$HYPE has surpassed $SUI to become the 11th ranked project by market capitalization.

Among the top 20 projects by market capitalization, only $HYPE, $SUI, and $TON are new coins in this round, while the others are classic old coins.

Now let's explore the opportunities within the Hyperliquid ecosystem.

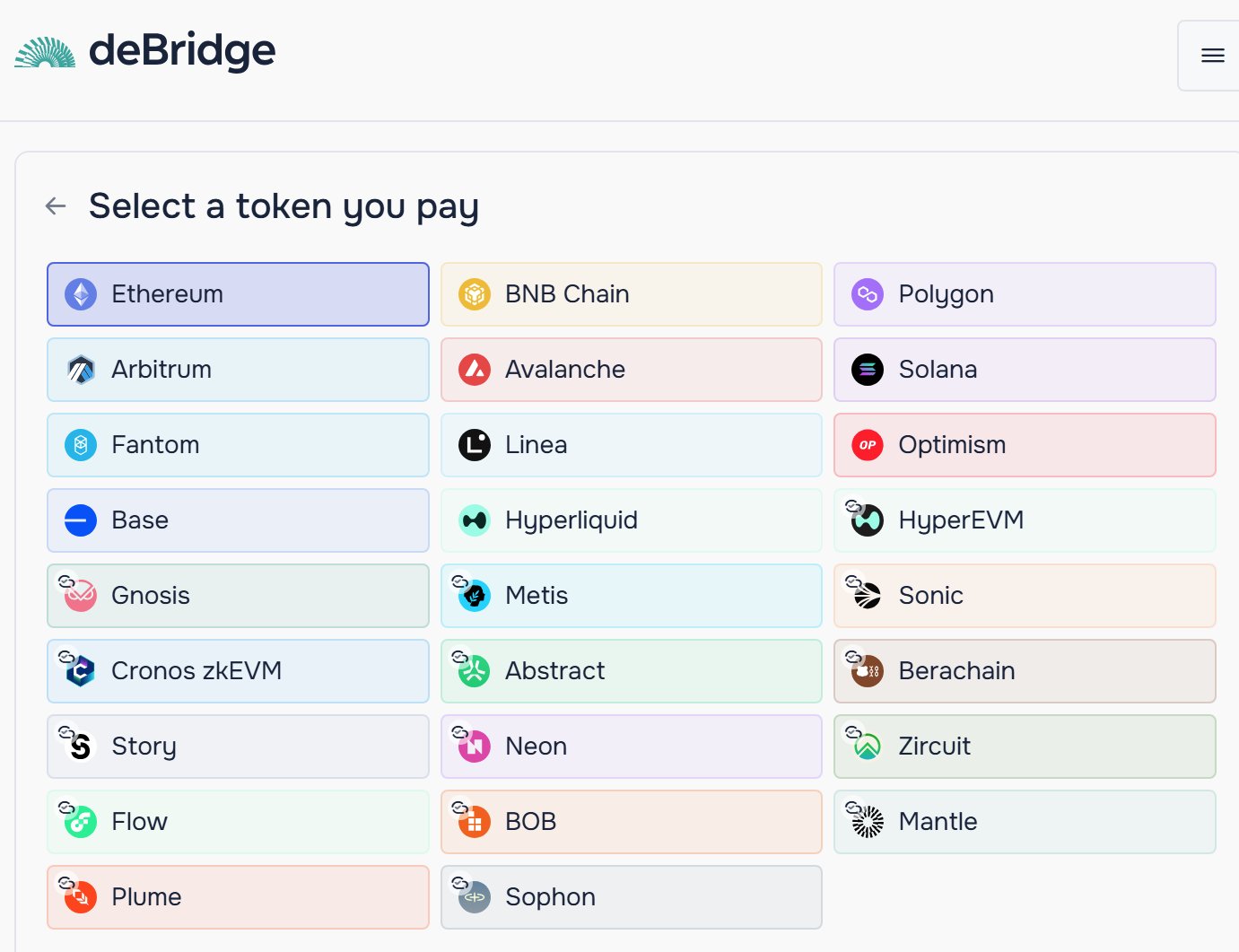

💠deBridge

◆ Application Type: Cross-chain bridge.

◆ Product Advantages: Lightning-fast cross-chain transactions, with points and subsequent airdrops.

◆ Product Limitations: Only supports Hyperliquid's $USDC and HyperEVM's $HYPE.

◆ Applicable Scenarios: Cross-chain transfers into the Hyperliquid ecosystem | funding inflow.

deBridge is likely the earliest project to integrate with the Hyperliquid ecosystem, having supported it since March.

At that time, it only supported transfers into HyperEVM and Hyperliquid outflows, but now it fully supports both inflows and outflows for HyperEVM and Hyperliquid.

deBridge is a project very sensitive to Layer1 and Layer2, currently supporting cross-chain transactions between 26 ecosystems. Recently, with the launch of the Plume mainnet, deBridge has enabled cross-chain transactions between the Plume ecosystem and the other 25 ecosystems, quickly providing a funding entry for RWAfi.

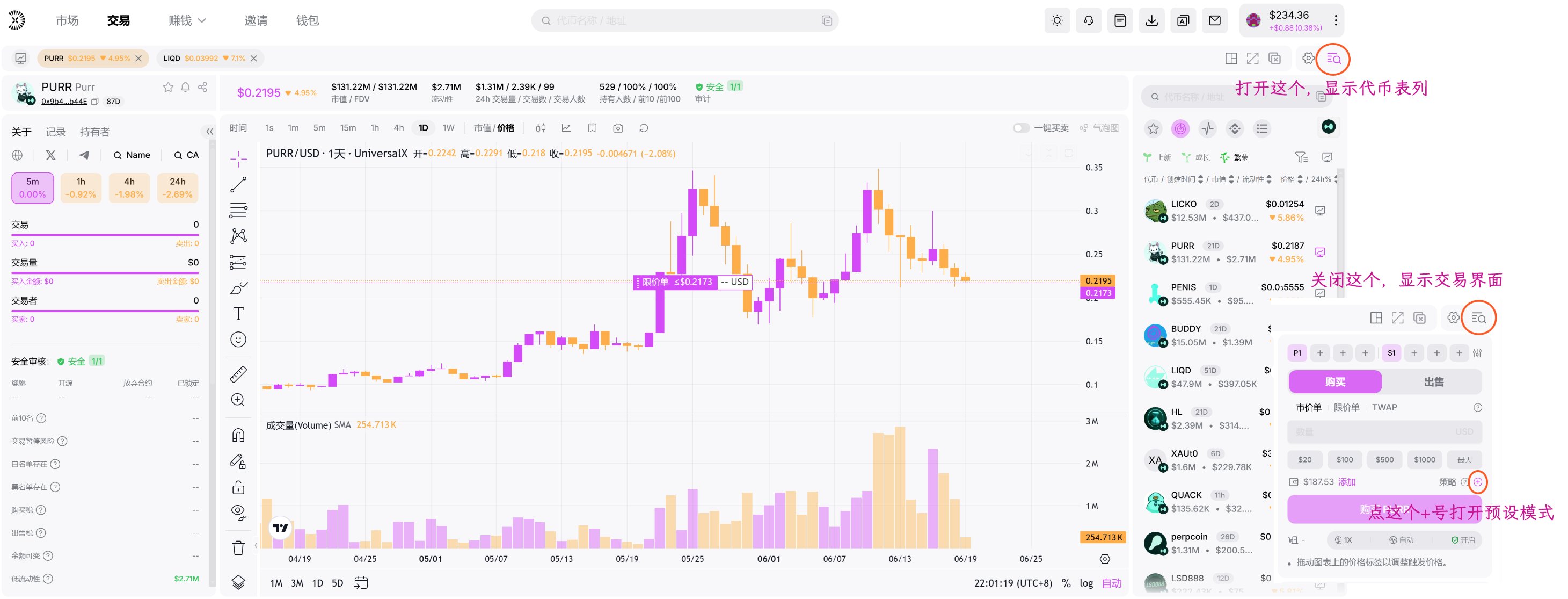

💠UniversalX

◆ Application Type: DEX based on chain abstraction.

◆ Product Advantages: Aggregates Hyper

◆ Product Limitations: Only supports spot trading, does not support perpetual futures.

◆ Applicable Scenarios: Trading HyperEVM and other chains' MEME coins and mainstream coins using USDC like in a CEX.

UniversalX directly lists the tokens of the HyperEVM ecosystem, revealing that the largest MEME by market and liquidity in the HyperEVM ecosystem is $PURR, with a market cap of $130 million.

UniversalX has recently updated many features, supporting market orders, limit market orders, and TWAP trading modes.

Users can also set 8 preset modes, where P is price priority mode and S is speed priority mode. UniversalX has set a default P1 strategy: double the capital out, halve the stop loss.

UniversalX is now the DEX with product features and experience closest to CEX. Although users need to deposit funds, it differs from single-chain channel DEXs like Hyperliquid. When users deposit into UniversalX, they are funding their universal account, controlled by an external wallet.

Users can buy any on-chain asset at any time, sell at any time, and purchase other on-chain assets without needing cross-chain transactions. This is because UniversalX's underlying infrastructure is based on Particle chain abstraction, which uses Particle technology to perform a series of operations like buying and selling across chains, all without user awareness, providing an experience similar to that of a CEX.

Additionally, if users want to trade leveraged contracts, they can go to MYX, connect the same external wallet, and choose the universal mode to use their funds in the universal account for perpetual futures trading.

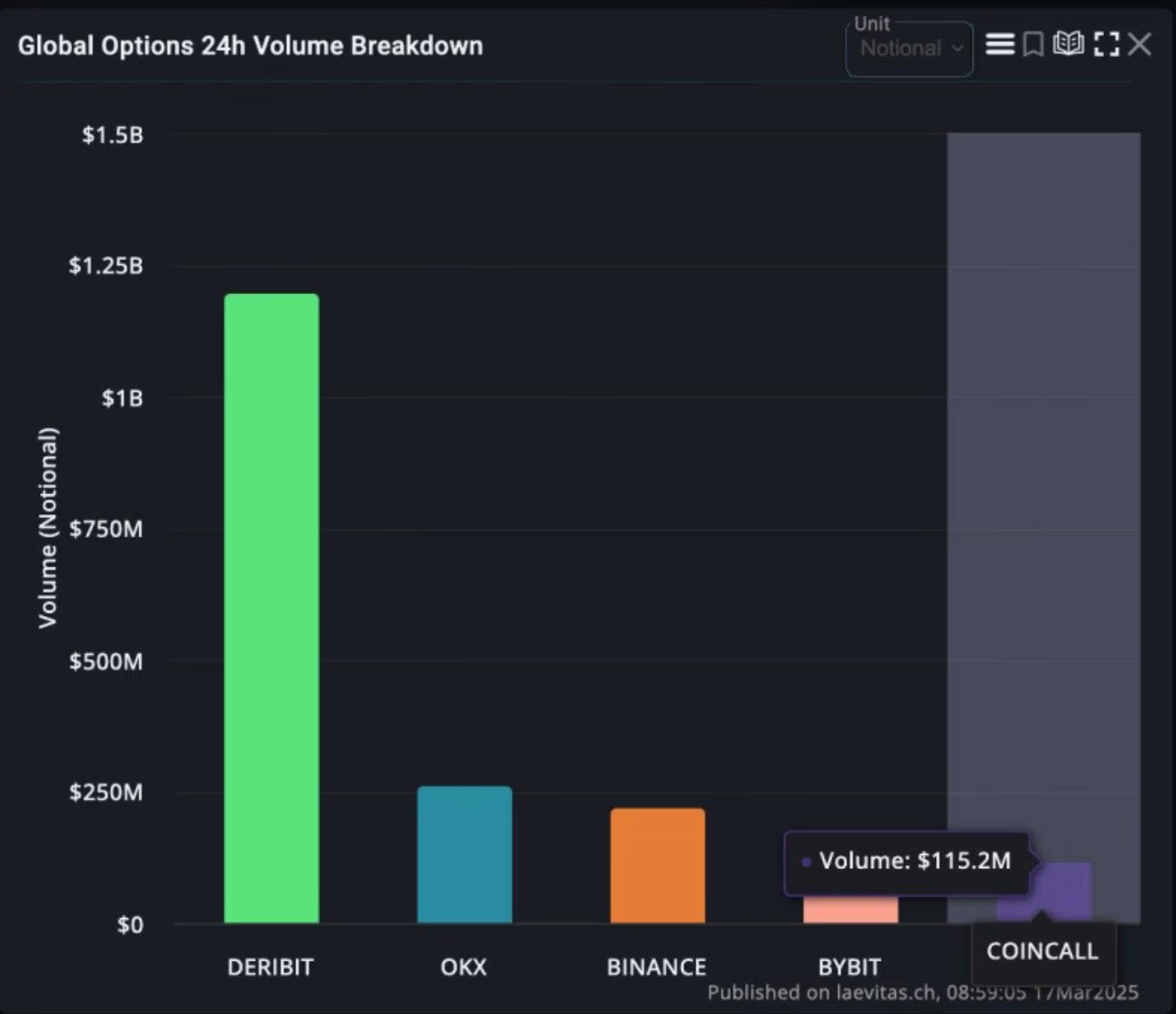

💠CoinCall

◆ Application Type: Options-focused exchange (also includes spot and perpetual futures).

◆ Product Advantages: Professional options trading products.

◆ Product Limitations: Options products have relatively high entry barriers.

◆ Applicable Scenarios: $HYPE options.

CoinCall is an options-focused exchange and ranks as the 5th largest options exchange, known for its user-friendly trading interface.

In the options field, "Call" means bullish, so CoinCall signifies a bullish stance on cryptocurrencies. Among the top 5 options exchanges, CoinCall is the youngest, but its name indicates that it was born for options. Therefore, CoinCall has an excellent reputation in terms of options trading interface and product experience.

As an external entity of the HYPE ecosystem, CoinCall is the only trading platform that supports $HYPE options, providing $HYPE traders with more strategies:

When market volatility is high, buy bullish or bearish $HYPE options,

When market volatility is low, sell bearish or bullish $HYPE options.

Use $HYPE options to hedge $HYPE futures or spot positions.

💠In Conclusion

Hyperliquid has risen due to its product experience and innovative listing methods, gaining popularity through the overseas version by James. However, the HyperEVM ecosystem is still in its early stages, and this article introduces the opportunities within the Hyperliquid ecosystem.

The DeBridge recommended in this article has supported the Hyperliquid ecosystem for over 3 months, serving as a very convenient funding entry for Hyperliquid and HyperEVM, allowing direct cross-chain access from 18 ecosystems.

UniversalX allows direct trading of HyperEVM ecosystem tokens and seamless switching between the HyperEVM ecosystem and other ecosystems without cross-chain operations, providing an experience similar to that of a CEX.

CoinCall offers $HYPE investors opportunities for options trading and hedging.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。