Original | Odaily Planet Daily (@OdailyChina)

Author | CryptoLeo (@LeoAndCrypto)

In the early hours of today Beijing time, Robinhood released "multiple heavy bombs," announcing the launch of stock tokenization, RWA L2, perpetual contract features, and staking services.

The weak interaction and liquidity issues between traditional funds and crypto have always been a "heart knot" for crypto practitioners. At the beginning of 2024, the situation began to improve, with the approval of the BTC spot ETF promoting traditional funds' engagement with crypto. Subsequently, other relatively mainstream crypto assets also followed closely in the approval of ETFs; by this year, the "GENIUS Act" ignited a "compliance bull" from the perspective of stablecoins, and traditional finance stepped back into the arena. However, in my view, this is still not enough; the most crucial link—stock tokenization—has yet to fully unleash its potential.

Currently, among the institutions laying out stock tokenization, three are relatively compliant and familiar to everyone: first is Kraken, which has already launched its stock tokenization platform xStocks last month, now supporting 60 U.S. stocks for trading around the clock; second is Coinbase, which is currently seeking SEC approval to issue blockchain-based stocks in the U.S.; if approved, it will allow Coinbase to offer traditional stock trading on-chain; and third is today's protagonist, Robinhood, which, while announcing its L2 (based on Arbitrum Orbit) and stock tokenization, also launched several new products, including perpetual futures for EU customers and staking for U.S. users. Additionally, Robinhood will give EU users OpenAI and SpaceX stock tokens.

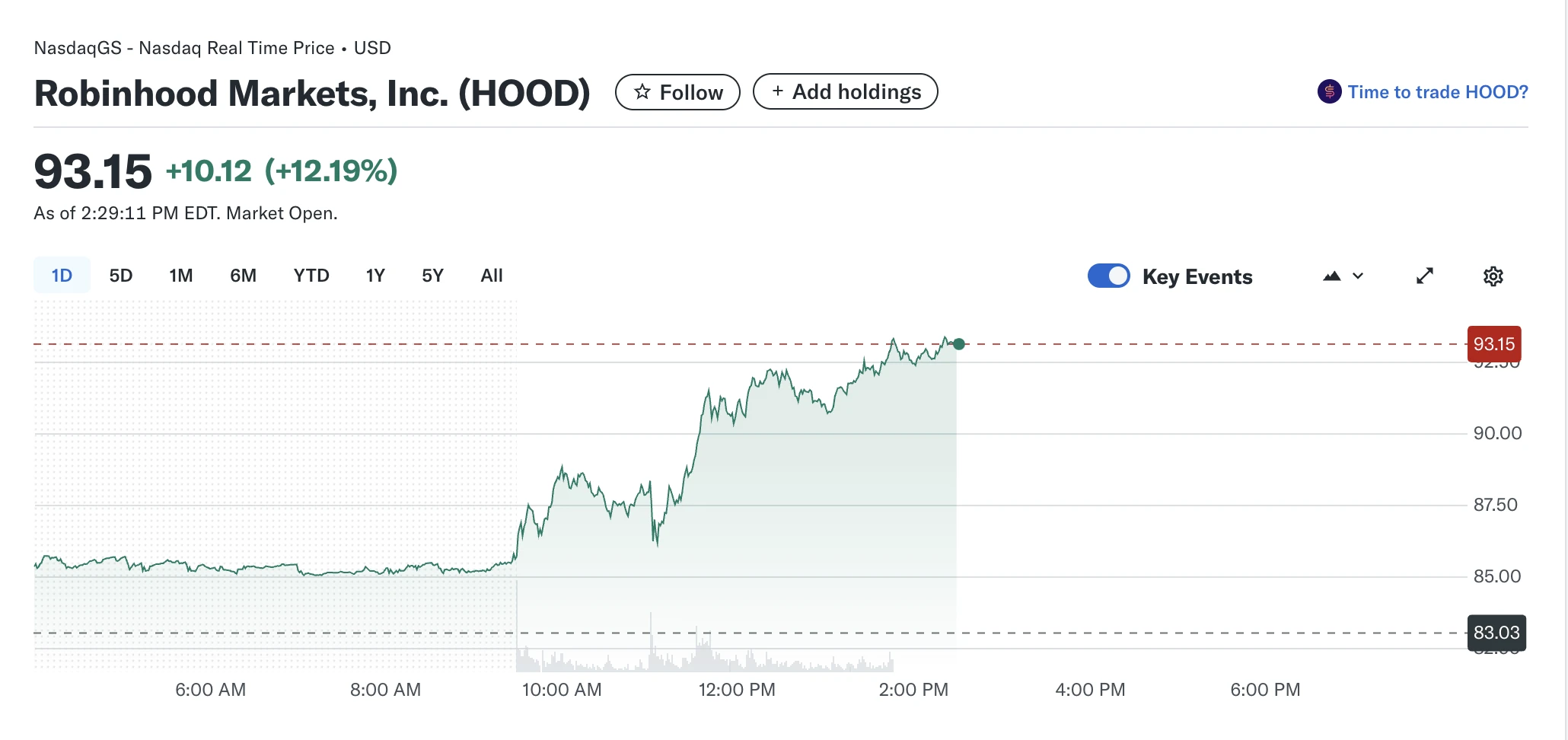

As a result of this news, Robinhood's stock HOOD rose over 12 points to $93.15 (at the time of writing).

Three Major Moves—Robinhood's Announcement is Set

As early as May this year, Robinhood submitted a proposal to the SEC aimed at achieving tokenization in the U.S. securities market. The proposal indicated that the scope of tokenization could include traditional assets such as bonds and stocks.

In the early hours of yesterday, Robinhood co-founder Vlad Tenev posted on X, stating that Robinhood would release an important announcement related to its crypto business one day later, revealing "exciting" news from Robinhood Crypto. Just hours before the official announcement of stock tokenization, there were rumors in the market that "Robinhood EU may launch tokenized stock trading services."

Below, Odaily Planet Daily will specifically introduce the three major announcements made by Robinhood today:

Stock Tokenization and Its L2

According to its official website, Robinhood users can currently purchase over 200 types of U.S. stock tokens on its app, including tokenized stocks like NVIDIA, Microsoft, and Apple. Specifically:

Stock tokens are displayed and traded in USD, and when users place an order, Robinhood will automatically convert it to euros based on the current exchange rate, charging a small foreign exchange fee of 0.1%. Additionally, there are no hidden fees;

Extremely low trading volume threshold: trading can start with as little as 1 euro;

Trading hours are nearly around the clock: from Monday to Friday, trading of tokenized stocks is available 24 hours a day.

Robinhood has also launched related activities; until July 7, eligible EU users can receive SpaceX and OpenAI stock tokens worth 5 euros for free through Robinhood EU. Robinhood has allocated a total of $500,000 in SpaceX tokens and $1 million in OpenAI stock tokens for this activity.

It should be noted that after stock tokenization, the stock code and token name will not be the same (for example, Facebook's stock code changed from FB to META), and the stock tokens will also change according to the company's actions, such as stock splits (1 share becomes 2 shares), and the tokens on Robinhood will change accordingly (1 token becomes 2 tokens), and vice versa.

Its CEO Vladimir Tenev explained the three phases of stock tokenization during a speech in Cannes (recently held ETHCC):

Phase One: Tokenizing stocks into receipt tokens, with trading still settled in the existing traditional financial market;

Phase Two: Integrating Bitstamp to enhance liquidity and achieve around-the-clock trading;

Phase Three: Integrating blockchain to gain composability advantages.

Stock tokenization will initially be issued on Arbitrum. In the future, trading will be conducted on the Robinhood L2 chain based on Arbitrum Orbit, which is currently under development and will be optimized for stock tokenization, supporting around-the-clock trading, seamless bridging, and self-custody.

Perpetual Futures for European Users

In addition to tokenized stocks, Robinhood also announced today the launch of perpetual futures for European users, set to launch later this summer. Users can open contracts with a maximum leverage of 3x long/short, with more options to be expanded for advanced customers in the future. Additionally, to help users reduce the complexity of trading perpetual contracts, Robinhood has built an intuitive interface to facilitate position sizing and margin management, with orders routed through the Bitstamp perpetual contract exchange.

Cryptocurrency Staking and a Series of Incentive Packages

Launching cryptocurrency staking services for eligible U.S. users, starting with ETH and SOL. Additionally, Robinhood has set no limits on the amount users can stake and has introduced a deposit activity, where within a limited time (after July 7), U.S. and European users can deposit cryptocurrency into Robinhood and receive a 1% deposit reward—if total deposits reach the target of $500 million, there is a chance to double it to 2%. Users who deposit before July 7 will directly receive a 2% reward;

Cryptocurrency credit card rewards: The Robinhood Gold Card offers U.S. customers cashback on all categories of spending. Until this fall, customers can use these rewards to automatically purchase cryptocurrency;

Cortex for Crypto (AI investment platform): Set to launch later this year, Robinhood Gold members can directly view insights, trends, and event-based market analysis on each token's detail page, designed to help customers quickly understand price and market changes in real-time.

Smart Exchange Routing: Evaluates multiple partner exchanges and routes user orders for the best price; the more trading volume users have in the past 30 days, the lower the fees, with API support coming soon;

Tax Lots: U.S. customers can now view and sell specific tax lots for cryptocurrency trades, allowing users to strategically choose which lots to sell;

Advanced Charts: Advanced charts in the Robinhood Legend app will be launched on mobile and will expand to cryptocurrency in August.

In a time when public companies are announcing new moves in crypto reserves every week, the series of services and packages launched by Robinhood are at a better time than ever. As CEO Vladimir Tenev stated in his speech: "We have the opportunity to prove to the world what we have always believed, that cryptocurrency is far more than a speculative asset. It has the potential to become a cornerstone of the global financial system."

Over the past few years, Robinhood has transformed from a retail brokerage into a crypto star, experiencing many ups and downs in the industry. Looking back, all of the above has a traceable path.

Robinhood's Efforts in Crypto Over the Past Seven Years

On the timeline, counting Robinhood's actions in crypto, it all started in 2018, when in February, Robinhood took its "first step" in crypto by announcing that it would allow users to trade BTC and ETH on its platform, initially launching in certain U.S. states and gradually expanding to more cryptocurrencies and regions. Since then, Robinhood has temporarily suspended crypto trading multiple times due to the volatility of cryptocurrency prices and other issues, and has also faced SEC scrutiny and fines. Fortunately, Robinhood has never stopped exploring its crypto business:

Timeline of Robinhood's Acquisitions of Crypto-Related Companies

Starting in 2021, Robinhood began acquiring crypto and crypto-related companies, including:

In 2021, Robinhood acquired the cross-exchange trading platform Cove Markets, marking Robinhood's first crypto acquisition aimed at strengthening its core crypto trading products. Since Cove Markets allows customers to manage accounts across multiple exchange platforms and aggregate large amounts of data, this acquisition aims to facilitate easier management of crypto accounts for Robinhood customers;

In 2022, Robinhood announced its acquisition of the UK crypto platform Ziglu, which allows retail investors to purchase cryptocurrencies and has obtained an Electronic Money Institution (EMI) license from the UK Financial Conduct Authority (FCA). "Ziglu's European compliance and large user base in Europe" represents another effort by Robinhood to expand its business _ (however, due to a significant downturn in the crypto market at the end of the year, Robinhood lowered its acquisition offer for Ziglu, and the acquisition was ultimately not completed);_

In May of this year, Robinhood announced the acquisition of the Canadian crypto platform WonderFi, which includes the regulated trading platforms Bitbuy and Coinsquare. Analysts stated that this acquisition is "a key first step for Robinhood to enter the Canadian market," and it is expected to bring "approximately $250 million in annual revenue" or "close to 10% growth potential";

In June of this year, Robinhood agreed to acquire Bitstamp for $200 million, with the transaction expected to be completed in the first half of 2025. This acquisition is expected to add 4 to 5 million new cryptocurrency customers to Robinhood, and another important reason for the acquisition is to allow it to take over Bitstamp's more than 50 licenses in Europe and globally, laying the groundwork for its announcement today of launching crypto perpetual contracts in Europe;

Today, Robinhood acquired the AI investment recommendation platform Pluto, known for its AI-driven personalized investment advice and real-time analysis, providing users with tailored investment strategies and insights. The acquisition of Pluto also serves as a prelude to its announcement of the AI assistant Robinhood Cortex, which will not only develop strategies for stocks and ETFs but will also cover news related to the crypto market and token price updates. Cortex will provide all relevant developments that have occurred recently on the token's detail page, helping users better understand the reasons behind token fluctuations.

Development History of Robinhood's Crypto Products

While Robinhood has been active in acquisitions, it has also been working to improve its product offerings:

As mentioned earlier, when it initially promoted its crypto business, it halted instant deposits for crypto trading due to the volatility of BTC and DOGE, marking the first hurdle in its transition to accepting crypto trading as a brokerage. Subsequently, Robinhood faced multiple investigations and fines from regulatory authorities.

Robinhood CEO Vladimir Tenev stated during a roadshow in 2021 that the company would fully invest in crypto, focusing on expanding its crypto products, and users could expect new crypto features "at some point." This marked the beginning of Robinhood's push for its crypto products.

Tenev kept his promise; as DOGE gained popularity, Robinhood seized the opportunity to test and launch the DOGE transfer feature, allowing users to transfer DOGE to external wallets. It also simultaneously launched crypto gift cards.

Following the rise of DeFi and NFTs, Robinhood announced the launch of a new Web3 wallet application, Robinhood Wallet (currently supporting dApps on Ethereum, Polygon, Arbitrum, Optimism, and Base networks), allowing users to access NFT markets, DeFi, DEX, and token swap functions, similar to other non-custodial wallets like MetaMask, but as a standalone application independent of existing stock and crypto platforms. After its launch, Robinhood Wallet has also been expanding its supported chains, tokens, and iOS version. _ (Last year, for a period, tokens transferred out of Robinhood could serve as reference targets for short-term price increases.)_

By the end of 2024, Robinhood released its crypto data, reporting that as of November 2024, the value of managed crypto assets was $38 billion, and the nominal trading volume of Robinhood's cryptocurrencies reached $119 billion (over the past year). In 2024, its product updates included:

Achieving comprehensive coverage across all 50 states and territories in the U.S., supporting new cryptocurrencies including SOL, PEPE, ADA, XRP, and WIF, bringing the total number of cryptocurrencies available to U.S. users to 20.

Launching the Robinhood cryptocurrency trading API, providing tools for viewing cryptocurrency market data, managing portfolios, and placing orders programmatically. Advanced order types, including stop-loss and limit orders, are also available on iOS and Android systems.

Announcing the launch of ETH and SOL staking for European customers at the end of the year; since its launch in the second quarter, over two-thirds of SOL holdings in the region have been staked.

Its wallet, Robinhood Wallet, has added swap functionality for Solana, Base, Arbitrum, and Optimism, in addition to existing support for Ethereum and Polygon. It has also launched cross-chain and zero gas exchanges on Ethereum and some of its L2s (as mentioned earlier).

Thus, Robinhood's complete suite of crypto facilities has gradually improved, covering spot trading, contracts, staking, AI, and its own stock tokenization public chain. At that time, Robinhood could not have imagined that the "first step" in opening up cryptocurrency trading would have such a significant impact; its products are now close to becoming a "unicorn" in the crypto industry.

"Seven years ago in spring, Robinhood picked up a real gun and pulled the trigger, but it had no impact at the time. Until today, Robinhood looks back and finds that the bullet hit the crypto stock market."

Impact: The Spring of the Stock Market, the End of Altcoins?

Currently, it seems that Robinhood excels in certain aspects of crypto compared to other crypto products, such as unlimited ETH staking. Staying true to its retail-friendly approach, it may also have more lenient trading restrictions on some tokens compared to other exchanges. However, the number of token types it currently supports is limited, and altcoins that have not yet been listed may need to consider how to get onto Robinhood; for the stock market, Robinhood's launch of SpaceX and OpenAI stock tokens in Europe signifies its democratization of private equity, allowing retail investors to access stocks that were previously unavailable for trading.

Although the concept of crypto stocks is not new, with multiple crypto trading platforms offering such products and many crypto platforms focusing on this direction, Robinhood's entry carries a different significance.

For crypto platforms creating crypto stock products, the significance lies in providing native users of the crypto space with convenient opportunities to trade other stock assets, while for compliant brokerage platforms, "chain" and "coin" represent a solution set to achieve more efficient settlement, better liquidity, lower trading friction, and connect trading scenarios and users across regions and time zones. In simple terms, it allows all ordinary investors to smoothly enter the market. In the future, for the same stock, will you look at Nasdaq or Robinhood in the pre-market?

Practitioners in the narrow sense of the "crypto circle" may not have much to be happy about; the liquidity of altcoins will be further squeezed, and the "incremental flow" will increasingly lack the necessity to enter the crypto market. In the future, apart from "coins that have passed the ETF" and "coins that can connect with traditional finance and provide underlying infrastructure," other altcoins may struggle to escape the fate of extinction.

Although Robinhood is a relatively young "alternative" brokerage and has gaps in scale compared to large traditional brokerages, and has faced criticism for multiple operational issues, its recent "move" will certainly provoke further contemplation and strategic planning from traditional giants who are already eager to act.

Many product forms are not new; who is doing them is the key to life and death.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。