In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Recently, Lin Chao's articles have popularized some essential cryptocurrency knowledge for beginners, and many fans have privately messaged Lin Chao, hoping to learn about methods that can multiply small investments by a hundred times. However, in our discussions, it became clear that many are not only unfamiliar with the cryptocurrency space but have also not systematically studied basic financial knowledge. While there are indeed miracles in the cryptocurrency world, and it is one of the few places where the general public can change their fate, this does not mean that one can profit in the market without any foundation. It requires more accumulation and practice, as well as timely supplementation of comprehensive financial foundational logic. Today, Lin Chao will share the basic theory of the century-long economic cycle and its impact on the cryptocurrency space.

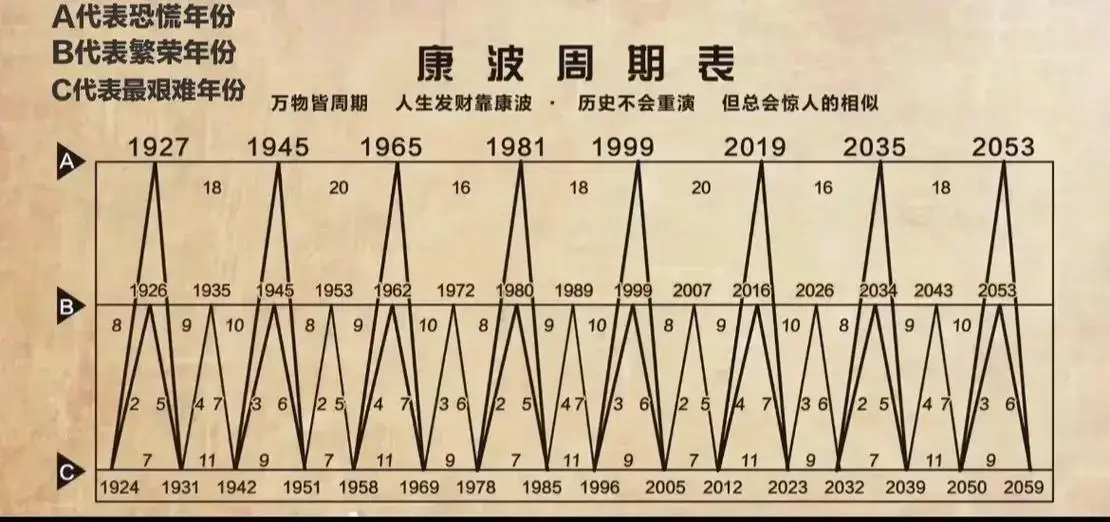

The Kondratiev wave theory, proposed by Soviet economist Nikolai Kondratiev over a century ago, is an unavoidable topic in finance and has proven to be frighteningly accurate in previous economic cycles.

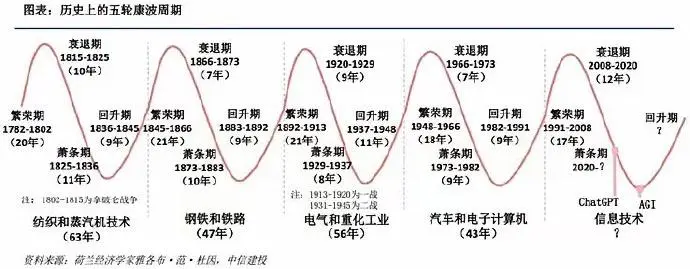

Its core theory is that the world economy experiences long-term fluctuations of approximately 50-60 years. Looking back at the five historical cycles, the core driving force of each cycle has been a revolutionary technological advancement, accompanied by the rise and fall of dominant countries. The first cycle (approximately 1783–1842) was driven by the steam engine and textile mechanization, with Britain dominating, experiencing prosperity, decline, and depression, ultimately ending with the railway bubble burst. The second cycle (approximately 1845–1897) was based on railways and the steel industry, alternating between Britain and the United States, falling into a "long depression" after a period of prosperity, with a shocking wealth gap. The third cycle (approximately 1897–1945) was the era of electricity, chemicals, and internal combustion engines, led by the US and Germany, but ultimately devastated by the Great Depression, concluding with the establishment of dollar hegemony. The fourth cycle (approximately 1948–1991) was dominated by computers, atomic energy, and aerospace technology, with the US and Japan advancing together, experiencing post-war prosperity before falling into the oil crisis and stagflation, ultimately ending with the conclusion of the Cold War. Currently, we are in the fifth cycle (1991 to present), where information technology and the internet serve as the engine, with the US leading and China rising. It has experienced a period of prosperity from the 1990s to 2008 (the rise of internet giants), with the 2008 financial crisis marking the beginning of a recession, officially entering a depression around 2019.

According to the Kondratiev wave theory, it is expected that in the second half of 2025 to early 2026, we will gradually move towards the recovery phase of the sixth cycle, and we are currently standing at this critical juncture of economic recovery. First, the productivity gains from old technologies (such as traditional IT) have significantly weakened, while new technologies like AI and renewable energy have yet to be widely applied and release their dividends. Secondly, global debt is alarmingly high, with public debt accounting for 93% of GDP, a 35% increase from 2008, with astronomical figures for old US debt and China's local special bonds. Furthermore, demand is weak, global trade in intermediate goods is shrinking, consumption is sluggish, and traditional low-interest rate methods are failing to stimulate growth, with even deflationary pressures emerging, as factories are generally underutilized (global manufacturing capacity utilization is below 75%), and companies are busy repaying debts. The stock market is performing poorly, while gold and cryptocurrencies, as safe-haven assets, are favored. Social issues are also intensifying, such as the widening wealth gap in the US (Gini coefficient of 0.494), and the widespread application of AI may threaten many jobs.

The end of a depression often sees asset prices bottoming out (the gold rush receding) and investments in emerging technologies heating up. Often, the most pessimistic times are the best opportunities for visionaries to position themselves. Many research institutions predict that 2025 will mark the end of the fifth cycle. As the saying goes, "the early bird catches the worm." From the perspective of the last two cycles, emerging financial industries are always the first to sense the beginning of a cycle. The global landscape is not monolithic; while Lin Chao will not analyze other financial fields here, interested friends can message for discussion. Next, Lin Chao will mainly discuss the role of the cryptocurrency market in this recovery cycle and the heights it may reach.

First, we know that the concentrated contradiction during this fifth cycle of depression (2019-2025) is the debt crisis (global government debt accounts for 93% of GDP) and the overdrawn credit of fiat currencies, with emerging market currencies depreciating (such as the Turkish lira depreciating by 40% annually). The US, burdened with debt, is promoting the cryptocurrency system as a means to alleviate debt and attempt to re-establish a new core economic system.

Bitcoin, with its fixed supply (21 million coins) and anti-inflation characteristics, partially replaces gold as a safe-haven asset. During the gold bull market in 2020, Bitcoin rose 400% in tandem, with a correlation that once reached 0.8 (Bloomberg data). When inflation was high in Europe and the US, Bitcoin's trading volume surged by 300% in countries like Argentina and Nigeria. As the "next-generation internet underlying technology," blockchain has attracted capital investment against the trend during the depression. In 2023, blockchain VC financing reached $27.8 billion, focusing on areas that enhance efficiency, such as Layer 2 scaling and decentralized storage.

From the perspective of traditional capital investment institutions, after BlackRock, Fidelity, and others applied for Bitcoin and Ethereum spot ETFs to be approved in 2024, more ETFs like SOL and XRP are entering the preparation stage in 2025. Once approved, they will inject more liquidity into the cryptocurrency market. The attitudes of various governments towards cryptocurrencies also indicate that the US, China, and others have passed their respective stablecoin bills, paving the way for the compliance of cryptocurrency trading. All of this reminds Lin Chao of how PayPal was born during the fourth Kondratiev depression in 1998, laying the foundation for the internet payment revolution and leading the internet cycle.

In this sixth Kondratiev recovery phase (expected 2026-2035), global central bank easing policies are needed to stimulate liquidity, which often drives up risk assets, making crypto assets a new cycle "leading indicator." Reviewing past Fed rate-cutting cycles, Bitcoin's average increase reached 150% (data from 2015-2017, 2019-2021). If the dollar enters a depreciation cycle in 2025, the attractiveness of crypto assets as a "hedge against fiat currency depreciation" will rise. Therefore, Lin Chao conservatively estimates that if this Kondratiev cycle begins, Bitcoin's price will at least rise to $500,000.

In addition to its financial attributes, the underlying application technology of cryptocurrencies also makes it a pillar of future productivity. Whether it is AI or renewable energy, both require electricity. Power Ledger allows photovoltaic users to sell excess electricity through blockchain, and similar applications can drive a massive industrial chain. The decentralized computing power market: projects like Render Network (RNDR) utilize idle GPU resources to train AI models, reducing costs for centralized giants like OpenAI. Here, Lin Chao would like to inform you that the issuer of WLD tokens is OpenAI, the popular artificial intelligence behind ChatGPT. Carbon credit tokenization: Toucan Protocol puts carbon offset quotas (1 ton of CO2 = 1 BCT token) on-chain, promoting the circulation of green finance. The deep integration of AI + renewable energy and AI + blockchain will also bring more vitality and practitioners to the cryptocurrency market.

Under the regulatory arbitrage and innovation leadership of the US, countries are gradually relaxing their high-pressure policies on the cryptocurrency market, establishing a global regulatory framework that eliminates the opposition between sovereign currency systems and the crypto ecosystem. From previously banning cryptocurrency trading to now allowing countries to open their own stablecoins, including Hong Kong allowing retail crypto trading, and major traditional brokerages entering the market, attracting funds from the Asia-Pacific region. According to Lin Chao's research, since the beginning of 2023, blockchain patents account for 60% of the global total and are gradually increasing each year. In the recovery phase of the new Kondratiev cycle, the blockchain cryptocurrency industry is overall in a position of being a promoter. Therefore, Lin Chao conservatively estimates that if this Kondratiev cycle truly begins, Bitcoin's price will likely rise to $500,000 by the end of the cycle.

Lin Chao's Summary

Friends who are familiar with Lin Chao know that my philosophy has always focused on final profits rather than gambling on cyclical altcoins or hundredfold coins in the short term. Given the current market state, the era of flourishing diversity has long passed. Whether you hold spot or profit from the contract trading market, the ultimate goal must be to convert everything into Bitcoin for long-term holding.

Although the Kondratiev theory suggests a bright future for the cryptocurrency space, this does not mean that anyone can reap the rewards by entering at any point. After all, the cryptocurrency market is still a jungle market, where costs, positions, fundamentals, and understanding of the market all affect our overall returns during the cycle. Looking at the short-term Bitcoin trend, the price has not yet reached a structural high point. As Lin Chao previously judged, the entire quarter's cryptocurrency trend will still be spent in a fluctuating downward manner. I will take profits on part of my spot Bitcoin at structural high points, regardless of whether it breaks new highs or turns downward later; that will be defined afterward. We should not have more anticipatory expectations for short-term market conditions. For now, we should focus on our own tasks and actively manage position risks, which is what we can control.

Recently, many fans have been asking Lin Chao why I offer so much free teaching on macro judgments to micro techniques and even encourage everyone to trade without relying on anyone. In fact, I have been in this space for nearly 10 years, and the original intention of creating this account is to hope that by sharing some of my methods and insights, everyone can independently build their trading systems in the future. Because I deeply understand that only what you know is something that cannot be taken away.

Too many people in this space profit by exploiting human weaknesses, and combined with previous national policies, most people have a negative view of this market. Coupled with the trading mechanisms in the cryptocurrency space, where gamblers run rampant, after each violent market movement, liquidations are everywhere, and despair fills the air, making this space full of negativity.

Lin Chao believes that the cryptocurrency market should not be like this. It should be a thriving market. At the very least, it has given ordinary people like me a glimmer of hope to change our fate. I hope that my positive mindset can actively influence more people, even if it is just to become an opportunity for everyone to choose between positivity and negativity. That is enough.

If you have ever been or are currently in a low point, you must firmly believe that the future will be better.

What has happened in the past is like yesterday's death

What happens in the future is like today's birth

Fate is uncertain, and destiny is made by oneself; fortune must be sought by oneself.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

For real-time consultation, please follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。