Selected News

The DTSP Act in Singapore takes effect today, unlicensed platforms will exit the market

Binance announces Alpha user participation rules for NODE TGE, with a points threshold of 208

Upbit 24-hour trading volume ranking: SAHARA, BTC, XRP in the top three

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

ARB: Today's discussion about ARB mainly focuses on the upcoming presale of the Yapyo token on the Arbitrum network, sparking excitement and speculation about potential returns. Many tweets emphasize Arbitrum's collaborative strategy and its growing influence in the crypto space, especially in the context of Robinhood potentially adopting its technology. The phrase "Arbitrum Everywhere" frequently appears, reflecting the community's anticipation of its ecological expansion in areas like DeFi and gaming.

FARTCOIN: FARTCOIN has attracted significant attention on Twitter. Discussions include its high trading volume on Coinbase, even surpassing DOGE, and the high return potential from yield farming. While some users express skepticism about the memecoin market, many share successful investment experiences with FARTCOIN. The market cap of this coin continues to grow, and the participation of "smart money" and whale addresses suggests future upward potential. Although some view it as a joke, its market performance and active community indicate it has a place in the current crypto ecosystem.

LOUD: Discussions about LOUD, particularly regarding Loudio, center on the significantly increased attention ahead of its Initial Asset Offering (IAO). Many tweets compare it to another InfoFi project, Yapyo. Despite concerns about the project's sustainability, some users point out its high return potential. Additionally, discussions extend to other platforms in the InfoFi ecosystem, such as KaitoAI and Arbitrum, highlighting the importance of "mindshare" in enhancing project exposure and engagement.

PORTAL: The discussion around PORTAL focuses on its innovative approach to driving native Bitcoin DeFi, emphasizing the ability to conduct Bitcoin transactions without wrapping or cross-chain bridges, enhancing security and user control. The project has received funding support from mainstream institutions like Coinbase and OKX, and it offers airdrops to core community contributors. The community is highly active in discussing the project's potential, believing it could revolutionize Bitcoin's integration in the DeFi space through atomic swaps and trustless cross-chain operations.

MULTIBANK: The discussion around MULTIBANK centers on its plan to repurchase and destroy $440 million worth of tokens over the next four years, supported by stable income, which has garnered widespread attention due to its scale and feasibility. The project's unique strategy and strong financial foundation set it apart from many others. Meanwhile, positive feedback and promotion of the MULTIBANK ecosystem on Twitter continue to grow, indicating its active presence and appeal in the crypto community.

Featured Articles

In highly developed financial markets like the United States, stablecoins struggle to deliver significant efficiency gains; however, in underbanked regions like Nigeria, Argentina, and the Philippines, stablecoins have become a practical solution for cross-border payments and asset preservation. Tether has achieved breakthroughs in such "market failures," with profits exceeding $13 billion in 2024. Now, Tether has proactively abandoned replicating the Southern strategy in the U.S., shifting towards building AI wallets, IoT interfaces, and programmable payment SDKs, exploring a new generation of "digital operating systems."

Today, Robinhood co-founder Vlad Tenev posted on X that the company will announce a significant update related to its crypto business at 11 PM Beijing time tonight. This move aligns perfectly with Robinhood's current comprehensive expansion in the crypto and fintech sectors. As fintech gradually evolves towards "platformization" and "intelligence," Robinhood stands at the intersection of traditional brokerage and the new order of crypto, reshaping the potential forms of personal financial services with a series of product lines.

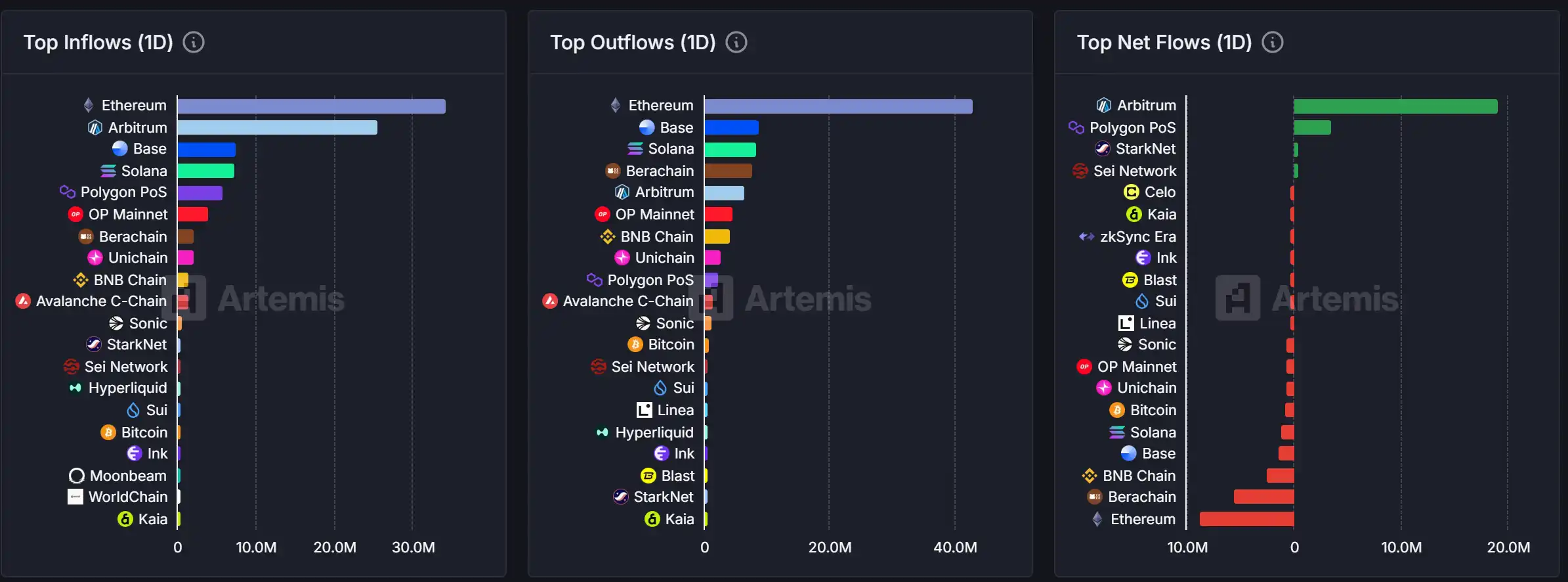

On-chain Data

On-chain fund flow situation on June 30

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。