Written by: Deron, Mankun

On May 13, 2025, Tether, the issuer of the stablecoin USDT, announced the launch of Tether Gold Token (XAU₮) on the Thai digital asset exchange Maxbit. According to Tether, 1 XAU₮ corresponds to 1 ounce of gold in the real world.

Prior to this, on March 10, 2025, the Thai Securities and Exchange Commission (SEC) announced that USDT is an approved cryptocurrency. The Thai Deputy Prime Minister also announced that Thailand intends to utilize cryptocurrency and blockchain technology to promote the development of the local tourism industry.

Figure 1 Tether officially announces the entry of gold tokens into Thailand

Earlier, on December 7, 2023, Tether announced a partnership with Bitkub, Thailand's largest cryptocurrency exchange by trading volume, to launch an educational project on stablecoins and blockchain knowledge in Thailand. The two parties will enhance the digital financial awareness of Thai users through the establishment of educational courses, general campaigns, incentive learning programs, and Q&A shows. Notably, USDT is also the largest stablecoin by trading volume for Thai users and on the Bitkub exchange.

Tether, the issuer of the world's largest stablecoin USDT, reported in its latest Q1 2025 financial statement that as of March 31, the market value of the stablecoins issued by Tether was approximately $143.7 billion, with holdings of U.S. Treasury bonds amounting to about $120 billion. In Q1, USDT saw a new supply of approximately $7 billion and added 46 million user wallets.

Even as the leading stablecoin, Tether has been continuously embracing regulation in recent years, hoping to gain more regulatory endorsement and market share. On January 13 of this year, after obtaining a Digital Asset Service Provider (DASP) license issued by El Salvador, Tether announced the relocation of its headquarters and related entities from the British Virgin Islands (BVI) to the Central American nation of El Salvador, with the company's CEO and COO also purchasing properties locally and obtaining local residency.

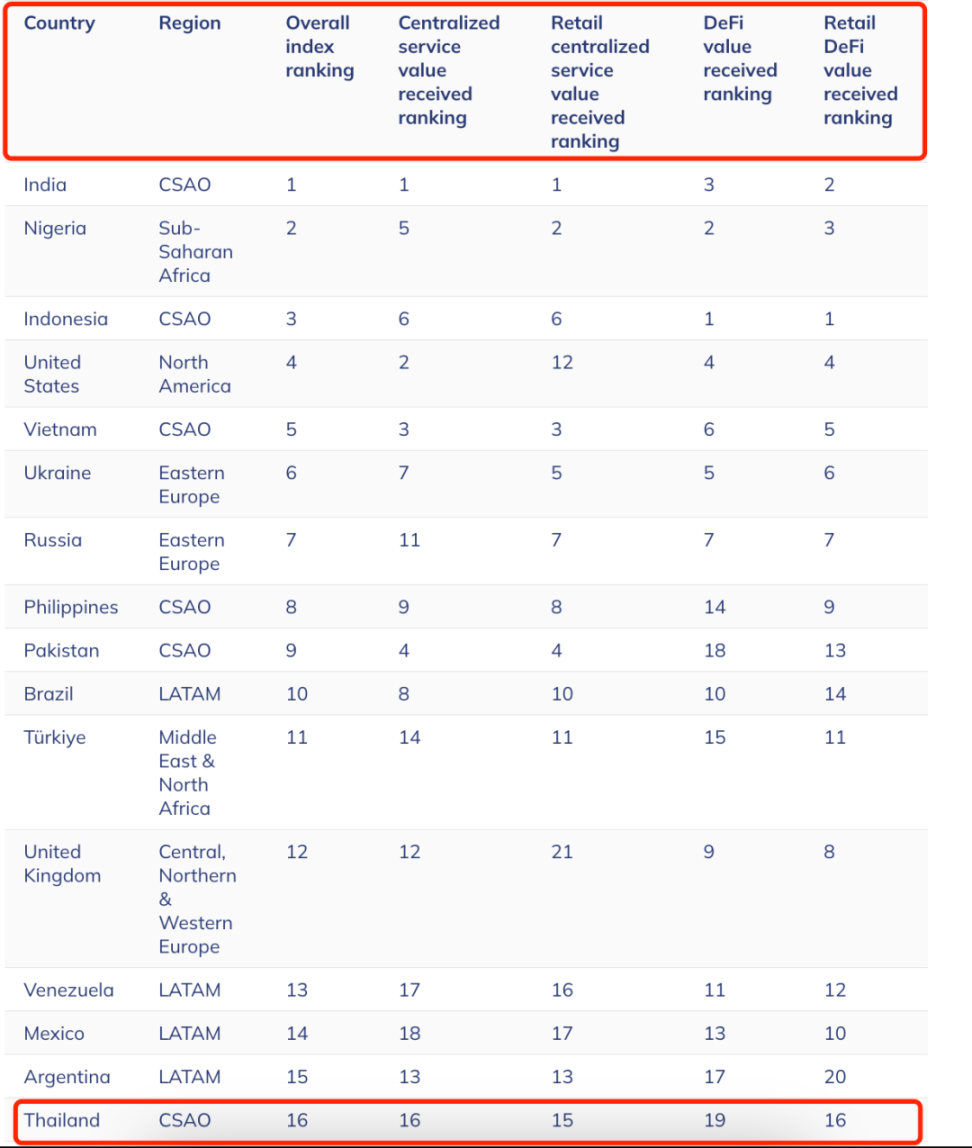

Thailand, one of the most active economies in Southeast Asia, is a world-renowned tourist destination with an export-oriented economy and frequent cross-border flow of funds and people. Under various factors, the Thai government's policy towards digital assets has been quite friendly, attracting many industry giants and startups to engage in cryptocurrency business in Thailand. In a global cryptocurrency adoption index country ranking released by Chainalysis in 2024, Thailand ranked 16th.

Figure 2 Chainalysis releases the 2024 cryptocurrency adoption index ranking

This article will take Tether's strategic layout in Thailand as a starting point to summarize the characteristics of Thailand's market regarding digital asset regulation.

Thailand's Regulatory Attitude Towards Digital Assets

Thailand's regulatory attitude towards cryptocurrency has evolved from cautious observation to active embrace, closely related to global digital economic development trends and adjustments in Thailand's domestic economic strategy.

On May 14, 2018, Thailand issued the "Digital Asset Business Act," categorizing digital assets into two main types: cryptocurrencies and digital tokens. The main difference between the two is that cryptocurrencies serve as a medium of exchange, while digital tokens represent rights. The act primarily regulates cryptocurrencies from two dimensions: the issuance of digital tokens and the conduct of digital asset businesses, including exchanges, market makers, service providers, fund managers, investment advisors, and custodial wallet service providers.

Regulation of Token Issuance in Thailand

- Regulated token issuance: investment tokens, utility tokens preparing to list on exchanges, cryptocurrencies.

Based on different sources of income, the Thai SEC categorizes digital tokens into real estate digital tokens, infrastructure digital tokens, sustainability-related digital tokens, debt tokens, etc. In 2022, real estate company SC Asset raised approximately 300 million baht (about $8 million) through an STO, becoming the first approved case.

If investors wish to issue regulated tokens, they must meet the following conditions:

- Obtain permission from the Thai SEC;

- Submit a registration application to the Thai SEC for the issuance of digital tokens and provide a prospectus for the token issuance;

- Meet the qualification requirements set by the regulations.

- Exempt token issuance: digital tokens issued by the Bank of Thailand (BOT), utility tokens for consumption purposes, limited offerings that meet specific conditions.

Utility tokens for consumption purposes:

Tokens issued by the issuer for consumption purposes or as digital certificates;

- Tokens not based on consumption purposes or as digital certificates but limited to use within specific distributed ledger systems, such as tokens used internally in centralized finance (CeFi) and decentralized finance (DeFi), tokens used as discounts or other subsidies on licensed digital exchanges, and tokens representing voting rights.

Issuers can conduct limited offerings that meet the SEC's requirements for investor information disclosure and satisfy one of the following specific conditions:

- Issued to institutional investors or ultra-high-net-worth clients;

- Issued to specific investors with a special relationship with the issuer, with an issuance period not exceeding 12 months and no more than 50 specific investors;

- Issuance period not exceeding 12 months, and total issuance value not exceeding 20 million baht.

Regulation of Digital Asset Exchanges in Thailand

The scope of regulated digital asset exchanges: centers or networks providing services for the purchase, sale, and matching of digital asset transactions.

Conditions that digital asset exchanges must meet:

Registered entity in Thailand, with a license issued by the Thai Ministry of Finance;

Exchanges must not engage in digital asset trading business;

Paid-up registered capital of no less than 100 million baht;

Maintain a net asset level that meets regulatory requirements;

Comply with regulatory requirements for anti-money laundering and counter-terrorism financing;

Fulfill obligations for KYC, CDD, and timely reporting of suspicious transactions.

Mankun Law Firm Recommendations

To conduct token issuance business in Thailand, it is necessary to register a company entity in Thailand and assess whether a license from the Thai SEC is required based on the characteristics of the tokens;

The company's management, such as directors, executive directors, and other management personnel, must not have a bankruptcy or criminal record;

The company should have a reliable business plan and audited financial statements;

The company should pay attention to timely disclosure of its operational and financial data as required by the SEC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。