Exploring Coinbase's Business Model and Core Logic for Future Growth.

Author: Dolphin Investment Research, Xueqiu

If we say that the expectations of interest rate cuts + the periodic halving of Bitcoin supply + the damage to dollar credit + the Trump administration's regulatory friendliness have supported the rise of cryptocurrencies from 2022 to the present.

As of June 23, the cryptocurrency market size reached $3.3 trillion, having increased nearly threefold since 2023. Among them, the most well-known and largest by market capitalization, Bitcoin, which contributes over 60% of the market value, has risen from less than $30,000 in mid-2023 to over $100,000 today.

What does $3.3 trillion represent? It is equivalent to 3% of the global GDP. If we consider the entire cryptocurrency asset as a national economy or a company called Crypto, then:

The current cryptocurrency assets are equivalent to the economic level of a moderately developed country, surpassing France to rank 7th globally;

It is also a company that surpasses Apple ($3 trillion), becoming the third largest company by market capitalization in the world. The companies ahead are Microsoft and NVIDIA, around $3.6 trillion, and with the current trend, Crypto becoming the global leader is just around the corner.

Therefore, from the perspective of global asset allocation, cryptocurrency assets are becoming increasingly difficult to ignore, and Dolphin has decided to start tracking them.

Considering that regulation is still the biggest influencing factor, currently in a transition from strict to somewhat relaxed, we prioritize researching leading companies with good business models and higher compliance attributes.

The cryptocurrency asset series kicks off with $Coinbase Global(COIN)$, and this article will mainly discuss Coinbase's business model and core logic for future growth. The next article will focus on stablecoins and also calculate the future value of Coinbase and $Circle(CRCL)$.

The following is a detailed analysis

1. Exchanges Are Not the Endpoint

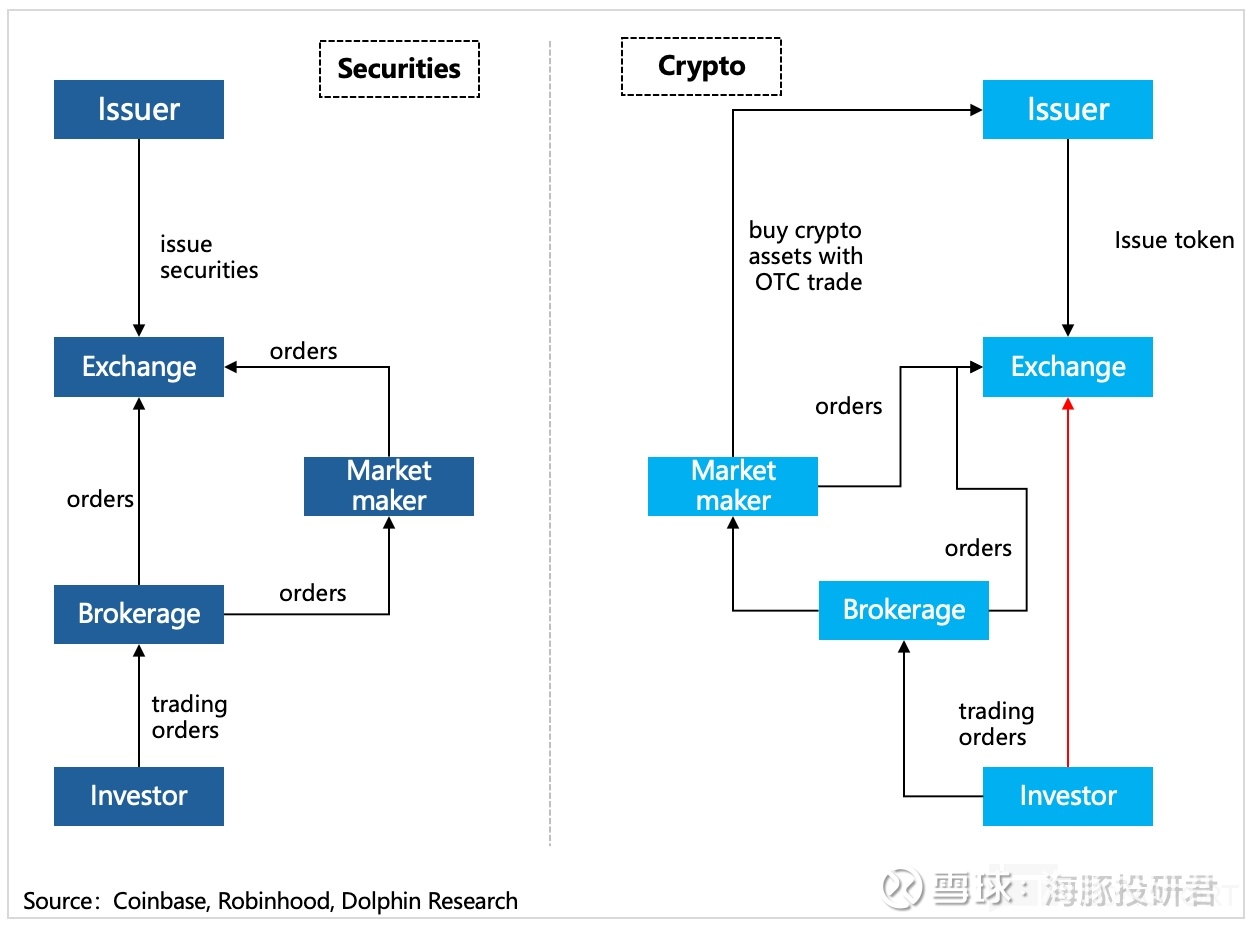

If we view "cryptocurrency" as the listed company targets in the stock market or as commodity contracts in the commodity market, then Coinbase is like the New York Stock Exchange and the Chicago Mercantile Exchange, with the most basic functions of providing cryptocurrency quotations, matching, settlement, and other exchange-like functions.

However, unlike traditional exchanges, Coinbase has also taken on the role of a "broker"—that is, it can directly face investors and provide services such as trading, lending, custody, staking, and withdrawals.

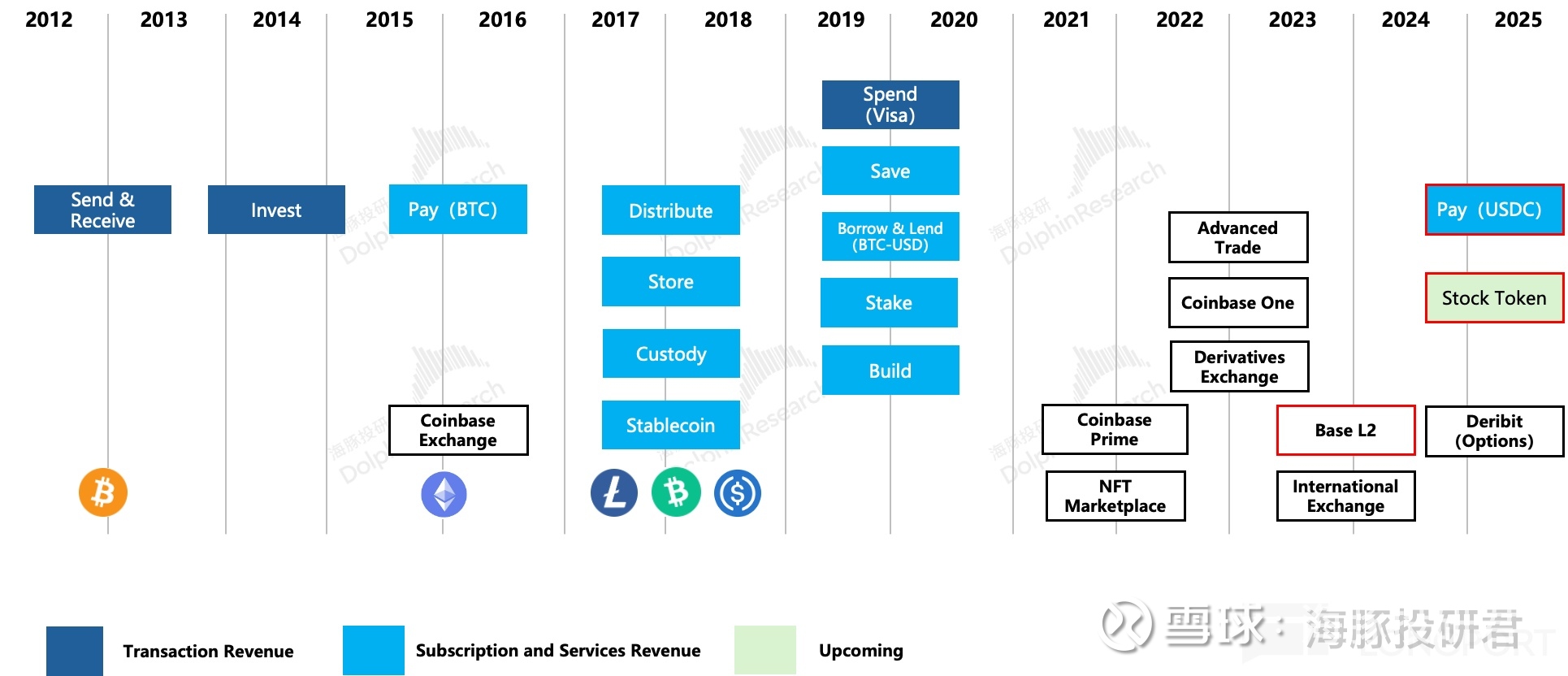

With the improvement of infrastructure like digital wallets and merchant ecosystems, Coinbase quickly advanced payment scenarios primarily based on BTC. In 2019, it even partnered with Visa to launch the Coinbase Card, allowing users to make offline/online purchases. However, one significant reason for the slow promotion of payment scenarios is the high volatility of cryptocurrency values. Therefore, once stablecoins are introduced and gain official recognition, Coinbase's payment scenarios are expected to receive a more robust push.

In addition to trading and payments, Coinbase is also applying for a stock token trading platform. If approved by the SEC, it would mean that users could indirectly invest in stocks on Coinbase.

Thus, Coinbase's future business landscape has a clearer blueprint, aiming to accelerate the on-chain of real assets and create a comprehensive financial scenario platform on-chain, rather than just being a pure cryptocurrency exchange.

Dolphin believes that both payment and investment are key operations to expand the application scenarios of cryptocurrencies, and the extension of these scenarios means the overall market for cryptocurrencies will expand, which will also allow Coinbase, as a "water seller," to earn more.

In the cryptocurrency market, platforms like Coinbase not only shorten the entire industry chain vertically but also quickly cross multiple demand scenarios horizontally, partly due to the past insufficient regulation of cryptocurrencies and the convenience of business expansion. For a leading company like Coinbase, which is relatively top-tier in terms of scale and compliance, more regulatory penetration in the future will only help it eliminate potential competitors.

Therefore, it is natural to think that Coinbase should be able to obtain more profit distribution.

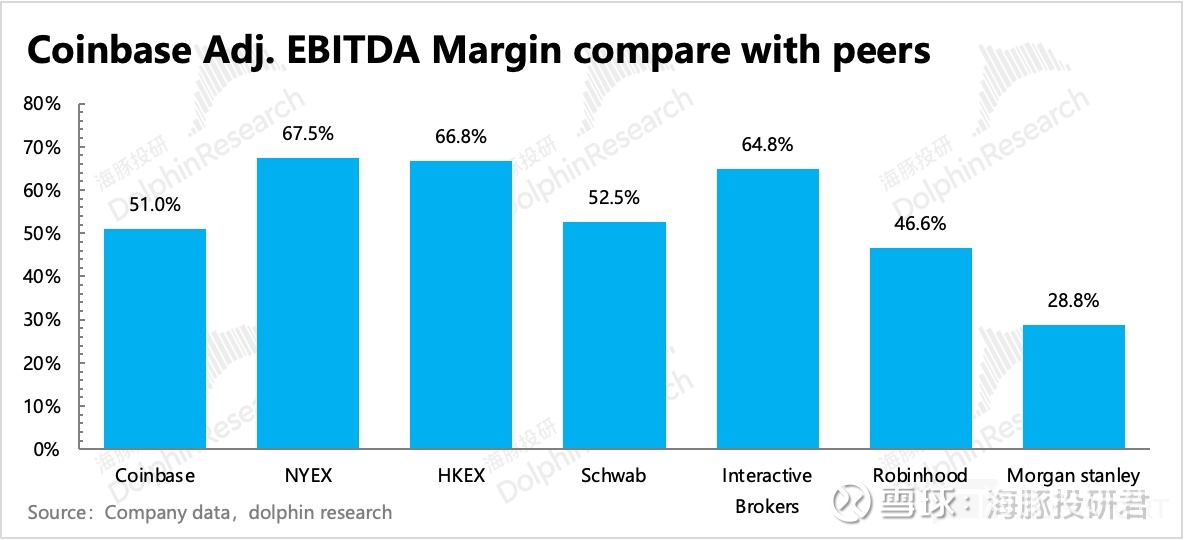

This is indeed the case, but due to the high volatility of the cryptocurrency market, Coinbase's performance is not stable. However, excluding special periods (such as listings, acquisitions, etc., which disturb short-term profit margins), the profitability during normal periods (measured by profit margins) is generally distributed in the range of 25% to 65%. Although the range is large, it can basically be compared to mature traditional financial institutions.

Looking at the situation in 2024, Coinbase's profit margin is close to that of low-discount/commission-free brokers like Robinhood, but lower than pure exchanges, indicating that it has not yet fully realized the additional profit space brought by the advantages of exchanges and the industry chain.

As the virtual currency market continues to grow with the more universal recognition of cryptocurrency assets, as long as Coinbase maintains its competitive position, its profit margin ceiling will gradually open up. In the end, Dolphin believes it can reach a profit level that is more advantageous compared to traditional financial institutions.

2. Compliance Advantages Open Up Imagination Beyond "Trading"

So what kind of competitive environment does Coinbase face? Dolphin discusses while sorting out Coinbase's basic business and business model.

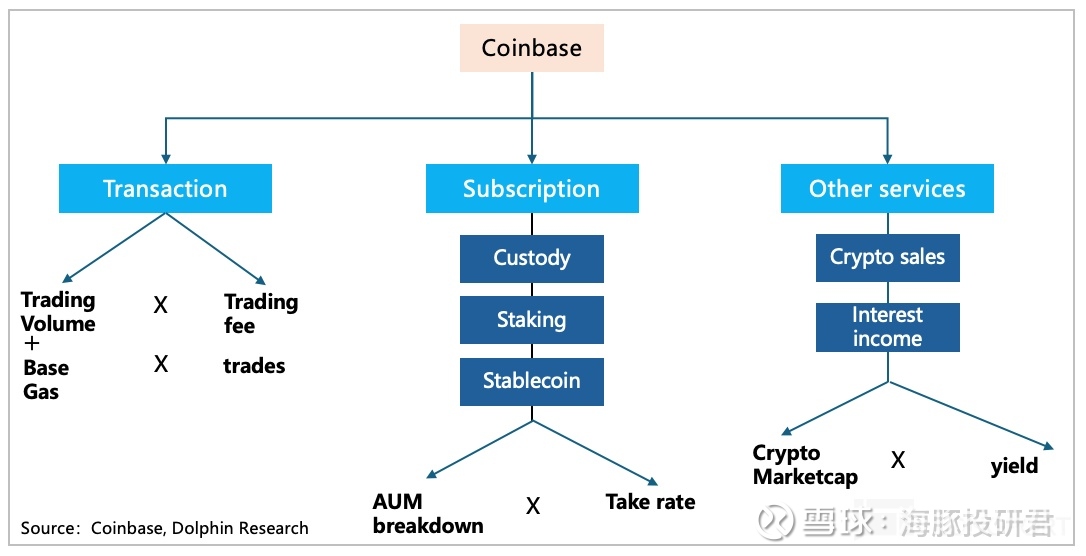

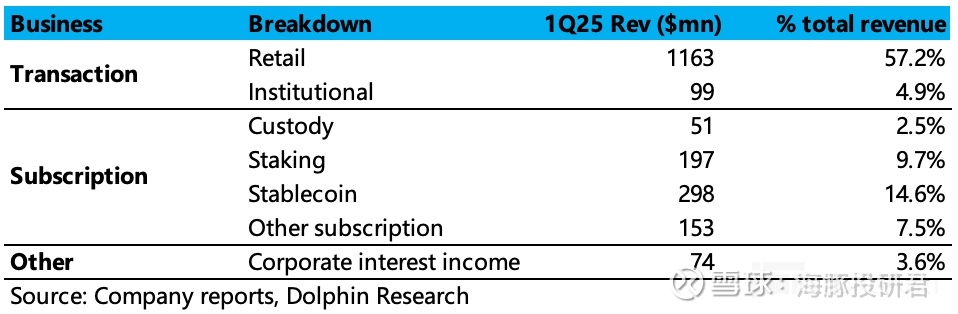

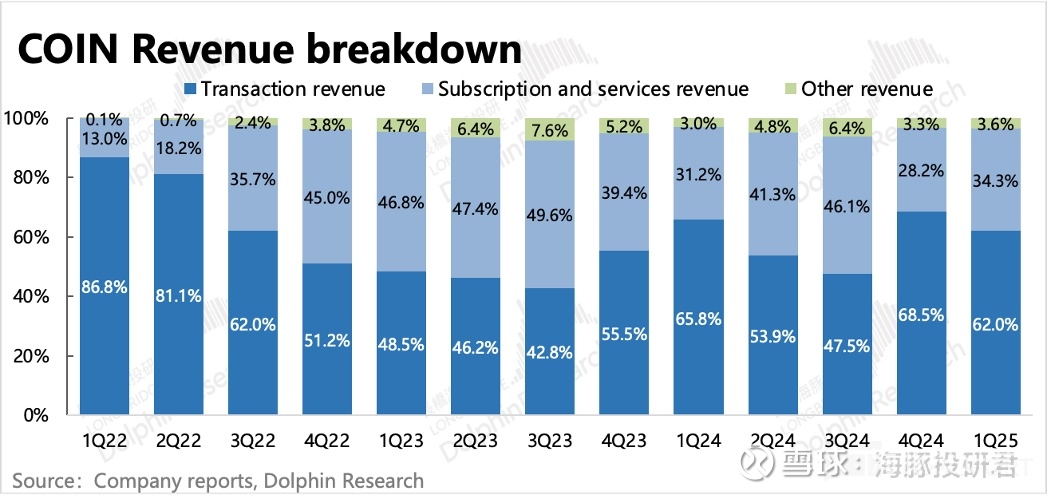

Looking directly at the chart below, in terms of major revenue contributions, Coinbase has three main sources of income: trading revenue, subscription revenue, and others.

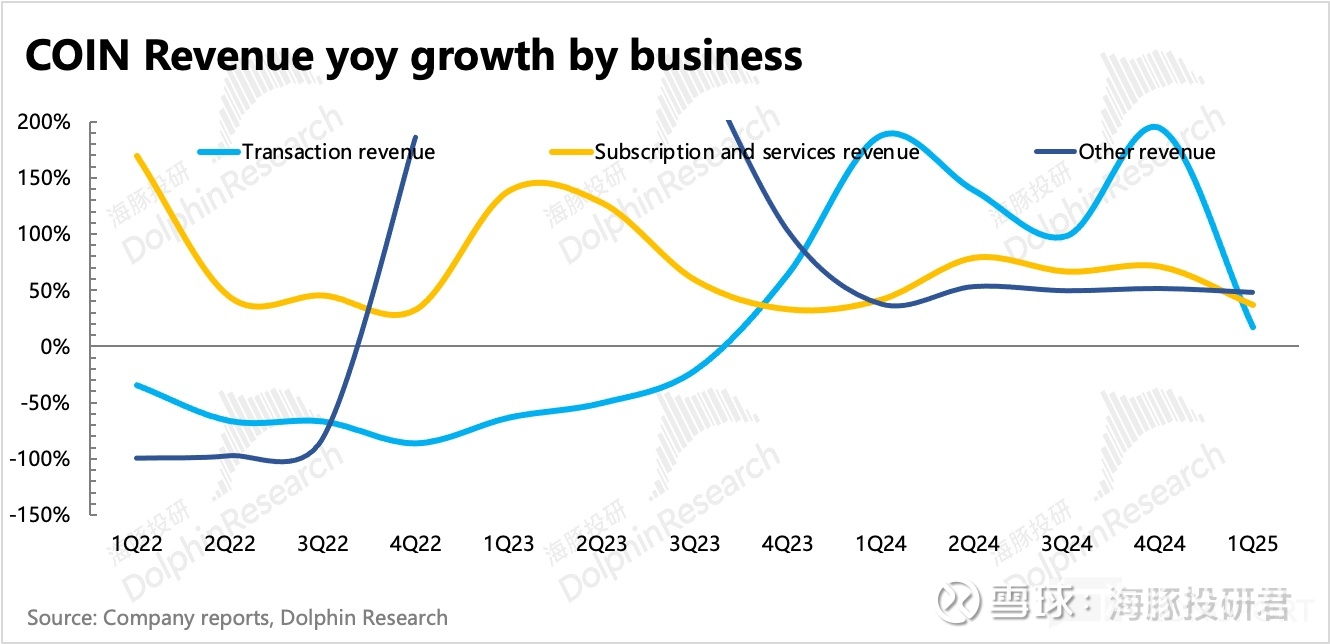

Trading revenue is highly susceptible to market conditions but is currently Coinbase's main source of income, accounting for 50%. Subscription revenue and other sources (including custody settlement, staking, stablecoins, data/cloud, and corporate investment income, etc.) act more like a lubricant, as they grow relatively steadily and can slightly smooth out the fluctuations in trading revenue.

However, a clear trend is that as scenarios broaden, competition intensifies, and the structure of incremental funding sources changes, Coinbase's reliance on trading revenue will decrease in the future.

1. Trading Barriers Will Gradually Lower

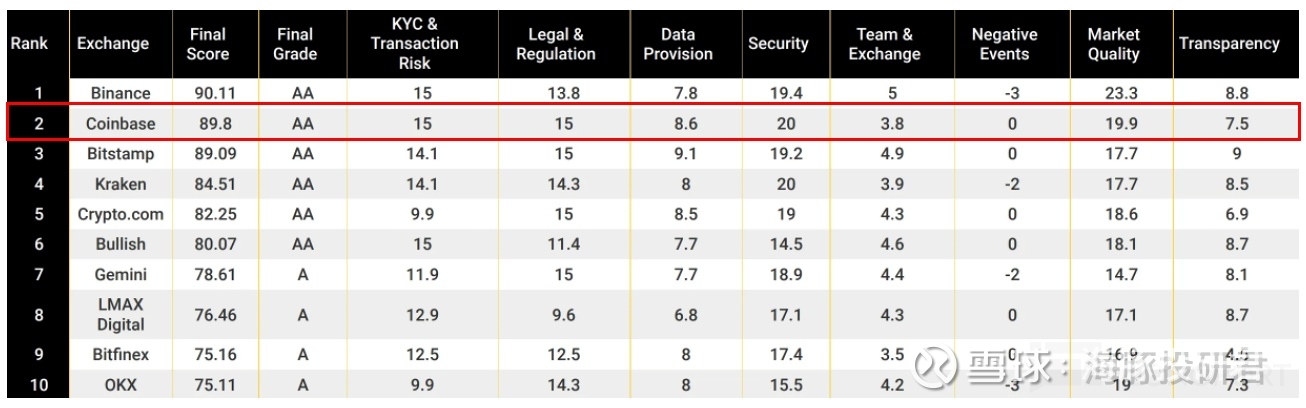

Compared to its peers, Coinbase's product advantages are compliance and security, but its disadvantages are high fees for retail investors and a lack of derivative trading options. However, these two shortcomings have been rapidly addressed by Coinbase over the past 1-2 years.

Source: CoinDesk

Currently, Coinbase operates three exchanges: the spot trading Coinbase Exchange, the Coinbase International Exchange (CIE) aimed at professional individuals and institutions outside the U.S., and the Coinbase Derivatives Exchange (CDE), which has transformed from the acquisition of FairX.

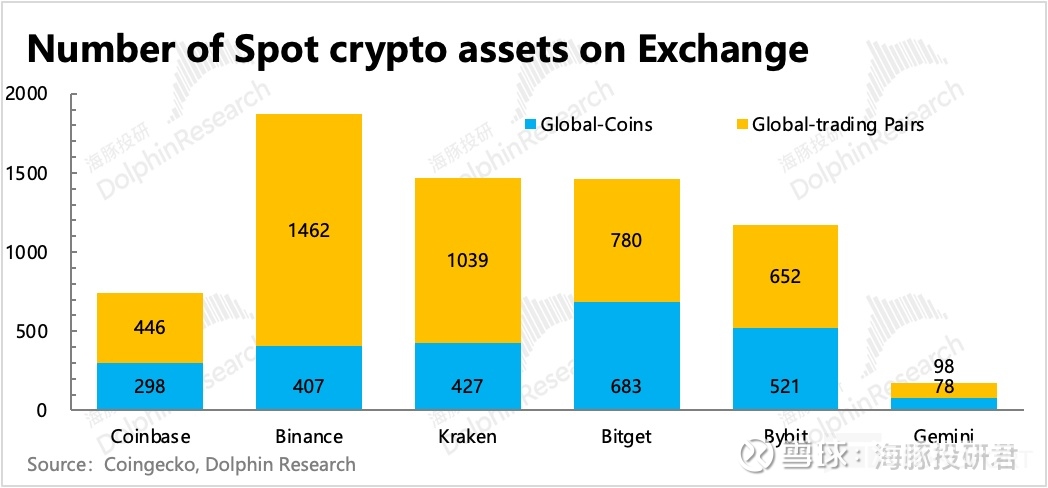

The three exchanges mentioned above cover the vast majority of nearly 300 cryptocurrencies currently available in the market. In the U.S. spot trading market, Coinbase's product coverage is absolutely dominant (compliance barriers have prevented competitors from launching a large number of long-tail coins). However, when looking at the global landscape and including derivative trading, Coinbase's range of trading products does not rank highly, with a noticeable gap compared to Binance and Bybit.

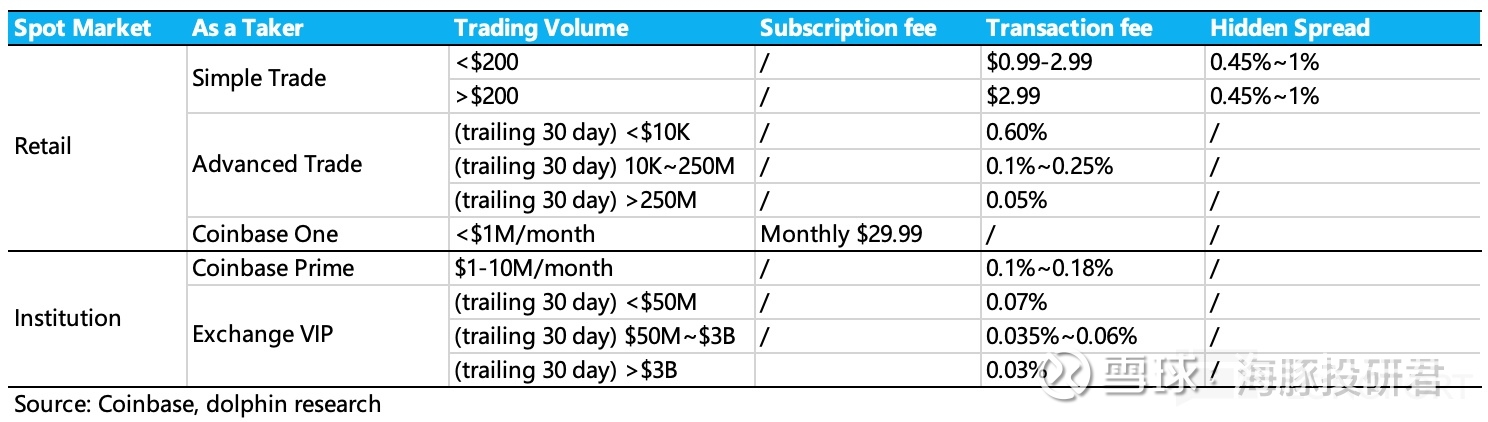

In addition to the range of trading products, the biggest difference for Coinbase in trading is the trading costs. Similar to traditional securities trading, Coinbase's trading fees are based on the trading volume and a certain (tiered) rate. For example, the following chart shows the fee details for Taker (market order) traders, while Maker (limit order) traders generally pay lower fees than Takers:

For ordinary retail investors, the different trading methods (simple trading, advanced trading, Coinbase One trading) come with varying trading costs. User trading costs = “trading fee rate + official hidden spread”:

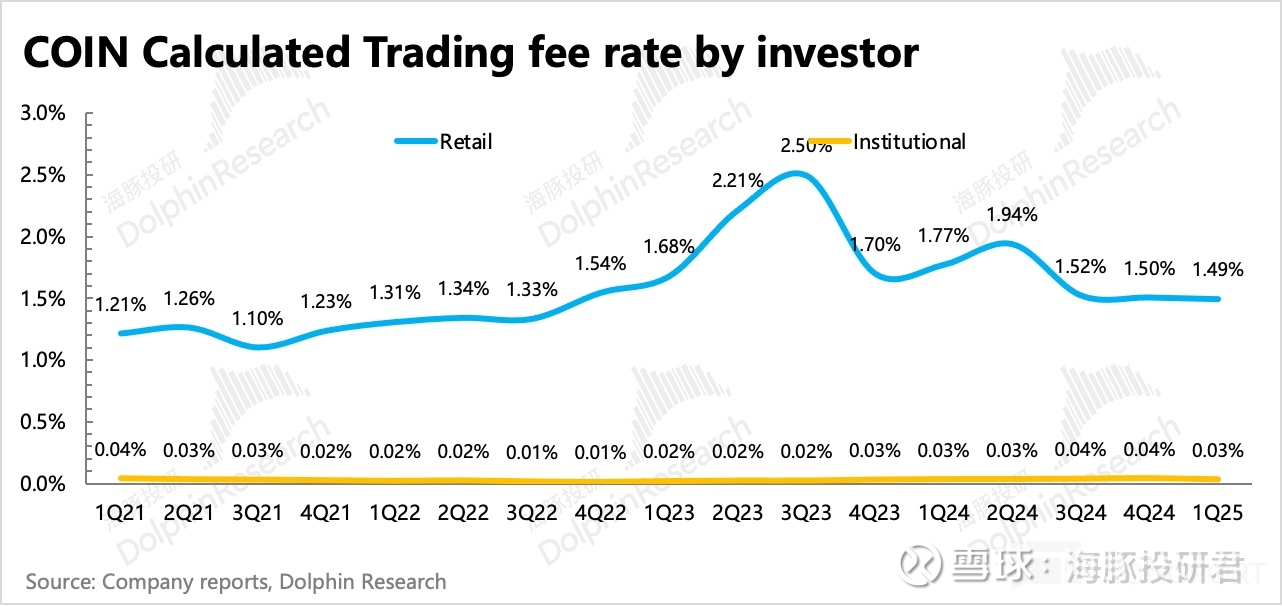

1) Retail trading costs can be as low as 0.05% and as high as 2.5% (at the end of 2022, for retail trades over $200, the trading fee rate dropped from 1.49% to a maximum of 0.6%).

2) For institutional users using Prime or Exchange VIP tiers, the fee rates range from 0.03% to 0.18%.

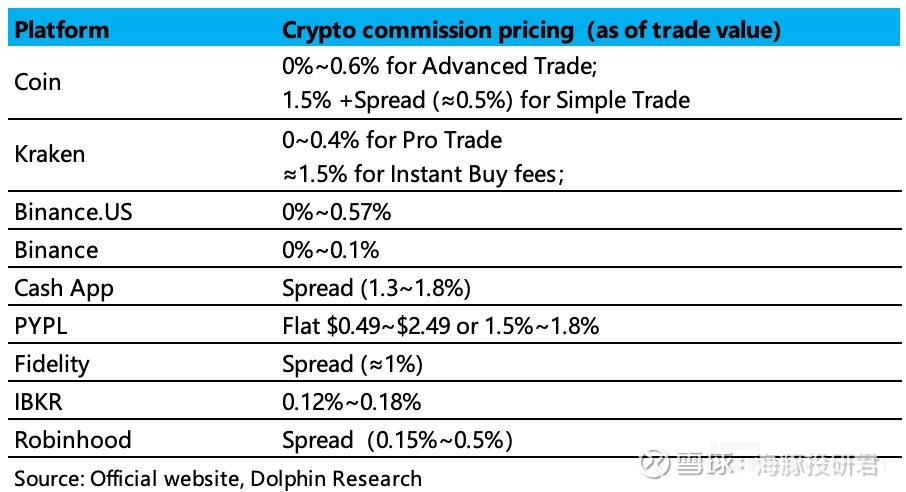

If we look directly at the comprehensive rates reflected in the final financial reports, the trading fee rates (including spread) for retail and institutional users are 1.49% and 0.03%, respectively. This fee level, compared to peers (especially other exchanges), primarily targets retail users, where Coinbase does not have an advantage.

Taking Binance as an example, the highest tier fee for retail spot trading is 0.1%, which is only 1/6 of Coinbase's fee (and this is after Coinbase's price reduction in 2023). If users pay fees with BNB (Binance Coin), this rate can be further discounted by 25%.

As shown in the chart below, other platforms for trading cryptocurrencies generally have lower fees than Coinbase, while platforms primarily serving as payment institutions tend to be more expensive, and discount brokers also have lower trading fees than Coinbase.

Coinbase had already implemented a fee reduction in August 2022, with the launch of Advanced Trade, which reduced trading costs (Taker trading fee 0.6%, Maker 0.4%, with virtually no hidden spread) to less than half of Simple Trade (1.49% + approximately 0.5% spread) for users with trading volumes below $10,000 in the past 30 days.

The limited range of trading products (mainly derivatives) and high trading costs can easily dampen retail trading enthusiasm. Although Coinbase has the largest number of cryptocurrency assets globally (AUC accounts for 12%), it only accounts for 5% of trading volume. This is just for spot trading; if we include derivative trading, Coinbase's total trading volume falls outside the top 10.

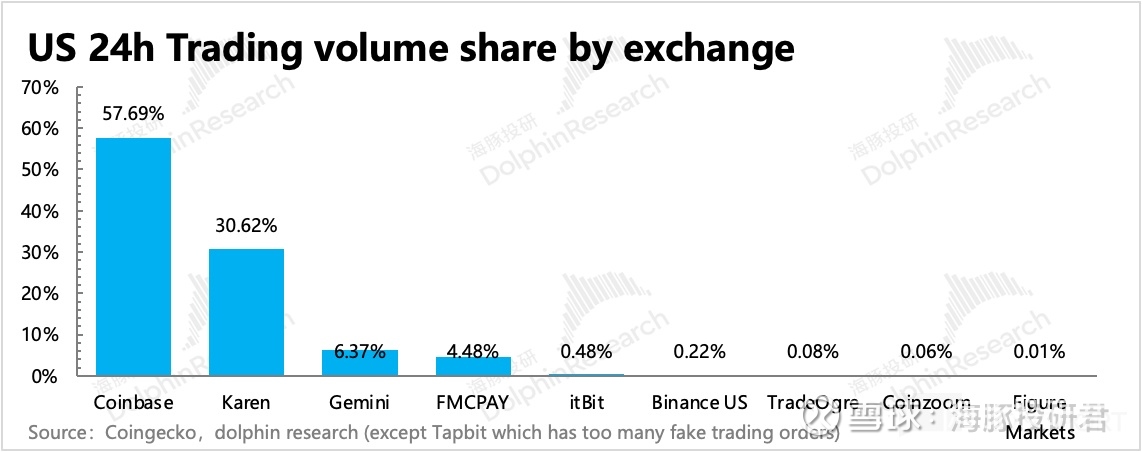

Only in the U.S. market, due to licensing and compliance issues, can Coinbase dominate, with spot trading volume accounting for over 50% of the U.S. market.

Why does Coinbase have a significant amount of assets but not a large trading volume?

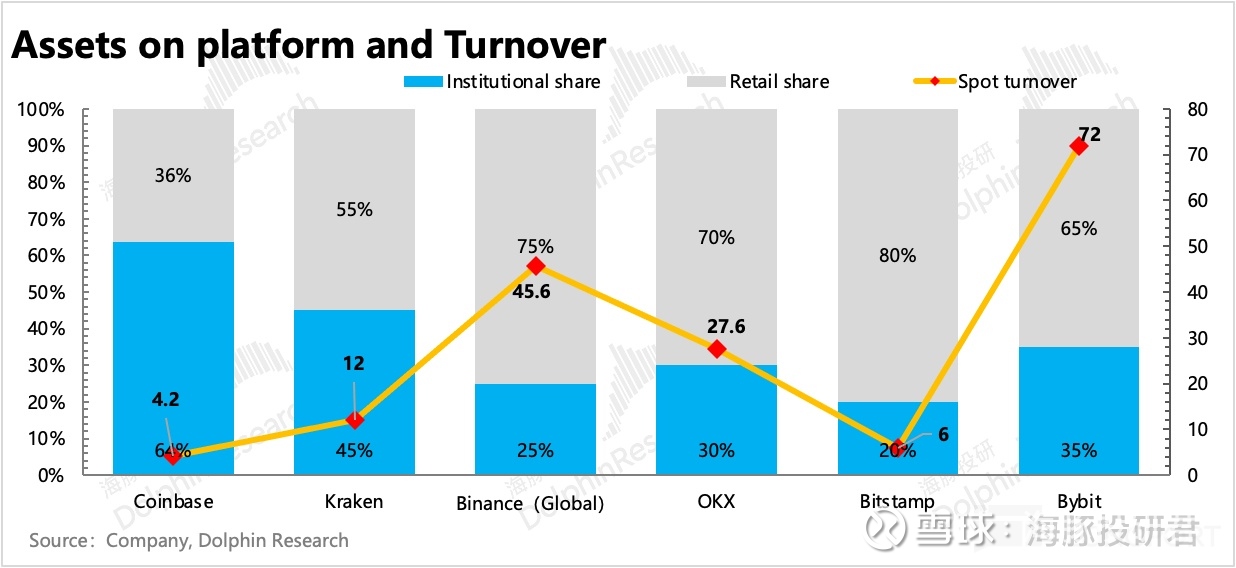

The issue lies in the turnover rate, which is significantly lower for Coinbase compared to its peers, showing no characteristics of high-risk, high-volatility cryptocurrency asset withdrawals. However, the turnover rate is merely a surface issue; the underlying cause is the different funding structures (user attributes), which are fundamentally influenced by product characteristics and advantages/disadvantages.

A common trading characteristic is that among retail investors, the proportion of those aiming for long-term asset allocation in cryptocurrencies is continuously increasing, leading to naturally lower trading frequency for this group. In institutions, high-frequency trading for volatility gains is still predominant, but as mainstream funds accelerate their entry, the overall trading frequency among institutions will decrease in the future.

Due to the limited range of trading products and higher trading costs on Coinbase, the appeal for high-frequency trading among retail investors is low. However, its compliance and security features attract high-net-worth retail investors focused on long-term allocations, as well as mainstream funds with strict compliance requirements for investment custody, both of which belong to the low-frequency trading group.

Of course, Coinbase is also well aware of its disadvantages in trading and is striving to catch up with its peers.

Regarding the issue of limited trading products, Coinbase has accelerated the speed of launching new coin trading and announced in early May the acquisition of Deribit (the world's largest cryptocurrency options and futures trading platform) to fill its gaps in derivative trading products and related institutional clients. (Dolphin will discuss the details of Deribit after the Q2 financial report is consolidated with Deribit.)

As for the high trading costs, this is actually associated with trading volume. In the short term, Coinbase's trading fees remain high, partly due to the additional compliance costs and other technical fees (such as the development costs of Base). It may also be due to low trading volume, leading to reluctance to drastically cut fees during a "self-inflicted" price reduction.

However, from a longer-term perspective, Dolphin believes that Coinbase's "price reduction" actions will continue soon.

(1) Relaxation of compliance, internal clearing, and intensified external competition

Future competition will not be limited to intra-industry competition among cryptocurrency exchanges; there is also increasing external competition from traditional financial institutions.

Currently, in terms of industry competition, Coinbase's main advantage is its “compliance”, especially in the U.S. market. The key point is that Coinbase is the only publicly listed cryptocurrency exchange and the first to obtain the ability to operate across the U.S.

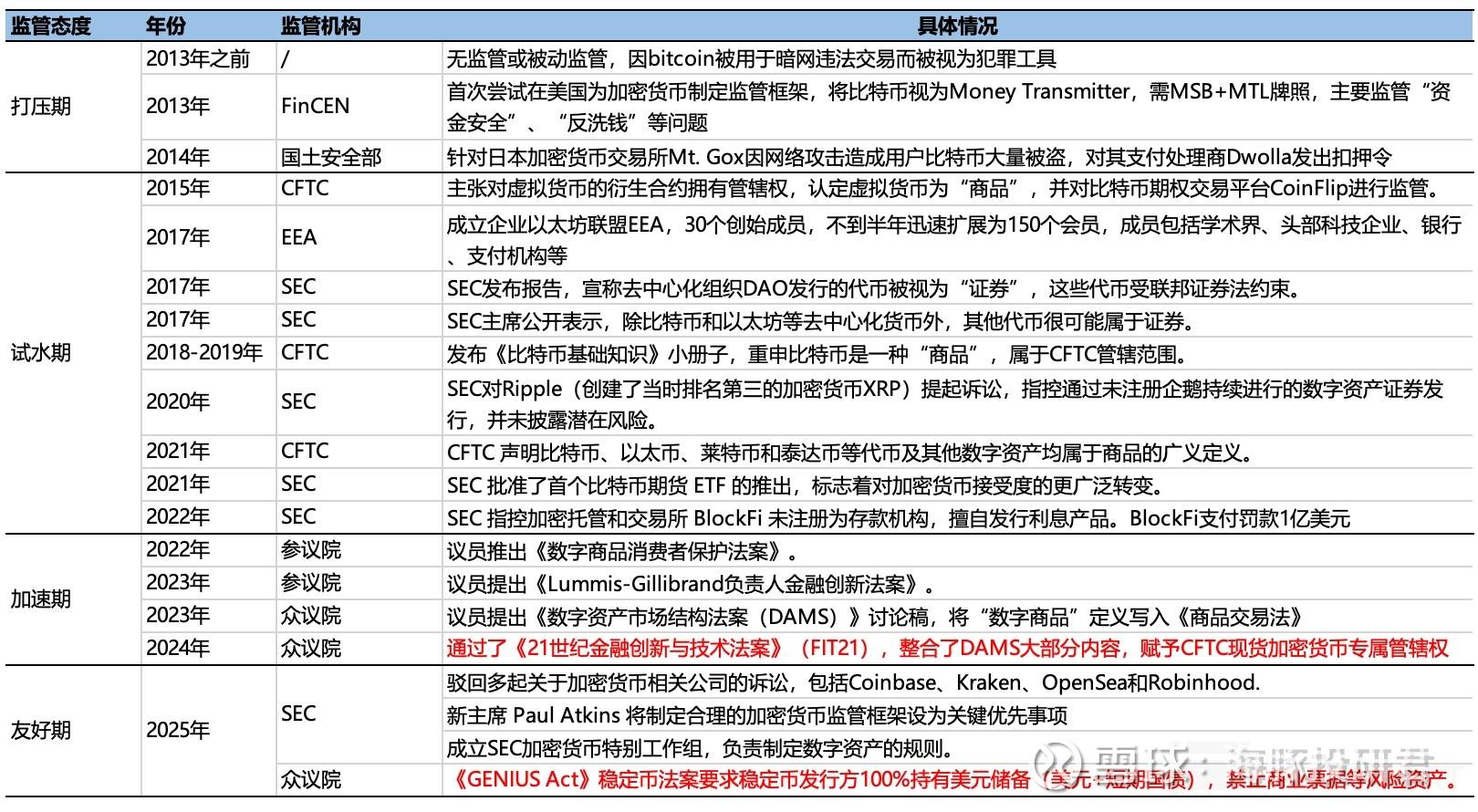

However, the flip side of "compliance" is that it does not have an advantage in the variety of trading assets (types of cryptocurrencies and derivatives). However, starting in 2025, under the active "endorsement" of the Trump administration, cryptocurrencies are gradually being recognized by more mainstream officials.

The main way of "recognition" is to include it in the category of "friendly regulation" without suppression, with the U.S. Market Structure Act and Stablecoin Act being the main drivers.

The Market Structure Act passed by the House of Representatives grants the CFTC exclusive jurisdiction over spot cryptocurrencies, and if it continues to pass through the Senate and is signed by the President, it will represent the end of the jurisdictional dispute between the SEC and CFTC.

The benefits of being regulated by the CFTC rather than the SEC include higher regulatory convenience:

1) No need to apply for additional licenses (ATS + BD); 2) Reduced clearing costs; 3) New token listings do not require individual disclosures;

Under CFTC jurisdiction, cryptocurrency exchanges dealing in derivatives only need to register as brokers, and for spot trading, they may not even need to register with the CFTC, which not only saves high compliance costs (legal, auditing, etc.) but also eliminates the need to modify existing systems to connect to NMS-level clearing pipelines.

The increasing recognition of cryptocurrencies by regulators is naturally a good thing. As more funds flow into the cryptocurrency market, leading companies like Coinbase, which are already compliant, will directly benefit, while smaller long-tail platforms will continue to be cleared out.

At the same time, official recognition will also encourage traditional financial institutions to accelerate their transformation with confidence, especially those platforms that have carved out a niche through business innovation, which will be more responsive to changes at the forefront of the industry.

For retail users, platforms like broker Robinhood or payment wallet Block have already supported cryptocurrency trading for years. They are now rapidly expanding into areas like "merchant payments" by improving "investment scenarios." However, due to compliance and security requirements, traditional financial institutions mainly focus on leading cryptocurrencies like BTC and ETH, making their "limited trading product range" the most obvious disadvantage when facing the Coinbase platform.

However, as cryptocurrencies gain further widespread recognition, it is reasonable to imagine that traditional financial institutions will be more motivated to broaden the range of cryptocurrency products, leading to more direct competition with Coinbase from platforms that already have user and scenario advantages.

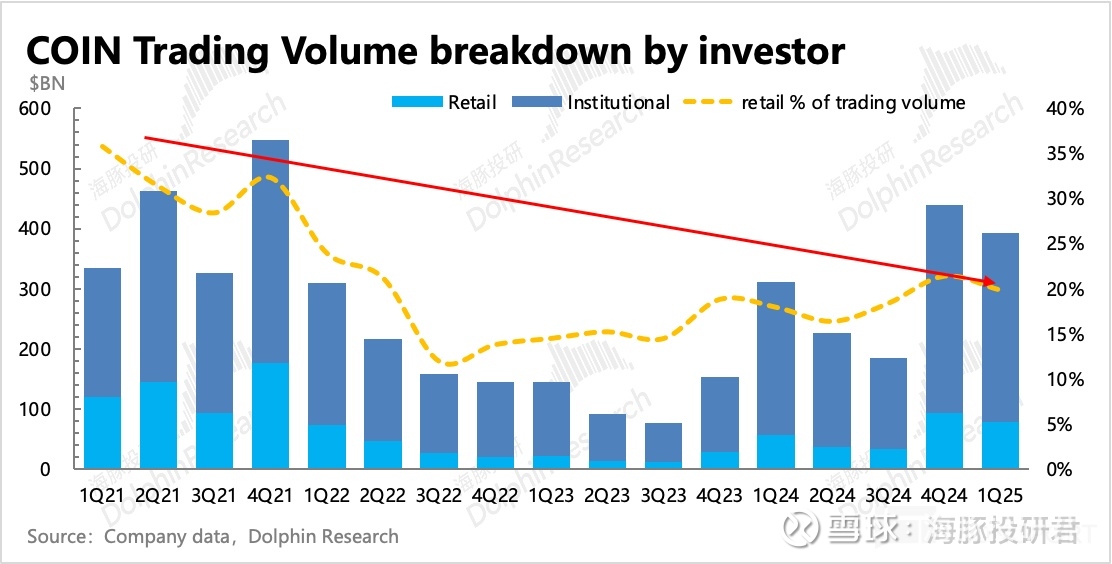

(2) More capital inflows shifting towards institutions

Another impact of regulatory recognition is the change in the way funds flow in. In the past, institutions participating in cryptocurrency market trading primarily relied on quantitative strategies for volatility gains, and mainstream institutions faced limitations in allocation scale due to compliance issues. However, as regulatory restrictions ease, mainstream institutional participation will further increase in the future.

For new retail investors, the way to allocate cryptocurrencies may not necessarily require "personal involvement." From the perspective of fund security and convenience, they can allocate through investment institution funds.

Therefore, the market share of pure retail trading will further shrink, and with increasing competition, reducing fees will become an inevitable path for Coinbase.

2. Future Added Value Comes from Expanding On-Chain Scenarios

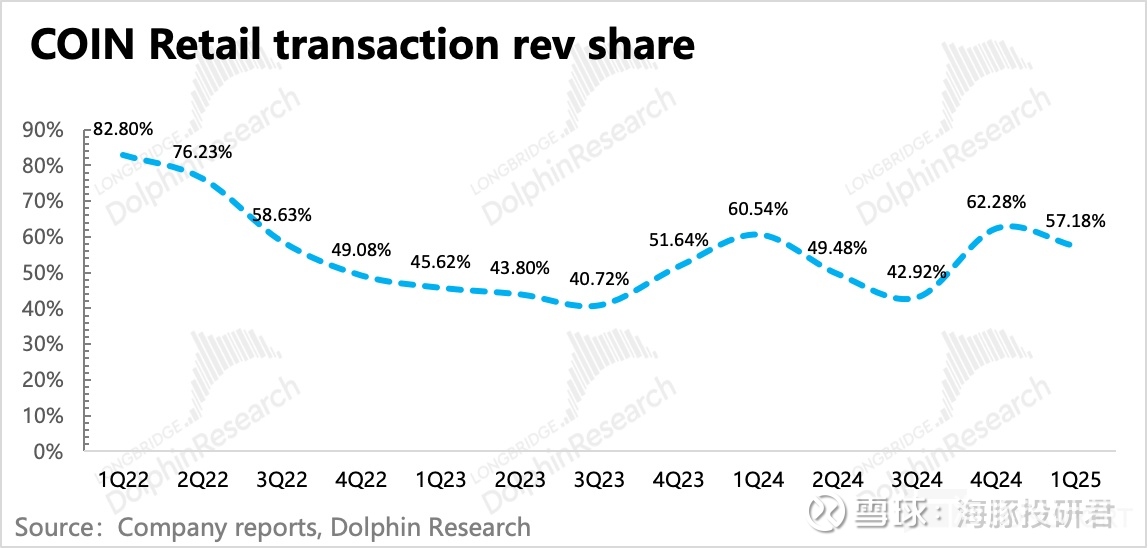

As of Q1 2025, Coinbase's retail trading revenue (trading fees + spread) accounted for 92% of trading income and 57% of total revenue. At the same time, the marginal profit from trading is also very high, so if fee reductions do not immediately lead to a significant increase in trading volume, the impact of fee reductions on Coinbase's overall performance will be substantial.

However, since this is an unchangeable trend, it means that developing non-trading income is crucial both now and in the future.

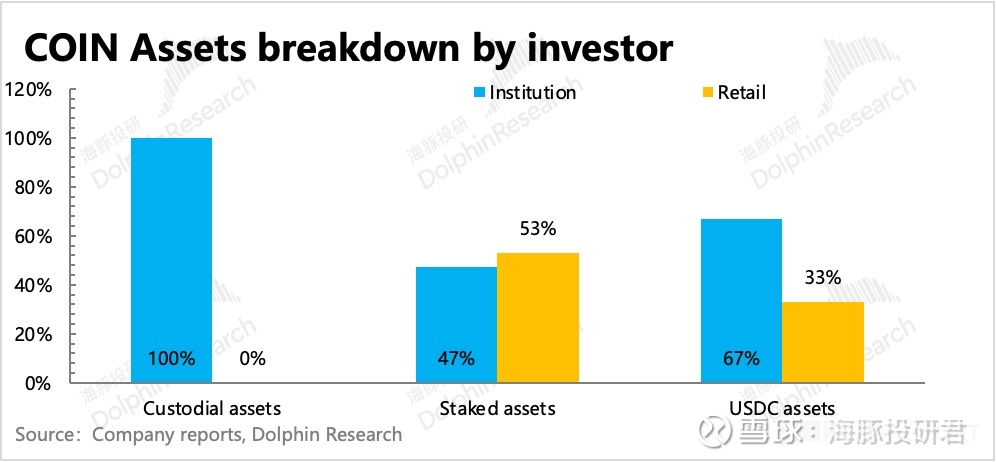

Currently, Coinbase's non-trading income mainly refers to subscription revenue from comprehensive financial services, including custody, staking, stablecoins, and lending. The demand for these services, apart from the expansion of payment scenarios that relies more on retail users, mainly comes from users with relatively large capital scales, thus the service targets are primarily institutional clients.

Therefore, lowering the entry threshold for capital with lower trading fees and then expanding added value through comprehensive financial services is a strategy Coinbase is more willing to adopt—this is the reason for reducing institutional trading fees (aligning them to peer levels).

Let’s take a closer look at the relatively large segments of the current subscription business that can expand revenue as institutions enter the market:

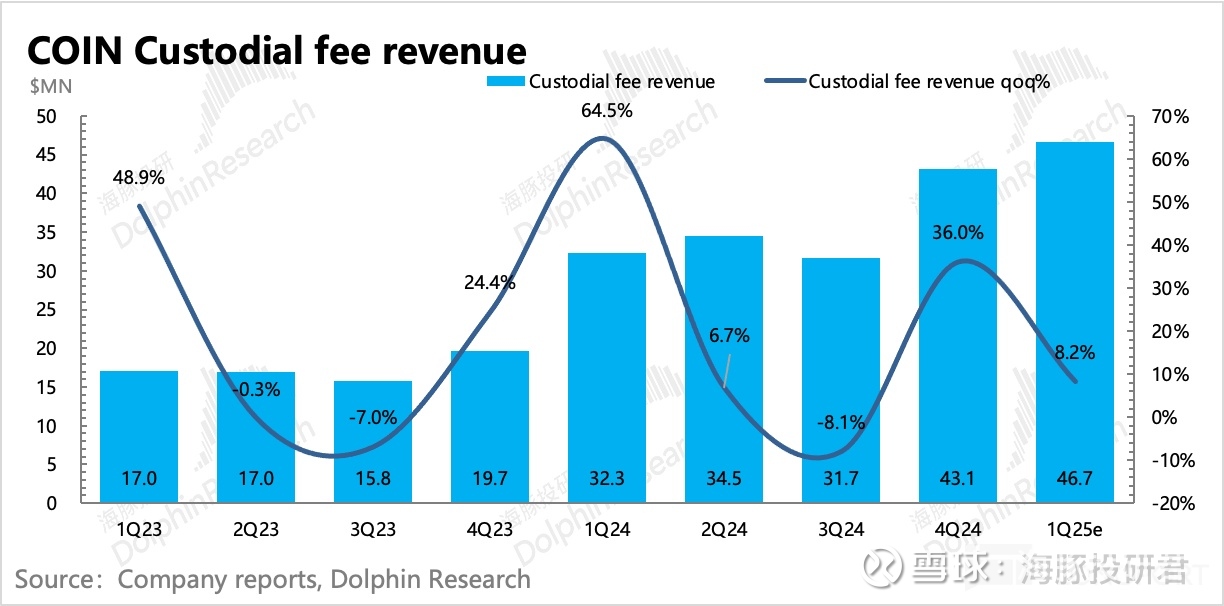

(1) Institutional Custody: The Easiest Value-Added Service to Develop

Fund custody generally arises from trading business and is mainly aimed at institutional clients, providing services such as cold storage of cryptocurrencies, 24/7 withdrawal processes, insurance, auditing, and compliance reconciliation reports, with a comprehensive custody fee calculated at around 0.1%. (Starting from Q1 2025, this will no longer be disclosed separately; the following chart shows Dolphin's estimated value.)

Since the fee rates are basically stable, the growth of custody income is mainly driven by the expansion of institutional capital scales. For institutions, Coinbase's compliance advantage is the primary factor they consider when choosing a platform, so as long as the regulatory trend continues to relax in the future, this revenue growth can be sustained.

However, in the long term, there will also be an external competition issue. When more compliant traditional financial institutions with cross-market assets "attack" the market, how can Coinbase attract more mainstream capital?

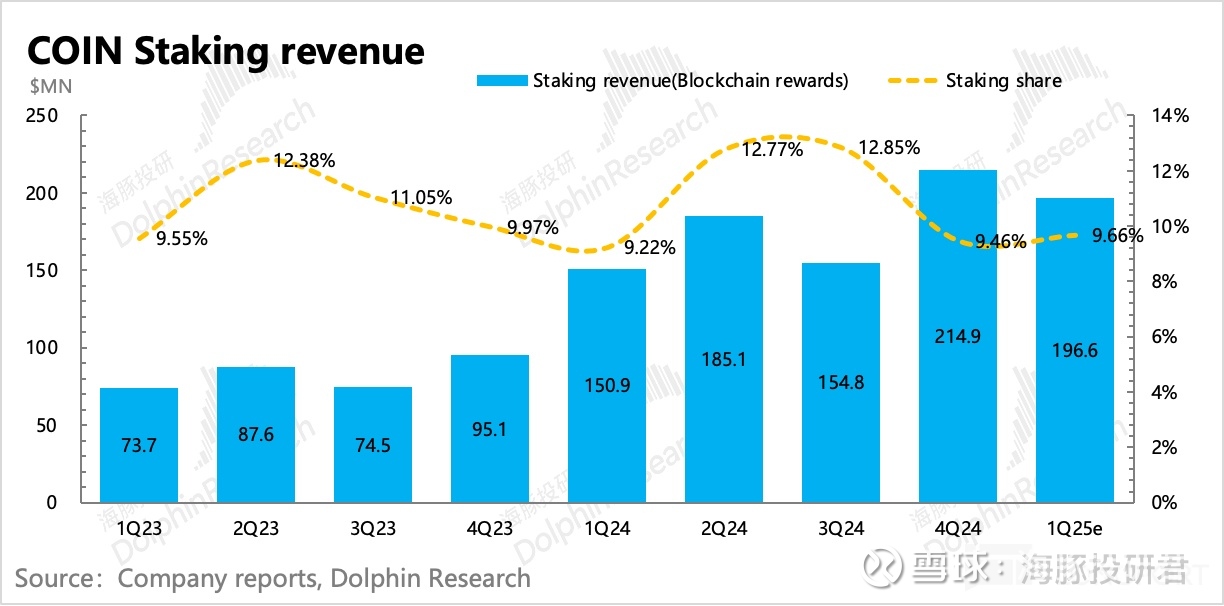

(2) Staking Revenue: Medium to Long-Term Growth Has a Ceiling

Before partnering with Circle in 2022, the largest source of Coinbase's non-trading business was cryptocurrency staking, which once accounted for nearly 13% of total revenue.

Cryptocurrency staking revenue is similar to users investing in mining projects (becoming validators for mainstream PoS public chains) to earn returns, from which Coinbase takes a portion as a custody service fee. This money is received by Coinbase from the front end, keeping 25% for itself and giving the remainder to users.

The staking yield can vary significantly between different cryptocurrencies, usually related to the stability of the coin's value, inflation rate (the proportion of supply increase), and the level of competition to become a validator (total staking volume).

The staking yield for leading cryptocurrencies is generally low, mainly due to their fixed or decreasing supply, but because their value is relatively stable, the competition for validators is too crowded. To become a validator, one must hold more "collateral" (staked assets), which dilutes the yield from single-coin staking.

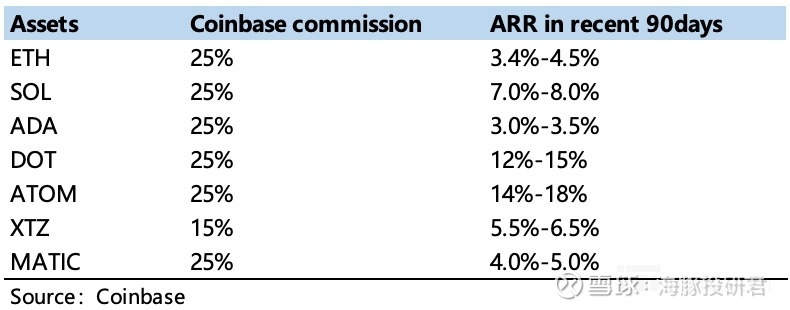

As shown in the chart below, the staking yield for leading ETH (Ethereum) is 3.4% to 4.5%, while smaller coins like DOT (Polkadot) can yield 12% to 15%.

In the short term, staking income generally expands with the increase in staked asset volume. However, in the medium to long term, with supply being relatively limited, the block production rate of quality cryptocurrencies will trend downward, while lower-quality or niche cryptocurrencies may have high block production rates, but their value may not be high or may fluctuate, resulting in actual staking incentives translating to low dollar value. Therefore, this trend will limit the long-term growth potential of staking business income.

It seems that (1) and (2) indicate that Coinbase's subscription business, in the short to medium term, will grow alongside the expansion of the cryptocurrency market and stable competitive advantages (security, compliance, official endorsement), with growth not being a concern. However, in the long term, if traditional institutions accelerate their entry, what reasons will Coinbase have to still be viewed as the "preferred" choice by mainstream institutions?

The answer lies in (3) stablecoin business. On one hand, it expands the cryptocurrency market, and with official recognition, the speed of real assets being tokenized increases, with funds flowing into the cryptocurrency market no longer driven by speculative demand but rather for more stable payments and value storage. On the other hand, Coinbase's significant advantage comes from its unique position in the USDC ecosystem.

Therefore, the stablecoin business, which accounts for 15% of revenue, is a major artery for Coinbase's future growth and a key factor in determining whether Coinbase's valuation has reached its peak. Currently, Coinbase's overall revenue share from stablecoin business has reached 55%, but the actual USDC holdings on the platform only account for 17%, clearly indicating that Coinbase has a "privilege."

However, the problem is that Coinbase's special position in stablecoins partly stems from its deep ties with Circle. However, the interests of both parties are not entirely aligned. Coinbase may provide similar distribution conveniences for another stablecoin, USDT, which has a larger market scale based on user demand, while Circle, after going public, will also have revenue growth demands, attempting to secure a larger share of the revenue.

These business discrepancies, given Coinbase's small equity investment in Circle (the early partnership of the Centre Alliance, which was equally held by both parties, was dissolved in 2023, with USDC issuance rights reverting entirely to Circle), make it difficult to ensure that expanding differences will not affect their cooperation:

For instance, the introduction of Binance as a competitor to Coinbase for ecosystem cooperation at the end of last year, although Binance's share is very low and almost negligible, has actually weakened the competitive advantage Coinbase had due to USDC.

In addition, Circle is also working to capture USDC balances (through its Mint wallet rebates, incentivizing market makers and local payment companies to keep pending funds in Mint rather than exchange wallets) and expanding the necessary demand scenarios for issuers (such as cross-chain bridges, tokenized T-bills, traditional clearing) to increase the share of total revenue.

The agreement in 2023 has a term of 7 years, meaning that before 2030, the division of interests between the two may not change significantly. While expanding the USDC market is certainly a priority (after a sixfold surge, Circle's scarcity has begun to be questioned), what about seven years from now?

In the context of a trillion-dollar market scale expectation, how much can USDC capture? In the USDC ecosystem, Coinbase and Circle, one has the scenario end, and the other controls the issuance end; who will ultimately gain more influence? In other words, who has greater future value potential, Coinbase or Circle? In the next article, Dolphin will focus on discussing stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。