I. Introduction

Recently, cryptocurrency concept stocks have sparked an unprecedented frenzy in global capital markets. From the stablecoin giant Circle's stock price soaring nearly fourfold just a week after its IPO, to Tron rapidly igniting the market through a reverse merger with a U.S. stock, the crypto industry is entering the mainstream capital spotlight with unprecedented speed and intensity. Companies related to blockchain that have a clear compliance path can almost instantly achieve astonishing valuations, even becoming hot topics pursued by the capital market. As more and more crypto enterprises announce or initiate IPO plans, 2025 may witness an unprecedented "year of crypto enterprise IPOs," which will have a profound impact on the entire capital market and the crypto ecosystem.

This article will delve into the key drivers behind the recent surge in cryptocurrency concept stocks, provide a detailed overview of the major crypto-related listed companies in the market, and review heavyweight crypto enterprises that are preparing for IPOs. Additionally, the article will look ahead to the long-term impact of the crypto IPO wave on the market ecosystem, providing valuable references and insights for investors and industry observers.

II. Surge in Cryptocurrency Concept Stocks

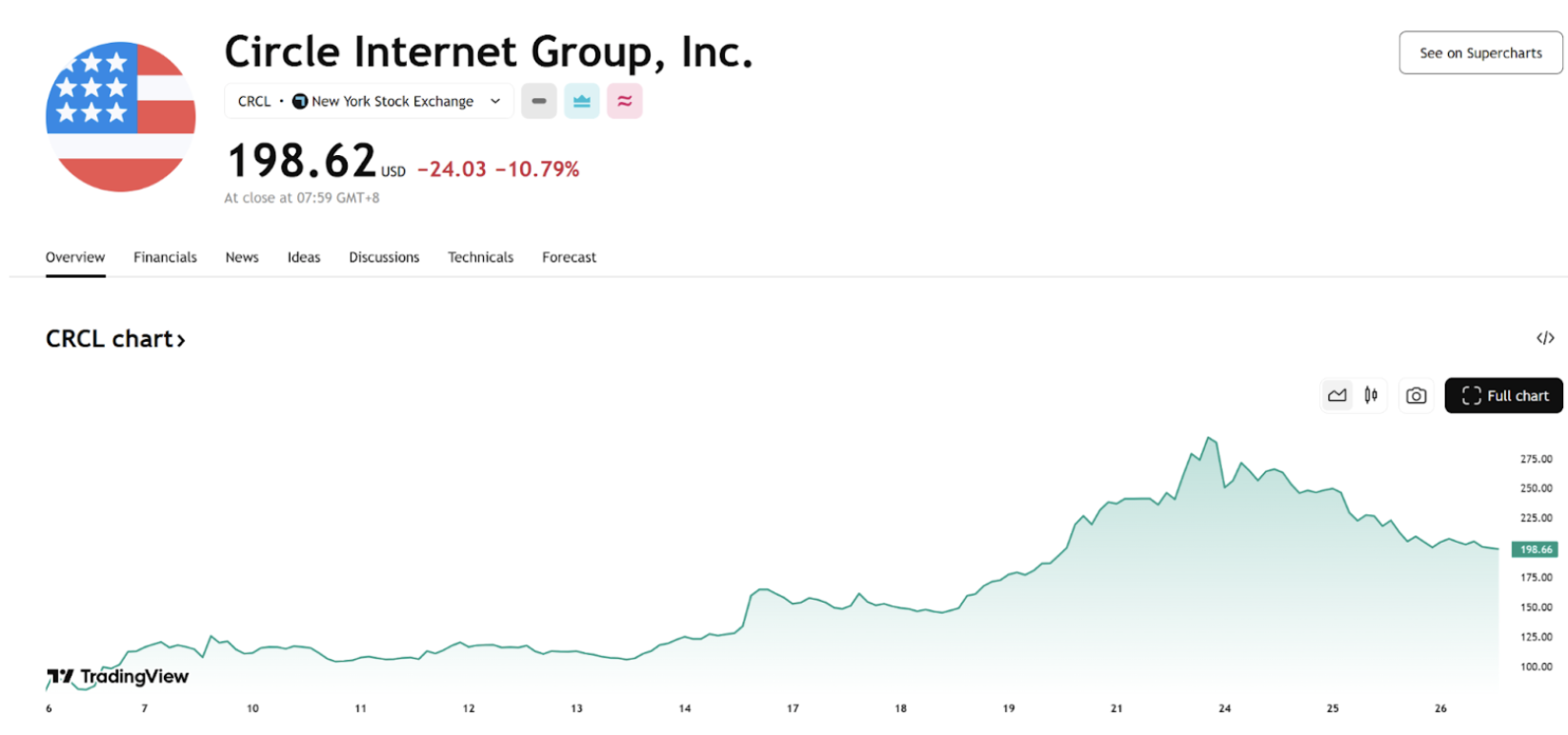

On June 5, stablecoin company Circle went public on the New York Stock Exchange at an issuance price of $31, and its stock price skyrocketed in the following days, closing at around $115 in the first week. On June 23, Circle's stock price peaked at $292.77 during trading, an increase of over 844% from the IPO price, before slightly retreating, yet the enthusiasm remained.

Source: https://www.tradingview.com/symbols/NYSE-CRCL

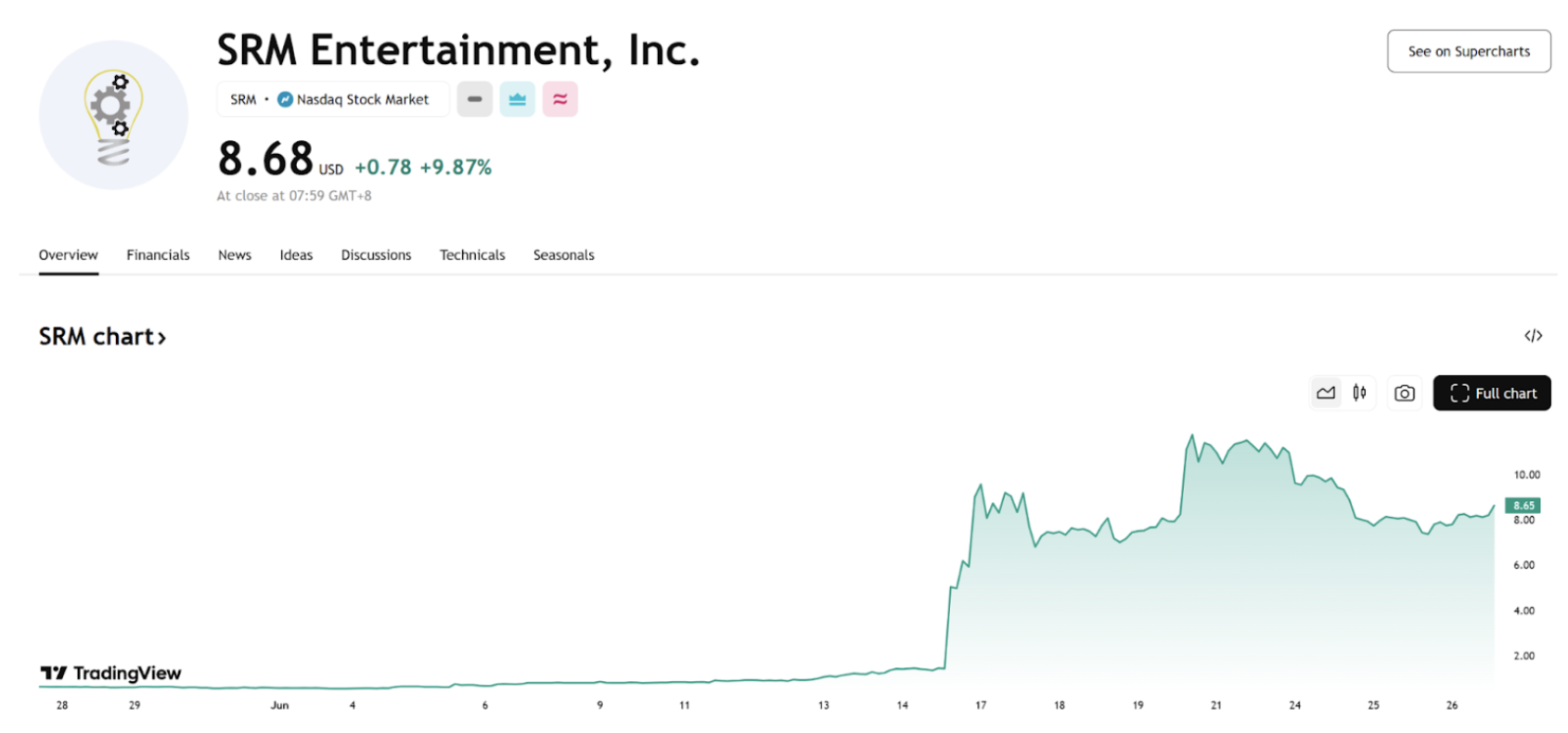

SRM Entertainment (SRM) saw its stock price rise from less than $1.5 at the beginning of June to more than five times that on June 16, following news that Tron Foundation founder Justin Sun would take the company public through a reverse merger and investment. The company's market value surged from tens of millions to about $158 million. The company announced it received $100 million in investment and would implement a treasury strategy for Tron’s TRX token, effectively becoming the Tron version of MicroStrategy.

Source: https://www.tradingview.com/symbols/NASDAQ-SRM

In addition to Circle and Tron-related concept stocks, several rising companies are also competing to implement "crypto asset treasury" strategies to attract attention:

MicroStrategy (MSTR), as the publicly traded company with the largest Bitcoin holdings globally, has its "digital gold reserve" strategy making its stock price a barometer for Bitcoin prices.

SharpLink Gaming (SBET) announced it spent approximately $463 million to acquire Ethereum (a total of 176,271 coins) and implement a crypto asset treasury strategy.

DeFi Development (DFDV) has repositioned itself as a "Solana treasury," holding over 600,000 SOL tokens as of May and announcing a $5 billion equity financing limit to increase its Solana holdings.

Nano Labs announced a $500 million convertible bond plan to fund large-scale BNB purchases, aiming to establish a $1 billion BNB treasury, targeting to accumulate 10% of its circulating supply.

This unprecedented investor enthusiasm reflects the recent popularity of cryptocurrency concept stocks, with the ignition point of the crypto bull market seemingly not in the crypto circle, but on Wall Street. Traditional secondary market investors are pouring funds into "compliant crypto asset mapping companies" at an unprecedented speed. Companies that are related to blockchain assets and have compliant disclosures and real business operations often achieve valuation premiums in a short period.

III. Background and Forms of Crypto Enterprises Going Public

Favorable policies, a bullish market, financing needs, and flexible listing tools have jointly spurred the trend of crypto enterprises going public this year. Moving from the "out of the circle" regulatory constraints to the mainstream market stage, crypto companies are embracing Wall Street with unprecedented vigor.

1. Analysis of Reasons for the Surge in Crypto Enterprises Going Public

Since the beginning of this year, more and more companies in the crypto industry have announced or are preparing for IPOs, with the U.S. stock market seemingly becoming the preferred stage for cryptocurrency concept stocks. This phenomenon is driven by both internal motivations and external environmental factors.

Warmer and clearer policy and regulatory environment: Trump is seen as a representative figure "friendly to crypto," and after his re-election, he quickly adjusted the personnel in the regulatory sector, leading to a more open attitude towards crypto assets in U.S. politics. On June 17, the U.S. Senate passed the "Stablecoin Innovation and Unified Regulation Act" (GENIUS Act) with an overwhelming 63 to 30 vote, establishing a unified regulatory framework for stablecoins and other crypto assets, giving the market a glimpse of the institutionalized prospects for compliant operations of crypto enterprises.

Macroeconomic environment providing a window for crypto enterprises to go public: With Bitcoin prices breaking and stabilizing above $100,000, the "crypto circle" has re-entered a bull market cycle, meaning related enterprises will achieve higher valuations and financing amounts in the capital market. This moment is an excellent window for crypto enterprises to enter the capital market, where investor enthusiasm can be converted into real financing and valuations. Many crypto companies that were previously on the sidelines have accelerated their IPO processes to seize this wave of benefits.

Internal needs for enterprise development: Choosing to go public during a bull market not only allows for raising funds at relatively ideal valuations but also enhances brand awareness and credibility. Some leading enterprises (such as exchanges, custodians, etc.) hope to consolidate their market position and obtain compliance qualifications through listing after the industry reshuffle, thereby gaining regulatory recognition and customer trust in global expansion. Additionally, for venture capital-backed unicorns, going public can provide exit channels for early shareholders and attract new institutional investors. These practical considerations have collectively contributed to the trend of crypto companies going public.

2. Diversity of Listing Forms for Crypto Enterprises

The listing forms of crypto enterprises exhibit diverse characteristics. To seize opportunities and accelerate processes, various crypto enterprises have adopted different paths to enter the capital market:

Traditional IPO: This is the most mainstream method of going public. For example, Circle chose to issue new shares through a conventional IPO on the NYSE, which proved to be very successful; in early June, Israeli social trading platform eToro and restructured Galaxy Digital also went public through IPOs. These IPOs are usually accompanied by impressive first-day gains, indicating strong market buying interest.

Direct Listing: Unlike IPOs that issue new shares, direct listings do not raise funds but directly list existing shares for trading. Coinbase used a direct listing method to go public on NASDAQ in 2021, setting a precedent for crypto unicorns. Direct listings are typically used by companies that are financially stable and well-known; while more companies are now choosing IPOs, direct listings remain a flexible option.

SPAC Merger Listing: The popular special purpose acquisition company route has also been adopted by some crypto enterprises. A typical example is the mining company Bitdeer, which successfully went public on NASDAQ in 2023 through a merger with a SPAC related to Blue Lake Capital; stablecoin company Tether and exchange Bitfinex-backed Twenty One Capital went public on NASDAQ in April 2025 through a merger with Cantor's SPAC, immediately becoming the third-largest "Bitcoin holding" company in the U.S. stock market with $3.6 billion in Bitcoin reserves. The SPAC route is relatively quick and flexible, suitable for crypto companies with clear business models and institutional backing. However, as the traditional IPO market warms up, the popularity of SPACs has declined, and some companies that originally planned to use SPACs have shifted back to the IPO track.

Reverse Merger: This is a new highlight that has emerged this year, represented by Tron's reverse merger with SRM. The Tron project has already issued the TRX cryptocurrency; leveraging the small-cap U.S. company SRM Entertainment, Justin Sun first injected $100 million into SRM and obtained a large number of new shares, then renamed the company "Tron Inc," allowing the Tron ecosystem to achieve a roundabout listing through SRM. Once the news was confirmed, SRM's stock price skyrocketed by more than five times, indicating the market's excitement for this "crypto project indirectly entering the U.S. stock market" model. Reverse mergers provide an alternative route for some crypto projects that cannot go public directly, but the corresponding compliance challenges and operational complexities (such as information disclosure, shareholder structure restructuring, etc.) must also be considered.

Dual Listing or Cross-Border Listing: Some large crypto companies seek to list in multiple markets to attract capital from different regions. For example, OKX is reportedly considering an IPO in the U.S. while exploring a "spin-off listing" plan, which may mean listing simultaneously in places like Hong Kong. Galaxy Digital was previously listed in Canada and then directly listed on NASDAQ in the U.S. through restructuring. Dual listings help enhance global visibility and liquidity and are also a strategy for some companies to cope with regional regulatory risks.

IV. Overview of Popular Cryptocurrency Concept Stocks

Currently, cryptocurrency concept stocks are spread across various capital markets globally, with the U.S. market being the main battleground, while important crypto-related stocks can also be found in Hong Kong, Singapore, and other locations. Below, we will review the major listed crypto enterprises according to different sub-sectors and analyze their performance and influence.

Crypto Financial Services and Investment

- MicroStrategy (NASDAQ: MSTR, now renamed Strategy): A traditional business intelligence software company that transformed into a "Bitcoin reserve company" by heavily purchasing Bitcoin as its main asset on the balance sheet. As of June 26, 2025, MicroStrategy has accumulated approximately 592,345 Bitcoins, accounting for 2.82% of the total global Bitcoin supply. With the company's strategic transformation, its market value once surpassed $10 billion. By the end of 2024, MicroStrategy was included in the NASDAQ 100 index, marking the beginning of mainstream indices incorporating Bitcoin exposure. The stock performance of MicroStrategy is highly correlated with Bitcoin, and it is viewed by investors as an alternative way to invest in Bitcoin.

Source: https://bitbo.io/treasuries/microstrategy/

Circle Internet (NYSE: CRCL): The issuer of the USDC stablecoin successfully went public on June 5, 2025, raising $1.1 billion. As the world's first publicly listed stablecoin company, Circle has garnered significant attention. The company reported revenues of up to $1.7 billion in 2024, with 99% coming from interest income generated by USDC reserves. This "passive income" model provides robust cash flow with very low volatility, making it a highly favored investment target. Circle's stock price nearly doubled on its first day of trading and continued to soar several times thereafter. The successful IPO not only brought high valuation to Circle but also ignited enthusiasm in the entire crypto IPO market.

Galaxy Digital (NASDAQ/TSX: GLXY): Founded by Wall Street celebrity Mike Novogratz, Galaxy is a digital asset financial services provider that represents the entry of crypto investment banking and asset management into the public market. Galaxy was listed on the Toronto Stock Exchange as early as 2018 and underwent restructuring to directly list on NASDAQ on May 16, 2025. Galaxy's business includes crypto trading, asset management, and investment banking services, making it a representative of the "Goldman Sachs" of crypto.

Amber Group (NASDAQ: AMBR): Established in 2017, Amber Group is a leading Asian crypto financial services platform that offers comprehensive services such as trading, market making, and lending, and has received investments from several well-known institutions. After some setbacks, Amber went public on NASDAQ on March 13, 2025. Amber is globally leading in technology-driven high-frequency trading and quantitative strategies, representing the internationalization of Singapore's crypto enterprises.

Twenty One Capital (NASDAQ: XXI): A company initiated by stablecoin giant Tether and exchange Bitfinex, it went public through a SPAC merger in April 2025. Upon listing, it became a significant player with $3.6 billion in Bitcoin reserves, reportedly ranking third globally in Bitcoin holdings, only behind MicroStrategy and Tesla. The company functions more like a Bitcoin ETF alternative or investment firm, reflecting the demand from some investors to gain exposure to Bitcoin through stock investments. After its listing in the U.S., XXI's stock price performed steadily and rose under favorable stablecoin legislation.

Exchanges and Platforms

Coinbase (NASDAQ: COIN): A globally recognized leading cryptocurrency exchange. Founded in the U.S. in 2012, it serves over 120 million users. Coinbase went public through a direct listing in April 2021, becoming one of the first crypto unicorns to enter the U.S. stock market. In May 2025, the stock was officially included in the S&P 500 index, becoming the first crypto concept stock to enter the S&P index. This milestone event pushed Coinbase's stock price up 10% in after-hours trading and is seen as a sign of crypto stocks entering the mainstream. Currently, Coinbase has a market capitalization of over $60 billion, and its stable performance (recently rising gradually with low volatility) reflects investor confidence in compliant trading platforms.

eToro (NASDAQ: ETOR): A social trading platform founded in Israel, featuring unique functions like "copy trading," with over 30 million users globally. After experiencing a failed SPAC attempt, eToro successfully went public on NASDAQ through an IPO on May 15, 2025, with its stock price rising over 40% on the first day. As a platform that encompasses both crypto and traditional asset trading, eToro's listing demonstrates investor optimism about the prospects of cross-market integrated trading platforms, setting an example for crypto enterprises in Europe and the Middle East.

Robinhood (NASDAQ: HOOD): A well-known U.S. commission-free brokerage that began offering crypto trading services in 2018. Although the company is not entirely a crypto enterprise, it is considered one of the crypto concept stocks due to its support for trading Bitcoin, Ethereum, and others. Robinhood went public in 2021, with approximately 20% of its revenue coming from crypto trading. As a representative of the integration of traditional finance and crypto business, Robinhood reflects the trend of FinTech giants embracing crypto.

Block (NYSE: SQ): Formerly known as Square, this American payment technology giant went public in 2015. The company changed its name to "Block" in 2021 to emphasize its focus on blockchain technology, as its Cash App provides Bitcoin buying and selling features. Block has also invested in Bitcoin mining and hardware wallet development, making it one of the pioneers among traditional tech companies actively involved in the crypto space. Although its main business is payments, the market positions it as "part crypto company," with its stock price showing some correlation to Bitcoin prices.

OSL (HKEX: 0863): A representative crypto trading platform stock in Asia. OSL is part of BC Technology Group, established in Hong Kong in 2018, and holds a virtual asset trading license issued by the Hong Kong Securities and Futures Commission, making it one of the first legally compliant digital asset trading platforms in Hong Kong. OSL went public on the Hong Kong Stock Exchange in 2019 through a reverse merger (the predecessor of BC Group was engaged in media business). Currently, OSL primarily serves institutional and high-net-worth clients, providing brokerage, custody, and other services, managing over $5 billion in assets. In recent years, Hong Kong has actively embraced crypto, introducing new regulations for virtual assets and allowing retail trading. As a licensed leader, OSL has benefited significantly from favorable policies, and its stock price has risen due to these developments. OSL's existence indicates that the Hong Kong market is also cultivating its own ecosystem of crypto concept stocks.

Mining and Mining Hardware

Marathon Digital (NASDAQ: MARA): One of the largest Bitcoin mining companies in the U.S., listed in 2012, operating several large mining sites in North America. As of June 26, 2025, the company holds a total of 49,179 Bitcoins. The rebound in Bitcoin prices from 2023 to 2025 has significantly boosted its stock price, attracting institutions to maintain positive ratings. Marathon's stock price has become a "magnifying glass" for Bitcoin market trends, making it one of the main tools for Wall Street to bet on coin prices.

Riot Platforms (NASDAQ: RIOT): Another long-established Bitcoin mining company, listed in 2003, focusing on North American mining operations. Similar to Marathon, Riot's stock price has risen by 20-30% since early 2024 as Bitcoin prices have recovered, with capital flowing back into the sector during the same period, propelling Riot to become a core asset in mining.

Bitdeer (NASDAQ: BTDR): Founded by Jihan Wu, former chairman of Bitmain, Bitdeer focuses on mining operations and computing power leasing. It went public on NASDAQ in April 2023 through a merger with Blue Safari SPAC, attracting attention due to its computing power resources and market scarcity. The company operates multiple mining sites in the U.S. and Norway, with stable revenue growth expected from 2024 to 2025, and plans to expand its data center facilities into AI cloud services. As a derivative enterprise of China's mining giant overseas, Bitdeer's listing signifies the curve of Chinese mining capital entering the U.S. stock market.

Canaan (NASDAQ: CAN): Canaan is one of the first publicly listed Bitcoin mining machine manufacturers in China, going public on NASDAQ in 2019 with its Avalon series of mining machines. It performed exceptionally well during the Bitcoin bull market in 2021 but faced a downturn due to market corrections and intense competition, leading to a period of low stock prices. With the mining sector recovering since 2023, Canaan has improved its performance, and revenue and orders have rebounded. Currently, Canaan is a key representative in the capital market covering the blockchain hardware sector, and its recovery indicates that the industry cycle has begun.

Other Ecosystem-Related Companies

Tron Inc (proposed listing): The Tron project is advancing its reverse merger with SRM. Once completed, Tron will become the first crypto public chain project to successfully enter the U.S. stock market. The listing process for Tron may pioneer a new model for the capitalization of crypto projects, prompting other projects to follow suit or explore similar paths. However, the Tron case has also raised discussions about its compliance, especially given that its tokens are still trading and it has previously faced SEC lawsuits. If Tron successfully goes public, it will undoubtedly further elevate market expectations for the securitization of "crypto-native projects."

DeFi Development (NASDAQ: DFDV): This company has transformed from real estate technology to a company holding Solana assets, exploring the securitization of DeFi ecosystem companies. Its stock price surged by 28 times due to the switch in business focus. This indicates that as long as a small company is linked to a popular public chain ecosystem and boldly announces its holding strategy, it can achieve remarkable speculation in the capital market.

Other Targets in Hong Kong and Singapore Markets: In addition to OSL, Hong Kong has companies like New Fire Technology (formerly Tong Cheng Holdings, HKEX: 1611) involved in crypto asset management and brokerage services. In Singapore, besides Amber, which is already listed, Osmosis (a mining machine distributor) is also seeking to go public locally. Although the scale and number of crypto concept stocks in these regions are not as large as in the U.S., they are gradually developing within their respective regulatory frameworks. For example, the Hong Kong government has actively promoted the region as a crypto hub, and it is expected that more Asian crypto enterprises will choose to list in Hong Kong in the future, potentially giving rise to iconic companies like a "Hong Kong version of Coinbase."

Overall, the global landscape of publicly listed crypto companies now encompasses the entire industry chain. The upstream includes mining companies and hardware manufacturers, the midstream includes exchanges and wallets, and the downstream includes payment and investment services, even public chain ecosystem companies. This expansion of the landscape is a microcosm of the blockchain industry moving from the margins to the mainstream. The stock market provides a new stage for crypto enterprises to showcase their value, allowing traditional investors to share in the dividends of the blockchain revolution.

V. Overview of Crypto Enterprises Preparing for IPOs

Several blockchain-related enterprises are actively preparing to enter the capital market, and it is expected that in the next 1-2 years, a number of heavyweight companies in the crypto industry will enter the secondary market, including exchanges, mining companies, infrastructure, and Web3 content platforms.

Bitmain / Antalpha (Bitmain and its Subsidiaries)

Bitmain attempted to go public in Hong Kong in 2018 but was unsuccessful, and there are currently no direct IPO plans. However, its mining financial subsidiary Antalpha submitted an IPO prospectus (Form F-1) for the U.S. stock market in April 2025, planning to list on NASDAQ, with an expected issuance of approximately 3.85 million shares, raising about $50 million, which will be used for asset management of Bitcoin and digital gold. Antalpha primarily focuses on mining machine supply chain finance and has signed an MOU with Bitmain as its main financing partner, which is seen as a "roundabout listing" operation for Bitmain.

BitGo (Crypto Asset Custodian)

The established custody platform BitGo is actively preparing for an IPO. According to multiple financial media outlets, including Bloomberg, the company is collaborating with investment banks and is expected to go public in the second half of 2025 in the U.S. (NASDAQ/NYSE), with its asset custody scale surpassing $100 billion in the first half of 2025. BitGo has also added OTC trading services to expand its revenue channels.

Kraken (Established U.S. Crypto Exchange)

Kraken has repeatedly stated its IPO plans at the end of 2024 and the beginning of 2025, and in 2025 initiated preparations including $100 million in debt financing. According to market news, the company is sprinting towards a listing in Q1 2026, preparing for compliance and optimizing its capital structure. Although the co-CEO emphasized that the listing must "benefit customers and build trust," the IPO will proceed steadily if regulatory conditions are favorable.

Gemini (Winklevoss-founded, U.S. Compliant Exchange)

Gemini officially launched its IPO process by submitting a confidential S-1 form to the SEC on June 6, 2025. The listing process had previously slowed due to the industry's downturn and the Genesis incident involving a partner. The company resolved investigations by the CFTC and SEC earlier this year, clearing obstacles for its listing plans.

OKX (Established Offshore Exchange)

OKX is preparing for a U.S. IPO, planning to list on NASDAQ through its U.S. subsidiary. The company has reached a settlement with the U.S. Department of Justice and the Treasury and has resumed its U.S. operations. At the same time, it must pass SEC reviews and adjust its Asian licensing system. Reports indicate that OKX is expected to leverage the "warming" regulatory environment to go public.

Bithumb (Leading South Korean Crypto Exchange)

Bithumb is on track to split its business in the second half of 2025, focusing on its core exchange, and is preparing to list on Korea's KOSDAQ. It has already hired Samsung Securities as the lead underwriter and will separate its trading and investment departments, aiming for an initial domestic listing to raise $1 billion before considering a U.S. IPO.

Bitkub (Thailand's Largest Crypto Exchange)

Bitkub Capital Group is preparing for an IPO on the Stock Exchange of Thailand (SET) in 2025. The CEO revealed that the valuation will reach 6 billion Thai Baht (approximately $165 million). The company is expanding its team and hiring financial advisors to accelerate the listing process, viewing the IPO as a strategic milestone for rapid expansion.

FalconX (Crypto Brokerage Platform for Institutions)

FalconX is actively preparing for an IPO, potentially listing on the NYSE as early as 2025. The company provides OTC and derivatives trading services for institutions and is currently leveraging the market recovery and investment bank support to achieve its final listing.

Ripple (RippleNet Network Operator)

After the gradual conclusion of its lawsuit with the SEC, Ripple's management has repeatedly stated that it is not in a hurry to go public. CEO Brad Garlinghouse indicated that Ripple is well-funded and is currently focusing on mergers and acquisitions rather than fundraising for an IPO, which is explicitly listed as a "non-priority." Although there is "definitely a possibility" in the future, Ripple prefers to wait until the regulatory environment is fully clarified before considering it.

VI. Impact of the Crypto IPO Boom on the Market and Future Trends

With a large number of crypto companies heading for IPOs, 2025 has become a "big year for crypto IPOs." This intense wave of listings has had a profound impact on both the cryptocurrency market and the traditional financial market, bringing new variables to future trends.

Impact of the Crypto IPO Boom

First, the large number of crypto companies going public signifies that traditional capital is further embracing the crypto industry. As stocks like Circle, Coinbase, and MicroStrategy enter authoritative indices such as the S&P 500 and NASDAQ 100, global passive investment funds and traditional institutional investors are passively or actively allocating crypto exposure. This will deepen the linkage between the crypto market and the overall financial market. On one hand, crypto assets are no longer limited to token forms but are integrated into mainstream investment portfolios through stocks; on the other hand, the volatility and capital flows of traditional stock markets may also affect the performance of these crypto concept stocks, thereby indirectly influencing the sentiment in the cryptocurrency market.

Secondly, the listing boom may also have an indirect impact on cryptocurrency prices themselves. On one hand, some listed companies directly hold large amounts of crypto assets. The fundraising and stock appreciation of these companies enhance their ability to increase their crypto asset holdings. For example, Semler Scientific announced plans to raise significant funds to purchase up to 100,000 Bitcoins in the coming years, which will effectively draw capital from the stock market into the crypto asset market. Similarly, companies implementing "treasury strategies" may be more motivated and resourced to buy related tokens after their stock prices rise, thus providing support for token prices. On the other hand, when crypto company stocks perform well, it also boosts investor interest in the underlying crypto assets.

Potential Risks and Challenges

It is important to note that not every listed crypto company can replicate Circle's success. Investor enthusiasm may inevitably have an overheating component, leading to potential differentiation: only companies with real performance support and mature models can maintain high valuations, while those lacking fundamental backing will eventually return to rationality. For example, SharpLink Gaming (SBET) saw its stock price soar before quickly halving. This serves as a reminder that when the hype subsides, the market will pay more attention to fundamentals. Therefore, in the short term, this wave of IPOs has brought funding and attention to the industry, but in the medium to long term, whether companies can deliver growth and whether the regulatory environment remains friendly will determine whether stock prices and market capitalizations can stabilize.

Regarding regulation, although the current U.S. regulatory attitude is becoming more positive, policy uncertainty remains a long-term variable. Future political changes and regulatory shifts may affect the regulatory scale for crypto companies. For instance, if the stablecoin bill faces obstacles in the House of Representatives or if other regulatory measures tighten, it could dampen market sentiment. However, there are reasons to be optimistic: the two major U.S. securities indices have included multiple crypto stocks, and the interests of millions of traditional stock investors are now tied to the crypto market, which will compel regulators to be more cautious and balanced in policy-making, rather than easily imposing blanket restrictions. Thus, the entry of crypto companies into the public market has, to some extent, increased the "political weight" of the industry, helping to advocate for a more rational regulatory environment.

Future Trend Outlook

Looking ahead, we can foresee that the integration of crypto and traditional finance will deepen further. In the next 18 months, industry predictions suggest that more companies will join the listing ranks: for example, the established U.S. exchange Kraken is reportedly preparing for an IPO before 2026; custody giant BitGo may go public as early as this year; Ethereum ecosystem development company Consensys, hardware wallet manufacturer Ledger, institutional custody company Fireblocks, and on-chain data analysis company Chainalysis, all valued at billions of dollars, are also considered to have IPO potential. Additionally, companies and projects with Chinese backgrounds are also making moves: the OKX exchange has established a headquarters in the U.S. and is considering an IPO; Tron is actively pursuing a reverse merger to enter the U.S. stock market. If the crypto market remains strong, these reserve projects are likely to materialize one after another, sparking the largest wave of crypto IPOs in history. It is foreseeable that crypto concept stocks will further enter the public eye, with the sector's market capitalization and influence continuing to rise.

Conclusion

The recent strong performance of crypto concept stocks in the global capital market represents a concentrated victory for the crypto industry in its march toward the mainstream. The "two-way rush" between the stock market and the blockchain space shows that crypto companies are no longer limited to self-entertainment within the circle but have truly knocked on the door of the capital market. From macro policy shifts and capital enthusiasm to specific companies doubling their stock prices and surging fundraising amounts, the crypto industry is gaining increasing recognition from traditional investors. For investors, it is essential to recognize the opportunities and risks involved: on one hand, high-quality crypto company stocks are expected to share in the rapid growth dividends of the industry; on the other hand, the high volatility characteristic of the crypto field has not disappeared; it has merely manifested in a different form in the stock market. Looking to the future, the wave of crypto company IPOs may continue to rise, and the integration of the crypto world with traditional finance will deepen further, jointly composing an exciting chapter for the next stage.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend assessment + value excavation + real-time tracking" three-in-one service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluations of potential projects, and all-weather market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selection" and daily news briefings of "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。