After Trump returns to power, the regulatory environment in the United States undergoes significant changes, and the tokenization of securities welcomes a policy dividend window. Platforms like Robinhood, Bybit, and Kraken are entering the market, sparking a wave of "Tokenized Stocks," attempting to reconstruct the logic of global asset trading on-chain. This revolution of capital and crypto is driven by ambitions to disrupt traditional brokerage models and deep considerations of compliance games and product pathways.

Mainstream Models of U.S. Stock Tokenization

Current attempts at U.S. stock tokenization in the market can be roughly divided into three paths: the "third-party compliant issuance + multi-platform access model" represented by Backed Finance; the "licensed broker self-operated closed-loop model" represented by Robinhood; and the "Contract for Difference (CFD) model" adopted by platforms like Bybit. These three paths not only differ in technical architecture but also represent different understandings of compliance responsibilities, user relationships, and market structures.

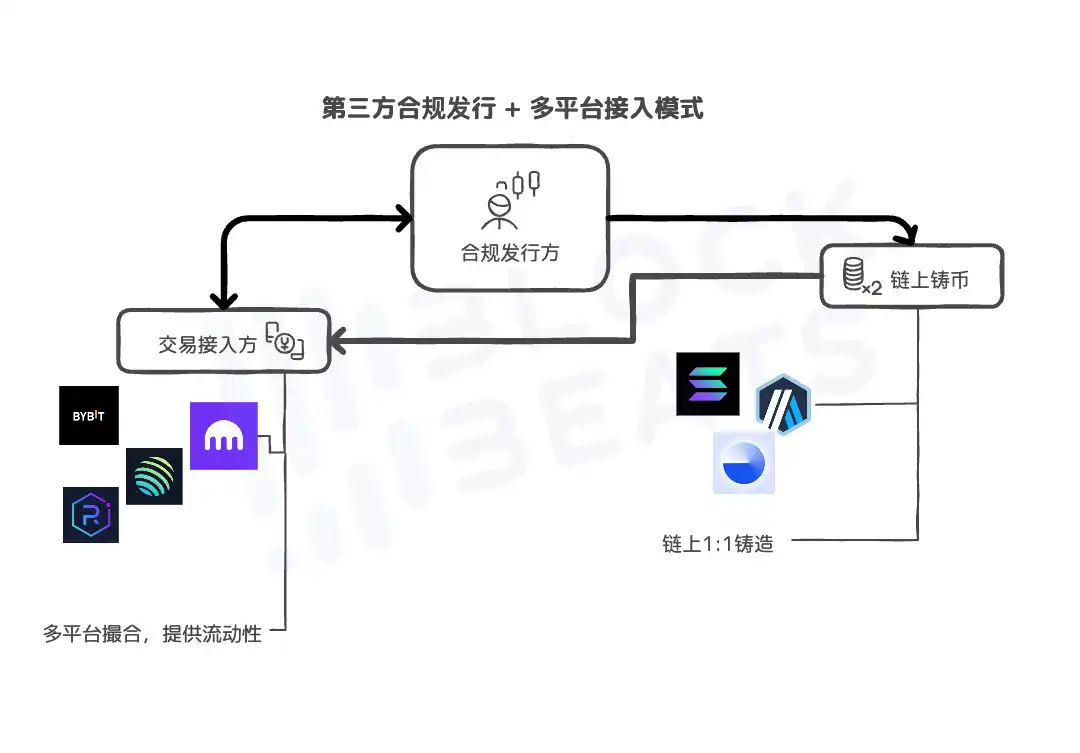

Third-Party Compliant Issuance + Multi-Platform Access Model

The core of this model is the "separation of compliant issuance and platform access," primarily represented by the recent alliance of xStocks with Kraken and Bybit. The specific operational path involves institutions like Backed Finance, which hold Swiss or EU regulatory licenses, purchasing stocks in the U.S. market through the IBKR Prime channel and holding them under the custody of regulated institutions like Clearstream and Interactive Brokers.

Once the stocks are actually purchased and recorded, corresponding stock tokens (such as TSLAx, AAPLx, NVDAx) are minted 1:1 on public chains like Solana (with plans to expand to Ethereum ERC20 in the future), and liquidity support and secondary trading matching services are provided by crypto trading platforms like Kraken, Bybit, and Jupiter.

The biggest feature of this model is that "the issuer is the primary responsible party," with all compliance requirements, asset transparency disclosures, and actual off-chain custody borne by institutions like Backed; the trading platform merely acts as a front-end access point, without the need to bear the compliance pressure of securities token issuance, thus achieving compliant circulation in large non-U.S. markets.

The advantage of this path lies in the clear logic of asset confirmation, with all tokens 100% corresponding to actual holdings, managed by custodians in separate accounts. It possesses openness and liquidity, supports on-chain trading, 24/7 trading, and can seamlessly connect with DeFi applications, allowing for smooth integration with the later extended "coin-stock" DeFi protocols. Moreover, the compliance path is clear, requiring only the issuer to have a regulatory license, while the platform can theoretically expand its business infinitely as a "distributor," quickly tapping into the "non-U.S. market."

In fact, as early as around 2020, FTX attempted to tokenize stocks using this path. At that time, FTX allowed users to trade tokens of well-known U.S. companies like Tesla (TSLA) and Apple (AAPL) on its platform. These tokens were issued by its Swiss subsidiary Canco GmbH and were linked to real stocks held at third-party brokers, achieving a "1:1 peg" mapping relationship.

At that time, users could participate in investments in popular U.S. stocks with a minimum of about $1, 24/7. To further "comply," FTX collaborated with German financial services institutions CM-Equity AG and Digital Assets AG to jointly create a compliance framework, making these U.S. stock tokens legitimate and financially integrable. However, this business was halted when FTX declared bankruptcy in November 2022 due to serious issues such as fund misappropriation and fraud allegations.

This path also has obvious limitations. Although the SEC is not as "strict" as during the FTX period, the SEC has not yet recognized the compliance of such products, limiting the products from this path aimed at U.S. users. Additionally, because this path is relatively easy to replicate, if major trading platforms cannot reach a consensus, there will be multiple "tokenized" stocks of the same company, leading to fragmented liquidity.

Most importantly, trust in the issuer is still required. Despite the independent custody system, the issuer may have a "hollow period" in data disclosure and asset redemption (data falsification or redemption delays). For example, regarding the issuer behind xStocks, Backed, some voices of doubt have emerged in the community. KOL Crypto Brave "cryptobraveHQ" expressed concerns about the backgrounds of Backed's team members on X, noting that the three main co-founders of Backed—Adam Levi, Yehonatan Goldman, and Roberto Klein—were respectively the co-founder and former CTO, COO, and head of legal and regulatory affairs of the "zero" project DAOstack. Crypto Brave further stated, "After raising about $30 million in their $GEN ICO, the team couldn't even be bothered to set up a small firm; they just issued the tokens and let it go to zero."

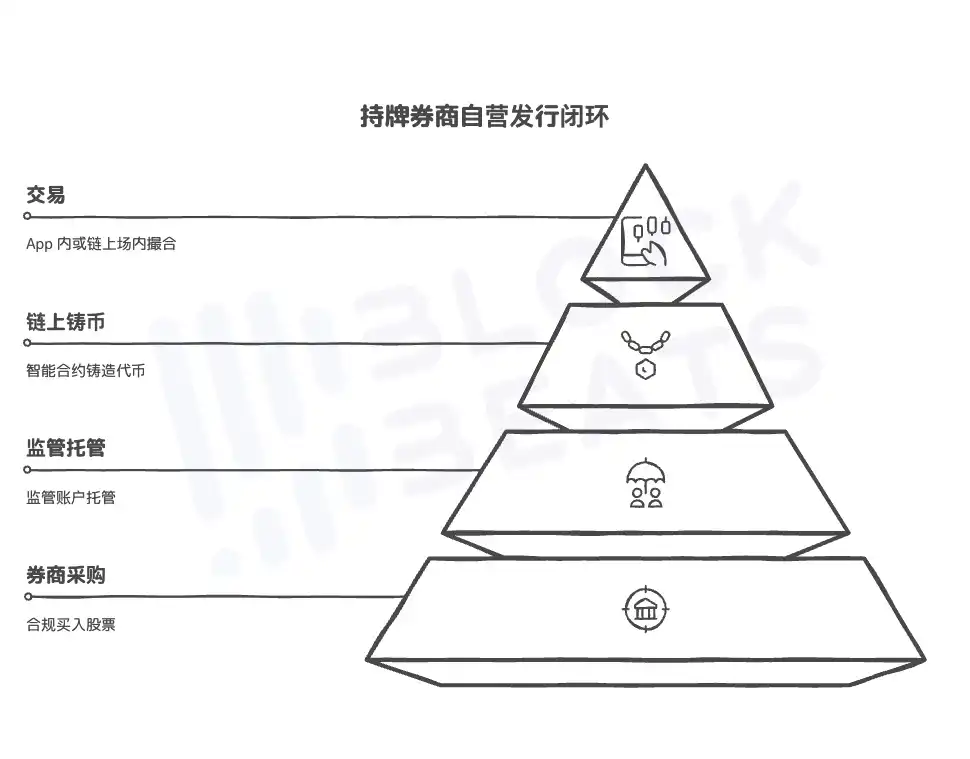

Licensed Broker Self-Operated Issuance + Closed-Loop On-Chain Trading

Currently, the only project with a well-planned path in this model is Robinhood, which follows a more thorough "broker-driven on-chain model." Compared to the xStocks model, it does not rely on third-party compliant issuers but uses its traditional brokerage license as a foundation, integrating the entire chain of stock procurement, token minting, user trading, and settlement.

Specifically, Robinhood's European subsidiary holds a Lithuanian securities license, allowing it to legally procure and custody U.S. stocks, ETFs, private equity, and other assets. It then mints tokens (such as TSLA-t, APL-t) on Arbitrum and conducts closed trading within its app. Each token transaction synchronously updates the on-chain status, with the backend inventory dynamically mapping the actual holdings, ensuring that "on-chain total = regulatory custody position." Robinhood also plans to migrate this system to its self-developed Robinhood Chain, achieving complete on-chain autonomy and cross-chain transfer capabilities.

This model is more difficult to replicate, as Robinhood itself, as a regulated entity, possesses the full chain capabilities of securities issuance, clearing, and dividend execution. Therefore, whether it is off-chain stock procurement, on-chain minting, or trading settlement and capital flow, it can achieve complete closed-loop control without relying on third-party custody or matching. The business line is also broader; although it has only announced the tokenization of "OpenAI and SpaceX" stocks so far, Robinhood has the institutional foundation and technical system to handle everything from stocks to private equity, bonds, and real-world assets (RWA).

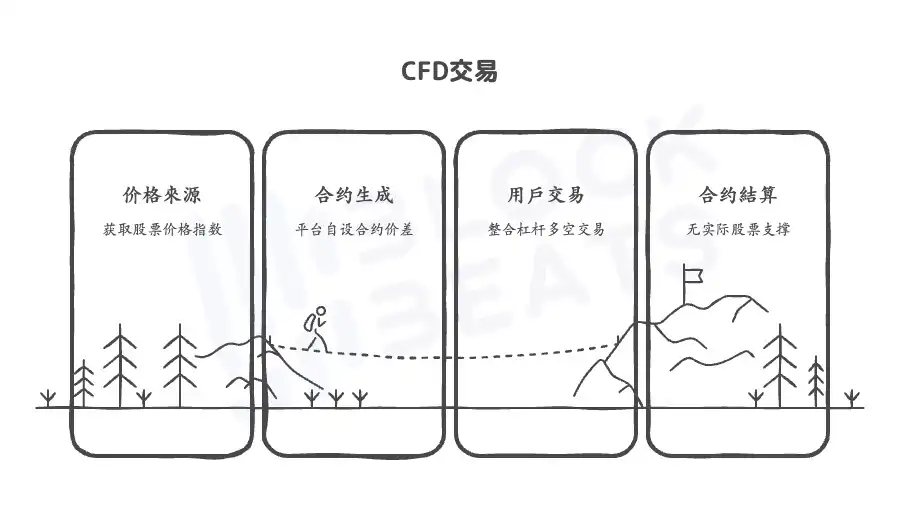

Contract for Difference (CFD) Model

The CFD path does not touch the stock assets themselves but uses stock prices as an index source, creating price speculation through self-established contracts on the platform. For example, Bybit offers a TSLAUSDT perpetual contract, which does not hold any Tesla stock as its underlying asset but provides users with high-leverage, two-way trading contract products based on oracle price sources and market-making logic.

The advantages of CFDs are also clear: they are easy to deploy, can be launched quickly, and do not require actual stock purchases or custody links, allowing any U.S. stock-related assets to be launched. After the launch of Bybit TradFi, users can trade most traditional financial assets on the Bybit App, such as oil, gold, stock CFDs, and forex, totaling over 100 assets, and support high-frequency trading, leveraged operations, etc. Since it is not actual securities issuance, the platform operates only under derivative regulatory standards.

However, the problems with this path are also evident. CFDs are not a true path in the sense of "tokenized securities," but rather a speculative response from crypto platforms to the demand for U.S. stocks. Users do not actually hold these assets, and there is a clear centralization risk, with the asset structure even posing greater risks than on-chain Memecoins.

The Two Sides of a Path: Who Will Win, Robinhood or Coinbase?

As the trend of U.S. stock tokenization heats up, Coinbase and Robinhood, two "San Francisco-born" fintech companies, have embarked on two distinctly different paths: one starting from on-chain infrastructure, attempting to penetrate U.S. regulatory barriers with technology and law, and the other starting from brokerage, first landing closed-loop scenarios in Europe, gradually building a global tokenized trading network.

How Will Robinhood Be the First to Successfully Implement the "On-Chain Broker" Model?

In today's world where global exchanges are competing to explore tokenized stocks, Robinhood is no longer satisfied with the label of "zero-commission revolutionary" but is attempting to reshape the entire infrastructure of traditional asset trading. From launching stock tokenization trading in Europe to building the Robinhood Chain for global developers, this American brokerage giant is advancing a deeper transformation at an unprecedented pace, bringing stocks, private equity, and even financial derivatives fully into the on-chain world.

Robinhood's on-chain strategy is far from simply mapping real stocks into tokens; it involves a deep reconstruction around compliance licenses, on-chain clearing, and multi-market collaboration. This fundamentally distinguishes it from other crypto platforms that only offer token trading, as Robinhood is the only one that integrates "broker + Layer2 + real stock custody" into a prototype of an on-chain broker.

Starting in Europe, Creating the First Compliant Testing Ground for Tokenized Assets

In early June 2025, Robinhood completed the acquisition of the Luxembourg cryptocurrency trading platform Bitstamp for $200 million in cash, adding over 50 licenses and registrations to its cryptocurrency division, as well as a mature institutional exchange with over 5,000 institutional clients. At the same time, in May, Robinhood announced it would acquire the Canadian cryptocurrency platform WonderFi for approximately $179 million to strengthen its business in the Canadian market. With this, Robinhood has secured an important piece in its "U.S. stock tokenization" plan.

By the end of June, Robinhood announced the launch of a stock token trading platform based on Arbitrum in 31 European countries, with over 200 U.S. stocks and ETFs available at launch, and plans to expand to equity tokens of private companies like SpaceX and OpenAI. These tokens are entirely held and minted by Robinhood, ensuring a 1:1 correspondence with real stocks, and they also support real-time dividends and stock splits.

Unlike previous attempts by centralized platforms, Robinhood did not rely on third-party issuing institutions but instead utilized its Lithuanian MiFID securities license held by its European subsidiary to purchase real stocks within a compliant framework and place them in a regulated account, creating its own custody-minting-trading closed-loop process. Additionally, Robinhood did not stop at upgrading the token trading interface but also upgraded the original Robinhood Crypto App into a comprehensive investment platform, integrating perpetual contract trading, cryptocurrency management, on-chain staking, and an AI investment assistant into one app, providing a complete investment toolkit for user migration.

Sound familiar? Phase one is issuing tokens, phase two is seeking liquidity, and phase three is decentralized finance.

However, the European business is just the first step for Robinhood. The launch of Robinhood Chain is a comprehensive announcement of the future form of the asset internet. This Layer 2 network built in collaboration with Offchain Labs based on Arbitrum not only carries the trading and settlement functions of all tokenized assets of Robinhood but will also be open to global third-party developers, forming an on-chain ecosystem around the issuance of real assets.

The underlying design logic is divided into three phases: the first phase involves Robinhood brokers purchasing real stocks and minting on-chain tokens after custody; the second phase introduces Bitstamp as a supplementary liquidity source, allowing token trading to continue even during traditional market closures on weekends; the final phase allows users to self-custody the token assets issued by Robinhood and migrate them to other chains or DeFi protocols for use.

Throughout this process, Robinhood controls the rights to purchase, custody, mint, trade entry, and user relationships, thus achieving an on-chain closed loop of "token ≈ stock." The on-chain aspect serves merely as a bookkeeping layer, with all actions having corresponding records off-chain. This model sacrifices the transferability of tokens but greatly enhances regulatory controllability, paving the way for its subsequent expansion into Robinhood Chain, a public chain compatible with both traditional finance and blockchain assets globally.

Robinhood's logic is that since it is a broker, it will buy stocks, custody them, and mint tokens itself. Throughout the process, Robinhood controls the rights to purchase, custody, mint, trade entry, and user relationships, thus achieving an on-chain closed loop of "token ≈ stock." The on-chain aspect serves merely as a bookkeeping layer, with all actions having corresponding records off-chain. This model sacrifices the transferability of tokens but greatly enhances regulatory controllability, paving the way for its subsequent expansion into Robinhood Chain, a public chain compatible with both traditional finance and blockchain assets globally.

This means that Robinhood is no longer just a terminal trading platform but is transforming into a "chain-based broker foundation" that integrates asset issuance, clearing, and trading. Notably, Robinhood's layout for private equity is particularly worth attention; its tokenized issuance not only breaks the high-threshold structure of traditional private investment but may also change the liquidity logic of early-stage tech equity, forming a new species akin to a "crypto primary market." The "ICM" that Solana has been promoting recently may be realized at this traditional brokerage end.

Coinbase: Building from the Chain, Seeking Synergy between "Exchange + Compliant Issuance"

Although it has not yet launched stock business, Coinbase, which recently went public with Circle and brought perpetual contract business back to the U.S., cannot be overlooked here. In fact, Coinbase's logic follows a different path: first, establish the infrastructure and then lobby regulators to seek licenses, exemptions, or precedents before proceeding with asset tokenization.

According to Reuters, on June 17, Coinbase's Chief Legal Officer Paul Grewal stated that relying on its own Base public chain and Layer 2 technology stack, as well as a dormant broker-dealer entity, it has applied to the SEC for a no-action letter, hoping to obtain legal exemptions for tokenized stock products.

Coinbase's plan is that once it receives the SEC's approval, it can issue tokens representing equity on-chain and complete processes such as T+0 settlement, fractional share splitting, and real-time dividends using on-chain smart contracts. Its native underlying stablecoin assets, the native Layer 2 Base, and its top-tier institutional exchange will bring even greater advantages on the "sales side."

In contrast to Robinhood's approach of "doing first and regulating later," Coinbase has chosen a "compliance-first" path. This reflects the sensitivity of its identity as a publicly traded company in the U.S. and represents a higher-risk strategy that, if successful, could "capture the largest market share in the U.S."

Technology vs. Licenses, Open Source vs. Closed Loop: Who Can Win the Last Mile?

From a structural perspective, Robinhood is a "license-driven" on-chain broker, while Coinbase is an "infrastructure-driven" on-chain platform. The former follows a closed-loop control path, while the latter seeks open collaboration.

Robinhood currently possesses the full chain qualifications for securities issuance and has a stronger ability to connect fractional shares with real equity; while Coinbase, although it has not yet achieved actual issuance, has the technical maturity of its Base public chain and the depth of matching on the exchange side, giving it the potential to become a "global on-chain securities standard network."

Ultimately, this showdown is a multi-party collaborative game of "who can simultaneously persuade users, regulators, and the market." If Robinhood can connect on-chain liquidity with multi-platform interactions, and if Coinbase can receive the green light from the SEC, it could directly become the entry point for tokenized equity in the U.S. market. One starts from the traditional industry, while the other begins from cryptocurrency; this competition over the future of on-chain securities has only just begun.

Although significant progress has been made in technology, compliance, and user experience for tokenized stocks, scaling still faces several challenges, including fragmented liquidity, high hedging difficulty, complex on-chain dividends and governance, and varying geopolitical regulations. However, the trend indicates that with the entry of compliant giants like Robinhood and Coinbase, tokenized stocks will transition from "gray experiments" to "legal entry points," and the next stage of asset transformation may be on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。