all new owners must receive approval from regulators. As for how long this will take, we shall see.

Additionally, there is a provision in the act that hands the stablecoin market over to banks, which is the prohibition on paying interest to stablecoin holders. Without the ability to compete with banks by paying interest, fintech companies will be unable to attract deposits away from banks at low costs. Even successful issuers like Circle will never be able to touch the $6.8 trillion TBTF traditional deposit market.

Moreover, fintech companies like Circle and small banks do not have government guarantees on their liabilities, while TBTF banks enjoy this protection. If my mother were to use a stablecoin, she would certainly choose one issued by a TBTF bank. Baby boomers like her will never trust fintech companies or small banks for this purpose because they lack government backing.

David Sachs, the "crypto czar" of former President Trump, agrees with this. I believe many corporate cryptocurrency donors will be dissatisfied with the outcome—after donating so much to cryptocurrency campaigns, they are quietly excluded from the lucrative stablecoin market in the U.S. Perhaps they should change their strategy and truly advocate for financial freedom, rather than just providing a stool for the "toilets" of those TBTF bank CEOs.

In short, the adoption of stablecoins by TBTF (Too Big To Fail) banks not only eliminates competition from fintech companies for their deposit base but also reduces the need for expensive and often underperforming human compliance officers. Additionally, this approach does not require the payment of interest, thereby increasing the net interest margin (NIM) and ultimately driving up their stock prices. In return, to thank the stablecoin gift bestowed by the BBC Act, TBTF banks will purchase up to $6.8 trillion in Treasury bills (T-bills).

ATI: Yellen's Maneuver: Stablecoins and the BBC Act

Next, I will discuss how the BBC Act could release an additional $3.3 trillion in static reserves from the Federal Reserve's balance sheet.

Interest on Reserve Balances (IORB)

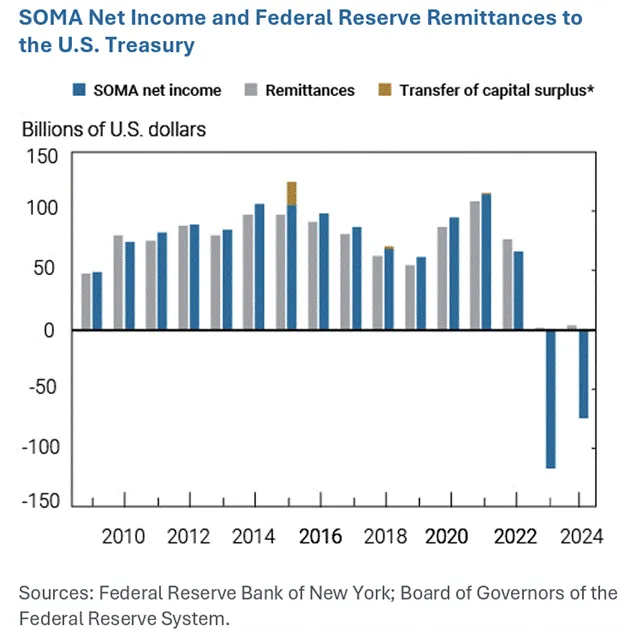

After the 2008 Global Financial Crisis (GFC), the Federal Reserve decided to ensure that banks would not fail due to insufficient reserves. The Fed created reserves by purchasing Treasury bonds and mortgage-backed securities (MBS), a process known as quantitative easing (QE). These reserves quietly sit on the Fed's balance sheet. Theoretically, banks could convert the reserves held by the Fed into circulating currency and lend it out, but they choose not to do so because the Fed pays them enough interest through money printing. The Fed "freezes" these reserves in this way to prevent inflation from rising further.

However, the problem the Fed faces is that when it raises interest rates, the interest on reserve balances (IORB) also increases. This is not favorable because the unrealized losses in the Fed's bond portfolio also increase with rising rates. As a result, the Fed finds itself in a situation of being undercapitalized and facing negative cash flow. However, this negative cash flow situation is entirely a result of policy choices and can be changed.

U.S. Senator Ted Cruz recently stated that perhaps the Fed should stop paying interest on reserve balances (IORB). This would force banks to compensate for lost interest income by converting reserves into Treasury bonds. Specifically, I believe banks will purchase Treasury bills (T-bills) because of their high yield and cash-like attributes.

According to Reuters, Ted Cruz has been pushing his Senate colleagues to eliminate the Fed's authority to pay interest on reserves, arguing that this change would significantly reduce the fiscal deficit.

Why should the Fed print money and prevent banks from supporting the "empire"? There is no reason for politicians to oppose this policy change. Both Democrats and Republicans have a fondness for fiscal deficits; why not release $3.3 trillion of bank purchasing power into the Treasury bond market, allowing them to spend more? Given the Fed's reluctance to assist the "Trump team" in financing with an "America First" agenda, I believe Republican lawmakers will use their majorities in both chambers to strip the Fed of this power. Therefore, the next time yields soar, lawmakers will be ready to unleash this flood of funds to support their extravagant spending.

Before concluding this article, I want to discuss the cautious strategic layout of Maelstrom during the implementation of the BBC Act, when dollar liquidity is bound to increase.

Cautionary Tale

While I hold a very optimistic view of the future, I believe that after the passage of Trump's spending bill—referred to as the "Big Beautiful Bill"—there may be a brief stagnation in dollar liquidity creation.

According to the current bill's content, it will raise the debt ceiling. Although many provisions will become bargaining chips in political games, Trump will not sign a bill that does not raise the debt ceiling. He needs additional borrowing capacity to support his agenda. There are currently no signs that the Republicans will attempt to force the government to cut spending. So, for traders, the question is: what impact will this have on dollar liquidity when the Treasury resumes net borrowing?

Since January 1, the Treasury has primarily funded the government by depleting its Treasury General Account (TGA) balance. As of June 25, the TGA balance was $364 billion. According to the Treasury's guidance in its recent quarterly refinancing announcement, if the debt ceiling is raised today, the TGA balance will be replenished to $850 billion through debt issuance. This would lead to a $486 billion contraction in dollar liquidity.

The only major dollar liquidity project that could mitigate this negative shock is the release of funds from the Reverse Repo Program (RRP), which currently has a balance of $461 billion.

Due to the Treasury's replenishment plan for the General Account (TGA), this is not a clear short-selling opportunity for Bitcoin, but rather a market environment that requires cautious operation—bull markets may be temporarily interrupted by short-term fluctuations. I expect that from now until the Jackson Hole meeting in August, before a speech by Federal Reserve Chairman Jerome Powell, the market may consolidate or slightly decline. If the TGA replenishment negatively impacts dollar liquidity, Bitcoin could dip to the $90,000 to $95,000 range. If the replenishment plan does not have a substantial impact on the market, Bitcoin may oscillate within the $100,000 range but struggle to break through the historical high of $112,000.

I suspect Powell may announce the end of quantitative tightening (QT) or other seemingly mundane yet impactful adjustments to banking regulations. By early September, the debt ceiling will be raised, the TGA account will be mostly replenished, and Republicans will focus on courting voters for the November 2026 elections. At that time, with a surge in money creation, bulls will counter bears with strong green candles.

From now until the end of August, Maelstrom will increase its allocation to staking USDe (Ethena USD). We have liquidated all positions in illiquid altcoins and may reduce Bitcoin risk exposure based on market performance. Risk positions in altcoins bought around April 9 have achieved returns of 2 to 4 times within three months. However, in the absence of clear liquidity catalysts, the altcoin sector may suffer significant setbacks.

After the market adjustment, we will confidently reposition ourselves to seek undervalued assets, potentially seizing 5 to 10 times return opportunities before the next round of fiat liquidity creation slows down (expected by the end of Q4 2025 or early Q1 2026).

Gradual Checkmarks

The adoption of stablecoins by systemically important banks (TBTF) could create up to $6.8 trillion in purchasing power for the Treasury bill market.

The Federal Reserve's cessation of interest on reserve balances (IORB) could further release up to $3.3 trillion in T-bill purchasing power.

Overall, due to the policies of the "BBC," there could be $10.1 trillion flowing into the T-bill market in the future. If my predictions are correct, this $10.1 trillion liquidity injection will have a similar impact on risk assets as the $2.5 trillion liquidity injection by former Treasury Secretary Yellen—driving the market into a "frenzy"!

This adds another arrow of liquidity to the policy toolbox of the "BBC." With the passage of Trump's "Big Beautiful Bill" and the raising of the debt ceiling, this tool may be forced into action. Soon, investors will once again worry about how the U.S. Treasury market will digest the pressure of the massive debt issuance without collapsing.

Some are still waiting for the so-called "monetary Godot"—waiting for Federal Reserve Chairman Powell to announce a new round of unlimited quantitative easing (QE) and interest rate cuts before selling bonds and buying cryptocurrencies. But let me tell you, this will not happen, at least not until the U.S. is indeed embroiled in a hot war with Russia, China, or Iran, or until a systemically important financial institution is on the brink of collapse. Even an economic recession is not enough to bring "Godot" to the scene. So, stop listening to that "weak and powerless" person and focus on those who truly hold the reins!

The following charts will show the opportunity cost investors suffer from waiting for "monetary Godot."

As the Federal Reserve's balance sheet (white line) shrinks, the effective federal funds rate (gold line) rises. Logically, Bitcoin and other risk assets should have declined during this period.

But former Treasury Secretary "Bad Gurl" Yellen did not disappoint the wealthy; she stabilized the market by implementing ATI (possibly referring to asset-backed liquidity tools). During this period, Bitcoin (gold line) rose 5 times, while the overnight reverse repo (RRP) balance fell by 95%.

Do not make the same mistake again! Many financial advisors are still advising clients to buy bonds because they predict yields will fall. I agree that central banks will indeed cut rates and print money to avoid a collapse in the government bond market. Furthermore, even if central banks do not act, the Treasury will take action.

The core point of this article is that by supporting stablecoin regulation, relaxing SLR (Supplementary Leverage Ratio) restrictions, and stopping the payment of IORB, the Federal Reserve could release up to $10.1 trillion in Treasury purchasing power. But the question is, is it really worth holding bonds for a 5% to 10% return? You might miss the opportunity for Bitcoin to rise 10 times to $1 million or the Nasdaq 100 index to soar 5 times to 100,000 points, which could happen before 2028.

The real stablecoin "game" is not betting on traditional fintech companies like Circle, but recognizing that the U.S. government has handed a "liquidity rocket launcher" worth trillions of dollars to systemically important banks (TBTF) under the guise of "innovation." This is not decentralized finance (DeFi), nor is it so-called financial freedom; it is debt monetization cloaked in Ethereum's attire. If you are still waiting for Powell to whisper "QE infinity" in your ear before daring to take risks, then congratulations—you are the market's "bag holder."

Instead, you should go long on Bitcoin and JPMorgan, rather than wasting energy on Circle. The stablecoin "Trojan Horse" has already infiltrated the financial fortress, but when it opens, it does not contain the dreams of libertarians; it is filled with liquidity for purchasing U.S. Treasury bills (T-bills). This liquidity will be used to maintain high stock market levels, fill fiscal deficits, and soothe the anxieties of the baby boomer generation.

Do not sit on the sidelines waiting for Powell to "bless" the bull market. The "BBC" (note: possibly a nickname for the Federal Reserve or related policies) is ready to end the prelude and begin saturating the global market with a flood of liquidity. Seize the opportunity and do not let yourself become a passive observer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。