The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

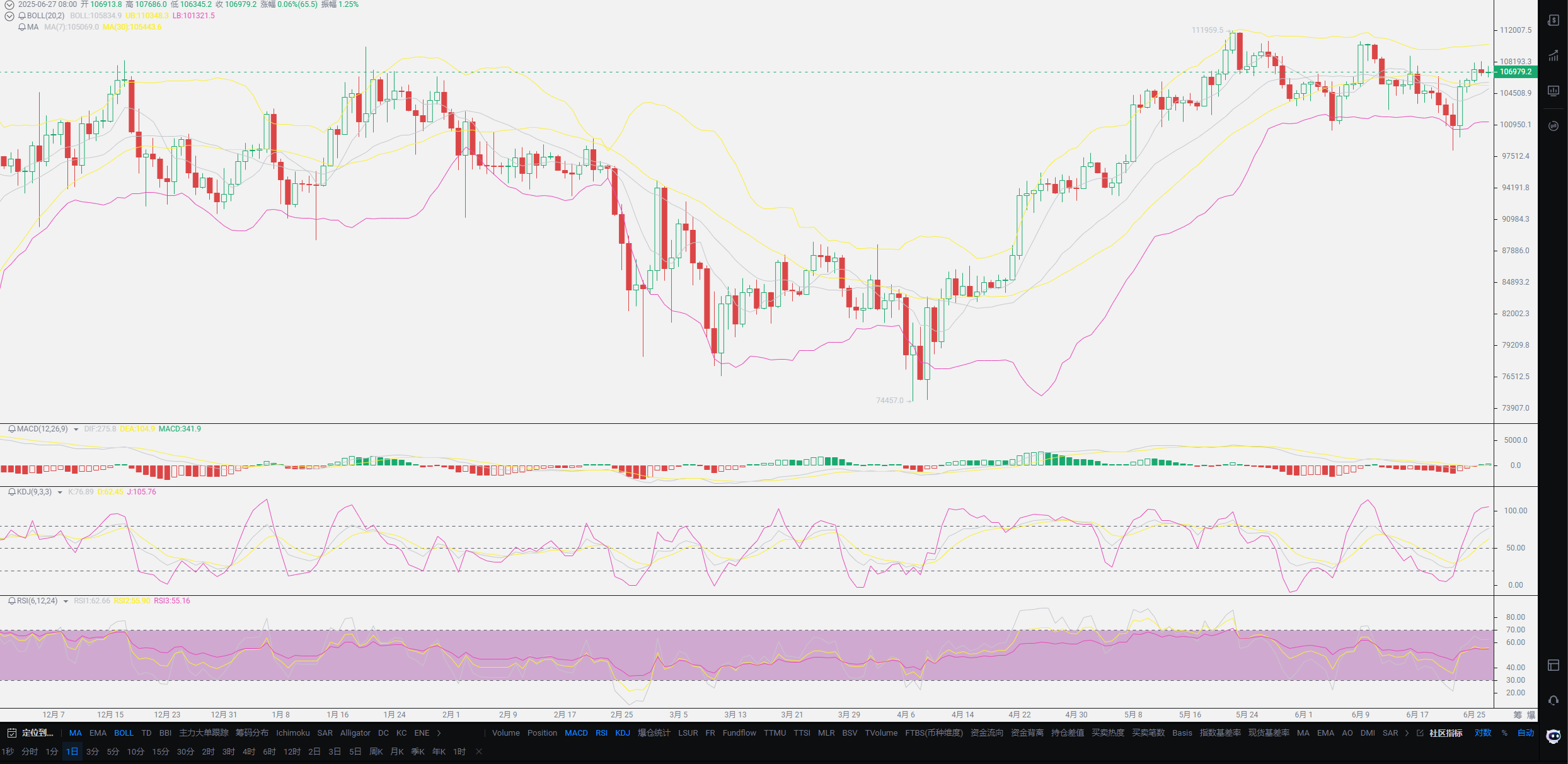

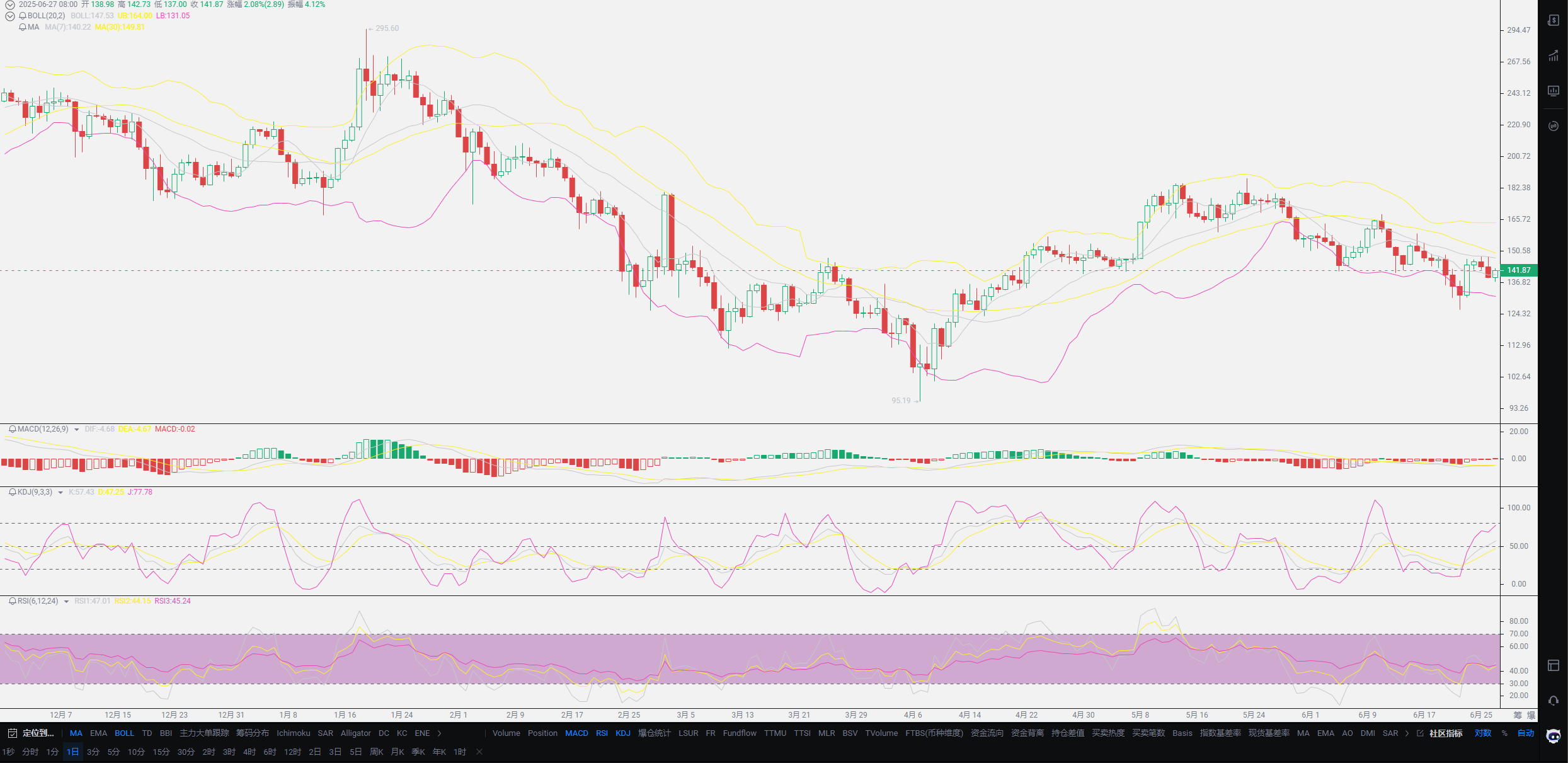

Through recent analysis, many friends feel confused about the future trends. Whether going long or short, they lack confidence. Therefore, Lao Cui has consolidated recent viewpoints to emphasize the trends. Last night, Lao Cui mentioned the need to short Bitcoin, which was explained in relation to the evening's trends, and on a mid-term level, Lao Cui still maintains a bearish outlook. The overall thinking has not changed significantly; Bitcoin's speculative wave form can definitely exit around 1000-3000 points, while Ethereum corresponds to 20-40 points. These analyses are not afraid of trend levels because such fluctuations occur almost daily. The main confusion for most friends is why, under numerous positive news, Lao Cui still maintains a bearish outlook. This is what Lao Cui has always emphasized: positive news must be seen in terms of tangible implementation. Before measures are implemented, it will only drive the growth of public opinion effects.

Regarding the current price of Bitcoin, from Lao Cui's perspective, it is not truly stable. On the issue of stability, Lao Cui can share the basis for judgment. The first point is the issue of capital volume; observing capital volume inevitably leads to the overall market value. Currently, Ethereum's overall market value has risen to 9%, and the overall market value proportion has increased to 0.45%. Under the push of this capital volume, compared to Ethereum's price this year, it is surprisingly still in a declining range. This is not difficult to understand because Ethereum has been continuously issued, and as the quantity increases, the unit price naturally struggles to rise. Yesterday's trading volume reached 41.9 billion, and compared to other cryptocurrencies, Ethereum's circulation effect is still relatively considerable. If Ethereum is to double, under the overall bull market conditions, at least the current market value needs to double because the issue of oversupply cannot be resolved. Therefore, regarding the assessment of Ethereum, Lao Cui's attitude is not optimistic; achieving even a double is very difficult.

From this perspective on Bitcoin, you will also find that although Bitcoin quickly warmed up after a dip, the overall 24-hour inflow status is still negative, with a net outflow exceeding 200 million. Although short-term capital volume cannot explain too many issues, from a technical linear perspective, you will feel strong selling pressure above. As soon as it touches key points, a large amount of selling will occur. To break through this pressure, only large capital systems have a chance, and currently, the large capital volume is almost all impacting stablecoins. From a different perspective, the returns brought by a stablecoin company's listing are all more than doubled. You can observe the trends of Guotai Junan or the American cryptocurrency concept trends. These two have almost siphoned off capital investment from other cryptocurrencies, including Bitcoin, due to their excessively high return rates. At this stage, the cryptocurrency market has no power to resist compared to the emerging market of stablecoins. Therefore, before interest rate cuts, do not fantasize that the cryptocurrency market can still see capital intervention to save the market!

Lao Cui does not recommend everyone to engage in contract operations; contracts are too cruel a test of human nature. However, for every wave of market movement, there are almost always many users consulting Lao Cui. The form of contracts is mainly speculative, and compared to small coins, the risks are almost equivalent. Regarding small coins, Lao Cui's views on both are consistent. Especially after the emergence of stablecoin legislation, the survival space for small coins will be further compressed. This is not difficult to understand; previously, most funds entered the small coin market solely for harvesting, and the lessons from FIL and SHIB are not far away. The funds that need to be laundered have already provided very legal channels, so issuing coins has been vetoed for the black and gray industries. A crucial point about the stablecoin legislation is the clearance of U.S. debt. Now, directly pegging to the U.S. dollar must have corresponding U.S. dollars to qualify for issuing coins. This pegging form poses a significant threat to small coins.

Under this operation, the 93-day waiting period for U.S. debt is directly omitted, and stablecoins will be made public and transparent. The circulating funds in the cryptocurrency market will also become transparent. It is simple: holding stablecoins can be exchanged for U.S. dollars at any time, and no one is willing to go through an extra step with small coins. For the market, this is a process of good money driving out bad money; in the future, small coins will find it extremely difficult to harvest retail investors. This will also increase costs for most small coins; under current conditions, it is wise not to seek multiple small coins. For those about to be listed, as soon as they double, they should prepare to clear assets. The reform of the legislation directly tells the gray industries of various countries that they are welcome to the American market. The one most affected by this series of changes is USDT; the previous U.S. debt ratio has already issued a notice requiring it to be fully converted into U.S. dollar reserves within a certain period, or it will lose its qualification.

This is also what Lao Cui mentioned last year: stablecoin USDT may be liquidated. There is no need for everyone to panic; just look at European platforms where all transactions are directly linked to fiat currency. This was the previous state of the cryptocurrency market and its original intention. Stablecoins do not affect ordinary people; everyone should primarily hold physical assets. Among small coins, Ripple is worth paying attention to; its channel application is the most widespread. Although it has some outdated technical aspects, it is backed by a strong foundation. If you choose SOL, the capital volume is also somewhat lacking, so you can consider system coins. The likelihood of Ripple being listed is probably slightly less than SOL, but it may become the second coin to be listed this year. The possibility of doubling after listing is almost the same as SOL, but so far, this type of small coin still has some downward space and will definitely need to be washed back and forth. Including the entire cryptocurrency market, the next three months will mainly focus on washing positions, and users holding small coin physical assets should at least prepare for losses of over 40%!

Lao Cui summarizes: Overall, the order of investment should be mainstream currency Bitcoin greater than everything else, followed by Ethereum as a unique category, and then SOL as a secondary option, with XRP chosen if capital volume is insufficient. In a more stable manner, everyone can only choose top platform tokens like BNB, and remember to focus on the top ones, excluding low-quality platforms. If everyone wants to choose coins that are not yet released or listed, it is better to choose Bitcoin contracts to make a move. The fundamentals of Bitcoin and Ethereum have not fluctuated too much; retail investors still hold a considerable amount. Recent fluctuations may likely wash out again. Regarding the interest rate cut plan in July, do not hold too high expectations; ultimately, we still need to look towards the timing of the bull market starting in September. The reversal of trend levels is unlikely to exceed our estimates; the current cryptocurrency market does not have the timing to start a bull market. If everyone finds the recent market particularly dull, they can consider the stablecoin market. In the next three months and before the interest rate cut, physical asset users can aim for the stablecoin market. As for contract users, as long as Bitcoin reaches a high point, they can short it without too much worry. The probability of interest rate cuts is decreasing, and with the news of no cuts leaking out, it will lead Bitcoin to decline again, so everyone can seize this opportunity!

Original content by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or positions, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。