It will ignite a technological panic and a tsunami of public opinion, blasting out a historic bottom.

Written by: Daii

From now on, you need to remember a new term: Q-Day, short for Quantum Day.

This is the term used in the cryptocurrency industry to refer to the day when "quantum computers can actually crack Bitcoin private keys." It is not science fiction, not far-fetched, but a real technological milestone that is gradually approaching.

Q-Day means that when the first general quantum computer capable of running Shor's algorithm and cracking ECDSA private keys goes online, the solid shell of Bitcoin will be cracked open. IBM's timeline is 5–10 years, while Google is more optimistic, claiming that its "Willow" chip may be capable before 2030 (source: investopedia.com).

Once that day arrives, Bitcoin addresses that have previously exposed their public keys will lose their security—attackers will only need a few hours to deduce the private keys and steal assets. Approximately 4 million BTC (nearly 20% of the total network) will be exposed to risk.

This is Q-Day:

A time bomb that all cold wallet holders should not ignore.

However, the real crisis is never just fear; it may also be the starting point of the next bull market.

History has shown us that every seemingly apocalyptic technological shock often leaves a floor price for calm buyers—such as the internet bubble, the subprime mortgage crisis, and even the FTX collapse. The quantum crisis of Bitcoin will be no exception.

Of course, we should first confirm whether the quantum crisis of Bitcoin truly exists.

1. Why is the quantum crisis a real crisis?

The success and danger lie in the public key.

The quantum crisis of Bitcoin is a crisis created by technological advancement. At its core is the cornerstone upon which Bitcoin exists—the public-key cryptography algorithm.

Public-key cryptography is the foundation of Bitcoin's security system. Its greatest advantage is that it allows you to make the "keyhole" public to the world (the public key), while only you hold the "key" (the private key).

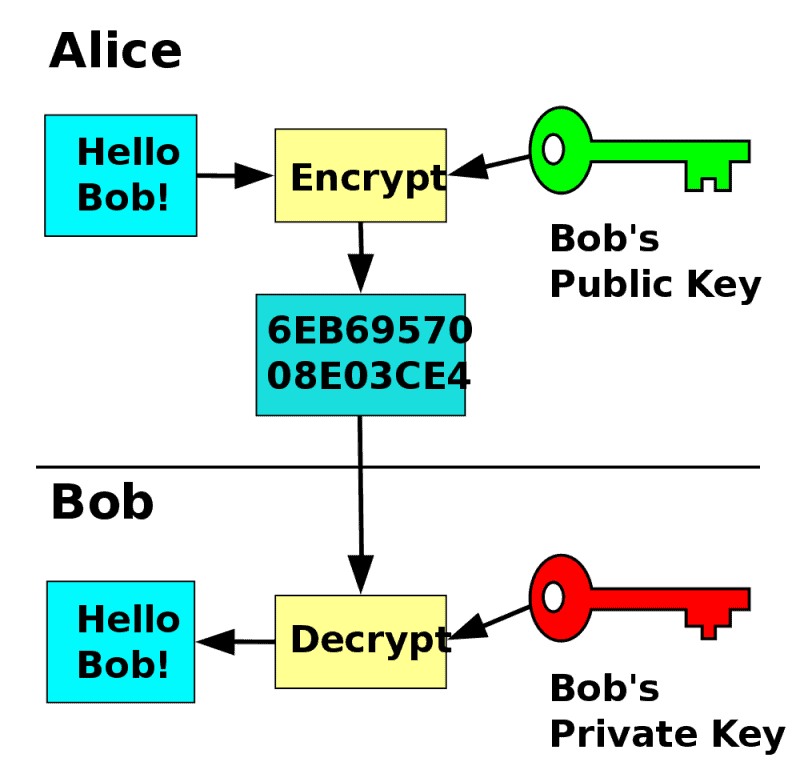

In the image above, Alice wants to send a message to Bob. She encrypts it using Bob's public key, generating a string of incomprehensible ciphertext. Only Bob, with his private key, can decrypt it back to the original text. This means:

Even if the data is intercepted during transmission, as long as the private key is not leaked, the information remains incredibly secure.

This mechanism gives Bitcoin the characteristic that "anyone can send you money, but only you can use it," and establishes its cryptographic foundation for "trustlessness."

Because Bitcoin uses a cryptographic system called the Elliptic Curve Digital Signature Algorithm (ECDSA). In front of classical computers, ECDSA is nearly unbreakable—deducing the private key from the public key requires 2¹²⁸ operations, which would take supercomputers thousands of years to accomplish.

But quantum computers are completely different.

They are not "faster" classical computers but devices that operate under entirely different physical laws. If you give it a quantum machine capable of running Shor's algorithm—it can deduce the private key from the public key in a matter of hours. It's like using a time machine to open a safe that has been sealed for 15 years.

In other words: Bitcoin's security is not threatened by "hackers," but by "scientific progress."

That is the most anxiety-inducing aspect.

This is not the intention of some attacker, but the inevitable result that will "certainly arrive" one day in the future. No one can stop technology from becoming stronger. When sufficiently powerful quantum computers are born, any address that has ever exposed its public key will be equivalent to having exposed its private key—even if it was signed once 10 years ago, it will be "unlocked" on Q-Day.

According to a 2025 Deloitte report, approximately 4 million BTC are vulnerable, accounting for about 20% of the total circulation, worth over $40 billion. The breakdown is as follows:

~2 million BTC are in P2PK addresses, which directly expose the public key and are vulnerable.

~2.5 million BTC are in reused P2PKH addresses, where the public key is exposed after reuse.

What makes matters worse is that Bitcoin is an irreversible asset. Once the private key is stolen and the funds are taken, no one will help you recover them; there is no "freezing accounts" or "password recovery."

So, the quantum crisis is not a science fiction story, nor a distant hypothesis.

It is not a weapon of the enemy but a future bomb we have buried ourselves—quietly lying beneath our feet, waiting for the loud bang of Q-Day.

You might wonder, can Bitcoin withstand such a huge crisis?

The answer is yes, because the quantum crisis has not fundamentally changed Bitcoin; it is forcing the lazy Bitcoin community to accelerate its self-evolution.

2. Why can Bitcoin withstand the quantum crisis?

Because Bitcoin's strength lies not only in its cryptographic algorithms but also in its ability to self-evolve.

Bitcoin is not a set of hard-coded programs but a "living system" maintained by global consensus—its protocol can be upgraded, its security model can be adjusted, and its community can respond in advance. The quantum crisis is precisely catalyzing this transformation.

2.1 Most of Bitcoin's assets are still "invisible"

Quantum computing attackers cannot directly crack all Bitcoin addresses.

They can only crack those addresses that have already exposed their public keys on-chain, meaning—you have used this address to sign or transfer funds, which makes it vulnerable to attack. As of July 1, 2025, the circulating supply of Bitcoin is approximately 19.88 million (CoinMarketCap: Bitcoin Supply), minus the 4 million that are vulnerable, leaving 15.88 million—they are not "open locks," but "puzzles." Cracking these addresses is not something that can be completed in a few hours; it requires brute-forcing the double hash (SHA256 + RIPEMD160) under Grover's algorithm, which would take 2⁸⁰ operations, equivalent to tens of thousands of years.

In other words:

As long as your coins have never been spent, they are temporarily safe.

2.2 Existing quantum-resistant cryptographic schemes can replace ECDSA

Currently, the global cryptography community has developed various quantum-resistant signature algorithms, which have been included in NIST's (National Institute of Standards and Technology) quantum cryptography standardization program.

Among them, the most notable are:

Dilithium (lattice-based signatures)

Falcon (compact and fast, suitable for embedded devices)

SPHINCS+ (does not rely on any mathematical problems, belongs to hash signatures)

These algorithms have already been tested and experimented with in the Bitcoin developer community, including proposals to add various quantum-resistant signature templates to Taproot through BIP-360, and some developers are calling for the restoration of early script commands (such as OP_CAT) to build more flexible quantum-safe contracts.

In other words, the tools are already available; it just depends on when the community decides to upgrade.

2.3 The reality of Q-Day will not arrive suddenly

Building a general quantum computer capable of running millions of quantum gates and having thousands of logical qubits is not something that can be achieved overnight. Even if IBM and Google can break through key milestones before 2030, the process from technological maturity to hackers mastering it to actual successful attacks will require a considerable buffer period. The entire process will not be completed overnight.

This gives the community, wallet providers, and miner nodes several years of response time. Before that, as long as you are willing to move your coins to a secure address, you can preemptively avoid the risk.

So, do not panic.

All you need to do now is to create a new Bitcoin cold wallet address and transfer your Bitcoin into it. Remember, once you have used it, your cold wallet is no longer quantum-resistant and needs to be transferred to a new cold wallet address. There is a zero-based Bitcoin cold wallet creation tutorial in the WeChat service account (Airdrop Web3) menu, which you can use to generate several for yourself; after all, it costs nothing and does not require anyone's approval.

After ensuring your own security precautions, all you need to do is patiently wait for the arrival of the quantum crisis.

Because where there is "danger," there is "opportunity."

3. Why is the quantum crisis not a disaster, but an opportunity?

Because market panic often represents the best time for smart money to enter. And the "quantum crisis"—this Q-Day (Quantum Day) expected to arrive in the next 5 to 10 years—may be the floor price window you have been waiting for to change your fate.

3.1 Proof from the stock market

The history of the stock market has repeatedly proven: true wealth is not built by buying at the peak but quietly establishing during panic.

For example, when the internet bubble burst in 2000, Amazon's (AMZN) stock price plummeted from $107 to $6, a drop of 94.4%. The media shouted, "The internet is over," and investors panicked and sold off. But true long-term holders reaped over 1000 times their returns 20 years later.

During the 2008 subprime mortgage crisis, the S&P 500 index fell more than 50% from its peak. The global market was in despair, with companies going bankrupt, banks collapsing, and everyone selling off assets.

In that year, Buffett wrote in his New York Times op-ed "Buy American. I Am." that famous quote:

Be fearful when others are greedy, and be greedy when others are fearful.

3.2 Annotations on the Crypto Market

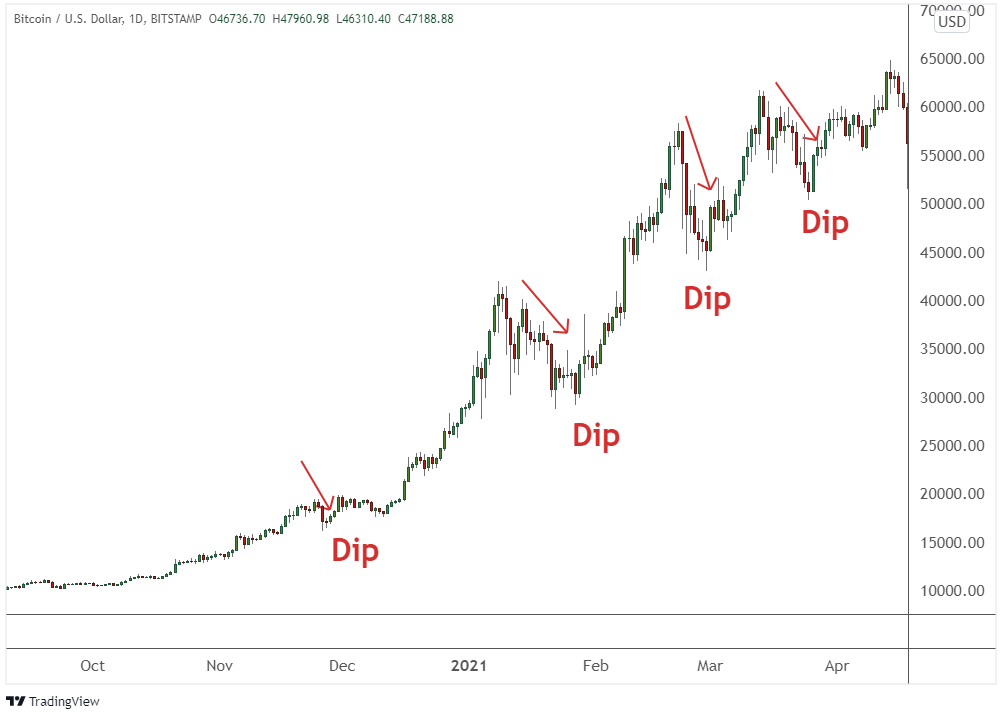

This script is being played out repeatedly in the crypto market:

In 2014, Mt. Gox collapsed, leading to the theft of 850,000 Bitcoins, causing BTC to drop from $1,000 to $200, a decline of over 80%.

In 2022, the collapse of Luna and the FTX explosion caused BTC to briefly fall below $16,000, resulting in widespread panic liquidation across the network. ETH also halved.

But we all saw the outcome: these were not the end of the crypto world, but the starting point for the next cycle. After the Mt. Gox collapse, Bitcoin reached a new high of $20,000 in 2017; following the FTX crisis, the entire market revived in 2023-2024, with Layer 2, public chains, and AI + Crypto applications emerging like mushrooms after rain.

The quantum crisis may also be another form of "black swan"—it will not end Bitcoin; rather, it provides a strategic opportunity for cognitive leaders to "pick up bargains."

You can imagine the scene: As Q-Day approaches, the media collectively amplifies "Bitcoin is no longer safe"; influencers on social platforms shout, "This is the crypto apocalypse"; even a celebrity or institutional wallet gets hacked, leading to widespread despair and funds fleeing overnight. At the moment when prices lose their anchor and emotions plunge into panic, that is the true moment for real value investors to take action.

Q-Day may become Q-Dip: Quantum Discounted Investment Point.

3.3 The Power of Logic

More critically, this "crisis" has not changed Bitcoin's three fundamentals:

The total supply of Bitcoin remains at 21 million, unchanged.

The protocol itself can be upgraded; as long as the community migrates to quantum-resistant signature algorithms, Bitcoin can continue to operate, and even be more secure.

The real supply and demand situation has not worsened: over 60% of Bitcoin supply is locked by long-term holders (LTH), who rarely sell in panic.

Therefore, this "technological panic" is likely just a short-term shock—similar to Mt. Gox or FTX, it is a localized collapse of trust, not a systemic collapse.

For those holding cash or stablecoins, possessing cognitive advantages and operational readiness, this may be a once-in-a-decade opportunity to build positions again.

What you really need to prepare for is not to predict the exact timing of Q-Day, but to ensure that when it arrives, you are ready with your wallet, your knowledge, and your patience.

Conclusion

The 15-year history of Bitcoin is an epic tale of collapse and rebirth:

In 2011, it fell by 93%; in 2014, it dropped by 85%; in 2018, it fell again by 80%; in 2022, the Luna and FTX events triggered a chain reaction, with a decline of up to 76%. With each downturn, the media declared it dead; yet every deep pit has been written into the prologue of the next bull market years later.

Now, the quantum crisis may be the next fuse.

It will ignite technological panic, a tsunami of public opinion, blasting out a historic bottom, and will also wash away those who overly rely on centralization and excessive leverage, the "fragile consensus."

But the explosion is not the end. For those who are prepared, it is a signal flare, a starting gun for bottom fishing.

Remember this golden saying:

True bull markets are never born from rises, but from falls.

Start preparing now—check if your cold wallet address is still secure, learn how to generate new addresses resistant to quantum attacks. There is a zero-based Bitcoin cold wallet creation tutorial available in the WeChat service account (Airdrop Web3) menu, which you can take for free, no thanks needed.

Q-Day will come, storms will rise, but you will not be the one who is unprepared.

You cannot stop the storm, but you can prepare your sails.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。