If we calculate based on the current stablecoin scale of WLFI at 2.2 billion, the market value of the WLFI project would be 22 * 0.66 ~ 0.76, corresponding to a project valuation between 1.452 billion and 1.672 billion USD, with the corresponding WLFI token price being 0.0145 ~ 0.0167.

Author: Alex Xu, Mint Ventures

Introduction

After Circle went public, its stock price surged (though it has recently seen a significant drop), and the global stock market's stablecoin concept stocks have also been unusually volatile. The U.S. stablecoin bill, the "Genius Act," has passed the Senate vote and is making its way through the House of Representatives. Recently, there have been reports that the Trump family's pureblood project, World Liberty Financial, may unlock its tokens for circulation ahead of schedule, marking a significant piece of news in the currently bleak and uninspired altcoin market.

So how is World Liberty Financial performing at the moment? How is the token mechanism designed? What should be used as a benchmark for valuation?

In this article, I will attempt to provide a multi-dimensional overview of World Liberty Financial's current business status, project background details, token mechanism, and valuation expectations, offering several perspectives for observing the project.

PS: This article reflects my thoughts as of the time of publication, which may change in the future. The views expressed are highly subjective and may contain errors in facts, data, or reasoning logic. All opinions in this article are not investment advice, and I welcome criticism and further discussion from peers and readers.

Business: Product Status and Core Competitive Advantages

World Liberty Financial (WLFI) is a decentralized financial platform co-founded by the family of U.S. President Donald Trump, with its core product being the USD stablecoin, USD1. USD1 is a stablecoin pegged 1:1 to the U.S. dollar and fully backed by cash and U.S. Treasury reserves. World Liberty Financial also has plans for lending (based on Aave) and a DeFi app, but these have not yet been launched.

USD1 Business Data

As of June 2025, the circulation of the USD1 stablecoin is approximately 2.2 billion USD. Among this, the supply on BNBchain is 2.156 billion, Ethereum supply is 48 million, and Tron supply is 26,000, with 97.8% of USD1 issued on BNBchain.

In terms of on-chain user numbers, there are 248,000 holding addresses on BNBchain, 66,000 on Ethereum, and currently only one on Tron.

Looking at the token holding situation, 93.7% of USD1 on BNBchain (corresponding to 2.02 billion) is held in two addresses on Binance, with 1.9 billion concentrated in one address (0xF977814e90dA44bFA03b6295A0616a897441aceC).

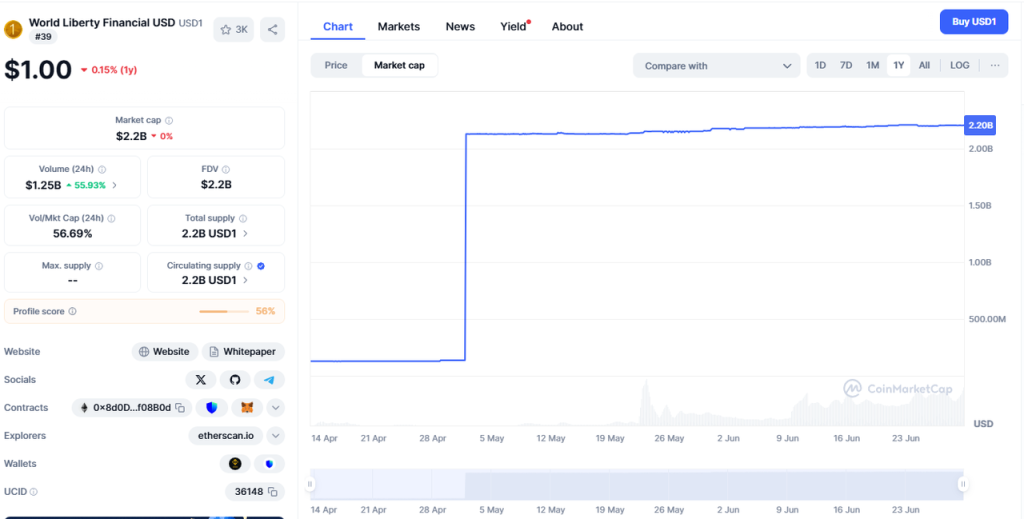

Reviewing the token scale of USD1, we find that its market value was only about 130 million before May 1, 2025, but on May 1, it surged to 2.13 billion, increasing by nearly 2 billion USD overnight.

Growth curve of USD1's scale, source: CMC

This explosive growth primarily came from the 2 billion USD equity investment by Abu Dhabi investment company MGX in Binance in May 2025, where USD1 was chosen as the payment currency. The current scale of USD1 tokens held in Binance addresses is also around 2 billion.

This means:

After accepting the USD1 investment from Abu Dhabi investment company MGX, Binance did not convert it into USD or other stablecoins, making it the largest holder of USD1, accounting for 92.8% of the total scale of USD1.

Excluding the tokens formed from this transaction, USD1 is still a small-scale stablecoin with a circulating market value of just over 100 million.

In future project developments, this business expansion model is likely to recur.

Business Cooperation

In terms of market expansion, WLFI has established partnerships with several institutions and protocols.

In June 2025, WLFI announced a collaboration with London-based crypto fund Re7 to launch a USD1 stablecoin vault on the Ethereum lending protocol Euler Finance and the Binance Chain staking platform Lista, aiming to expand USD1's influence in the Ethereum and BNB Chain ecosystems. Lista is a major BNB staking platform invested in by Binance Labs.

Additionally, the largest decentralized lending platform, Aave, has initiated a proposal to introduce USD1 into the Aave markets on Ethereum and BNBchain, with the draft already approved by vote.

In terms of trading platforms, USD1 has been listed on Binance, Bitget, Gate, Huobi, and is also available on DEXs like Uniswap and PancakeSwap.

World Liberty's Competitive Advantages

World Liberty's competitive advantage is straightforward: the strong influence of the Trump family in politics gives this project a natural advantage in specific types of business expansion that other projects do not possess. This project may serve as a conduit for individuals, organizations, or even countries that have business or political needs related to Trump.

Binance using USD1 issued by World Liberty as a funding vehicle to accept a massive investment from Abu Dhabi investment company MGX, and subsequently holding it interest-free (effectively supporting USD1's TVL), and quickly launching USD1 is a prime example.

However, the main risks for World Liberty token holders are threefold:

The Trump family has many channels for accepting benefits, and World Liberty may not be the final choice for those looking to funnel resources (for a detailed look at the Trump family's various money-making methods, refer to Bloomberg's article published in late May this year: THE TRUMP FAMILY’S MONEY-MAKING MACHINE).

The WLFI token itself may become decoupled from the value of the World Liberty project (this will be elaborated in the token model section below).

After the Trump family sells the tokens, or even during the selling process, they may essentially abandon the heavy operation of the project, leading to a soft exit (referencing all previous crypto assets issued by Trump, from Trump tokens to various NFTs).

Background: Support and Financing Details

Core Team Background

The core team of World Liberty Financial comes from the political and business sectors, which is also the source of the project's core competitiveness and influence.

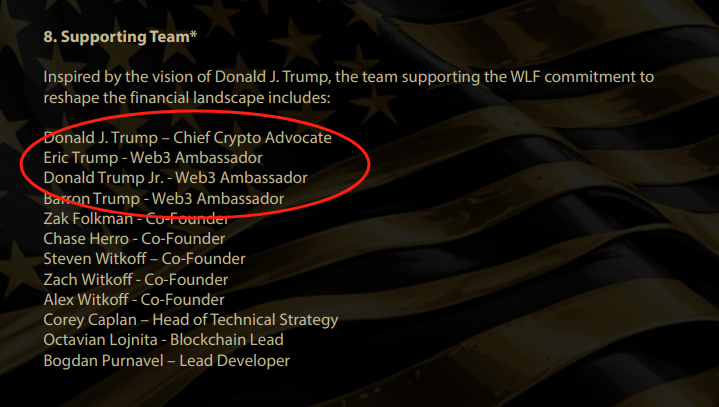

Undoubtedly, the soul of this project is Donald Trump, the 45th and 47th President of the United States, along with his three sons—Donald Trump Jr., Eric Trump, and 17-year-old Barron Trump.

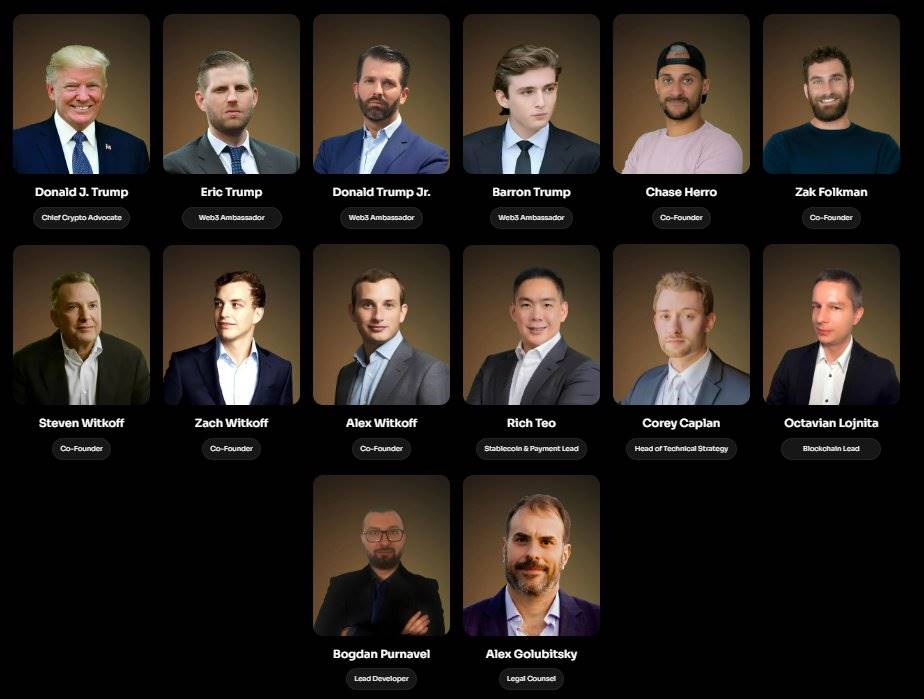

However, their "project positions" on the World Liberty Financial official website have undergone subtle changes in the past month. In the mid-June introduction on the official website, Donald Trump's position was described as the rather vague "Chief Crypto Advocate," while the three sons held similarly vague titles of "Web3 Ambassadors."

In the project's "golden book," the four members of the Trump family are defined as follows:

Despite this, the positions of the four Trump family members are listed before many of the project's Co-Founders.

World Liberty Financial's team introduction page in mid-June

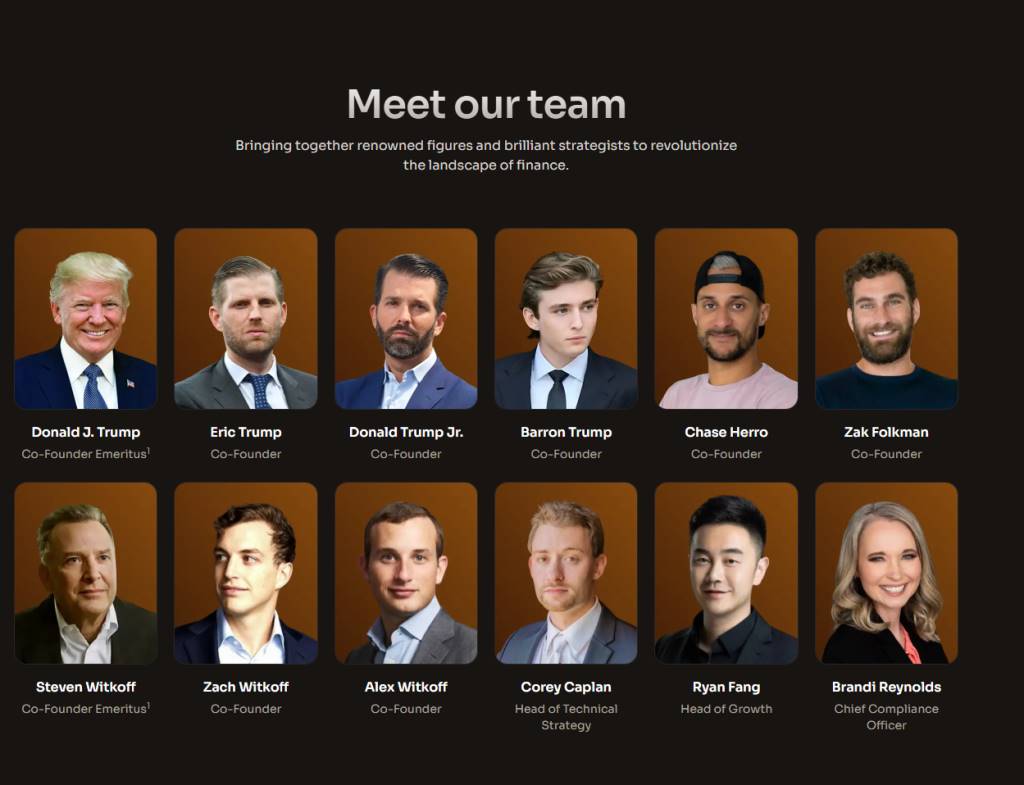

However, recently, the official page's introduction of the four has changed to: Trump himself as "Honorary Co-Founder," while the other three sons have become Co-Founders.

World Liberty Financial's team introduction page in mid-June

Another minor detail is that Donald Trump himself, along with another "Honorary Co-Founder," Steven Witkoff (who was previously listed as Co-Founder on the official website, now changed to "Honorary Co-Founder"), have a nearly invisible footnote "1" added after their position descriptions, with the explanation at the bottom of the webpage in small print: "Removed upon taking office." This means that once the individual takes office, their "Honorary Co-Founder" title will be removed.

This is a typical compliance practice aimed at preventing government officials from having conflicts of interest with company interests while serving in public office, in accordance with U.S. ethical requirements that public servants or high-ranking government officials must sever private business ties.

However, the issue is that Donald Trump is already a public official—he is the President of the United States.

In addition to the Trump family, another heavyweight in the team is Trump's long-time business partner, New York real estate mogul Steven Witkoff, who serves as an honorary co-founder. He is the founder and chairman of Witkoff Group and has known Donald Trump since the 1980s. The two have maintained a long-standing relationship and are known to be "old friends and business partners."

Since Trump took office, Steven Witkoff has been appointed by Trump as the "U.S. Special Envoy to the Middle East," reporting directly to Trump and playing a core role in major negotiations, including those involving Israel, Qatar, Russia, and Ukraine. He has also served as Trump's "private messenger" to Putin, representing Trump in meetings with Russian leaders in Moscow multiple times.

The Witkoff family is also actively involved in the project: their sons Zach Witkoff and Alex Witkoff are both co-founders of WLFI.

In addition to political and business celebrities, the technology and operations of WLFI are largely managed by professionals from the crypto industry. Zak Folkman and Chase Herro, both co-founders, are serial entrepreneurs in the cryptocurrency field; they previously founded the DeFi platform Dough Finance, which failed early on due to a hacking incident, making their entrepreneurial experience less than successful. In the WLFI project, Folkman and Herro were initially the main controllers of the company but ceded control to an entity controlled by the Trump family in January 2025.

Another core member, Richmond Teo, serves as the head of the WLFI stablecoin and payments department. Richmond Teo was previously a co-founder and former Asia CEO of the well-known compliance stablecoin company Paxos. Additionally, the team includes blockchain professionals such as Corey Caplan (Chief Technology Strategist) and Ryan Fang (Head of Growth), as well as traditional financial compliance experts like Brandi Reynolds (Chief Compliance Officer).

The project has also invited several advisors, including Luke Pearson, a partner at Polychain Capital, and Sandy Peng, co-founder of the Ethereum Layer 2 Scroll network. Sandy Peng assisted with operational tasks during the token sale.

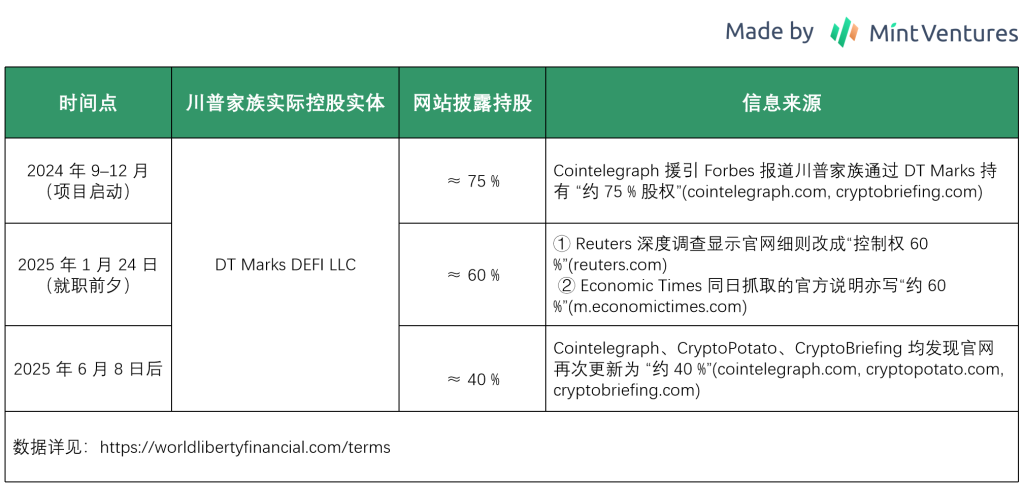

Changes in Trump Family's Equity in World Liberty Financial

In fact, the Trump family's ownership stake in World Liberty Financial has been steadily declining, currently down from an initial 75% to 40%.

The decrease in ownership from 75% to 40% may have been transferred to Sun Yuchen, DWF Labs, and the recently announced Aqua 1 Foundation, which is participating in the investment with 100 million USD (this is merely speculation).

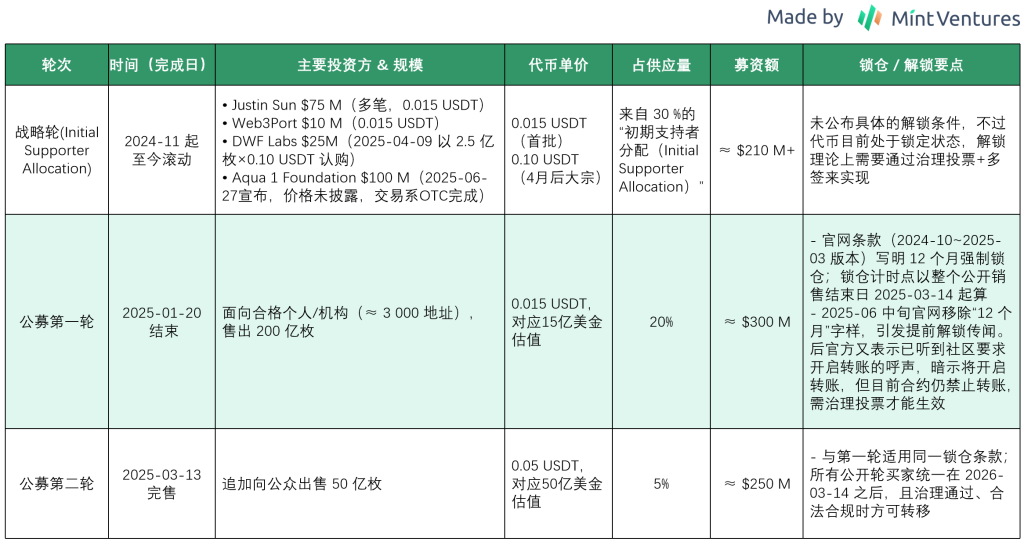

Financing History and Investment Institutions

Since its launch in September 2024, World Liberty Financial has raised over 700 million USD through multiple rounds of financing, with its valuation rapidly increasing after Trump took office and after the token issuance.

I have summarized the financing situation for each round as follows:

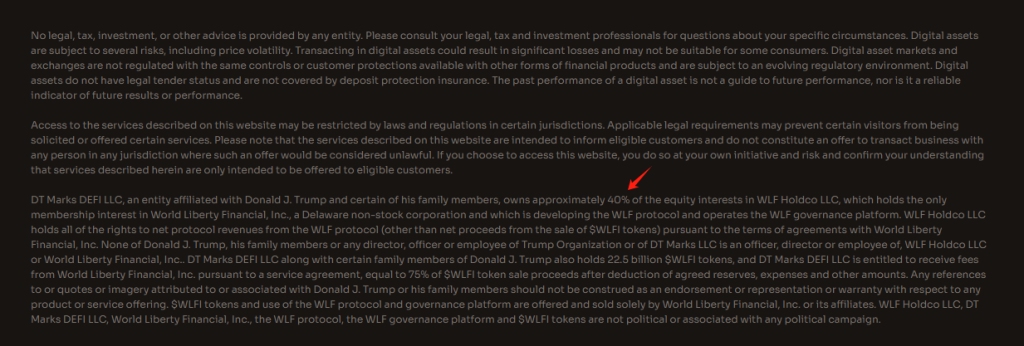

It is worth noting that according to the project's Gold Paper and website disclosures, the Trump family is entitled to 75% of the net proceeds from token sales (which should equate to a disguised resale of the token sales revenue through equity transfer) and 60% of future net profits from business operations (from the stablecoin business).

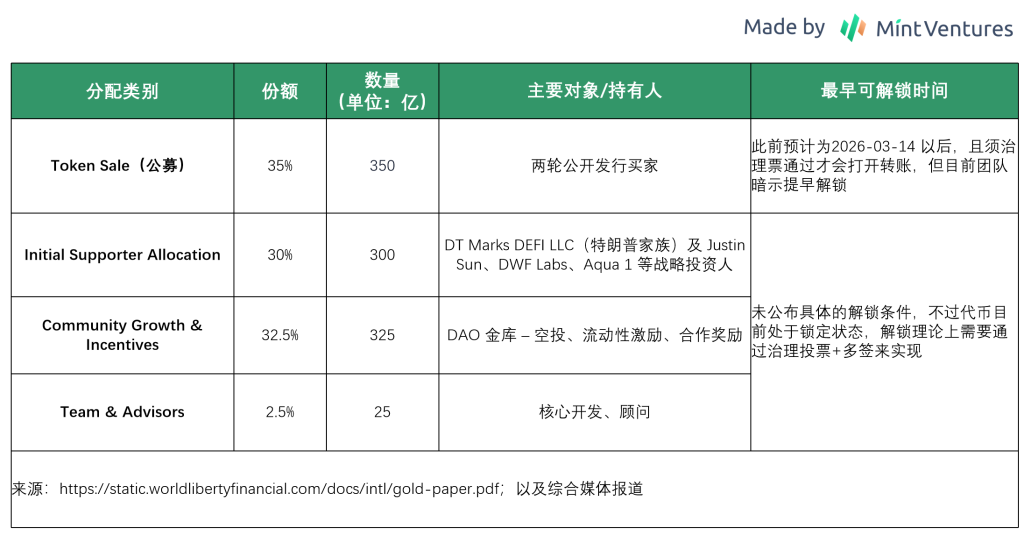

Token: Distribution Details, Token Functions, and Protocol Revenue

Token Distribution and Unlocking Details

The governance token of the WLFI platform, $WLFI, has a total supply of 10 billion tokens. According to the official "Gold Paper" token economic model, the distribution plan and unlocking schedule for WLFI tokens are as follows:

It is noteworthy that the team allocated 35% of the tokens for sale, but currently, only 25% of the public sale has been completed, and there is no answer on how to handle the remaining 10%.

Additionally, the WLFI tokens, apart from the public offering portion which has a specified lock-up period expected in December, do not have clear unlocking conditions and timelines for the other portions, but currently, like the public offering tokens, they are in a non-transferable state.

The ambiguity of the specific unlocking terms for the non-public offering WLFI tokens brings a high degree of uncertainty to the project.

The worst-case scenario would be if the team unlocks this portion of tokens without prior notice and dumps them on the secondary market. A more reasonable approach would be to announce the unlocking plan for the non-public offering tokens in advance before the public offering WLFI tokens are unlocked and to conduct phased unlocking through formal community governance voting.

Token Functions

WLFI is purely a governance token; it does not have any dividend or profit rights and does not represent a claim to equity in the project company. Its value primarily comes from participation in governance.

Distribution of Protocol Revenue

In WLFI's official Gold Paper, the handling of WLFI's protocol revenue is stated as follows:

"The initial $30 million of net protocol revenue will be held in a reserve controlled by WLF (the Gold Paper at this point refers to the project as WLF, later changed to WLFI) through multi-signature, to cover operational expenses, compensations, and obligations. The net protocol revenue includes WLF income from all sources, including but not limited to platform usage fees, token sales, advertising revenue, or other income sources, after deducting agreed expenditures and WLF's ongoing operational reserves. The remaining net protocol revenue will be paid to entities such as DT Marks DEFILLC, Axiom Management Group, LLC, and WC Digital Fi LLC, which are associated with our founders and certain service providers (initial supporters). These entities have indicated to WLF that once the WLF protocol is launched, they plan to use most of the fees received to support the deployment of the protocol."

In other words, the protocol's revenue primarily belongs to the entity companies behind WLFI (although these companies promise to allocate most of the fees to support the protocol), it is clear that the WLFI token itself does not have a direct link to business revenue.

Valuation: What is WLFI Worth in the Long Term?

Since WLFI's core business is stablecoins, we can refer to the valuation levels of major competitors that have already gone public, such as Circle, using its "market cap/stablecoin market cap" ratio to "roughly" estimate the reasonable valuation range for WLFI tokens.

As of the end of June, the scale of USDC was approximately 61.7 billion.

During the same period, Circle's market cap was 41.1 billion USD, and if options, convertible bonds, etc., are taken into account, the approximate fully diluted market cap is 47.1 billion USD.

This means that Circle's "market cap/stablecoin market cap" ratio is: 411/617 ~ 471/617 = 0.66 ~ 0.76.

If we calculate based on the current WLFI stablecoin scale of 2.2 billion, the market value of the WLFI project would be 22 * 0.66 ~ 0.76, corresponding to a project valuation between 1.452 billion and 1.672 billion USD, with the corresponding WLFI token price being 0.0145 ~ 0.0167.

Clearly, this is a number that WLFI investors find hard to accept, as it places first-round public investors just around the breakeven line. Expectations for WLFI are high, possibly for several reasons:

WLFI is not fully unlocked in its early stages, and its circulating market cap is far less than its FDV, allowing WLFI to enjoy a higher premium.

WLFI is in its early stages, and its potential growth rate is much higher than Circle's.

WLFI has strong political resources and should have a "Trump premium," leading to many projects eager to collaborate with WLFI.

The sentiment and bubble in the crypto market are more aggressive than in the stock market, and WLFI will enjoy a higher premium than Circle.

WLFI may closely follow the timing of the U.S. Genius stablecoin bill's passage for its token issuance, benefiting from high market sentiment.

……

However, we can also present corresponding counterarguments, such as:

Stablecoins are a business with a strong network effect, and leaders should have a stronger competitive advantage and higher valuation premium than new players (consider the comparison between the profitability of the leading Tether and the second-place Circle).

WLFI's project revenue is unrelated to WLFI, and the WLFI token lacks value capture, which should lead to significant discounts in valuation.

Currently, 93% of WLFI's stablecoin market cap is supported by Binance, leading to naturally low adoption and severely inflated business volume.

WLFI may just be one of many "white-label projects" of the Trump family, and they may be as ruthless in selling and operating as with Trump tokens and a series of Trump NFTs, potentially unable to make long-term investments.

The liquidity in the crypto market, especially for altcoins, has long dried up, and secondary players hardly believe any stories without hard business data support; most newly launched coins are in free fall.

……

As an investor, which side of the argument do you lean towards? It’s a matter of perspective.

In my view, the short-term price trend of the WLFI token after its launch will depend on two factors: on one hand, the final content and timing of the Genius Act's passage; more importantly, whether the Trump family is willing to place WLFI in a relatively core position as a medium for interest exchange in various benefit transfers and transactions. This is specifically reflected in "influential individuals/business entities/sovereign states" actively embedding USD1 (even symbolically) into their business processes to gain political and commercial benefits, such as using USD1 as an investment currency (equity investment) or settlement currency (cross-border trade).

If there is a lack of similar intensive business news after the launch, WLFI's position in the Trump family's business landscape may be concerning, as they have better revenue channels.

Let us wait and see how WLFI develops after its launch.

So, when will the WLFI token be transferable?

I guess it will be after the U.S. "Genius Act" is officially passed (it has already passed the Senate), which will be the time when the project can operate freely, and that time is not far off.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。