Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

With a series of aggressive moves into the "stock tokenization" market, Robinhood has dominated the headlines of major financial media over the past few days, with its stock price surpassing $100, setting a new historical high.

- Odaily Note: Refer to “Robinhood rewrites the global trading landscape, stock tokenization enters a new era”.

In addition to bringing publicly listed stocks into the on-chain market through tokenization, Robinhood has also expanded the scope of stock tokenization to include unlisted private companies and will gift unlisted OpenAI and SpaceX stock tokens to EU users, a move widely interpreted by the market as Robinhood attempting to seize pricing power in the Pre-IPO market.

OpenAI criticizes Robinhood for unauthorized actions

However, in the early hours of July 3, OpenAI officially clarified on X, stating: “These so-called OpenAI tokens are not OpenAI equity. We have no collaboration with Robinhood, have not participated in this matter, and do not endorse it. Any transfer of OpenAI equity requires our approval — we have not approved any transfers. Please be cautious.”

In response to OpenAI's criticism, Robinhood co-founder and CEO Vlad Tenev posted on X: “In our recent cryptocurrency activities, we announced that we would gift limited OpenAI and SpaceX stock tokens to eligible European customers. While technically these tokens are not 'equity' (interested parties can check our terms for specifics), they actually provide retail investors with access to these private assets. Our gifting initiative lays the groundwork for a larger plan. Since our announcement, we have received many letters from private companies eager to join us in this tokenization revolution.”

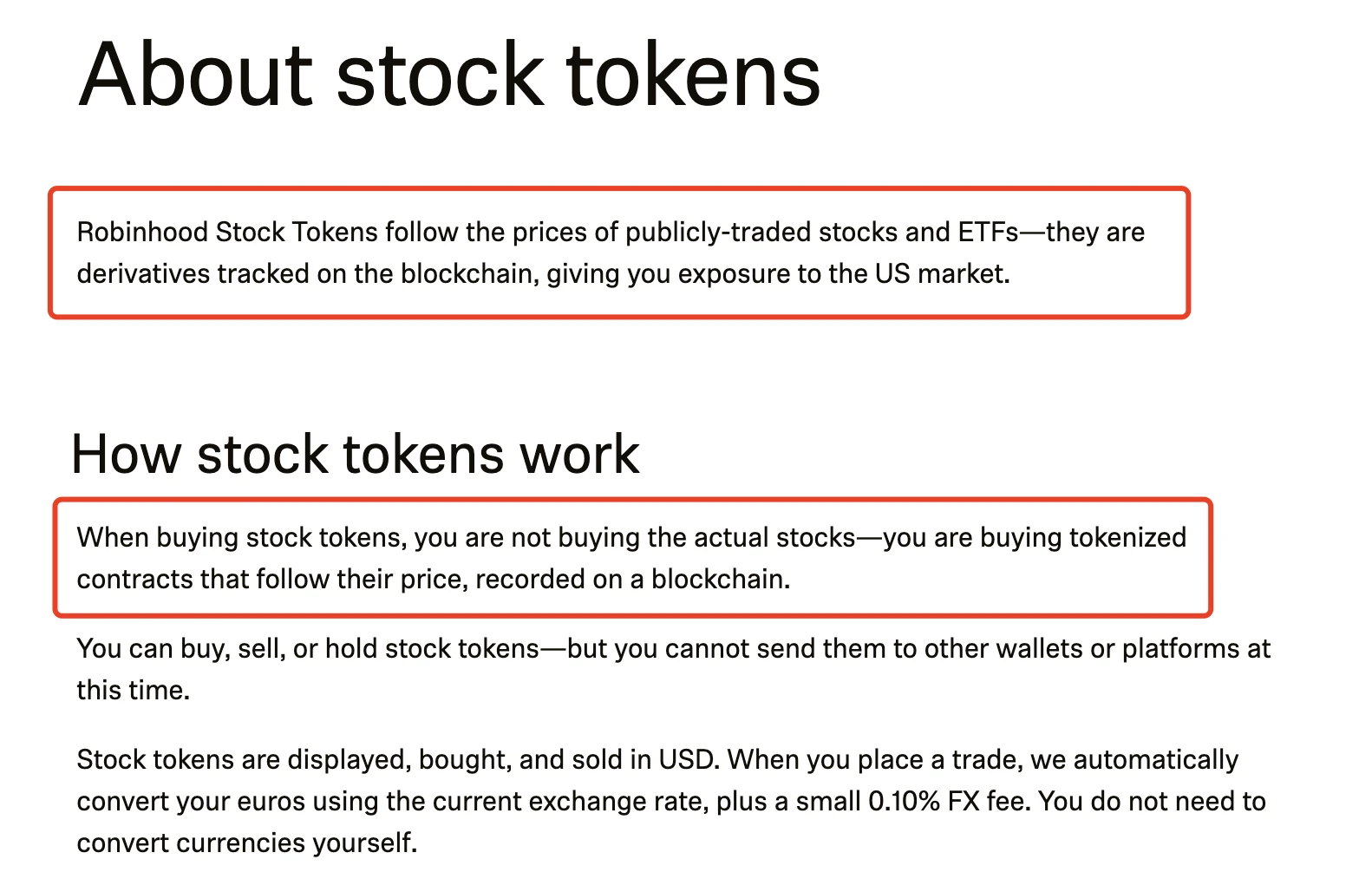

Regarding Vlad Tenev's description that "the tokens are not equity," we found a more detailed explanation in Robinhood's product documentation: “Robinhood stock tokens track the prices of publicly traded stocks and ETFs; they are derivatives that track prices on the blockchain… When you purchase stock tokens, you are not buying actual stocks, but rather purchasing tokenized contracts that follow their prices and are recorded on the blockchain.”

Core Controversy: Can Unlisted Stocks Be Tokenized?

As two of the hottest companies in the current financial market, OpenAI's criticism of Robinhood quickly sparked heated discussions across various sectors, focusing on — Can shares of unlisted private companies like OpenAI and SpaceX be tokenized? Do platforms like Robinhood (or derivative issuers) need authorization from the other party? Can private companies restrict the circulation of such stock tokens?

- Odaily Note: It is worth mentioning that Elon Musk, who has a complicated relationship with OpenAI, today mocked OpenAI for having "only fake stocks"… The feud between Elon Musk and OpenAI is related to OpenAI's transition from a non-profit organization to a for-profit entity, which has become a highly discussed case in the internet industry; interested readers can search for more information.

David Hoffman, founder of Bankless, speculated that Robinhood may have reached an agreement with a holder of OpenAI / SpaceX shares — “Vlad Tenev specifically mentioned a connection with a wealthy investor who owns OpenAI / SpaceX shares during his speech, and these shares may still belong to that original investor (individual or entity). OpenAI may have approved the original investor's sale of equity. In this case, Robinhood and the investor could sign a private agreement without needing OpenAI's approval. Nevertheless, private companies like OpenAI can still refuse to allow their shares to be traded in accessible venues, which would pose a real friction for Robinhood.”

However, Rob Hadick, a partner at Dragonfly, believes that this model carries another layer of potential risk, namely that private companies like OpenAI may refuse to recognize completed equity sale agreements under the pretext of default: “OpenAI's clarification highlights another risk from the private company side that I did not mention yesterday, but these issues often arise in the secondary market. Private companies are not obligated to recognize your perceived rights to equity transfers — in fact, I recently stated in a closed-door meeting that I expect this inherent contradiction to lead to more private companies directly canceling equity sales that violate shareholder agreements. Overall, many issues with this generation of products remain unresolved.”

Venture capital lawyer Collins Belton provided a more detailed explanation. Collins stated that many lawyers outside the venture capital field believe that the main restrictions on the operation of private and public stocks are securities laws and other regulations, which is somewhat correct, but additional contractual obligations reached between shareholders and the company can also apply. For example, a company can agree with shareholders in its articles of incorporation, memorandum, or terms that certain or all company shares cannot be "transferred" without the company's consent — "transfer" not only refers to actual transfers but is usually defined very broadly, covering everything from pledging to creating derivatives.

Collins added that popular Silicon Valley startups often impose secondary market restrictions through contracts in later stages, and in early-stage companies, these restrictions may only apply to common stockholders, especially when venture capitalists have influence. However, as companies become very popular and mature, they typically impose such restrictions on all shareholders (including well-known venture capitalists).

Collins also mentioned: “I was initially curious whether emerging stock tokenization issuers like Robinhood and xStocks addressed this issue. I thought that with Robinhood's influence, they might have resolved this potential problem, but based on OpenAI's statement, I doubt they did. They might be playing dumb, or they might genuinely not know about this restriction.”

According to Collins' legal explanation, if OpenAI indeed had signed an additional agreement with investors regarding the restriction of share "transfers," then Robinhood's stock tokenization operations concerning OpenAI (even in the derivative form as Robinhood claims) should be restricted, and combined with OpenAI's mention that "any transfer of equity requires our approval," it is very likely that OpenAI does have such restriction agreements — but since Robinhood did not disclose the specific source of these shares, the market cannot currently determine the specific details of the agreement between OpenAI and the unknown investor.

The Underlying Game: The Struggle for Pricing Power

OpenAI and Robinhood are publicly at odds, and neither side seems willing to back down. The reason for this is that behind the simple question of "can stocks be tokenized" lies the struggle for "IPO pricing power."

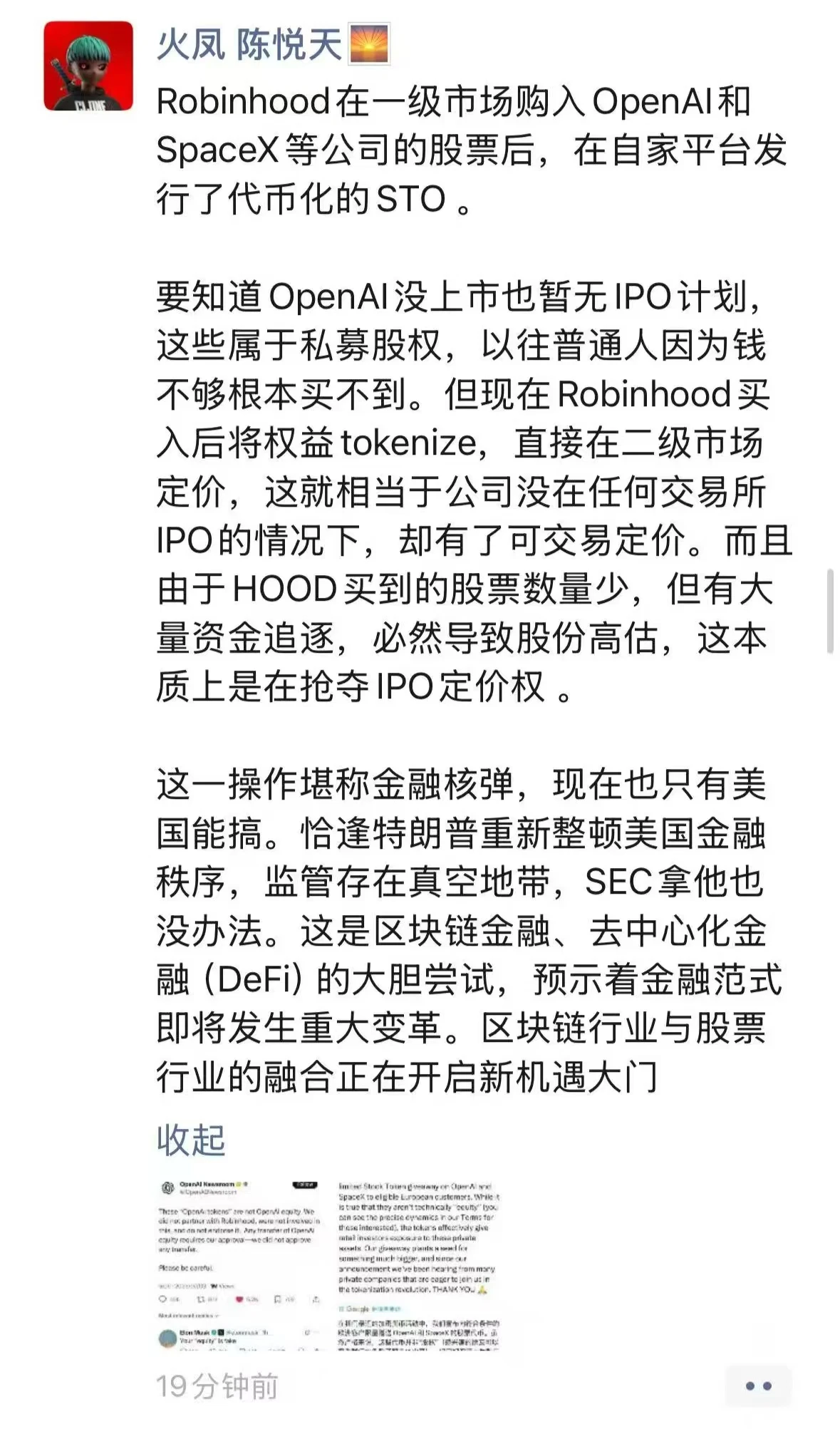

Chen Yuetian, founder of Huofeng Capital, analyzed in his personal circle: “After Robinhood purchased shares of companies like OpenAI and SpaceX in the primary market, it issued tokenized STOs on its platform. It should be noted that OpenAI is not publicly listed and has no IPO plans. These belong to private equity, which ordinary people previously could not buy due to insufficient funds. But now, after Robinhood's purchase, the rights are tokenized, allowing direct pricing in the secondary market, which is equivalent to a company having tradable pricing without any IPO on any exchange. Moreover, since the number of shares purchased by Robinhood is small but there is a large amount of capital chasing them, it will inevitably lead to an overestimation of shares, which essentially seizes the pricing power of the IPO.”

In traditional financial markets, the pricing of an IPO is dominated by the lead underwriters working with the company going public, who set the price based on various financing needs and development expectations. However, with the entry of Robinhood as a "catalyst," private equity, which was previously not publicly traded, now has a secondary market where anyone, regardless of their financial capacity, can trade freely on-chain. This means that private equity will undergo sufficient price discovery before the IPO, and the pricing power will be stripped from the company going public and the lead underwriters, which is precisely what OpenAI does not want to see.

Retail Investor Perspective: Can We Still Charge Ahead?

Considering the current situation, when tokenizing stocks that are already listed and have clear public prices, platforms like Robinhood have some historical experience to draw from, and the implementation path for this part is relatively straightforward. However, tokenizing stocks of private companies like OpenAI and SpaceX is an almost uncharted territory, and the solutions currently offered by Robinhood still carry a lot of uncertainties.

- Odaily Note: Refer to “10 Questions for xStocks: What Are We Really Trading When Trading US Stock Tokens?”

Rob Hadick, a partner at Dragonfly, stated: “Robinhood deliberately keeps the exact nature of the derivatives, how to hedge, who the counterparties are (where the equity comes from), and what legal recourse you have extremely opaque. Most importantly, private company equity is a derivative asset without a public price, which includes a large number of securities/profit-sharing plans traded at different prices. Moreover, how derivatives settle based on the actions of different underlying companies is also completely opaque.”

From the perspective of retail investors, uncertainty may sometimes represent opportunity, but more often it points to risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。