On July 2, Derlin Holdings opened high and surged in the morning session, once soaring by 15% to a peak of HKD 3.81. Behind the strong upward movement of the stock price is the company's official announcement of a strategic partnership with fintech company Asseto to jointly enter the hot RWA (Real World Asset) sector. Currently, with the gradual implementation of the "Stablecoin Regulation," RWA is experiencing a dual catalyst of policy and technology: on one hand, stablecoins serve as low-cost and efficient pricing and settlement tools, opening up funding channels for RWA products; on the other hand, they significantly enhance the liquidity of RWA assets, accelerating product innovation and scenario implementation. Hong Kong stock RWA concept stocks are also seizing this opportunity to ignite a new wave of enthusiasm.

Derlin Holdings: From Wealth Management to On-Chain Finance

Derlin Holdings Group is a fully licensed financial services group headquartered in Hong Kong, focusing on global family wealth management and investment banking services. The company has permanent offices in Shanghai, San Francisco, Singapore, and Tokyo, managing a total asset scale of over USD 3.5 billion, covering core businesses such as securities trading, financial advisory, asset management, and investment research, providing comprehensive financial services for high-net-worth individuals and institutional clients. However, what truly captures the market's attention is that Derlin Holdings is quietly completing a transformation from "traditional to future."

On July 2, Derlin Holdings announced a strategic partnership with fintech company Asseto Fintech Limited (Asseto), officially entering the RWA sector. This is not just a capital-level collaboration but an ecosystem-level cooperation driven by compliance and technology. Derlin Holdings will engage in deep collaboration with Asseto across multiple dimensions: joint fund issuance, RWA infrastructure construction, customer and market integration, and stablecoin ecosystem cooperation. In the future, Derlin Holdings will leverage Asseto's mature blockchain technology and its own professional advantages in asset management, securities trading, and family office services to accelerate the on-chain transformation of traditional financial businesses. Meanwhile, the Derlin board is reviewing the latest stablecoin regulatory draft in Hong Kong and plans to apply for a stablecoin issuance license, taking a crucial step from asset management to cryptocurrency-native infrastructure.

It is worth noting that one of Asseto's shareholders is HashKey Group, one of Hong Kong's most representative licensed crypto trading platforms. HashKey's exchange holds upgraded versions of licenses No. 1 and No. 7, which allow for the issuance of securities or security tokens, perfectly aligning with RWA's compliance requirements. Currently, HashKey has partnered with over 200 institutions to carry out RWA on-chain cooperation, involving traditional financial institutions, asset management companies, technology enterprises, and Web3 native projects, promoting the on-chaining of traditional assets such as money market funds, gold ETFs, bonds, and hedge funds, and has taken the lead in launching tokenized products for USD and HKD currency ETFs on its platform.

Derlin Holdings' entry means direct access to this rapidly developing RWA compliance track, securing a first-mover advantage.

In fact, Derlin's exploration of the crypto sector is not a spur-of-the-moment decision. As early as 2023, Derlin's digital family office applied to the Hong Kong Securities and Futures Commission for a virtual asset management license, with plans to increase the weight of virtual assets in its investment allocation.

On June 24 of this year, Derlin Holdings announced a strategic partnership with Bitcoin mining pool giant ViaBTC, planning to establish a joint venture to jointly conduct cryptocurrency over-the-counter trading, asset management, and family office services, and explore the establishment of a Bitcoin reserve system. Meanwhile, Derlin also revealed that it is planning to develop a virtual asset trading and management platform licensed by the Hong Kong Securities and Futures Commission, creating a closed loop for investment, custody, trading, and settlement.

The RWA Boom in Hong Kong Stocks: An "Asset Revolution" on the Blockchain is Unfolding

In the past two months, several Hong Kong-listed companies have boldly announced their plans to enter the RWA business, igniting an "asset revolution" in the capital market on the blockchain.

Ant Group: Technology + Scenario Dual-Drive, A Pioneer in Chain Reform

As one of the earliest tech giants to respond to the RWA concept, Ant Group has accelerated its layout in the RWA field since 2024. In May of this year, Ant officially joined the Hong Kong Monetary Authority's Ensemble sandbox project as one of the first private sector members, participating in tokenized deposit testing and industry standard formulation, and subsequently recruiting RWA architects in Hong Kong, frequently making moves in RWA applications.

On the product side, Ant Group has successively promoted several RWA projects: collaborating with Sui to explore ESG asset tokenization, completing a RMB 200 million photovoltaic RWA pilot with Xiexin Energy, participating in China's first green energy battery swap asset RWA project in collaboration with Conflux, and providing technical support for the battery swap assets of Xunying Group.

On the technology side, in October last year, Ant Group's AntChain publicly launched its "Two Chains and One Bridge" platform designed for RWA business, aimed at helping more mainland new energy assets go to Hong Kong for RWA, achieving technological empowerment of physical assets. In April of this year, Ant Group's open-source next-generation blockchain virtual machine DTVM integrated the large language model development framework SmartCogent, while being fully compatible with the Ethereum ecosystem, eliminating language barriers for RWA scenario developers in cross-platform development.

On June 12, Ant Group's international business department planned to apply for a stablecoin license in Singapore and Hong Kong, targeting core application scenarios of RWA such as cross-border payments, e-commerce settlements, and asset management. Boosted by this news, Ant concept stock Yunfeng Financial once surged by 90%, closing with a still significant increase of 54%.

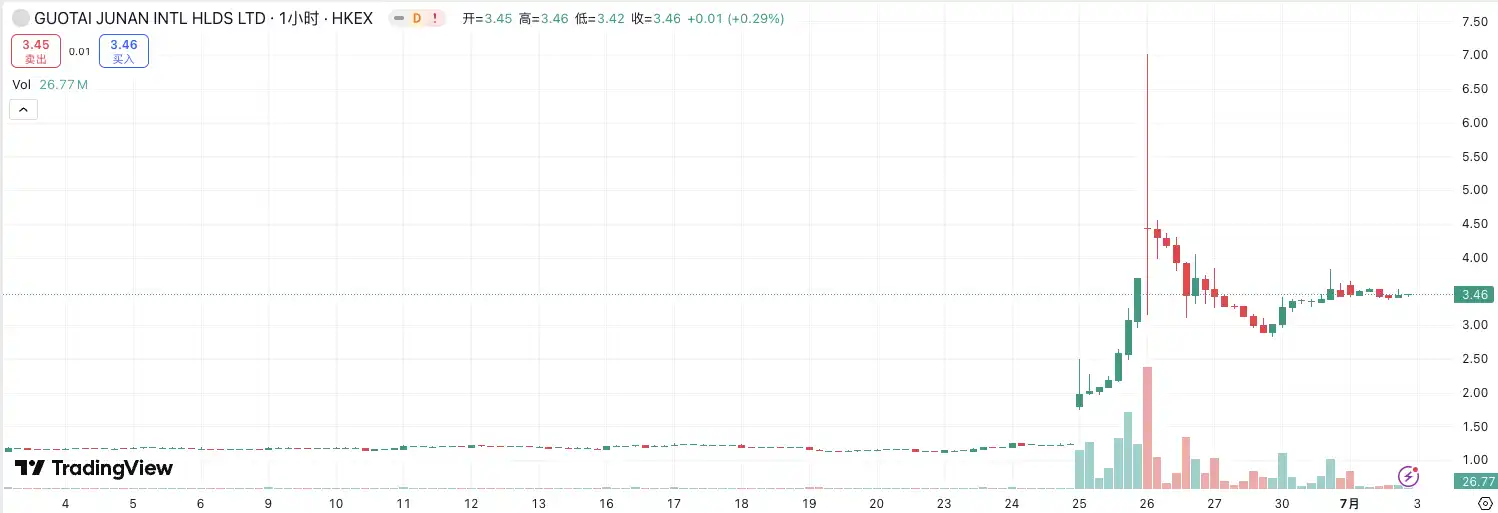

Guotai Junan International: Traditional Brokerage's Web3 Transformation

On June 25, Guotai Junan International officially received approval from the Hong Kong Securities and Futures Commission to upgrade its existing securities license to a comprehensive license that allows for virtual asset trading and related advisory services. It became the first Hong Kong-based Chinese brokerage to obtain this full-scale virtual asset trading service qualification. Guotai Junan International's stock price soared over 80% at the beginning of trading, with an intraday peak increase exceeding 190%.

With this, Guotai Junan International has become the first Hong Kong-based Chinese brokerage capable of providing comprehensive virtual asset-related trading services, covering virtual asset trading, professional advisory services during the trading process, and the issuance and distribution of virtual asset-related products, including over-the-counter derivatives.

This means that soon, Guotai Junan International's clients will be able to directly trade various virtual assets, including mainstream cryptocurrencies like Bitcoin and Ethereum, as well as stablecoins like USDT, through its platform, marking a significant acceleration of traditional brokerages towards Web3 finance.

Related Reading: "Guotai Junan Soars 190%, Is Hong Kong Stock Market Welcoming a 'Coin Stock' Wave?"

China Carbon Neutral: Green Assets Can Also Be "On-Chain" Traded

In addition to tech giants and brokerages, environmentally friendly listed companies are also beginning to turn their attention to RWA. In early May, China Carbon Neutral announced a strategic cooperation framework agreement with Gaol Street Holdings, planning to strategically invest in its security token platform CSpro to promote the tokenization of carbon assets and green energy.

As a sub-sector that naturally aligns RWA with ESG, green asset tokenization not only has policy support but also meets actual financial demand. Since the announcement in early May, the stock has surged from HKD 0.28 to a peak of HKD 1.63, an increase of over 5 times, becoming a "monster stock" representative in the Hong Kong stock RWA sector.

Conclusion

It is foreseeable that RWA is no longer just a conceptual "future finance," but a realistic path backed by real capital in the market. With the advancement of Hong Kong's "Stablecoin Regulation Draft," it will not only lay the regulatory foundation for stablecoins as pricing and settlement tools for RWA but also clear obstacles for compliant circulation of assets after going on-chain. Players in the RWA ecosystem are rapidly expanding.

Moving forward, how to continue to release innovation space while ensuring financial stability, attracting more assets, capital, and developers to "go on-chain," will be key to determining whether Hong Kong can stand out in the global RWA race. For Hong Kong, this is both an opportunity period for policy windows and a competition for the dominance of future financial infrastructure. The RWA wave has arrived, and those who dare to take the first step may seize the advantage for the next decade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。