This article is from: 21st Century Business Herald

Authors: Zhang Xin, Guo Congcong

Editor: Zhou Yanyan

Reprint Note: After Circle's IPO, its performance was exaggerated (see "Crypto Bull Market, All in US Stocks: Circle's Journey from $31 to $165 in Ten Days"), and the frenzy surrounding stablecoins is prompting global listed companies to jump on the bandwagon, resulting in a short-term surge in stock prices. Even in the domestic market, which has seen years of strict crackdowns on cryptocurrency-related businesses, many enterprises are officially announcing their exploration, development, and embrace of stablecoins, virtual assets, and RWAs under the guise of international or Hong Kong entities, further amplifying FOMO sentiment. The media outlet "21st Century Business Herald," which frequently published articles on the blockchain industry (now known as Crypto Web3) between 2020 and 2021, published another article last night warning of the risks behind stablecoins. Its perspective is quite representative, and the statement in the article about "Huatai Securities' research report showing that in Yiwu, the world's small commodity center in China, stablecoins have become one of the important tools for cross-border payments; blockchain analysis company Chainalysis estimates that as early as 2023, the on-chain stablecoin flow in the Yiwu market has exceeded $10 billion" has also sparked discussions.

As a recent focus of the global financial market, stablecoins have sparked a frenzy in the capital market.

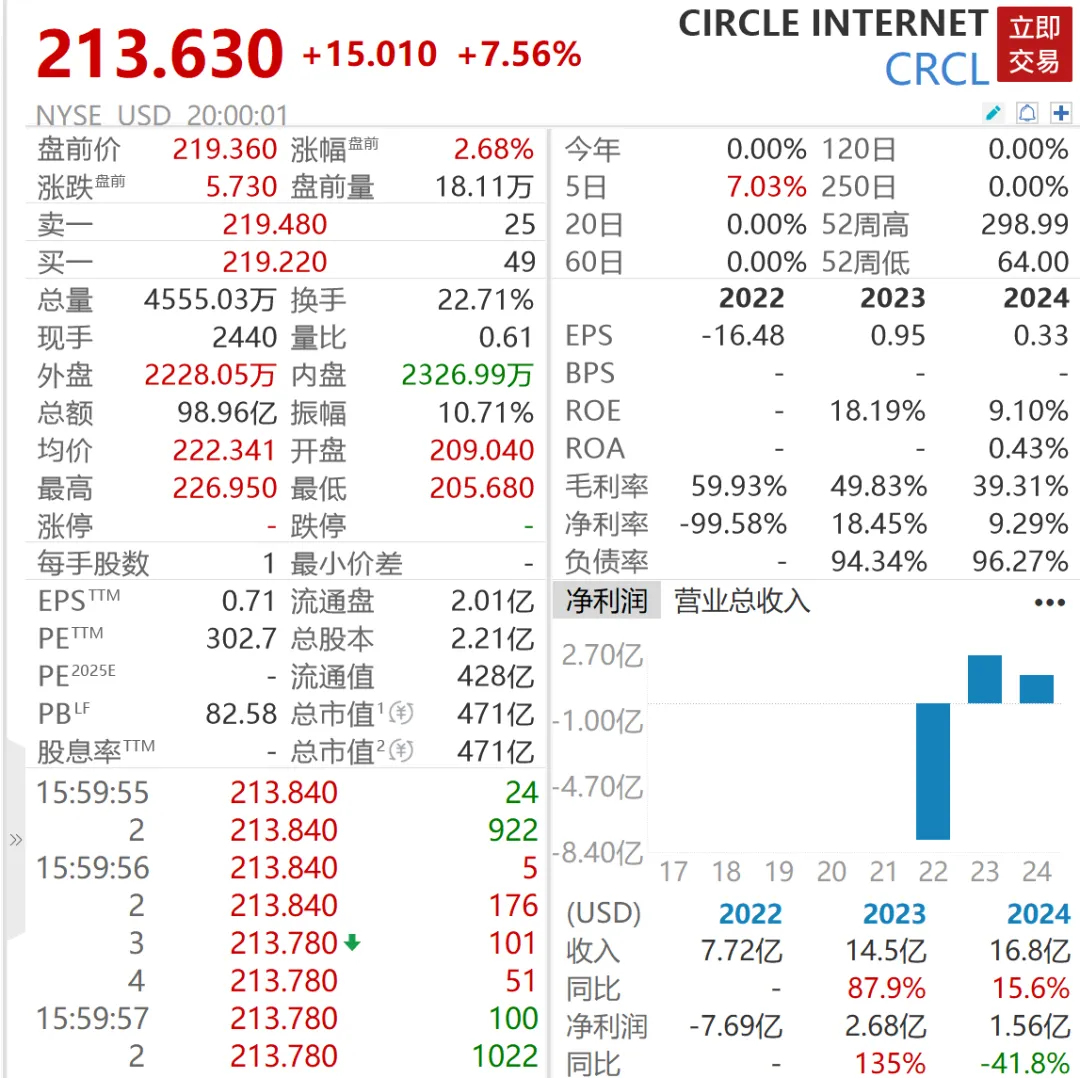

According to Wind data, since its listing on the New York Stock Exchange on June 5, the "first stablecoin stock" Circle's share price surged nearly tenfold in just over ten days, skyrocketing from an issue price of $31 to $298.99; on June 24, Guotai Junan International received approval from the Hong Kong Securities and Futures Commission to upgrade its virtual asset trading service license, with its stock price soaring nearly 200% on the same day. On June 27, Tonghuashun showed that its digital currency concept sector had been on the list for 22 consecutive days, ranking first in popularity that day.

"Sometimes nothing happens for decades, and sometimes decades' worth of events happen in just a few weeks." This statement has become a true reflection of the impact of stablecoins on the global monetary system. From the controversy sparked by Facebook's Libra project in 2019 regarding the impact on sovereign currencies to the stablecoin market potentially surpassing a market value of $250 billion by 2025, this blockchain-driven payment revolution has evolved from a technological experiment into a new battleground for major powers.

As USDT (Tether, a type of stablecoin) occupies over 60% of the market share, and as the US anchors stablecoins to the dollar or US Treasury bonds through the "Guidance and Establishment of the United States Stablecoin National Innovation Act" (hereinafter referred to as the "GENIUS Act"), and as Hong Kong implements the "Stablecoin Regulation," a deep-seated impact regarding monetary sovereignty, financial regulation, and global governance is quietly fermenting.

In the face of the wave of stablecoins, the regulatory authorities in mainland China, Hong Kong, and the Bank for International Settlements (BIS) have issued consecutive statements, sending an important signal: the impact of stablecoins must be approached rationally, recognizing both their innovative value and potential risks.

On June 18, People's Bank of China Governor Pan Gongsheng mentioned at the Lujiazui Forum that emerging technologies such as blockchain and distributed ledgers are driving the vigorous development of central bank digital currencies and stablecoins, achieving "payment equals settlement," fundamentally reshaping the traditional payment system, significantly shortening the cross-border payment chain, while also posing enormous challenges to financial regulation; HashKey Group Chairman Xiao Feng recently bluntly stated that if stablecoins occupy 30%-40% of the traditional financial market's transaction share, it would have a disruptive impact on the traditional payment system.

However, there is also considerable discussion about whether the recent impact of stablecoins has been overestimated by the capital market. Hong Kong Monetary Authority Chief Executive Eddie Yue wrote on June 23, calling for "as a regulator, I also want to cool things down, allowing everyone to view stablecoins more objectively and calmly"; the BIS report also clearly pointed out that stablecoins have structural defects in three dimensions: singularity, elasticity, and integrity, and cannot serve as the pillar of the monetary system, only playing a supplementary role.

Rise: From Crypto Asset Trading to Penetrating Cross-Border Payments

Stablecoins are a type of cryptocurrency that maintains value stability by being pegged to specific assets (such as the US dollar) or a basket of assets, serving as a payment tool and a store of value. Compared to other cryptocurrencies like Bitcoin, stablecoins are viewed as a "bridge" between fiat currencies and cryptocurrencies due to their relatively stable value and ability to overcome the challenges of pricing difficulties caused by price volatility in other cryptocurrencies.

According to the BIS, stablecoins are mainly divided into three categories:

Fiat-backed stablecoins (such as Tether, USD Coin) are backed by short-term US dollar-denominated assets, dominating the market with an asset structure similar to money market funds;

Crypto-backed stablecoins (such as Dai) are collateralized by cryptocurrencies, with "decentralized stablecoins" relying on smart contracts to manage collateral;

Algorithmic stablecoins (such as the now-collapsed TerraUSD) adjust supply to peg prices through algorithms but are susceptible to systemic risks due to market confidence.

Hashkey Tokenisation's Assistant Partner Yao Qing told 21st Century Business Herald that fiat-backed stablecoins initially aimed to solve the deposit and withdrawal issues of crypto asset exchanges. Most crypto asset exchanges, due to low compliance levels, cannot obtain support from the commercial banking system and cannot use fiat currencies for deposits and withdrawals, thus can only use US dollar stablecoins.

The earliest stablecoin was issued in 2014 by Tether, with 1 USDT pegged to 1 US dollar. Since then, US dollar stablecoins have accumulated a large user base in crypto asset trading and have rapidly penetrated other application scenarios, including cross-border trade settlement, inter-company payments, consumer payments, employee salary payments, and corporate financing, with types gradually diversifying. As of the end of May 2025, the global stablecoin scale is approximately $250 billion, achieving an elevenfold increase compared to $20 billion in 2020.

It is important to note that many people confuse China's central bank digital currency with stablecoins. In fact, central bank digital currency is a digital representation of fiat currency, with its credit support coming from national sovereignty; while stablecoins are issued by private institutions, relying on pegging to fiat currencies or other assets to stabilize their value, but may still experience pegging deviations in actual operation. There exists a certain degree of substitution relationship between central bank digital currencies and stablecoins, as well as some complementary effects, and both can jointly promote the efficiency of financial infrastructure.

In fact, due to lower cross-border payment costs, stablecoins are highly attractive for high-frequency, small-value international payment scenarios (such as cross-border e-commerce settlements and labor remittances) and are gradually penetrating daily cross-border payments.

Huatai Securities' research report shows that in Yiwu, the world's small commodity center in China, stablecoins have become one of the important tools for cross-border payments. Blockchain analysis company Chainalysis estimates that as early as 2023, the on-chain stablecoin flow in the Yiwu market has exceeded $10 billion.

In Manila, Philippines, traditional remittance centers are seeing fewer people in line, as over 40% of remittances have switched to stablecoin channels. In 2023, the Philippine central bank reported that stablecoin remittances accounted for 18% of the total remittances in the country, becoming a new pillar of the economy.

In Seoul, South Korea, stablecoin trading accounts for over 70% of the daily trading volume on the cryptocurrency exchange Bithumb. According to a 2024 report by the Korea Financial Institute, 32% of individuals aged 18-35 hold stablecoins, not only for investment and hedging but also gradually replacing bank transfers for daily consumption.

Zeng Gang, Chief Expert and Director of the Shanghai Financial and Development Laboratory, summarized that the rise of stablecoins stems from four core characteristics.

First is price stability. By pegging 1:1 to fiat currencies like the US dollar, the volatility is usually below 0.1%, making it the "value benchmark" in the crypto market.

Second is cross-border liquidity. Relying on blockchain's peer-to-peer transactions, USDT cross-border transfers take only 2 minutes, with costs as low as $1, crushing the 2-3 day cycle and 1%-3% fees of traditional wire transfers.

Third is a diverse backing mechanism. From fiat collateral to algorithmic adjustments, it meets the needs of different scenarios. For example, PAXG is linked to physical gold, becoming a new choice for hedging assets.

Fourth is a digital economy hub. In exchanges like Binance, 90% of transactions are mediated by stablecoins; in DeFi (decentralized finance) platforms, over 70% of lending agreements are denominated in stablecoins, forming the underlying infrastructure of DeFi.

It is understood that in virtual asset market transactions, the proportion of stablecoins as currency trading intermediaries has risen sharply in the past four to five years, currently exceeding 90%. According to Citigroup's forecast, under a scenario of clearer regulatory pathways, by 2030, the total circulating supply of stablecoins could grow to $16 trillion; in an optimistic scenario, it could reach $37 trillion.

Racing to Legislate: Stablecoins Seek to Integrate into the Mainstream Financial System

From the issuance of USDT by Tether in 2014 exploring decentralized cross-border payments, to the 2021 price crash of the algorithmic stablecoin TITAN triggering panic selling in the market, to the current stablecoin market size surpassing $250 billion, the stablecoin industry has undergone a transformation from wild growth to risk exposure. This has prompted major economies such as the United States, the European Union, and Hong Kong to accelerate regulatory actions. The rush to legislate among countries not only reflects the competition for regulatory authority over digital finance but also signifies that stablecoins are seeking to integrate into the mainstream track of the traditional financial system in a compliant manner.

On June 17, US time, the US Senate passed the "GENIUS Act" (also known as the "Guidance and Establishment of the United States Stablecoin National Innovation Act"). This act provides a clearer regulatory framework for the development of the US stablecoin market, marking a shift in US stablecoin regulatory policy from restricting development to actively supporting it.

The "GENIUS Act" places a "dollar lock" on stablecoins. On one hand, it imposes strict registration location restrictions on stablecoin issuance, allowing only US entities to issue compliant stablecoins, while foreign institutions must meet stringent cross-border regulatory requirements. On the other hand, it requires stablecoins to be tied to reserves, meaning stablecoins must be backed by core assets such as US dollar cash or US Treasury bonds within 93 days, directly injecting liquidity into the US Treasury bond market.

"The stablecoin mechanism cleverly transforms the expansion of the crypto market into an extension of the dollar's influence on-chain," believes Li Yang, a member of the Chinese Academy of Social Sciences and Chairman of the National Financial and Development Laboratory. He argues that the US's push for stablecoin legislation is clearly aimed at serving the interests of the dollar, promoting the modernization of dollar payments, consolidating and strengthening the international status of the dollar, and creating trillions of new demand for US Treasury bonds.

In South Korea, newly elected President Lee Jae-myung is actively fulfilling his campaign promises. The ruling party, the Democratic Party of Korea, has proposed the "Digital Asset Basic Act," which allows companies with a capital of 500 million won or more to issue stablecoins, backed by reserves to ensure refunds. Additionally, the roadmap for approving local spot cryptocurrency ETFs submitted by the Financial Services Commission indicates that an implementation plan will be developed in the second half of 2025, and preparations are underway to relax regulations on Korean won-backed stablecoins. Lee Jae-myung emphasized the importance of establishing a Korean won stablecoin market to prevent capital outflows, aiming to promote financial innovation and enhance the stability of the financial system through the legalization and regulation of stablecoins, thereby participating in the global digital asset competition.

As one of the international financial centers, Hong Kong's "Stablecoin Regulation" provides an experimental sample for the "gradual breakthrough" of offshore renminbi stablecoins:

As early as 2024, the Hong Kong Monetary Authority launched a "sandbox program" for stablecoin issuers, selecting three groups from over 40 applications: JD Coin Chain Technology (Hong Kong), Yuan Coin Innovation Technology, and an entity formed by Standard Chartered Bank, Anqi Group, and Hong Kong Telecom. These institutions have begun testing the stablecoin issuance process and business models in a controlled environment.

On May 21, 2025, the Legislative Council of the Hong Kong Special Administrative Region passed the "Stablecoin Regulation Bill"; on May 30, 2025, the Hong Kong SAR government published the "Stablecoin Regulation" in the Gazette, marking the official implementation of the regulation. The "Stablecoin Regulation" will officially take effect on August 1, marking the establishment of the world's first systematic regulatory framework for fiat-backed stablecoins.

The "Stablecoin Regulation" requires any entity issuing fiat-backed stablecoins or stablecoins pegged to the Hong Kong dollar in Hong Kong to apply for a license from the Hong Kong Monetary Authority, and only licensed institutions can sell stablecoins to retail investors. Eddie Yue mentioned that considering the characteristics of stablecoins as an emerging phenomenon, the risks involved in issuance, the need for user rights protection, and the market's capacity and long-term development plans, the license application has set high standards, and initially, only a "few licenses" will be issued.

However, for stablecoins to truly integrate into the mainstream financial system, there is still a long way to go. Zhao Binghao, Director of the Financial Technology Law Research Institute at China University of Political Science and Law, told 21st Century Business Herald that the legislative regulation of stablecoins by various countries marks their formal entry into the financial regulatory landscape, but this does not mean that stablecoins have become mainstream currencies.

Zhao Binghao believes that regulatory policies have a double-edged sword effect: on one hand, they promote industry development, attract institutional funds, and drive the integration of stablecoins with fiat currencies in payment and cross-border settlement scenarios; on the other hand, they also raise the entry barriers and compliance costs for the industry. Taking Tether, the issuer of USDT, as an example, its extremely high profit margins (in 2024, Tether had fewer than 200 employees but achieved a net profit of $13.7 billion, creating over $68 million in profit per employee) are largely due to low compliance costs. In contrast, Circle, the issuer of USDC, has invested significant resources in compliance, leading to higher operational costs and relatively limited market share. Similarly, the high compliance costs will confine the stablecoin market to a "big player competition" game, making it difficult for new players to find opportunities.

Ye Ningyao, a director of the Beijing Bank Law Research Association, also agrees with the rising compliance costs, stating that the "mainstreaming" process of stablecoins will inevitably be accompanied by a structural increase in compliance costs. Under the Hong Kong framework, issuers not only face high capital requirements but also need to bear technical investments such as reserve asset custody, independent audits, and real-time redemption systems. According to industry estimates, the annual operational cost of a compliant stablecoin issuing institution could reach 50 to 80 million Hong Kong dollars. Although the US "GENIUS Act" does not have a unified capital threshold, anti-money laundering (AML) compliance and regular reporting requirements also raise operational costs, potentially pushing small issuers out of the market. This "compliance premium" will lead to increased industry concentration, with traditional financial institutions (such as Standard Chartered Bank in Hong Kong and Fidelity in the US) gaining competitive advantages due to their existing compliance infrastructure, while crypto-native enterprises face transformation pressures.

Zhao Binghao pointed out that the asset reserves of stablecoins are primarily verified through audits. USDT has yet to adopt the "Big Four" auditing firms, which indirectly reflects the mainstream financial community's doubts about its transparency. This difference in auditing mechanisms highlights the core regulatory issue: how to ensure that stablecoin issuers indeed hold reserve assets equivalent to their issuance volume.

Four Dimensions to "Demystify" Stablecoins: Experts Say Stablecoin Value Could Even Reach Zero

Stablecoins have rapidly risen due to technological innovation, sparking heated discussions globally about the transformation of the monetary system, with some even viewing them as a "new Bretton Woods system" that could reshape the international monetary order. However, it is essential to examine the essence and impact of stablecoins from a rational perspective. The reporters of 21st Century Business Herald will "demystify" stablecoins from four dimensions to restore their true positioning in the global monetary system.

First, stablecoins are shadows of fiat currencies, not a currency revolution.

Zou Chuanwei, Director of the Frontier Finance Research Center at the Shanghai Financial and Development Laboratory and Chief Economist at Wanxiang Blockchain, pointed out that the mainstream model of stablecoins does not create new currencies; it merely tokenizes bank deposits and invests reserve assets in low-risk assets like US Treasury bonds. Essentially, it is a "blockchain translation" of the existing monetary system.

The aforementioned BIS report noted that stablecoins have defects in singularity and elasticity, which also proves that stablecoins are not a "currency revolution." Specifically, stablecoins lack the settlement function provided by central banks, leading to fluctuations in exchange rates and an inability to fulfill the principles related to bank-issued currencies, thus lacking the capacity to create money through lending activities. This indicates that stablecoins have not fundamentally changed the basic mechanisms of currency issuance and circulation, nor have they brought about revolutionary changes to the traditional monetary system; they are merely an innovative attempt based on technologies like blockchain within the existing monetary system framework, making it difficult for them to become pillars of the monetary system.

Taking the elasticity of currency as an example, Zhao Binghao stated that fiat currencies have solid backing through central bank credit, while the stability of stablecoins relies on the reserve assets of the issuer. In extreme market conditions, the value of stablecoins could even reach zero, as exemplified by the collapse of UST.

Second, stablecoins do not exist beyond sovereign currencies.

In other words, the moat of sovereign currencies is strong, and stablecoins cannot penetrate this system, but there is still a need to guard against their potential impact on sovereign currency systems.

"As long as sovereign states exist, the sovereign nature of currency will not change," Li Yang stated. Currency sovereignty is an essential component of national sovereignty, representing each country's highest authority to issue and manage its currency domestically, as well as its fundamental rights to independently implement its foreign monetary policy and participate equally in international monetary and financial affairs. Therefore, the introduction of various digital assets, including stablecoins, does not signify the emergence of a new international monetary system that transcends sovereignty.

The "integrity" defect mentioned in the BIS report regarding stablecoins serves as evidence of their inability to surpass sovereign currencies. As digital anonymous tools on borderless public chains, stablecoins lack "Know Your Customer" (KYC) standards and are prone to being used for illegal activities, making it impossible for them to possess a solid trust foundation and a comprehensive protection mechanism like sovereign currencies. In contrast, sovereign currencies benefit from national credit backing and a complete regulatory system, giving them advantages in preventing financial crimes.

Yao Qing also believes that US dollar stablecoins will support the international status of the dollar alongside systems like SWIFT messaging, Visa, and Mastercard for a considerable time in the future, rather than replacing the existing system. Essentially, US dollar stablecoins are still issued by private institutions based on dollar reserves, lacking national credit backing, international formal recognition, and a complete governance structure.

However, Li Yang cautioned that regardless of how stablecoins develop, when used for international payments, they cannot bypass the "exchange" regulations between sovereign currencies. Nevertheless, given that payment and settlement are fundamental functions of currency that cannot be replaced, the continuous growth of the stablecoin payment system, while it cannot create new international currencies, effectively erodes the functions of existing sovereign currencies. This poses a significant impact on the monetary systems of various countries and the international monetary system, warranting close attention.

Third, the digestion effect of stablecoins on US Treasury bonds is limited.

After the introduction of relevant legislation in the US, some viewpoints suggest that the US is attempting to alleviate pressure on US Treasury bonds through stablecoins. Zou Chuanwei explained that although public reports indicate that the scale of US Treasury bonds in USDT's reserve assets exceeds $120 billion, even higher than Germany's holdings, the demand for US Treasury bonds created by US dollar stablecoins is unlikely to effectively alleviate the US debt problem.

First, according to the US "GENIUS Act," the reserve assets of US dollar stablecoins can only be invested in short-term Treasury bonds maturing within 93 days, while long-term Treasury bonds are key to solving the US debt problem;

Second, compared to the total amount of over $36 trillion in US Treasury bonds, even if all reserve assets of US dollar stablecoins were used to purchase US Treasury bonds, the total would only be $245.2 billion, which is a very small proportion;

Third, if the issuers of US dollar stablecoins hold a large amount of US Treasury bonds and allow users to redeem flexibly, once faced with a large-scale redemption tide, issuers may be forced to sell US Treasury bonds, thereby impacting the stability of the US Treasury bond market.

Thus, it is evident that US dollar stablecoins face the "impossible triangle" dilemma—large-scale issuance, significant allocation of reserve assets to long-term US Treasury bonds, and flexible user redemptions cannot be achieved simultaneously.

Fourth, the hedging function and investment attributes of stablecoins have not been fully validated.

Despite being marketed as a "cross-border payment miracle," BIS's research has poured cold water on this notion. The research indicates that stablecoins are more often used as entry tools into DeFi and the crypto market. Furthermore, there is no conclusive evidence supporting their function as "hedging assets." Recent studies show that over 90% of fiat-backed stablecoins also experienced capital outflows when faced with shocks from the crypto market and US monetary policy, indicating their inability to provide effective risk mitigation during market turbulence.

Additionally, Yao Qing stated that although there have been forms such as algorithmic stablecoins and over-collateralized stablecoins in the development of stablecoins, their essence remains as a medium of exchange based on the characteristics of value storage and circulation convenience. This fundamentally differs from virtual currencies with investment attributes, and their functional positioning should be viewed rationally without excessive exaggeration or mythologizing.

Impact and Reconstruction: Possibilities and Challenges of a Diverse Monetary System

Amid the wave of blockchain technology, stablecoins have transitioned from niche applications in the crypto asset field to becoming key variables that disrupt the global monetary system. As USDT circulates in cross-border payment scenarios with daily transaction volumes in the hundreds of billions, and as countries engage in a new round of competition over stablecoin legislation, the future form of currency is undergoing unprecedented impacts and reconstructions.

Ye Ningyao stated that the current global stablecoin market is showing a trend of multipolar development: the European Union is strengthening regulatory restrictions on non-euro stablecoins through the MiCA Act (the "Regulation on Markets in Crypto-Assets"); Russia has innovatively launched the RUBC stablecoin, backed by a mix of gold and US dollars. In the process of de-dollarization, BRICS countries are exploring the establishment of a "common currency" mechanism, while some emerging economies are attempting to issue stablecoins backed by gold or commodities, all aimed at reducing traditional reliance on the dollar system.

However, the rapid development of stablecoins also brings a series of significant risks and regulatory challenges.

On June 25, during the Summer Davos Forum, Li Bo, Vice President of the International Monetary Fund (IMF) and former Deputy Governor of the Central Bank, stated that although many countries are actively conducting regulatory experiments on digital currencies and stablecoins, striving to build compatible legal frameworks, this is just the starting point, and further consensus is needed. He noted that the current definition of stablecoins' attributes is ambiguous—whether they belong to currency or financial assets has not been clarified, which directly affects the corresponding legal and regulatory requirements. Additionally, if they are recognized as currency, issues such as how to delineate currency tiers and how to establish supporting anti-money laundering mechanisms are still under intense discussion.

Zhao Binghao pointed out to our reporter that currently, all global stablecoins are issued by private institutions, and there have been no cases of direct central bank involvement. Taking the US market as an example, the robust development of private dollar stablecoins like USDT and USDC has objectively strengthened the international status of the dollar, which also explains why the Trump administration did not actively promote the construction of central bank digital currencies (CBDCs). However, this market-based issuance model has significant regulatory blind spots— the Federal Reserve lacks effective control measures over on-chain circulating dollar stablecoins, and this state of unregulated control may brew substantial financial risks.

Zhao Binghao particularly emphasized two prominent challenges currently facing stablecoin regulation:

First, there is a serious imbalance in cross-border and cross-chain regulatory mechanisms. Although major financial markets like the US and Hong Kong have established regulatory frameworks, the lack of uniform standards among countries creates space for regulatory arbitrage.

Second, there is a clear deficiency in technical regulatory capabilities. In the face of a stablecoin system supported by blockchain technology, regulatory agencies are still using traditional regulatory tools, leading to a severe lack of technical penetration. A typical manifestation of this problem is that mainstream stablecoins like USDT can only implement technical freezes (i.e., "blacklisting addresses") on a portion of on-chain assets, while most regulatory operations still rely on the cooperation of public chain infrastructure to be completed.

Yu Weimen wrote that the anonymity and cross-border convenience of stablecoins give rise to anti-money laundering challenges, while also posing risks of bank runs, deposit migration, systemic risk transmission, and technical security. Lin Yingqi, Deputy General Manager of the Research Department at China International Capital Corporation and a banking analyst, also told our reporter that the regulatory difficulties of stablecoins mainly lie in customer identity verification (KYC) and anti-money laundering (AML): currently, regulation mainly involves reviewing customer information at the platform level and identifying customer information during the exchange of digital currencies and fiat currencies. However, the blockchain technology used in cryptocurrencies determines that once funds enter the blockchain, the mapping of on-chain data to real customer information is difficult to trace, making it challenging to monitor on-chain fund flows and increasing regulatory difficulty.

From a regulatory perspective, Yu Weimen stated that internationally, represented by the Hong Kong Monetary Authority, there is active participation in the FSB's "Global Crypto Asset Activity Regulatory Framework" collaboration to promote cross-border regulatory cooperation; locally in Hong Kong, the principle of "same activity, same risk, same regulation" is followed, with the "Stablecoin Regulation" clarifying issuer qualification requirements and using a "sandbox" mechanism to validate business models in advance. Yu Weimen also emphasized that the approval of stablecoin licenses needs to be strictly controlled in number, focusing on real application scenarios and market trust, while also imposing strict requirements on reserve management, anti-money laundering compliance capabilities, and business sustainability.

Li Bo also revealed at the 2025 Summer Davos Forum that the IMF, along with the Financial Stability Board, the Basel Committee, and other institutions, will collaborate to develop relevant standards and guidelines to help countries better implement central bank digital currency and stablecoin initiatives.

Additionally, due to the impact of stablecoins, emerging markets must be wary of the risk of "digital dollarization." Yao Qing told 21st Century Business Herald that dollar stablecoins, with their advantages of speed, low cost, and disintermediation, have become important tools for cross-border payments and fund transfers, gaining popularity among individual and institutional users. In regions such as Latin America, Africa, and Southeast Asia, a large number of residents hold and use dollar stablecoins to avoid risks associated with domestic economic instability and currency depreciation, effectively creating a digital form of "dollarization." This trend not only reinforces the international dominance of the dollar but also poses a certain substitutive impact on the fiat currencies of countries with unstable legal tender values, challenging their monetary sovereignty.

Looking ahead, Li Yang believes that in the face of the stablecoin wave, China needs to advance comprehensively along two lines. The first is to firmly promote the internationalization of the renminbi. Given that stablecoins are still inherently tied to the sovereign currency system, continuously strengthening the international status of the renminbi remains a core task. Past measures such as expanding local currency swap agreements, optimizing the renminbi cross-border payment system, improving the global clearing network, and increasing the use of the renminbi in "Belt and Road" economic and trade activities must be steadfastly deepened and implemented.

Ye Ningyao also pointed out that offshore renminbi stablecoins are showing unique development potential: relying on the regulatory framework established by Hong Kong's "Stablecoin Regulation," tech giants like Ant Group and Tencent are actively exploring the application of renminbi stablecoins in cross-border trade scenarios, providing an innovative path for the internationalization of the renminbi.

Regarding the second line, Li Yang mentioned that it is necessary to recognize that the trend of the integration of stablecoins, cryptocurrencies, and traditional financial systems will be difficult to reverse. In recent years, the EU, Japan, the UAE, Singapore, and Hong Kong have shifted towards a model that supports the experimental integration of central bank digital currencies, stablecoins, and cryptocurrencies. This integration model helps achieve complementary development among the three, significantly improving payment efficiency and reducing payment costs, reconstructing the global payment system, and driving the development of DeFi. However, it is important to address issues such as the substitution of sovereign currencies, money laundering, user rights protection, and the loss of control over monetary policy during the promotion of stablecoin development.

The rise of stablecoins is a continuous struggle between technological innovation and institutional constraints. They are neither a "currency revolution" that disrupts sovereign currencies nor a tool for reconstructing monetary hegemony, but rather a technological revolution that reconstructs the payment system—rewriting the rules of value transfer with blockchain, yet always constrained by national monetary sovereignty.

In this technological revolution, the US attempts to legislate stablecoins into the "dollar system," while China explores renminbi stablecoins through offshore pilots, and emerging markets must be wary of the risks of "digital dollarization." Looking ahead, the global financial monetary system may not be characterized by dollar dominance or a pattern of pluralistic equality, but rather a complex ecology coexisting with sovereign currencies, central bank digital currencies, and compliant stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。