Author: Pzai, Foresight News

In recent years, as the cryptocurrency market has garnered increasing attention from various sectors, the demand for regulation in the crypto market has become more urgent. Different countries and regions have introduced distinctive regulatory policies based on their own economic, financial systems, and strategic considerations. From the ongoing tug-of-war between the U.S. SEC and crypto companies, to the EU's comprehensive MiCA regulation for crypto asset markets, and the difficult balancing act between innovation and risk in emerging economies, the global landscape of crypto regulation is exhibiting unprecedented complexity and diversity. At this moment, let us unfold the world map of crypto regulation and explore the hidden threads of this global regulatory wave.

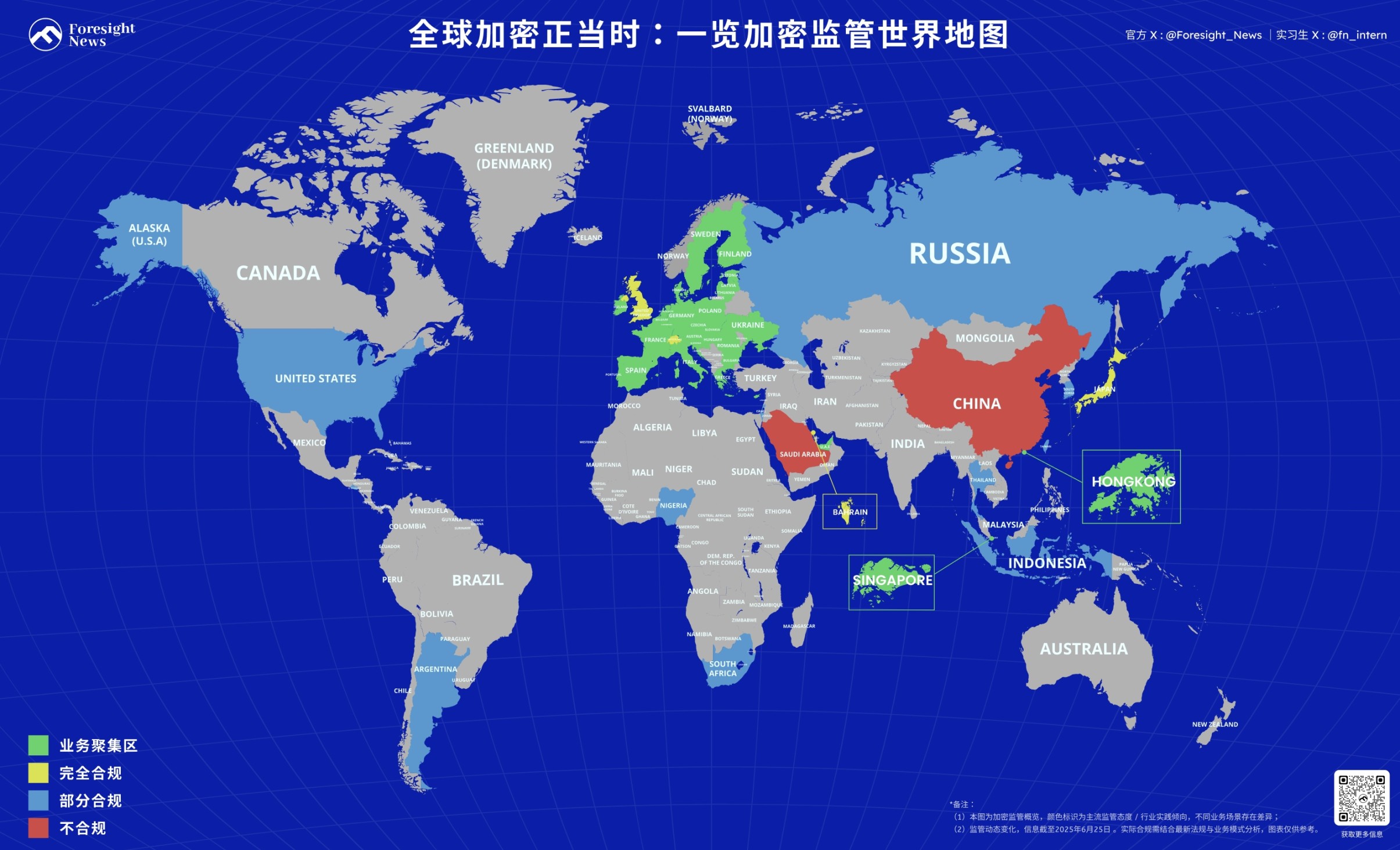

On the map, we categorize countries into four categories: business hubs, fully compliant, partially compliant, and non-compliant. The criteria for judgment include the legal status of crypto assets (50%), the implementation of regulatory frameworks and legislation (30%), and the establishment of exchanges (20%).

Asia

Greater China

Hong Kong

In Hong Kong, crypto assets are regarded as "virtual assets" rather than currency and are regulated by the Securities and Futures Commission (SFC). For stablecoins, Hong Kong implements a licensing system, and the "Stablecoin Ordinance" restricts licensed institutions from issuing Hong Kong dollar stablecoins. As for other tokens, NFTs are considered virtual assets, while governance tokens are regulated under the "Collective Investment Scheme" rules.

In terms of the regulatory framework, Hong Kong revised its "Anti-Money Laundering Ordinance" in 2023, requiring cryptocurrency exchanges to obtain licenses. Additionally, the SFC has issued rules for virtual asset ETFs. The SFC is responsible for issuing licenses, and currently, HashKey and OSL are the first to obtain licenses, with over 20 institutions in the application process. Licensed exchanges are allowed to serve retail investors. Notably, Bitcoin and Ethereum ETFs are set to be listed in Hong Kong in 2024.

By actively embracing Web3 and virtual assets, particularly by allowing retail trading and launching virtual asset ETFs, Hong Kong aims to solidify its position as an international financial center, contrasting sharply with the strict bans in mainland China. The Hong Kong SFC mandates licensing for exchanges and allows licensed exchanges to serve retail investors while launching Bitcoin/Ethereum ETFs. Against the backdrop of a complete ban on cryptocurrencies in mainland China, Hong Kong has chosen a distinctly different path, actively building a clear and regulated virtual asset market. Allowing retail participation and launching ETFs are key measures to attract global crypto capital and talent, enhancing market liquidity and international competitiveness.

Taiwan

Taiwan adopts a cautious stance towards cryptocurrencies, not recognizing their status as currency but regulating them as speculative digital commodities, gradually improving the framework for anti-money laundering and security token offerings (STOs).

Legal Status of Crypto Assets: Currently, Taiwan does not recognize cryptocurrencies as currency. Since 2013, the Central Bank of Taiwan and the Financial Supervisory Commission (FSC) have maintained that Bitcoin should not be viewed as currency but rather as a "highly speculative digital virtual commodity." For tokens such as NFTs and governance tokens, their legal status remains unclear, but in practice, NFT transactions are subject to capital gains tax. Security tokens are recognized by the FSC as securities and are regulated under the "Securities Exchange Act."

Regulatory Framework: Taiwan's "Anti-Money Laundering Act" regulates virtual assets. The FSC has mandated that local banks must not accept Bitcoin or provide any services related to Bitcoin since 2014. For STOs, Taiwan has specific regulations that differentiate regulatory paths based on the issuance amount (NT$30 million). The FSC also announced in March 2025 that it would draft a law specifically targeting virtual asset service providers (VASPs), aiming to transition from a basic registration framework to a comprehensive licensing system.

Licensing: In 2024, the FSC introduced new regulations under the "Anti-Money Laundering Act," requiring VASPs to register with the FSC before providing any virtual asset-related services (such as operating exchanges, trading platforms, transfer services, custody services, or underwriting activities). Failure to register may result in criminal penalties. For STOs, issuers must be registered joint-stock companies in Taiwan, and STO platform operators must obtain a securities dealer license and have a minimum paid-in capital of NT$100 million.

Mainland China

Mainland China has completely banned the trading of crypto assets and all related financial activities. The People's Bank of China believes that cryptocurrencies disrupt the financial system and facilitate criminal activities such as money laundering, fraud, pyramid schemes, and gambling.

In judicial practice, virtual currencies have corresponding property attributes, and there is a general consensus in judicial practice. Civil case precedents commonly recognize that virtual currencies possess characteristics such as exclusivity, controllability, and circulation, similar to virtual goods, acknowledging that virtual currencies have property attributes. Some cases cite Article 127 of the Civil Code, which states, "Where the law provides for the protection of data and network virtual property, it shall be implemented in accordance with its provisions," and refer to Article 83 of the "National Court Financial Trial Work Conference Summary," which states, "Virtual currencies possess some attributes of network virtual property," determining that virtual currencies are a specific type of virtual property and should be legally protected. In the criminal field, recent cases in the Supreme People's Court's case database have also clarified that virtual currencies fall under the definition of property in criminal law, possessing property attributes in the context of criminal law.

However, since 2013, banks in mainland China have been prohibited from engaging in cryptocurrency business. In September 2017, China decided to gradually close all domestic virtual currency exchanges within a limited timeframe. In September 2021, the People's Bank of China issued a notice prohibiting all services related to virtual currency settlements and the provision of trader information, clearly stating that engaging in illegal financial activities will result in criminal liability. Additionally, cryptocurrency mining operations have been shut down, and new mining sites are not allowed. Foreign virtual currency exchanges providing services to residents in China via the internet are also considered illegal financial activities.

Singapore

Legal Status of Crypto Assets: Singapore views crypto assets as "payment tools/goods," primarily based on its "Payment Services Act." For stablecoins, Singapore implements a licensed issuance system, requiring issuers to maintain a 1:1 reserve and conduct monthly audits. For other tokens, such as NFTs and governance tokens, Singapore adopts a case-by-case determination principle: NFTs are generally not considered securities, while governance tokens with dividend rights may be regarded as securities.

Cryptocurrency Regulatory Framework: The "Financial Services and Markets Act" enacted in Singapore in 2022 regulates exchanges and stablecoins. However, the recently effective DTSP regulations significantly reduce the scope of licensing compliance, which may impact offshore operations of crypto projects and exchanges. The Monetary Authority of Singapore (MAS) typically issues three types of licenses for crypto companies: currency exchange, standard payment, and major payment institutions. Currently, over 20 institutions have obtained licenses, including Coinbase. Many international exchanges choose to establish regional headquarters in Singapore, but these institutions will be affected by the DTSP regulations.

South Korea

In South Korea, crypto assets are regarded as "legal assets," but not as legal tender, primarily based on the "Act on Reporting and Using Specified Financial Transaction Information" (the "Specific Financial Transaction Act"). Currently, the draft "Digital Asset Basic Act" (DABA) is actively being promoted, which is expected to provide a more comprehensive legal framework for crypto assets. The existing "Specific Financial Transaction Act" mainly focuses on anti-money laundering regulation. For stablecoins, the DABA draft proposes requiring transparency in reserves. As for other tokens, such as NFTs and governance tokens, their legal status remains unclear: NFTs are currently regulated as virtual assets, while governance tokens may fall under the category of securities.

South Korea implements a real-name trading exchange licensing system, with five major exchanges, including Upbit and Bithumb, having obtained licenses. In terms of exchange establishment, the South Korean market is primarily dominated by local exchanges, and foreign exchanges are prohibited from directly serving South Korean residents. Meanwhile, the draft "Digital Asset Basic Act" (DABA) is being advanced, proposing transparency in stablecoin reserves. This strategy both protects local financial institutions and market share and facilitates effective monitoring of domestic trading activities by regulatory authorities.

Indonesia

Indonesia is undergoing a transition of crypto asset regulation authority from the Commodity Futures Trading Regulatory Agency (Bappebti) to the Financial Services Authority (OJK), signaling a move towards more comprehensive financial regulation.

Legal Status of Crypto Assets: The legal status of crypto assets in Indonesia remains unclear. With the recent transfer of regulatory authority, crypto assets are classified as "digital financial assets."

Regulatory Framework: Previously, Indonesia's "Commodity Law" regulated exchanges. However, the recently issued "OJK Regulation No. 27 of 2024" (POJK 27/2024) transfers the regulatory authority for crypto asset trading from Bappebti to the Financial Services Authority (OJK), and this regulation will take effect on January 10, 2025. This new framework sets strict capital, ownership, and governance requirements for digital asset exchanges, clearinghouses, custodians, and traders. All licenses, approvals, and product registrations previously issued by Bappebti remain valid as long as they do not conflict with current laws and regulations.

Licensing: The licensing authority has shifted from Bappebti to OJK. The minimum paid-in capital for crypto asset traders is IDR 10 billion, and they must maintain at least IDR 5 billion in equity. Funds used for paid-in capital must not originate from illegal activities such as money laundering, terrorist financing, or financing of weapons of mass destruction. All digital financial asset trading providers must fully comply with the new obligations and requirements of POJK 27/2024 by July 2025.

Exchange Establishment: Local exchanges such as Indodax are actively operating in the region. Indodax is a regulated centralized exchange that offers spot, derivatives, and over-the-counter (OTC) services, requiring users to comply with KYC regulations.

Thailand

Thailand is actively shaping its cryptocurrency market by encouraging compliant trading through tax incentives and a strict licensing system, solidifying its position as a global financial center.

Legal Status of Crypto Assets: In Thailand, owning, trading, and mining cryptocurrencies is completely legal, and profits must be taxed according to Thai law.

Regulatory Framework: Thailand has established the "Digital Asset Act." Notably, Thailand has approved a five-year capital gains tax exemption on income from cryptocurrency sales conducted through licensed crypto asset service providers, a policy that will be in effect from January 1, 2025, to December 31, 2029. This measure aims to position Thailand as a global financial center and encourage residents to trade on regulated exchanges. The Securities and Exchange Commission (SEC) of Thailand is responsible for regulating the crypto market.

Licensing: The Thai SEC is responsible for issuing licenses. Exchanges must obtain official permission and register as limited or public companies in Thailand. Licensing requirements include minimum capital (50 million Thai Baht for centralized exchanges, 10 million Thai Baht for decentralized exchanges) and directors, executives, and major shareholders must meet "fit and proper" standards. KuCoin has obtained SEC licensing through acquisition.

Exchange Establishment: Local exchanges such as Bitkub are active in the region and have the highest cryptocurrency trading volume in Thailand. Other major licensed exchanges include Orbix, Upbit Thailand, Gulf Binance, and KuCoin TH. The Thai SEC has taken action against five global crypto exchanges, including Bybit and OKX, to prevent them from operating in Thailand due to their lack of local licenses. Tether has also launched its tokenized gold digital asset in Thailand.

Japan

Japan is one of the first countries in the world to clearly recognize the legal status of cryptocurrencies, with a mature and prudent regulatory framework.

Legal Status of Crypto Assets: Under the "Payment Services Act," crypto assets are recognized as "legal payment instruments." For stablecoins, Japan implements a strict banking/trust monopoly system, requiring them to be pegged to the yen and redeemable, while explicitly prohibiting algorithmic stablecoins. As for other tokens, such as NFTs, they are considered digital goods; governance tokens may be classified as "collective investment scheme rights."

Regulatory Framework: Japan formally recognized crypto assets as legal payment instruments by amending the "Payment Services Act" and the "Financial Instruments and Exchange Act" (2020). The Financial Services Agency (FSA) is responsible for regulating the crypto market. The revised "Payment Services Act" also added a "domestic holding order" clause, allowing the government to require platforms to keep a portion of user assets within Japan to prevent asset outflow risks. In terms of licensing, the FSA is responsible for issuing exchange licenses, with 45 licensed entities currently in operation. Key requirements for obtaining a Japanese cryptocurrency license include having a legal entity and office in the country, meeting minimum capital requirements (over 10 million yen with specific capital holding regulations), complying with AML and KYC rules, submitting a detailed business plan, and conducting ongoing reporting and audits.

Exchange Establishment: The Japanese market is primarily dominated by local exchanges such as Bitflyer. International platforms typically need to enter the Japanese market through joint ventures (e.g., Coincheck).

Europe

European Union

As one of the jurisdictions with the most comprehensive and extensive judicial regulation in the global crypto space today, Europe is becoming the first compliance stop for many crypto projects. The EU has demonstrated its leadership as a significant global jurisdiction in the cryptocurrency field by establishing a unified regulatory framework through the "Markets in Crypto-Assets Regulation" (MiCA).

Legal Status of Crypto Assets: Under the MiCA framework, crypto assets are defined as "legal payment instruments but not legal tender." For stablecoins, MiCA implements strict regulations, requiring them to have a 1:1 fiat currency peg and sufficient reserves, and only licensed institutions are allowed to issue them. MiCA categorizes stablecoins into Asset-Referenced Tokens (ARTs) and Electronic Money Tokens (EMTs) for regulation. For other tokens, such as non-fungible tokens (NFTs) and governance tokens, the EU adopts a classification regulatory approach: NFTs are generally considered "unique digital assets" and are exempt from securities rules, while governance tokens are classified as securities based on their functions and the rights they confer. MiCA currently does not cover security tokens, NFTs, and central bank digital currencies (CBDCs).

Regulatory Framework: The EU passed the MiCA regulation in June 2023, with stablecoin rules taking effect in June 2024, and the regulation will be fully effective by December 30, 2024. This regulation applies to 30 countries in Europe, including 27 EU member states and Norway, Iceland, and Liechtenstein in the European Economic Area. MiCA aims to address issues such as legal ambiguity, stablecoin risks, and insider trading by establishing unified rules to protect investors, maintain market integrity, and ensure financial stability. It provides detailed regulations on the issuance of crypto assets, the authorization of service providers, operations, reserve and redemption management, and anti-money laundering (AML) regulation. Additionally, MiCA integrates the travel rules of the "Funds Transfer Regulation" (TFR), requiring crypto asset service providers (CASPs) to include sender and receiver information in each transfer to enhance traceability.

Licensing: MiCA adopts a "single license, valid across the region" model, meaning that CASPs only need to obtain authorization in one member state to operate legally across all member states, significantly simplifying the compliance process. CASPs must obtain authorization from their national regulatory authority. Licensing requirements include good reputation, capability, transparency, data protection, and compliance with the minimum capital requirements specified in MiCA Annex IV, which range from €15,000 to €150,000 depending on the type of service. CASPs must also have a registered office in an EU member state and at least one director who is a resident of the EU.

Stablecoin Establishment: USDC and EURC issued by Circle have received MiCA compliance approval and are considered stablecoins that meet EU standards. Tether (USDT) has faced delisting actions from major exchanges such as Coinbase and Binance for not complying with MiCA's strict stablecoin regulations in the EU region.

United Kingdom

After Brexit, the UK did not fully adopt MiCA but chose an independent yet equally comprehensive regulatory path aimed at maintaining its competitiveness as a global financial center.

Legal Status of Crypto Assets: In the UK, crypto assets are explicitly regarded as "personal property," a legal status confirmed in the 2024 parliamentary bill. This bill aims to provide digital assets with the same legal protection as traditional property, thereby enhancing certainty for owners and traders. For stablecoins, the UK adopts a prudent regulatory approach, requiring them to obtain approval from the Financial Conduct Authority (FCA), and reserve assets must be held in segregated custody. As for other tokens, such as NFTs, court cases have also classified them as property. The legal status of governance tokens is determined based on their specific use, potentially classifying them as securities or utility tokens.

Regulatory Framework: The "Financial Services and Markets Act" (2023) has brought crypto assets under regulatory oversight and amended the definition of "designated investments" in the "Financial Services and Markets Act 2000" to include crypto assets. The Bank of England has also begun regulating stablecoins, viewing them as digital payment tools and requiring issuers to obtain FCA authorization. Additionally, the "Economic Crime and Corporate Transparency Act 2023" grants law enforcement the power to freeze and recover illegal crypto assets. The Treasury has also released detailed proposals aimed at creating a financial services regulatory framework for crypto assets, including new regulated activities such as "operating crypto asset trading platforms."

Licensing: The FCA is responsible for issuing relevant licenses. Companies engaged in crypto asset activities, including operating trading platforms, trading crypto assets as a principal, or providing custody services, must obtain FCA authorization. Although there is currently no mandatory cryptocurrency exchange license in the UK, crypto asset businesses must register with the FCA and comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Registration requirements include being a registered company in the UK, having a physical office, maintaining detailed records, and appointing a resident director.

Russia

Legal Status of Crypto Assets: Russia classifies crypto assets as "property" for confiscation purposes, while stating that digital financial assets (DFA) "are not payment instruments," and the central bank does not recognize cryptocurrencies as payment instruments. The legal framework in Russia distinguishes between digital financial assets (DFA) and digital currencies. DFA is defined as digital rights, including monetary claims or rights related to securities, based on distributed ledger technology. According to the law, DFA is not considered a payment instrument. The "Federal Law No. 259-FZ on Digital Financial Assets, Digital Currency, and Amendments to Certain Legislative Acts of the Russian Federation," enacted on July 31, 2020, regulates the issuance and circulation of DFA. Additionally, this law recognizes hybrid rights, which simultaneously include DFA and rights to transfer goods, intellectual property, or services.

Industry Establishment: As an energy powerhouse, the crypto mining industry is prevalent in Russia, and the Russian government began implementing two laws related to cryptocurrency mining in October and November 2024, introducing legal definitions and registration requirements for mining activities. According to the new legislation, only registered Russian legal entities and individual entrepreneurs are allowed to engage in cryptocurrency mining. Individual miners can operate without registration as long as their energy consumption does not exceed government-set limits.

Despite these laws, as of late 2024, only 30% of cryptocurrency miners have registered with the Federal Tax Service, indicating that 70% of miners remain unregistered. Measures to encourage registration include stricter penalties, such as a new law increasing fines for illegal mining from 200,000 rubles to 2 million rubles (approximately $25,500). Law enforcement actions are underway, with recent reports of illegal mining farms being shut down and equipment confiscated. The Russian Ministry of Internal Affairs has initiated cases based on Article 165 of the Russian Criminal Code for such incidents.

Switzerland

Switzerland has been at the forefront of cryptocurrency regulation, known for its flexible token classification laws and support for blockchain innovation.

Legal Status of Crypto Assets: Although cryptocurrencies are legal in Switzerland, there are no specific regulations regarding the buying and selling of virtual crypto assets or their use as payment for goods and services, so these activities typically do not require special financial market licenses. The Swiss Financial Market Supervisory Authority (FINMA) classifies crypto assets based on their economic and practical use, primarily into payment tokens, utility tokens, and asset tokens, and regulates them accordingly. FINMA notes that these types are not mutually exclusive and may also include hybrid tokens. Asset tokens are generally regarded as securities, while utility tokens are not considered securities if they have a practical function at the time of issuance, but may be classified as securities if they have investment purposes.

Regulatory Framework: Switzerland passed the "Blockchain Act" in 2020, which comprehensively defines token rights and amends several existing federal laws to integrate distributed ledger technology (DLT). FINMA has applied anti-money laundering laws to virtual asset service providers (VASPs) and issued travel rule guidelines in August 2019, which took effect on January 1, 2020. Additionally, the law improved the framework for bookkeeping securities on the blockchain and increased legal certainty in bankruptcy law by clearly stipulating the segregation of crypto assets in bankruptcy.

Licensing: FINMA is responsible for issuing VASP licenses. Providing custody, exchange, trading, and payment services for payment tokens falls under the jurisdiction of the Anti-Money Laundering Act, and relevant service providers must join a self-regulatory organization (SRO) in advance. In certain specific cases, a FinTech license may suffice to replace a banking license, thereby reducing licensing requirements. Requirements for obtaining a Swiss crypto license include establishing a legal entity in Switzerland, meeting capital adequacy requirements (ranging from 20,000 to 100,000 Swiss Francs depending on the license type), implementing AML and KYC procedures, and complying with FATF travel rules. Zug has also piloted a "crypto-friendly" regulatory sandbox. Traditional banks like ZKB and exchanges like Bitstamp are licensed to provide crypto services.

Americas

United States

The regulatory landscape for crypto assets in the United States exhibits significant interstate differences and a lack of unified federal legislation, leading to high market uncertainty. With the acceleration of policy initiatives following Trump's administration and changes in the SEC, federal-level cryptocurrency regulatory bills are on the horizon.

Legal Status of Crypto Assets: The legal status of crypto assets in the U.S. shows significant interstate variation. At the federal level, the IRS views them as "property," while New York State defines them as "financial assets." For stablecoins, the GENIUS Act draft proposes that payment stablecoins should not be considered securities but requires them to have 100% high liquidity reserves. For other tokens, such as NFTs and governance tokens, the SEC leads their classification, with NFTs potentially being viewed as securities, while governance tokens are often classified as securities.

Regulatory Framework: Currently, there is no unified cryptocurrency bill at the federal level in the U.S. The SEC primarily regulates tokens under securities law. Additionally, New York State has a BitLicense regime. The GENIUS stablecoin bill is currently under review. In terms of licensing, the U.S. primarily implements state-level licenses (such as the New York State Department of Financial Services NYDFS) and requires registration as a Money Services Business (MSB) for anti-money laundering purposes. For example, New York has a strict BitLicense regime that requires cryptocurrency businesses operating in the state to obtain this license. Many other states have also enacted or are reviewing their own crypto asset legislation, such as some states revising the Uniform Commercial Code (UCC) to accommodate digital assets or imposing specific requirements on operators of cryptocurrency self-service terminals. Furthermore, crypto businesses engaged in money transmission, exchange, and other activities must register with FinCEN as MSBs and comply with federal anti-money laundering and counter-terrorism financing requirements, including implementing KYC procedures, monitoring suspicious transactions, and reporting.

Exchange Establishment: Major cryptocurrency trading platforms such as Coinbase, Kraken, and Crypto.com operate compliantly in the U.S., and Binance US has recently enabled USD deposit functionality for U.S. users. However, due to previous regulatory uncertainties, some international cryptocurrency exchanges have chosen not to enter the U.S. market or only offer limited services. The SEC has also taken enforcement actions against exchanges claiming to operate unregistered securities trading in previous administrations.

El Salvador

El Salvador has undergone a unique journey regarding the legal status of crypto assets. The country recognized Bitcoin as legal tender in 2022 but later abandoned this position under pressure from the International Monetary Fund (IMF). Currently, Bitcoin is legally not considered legal tender, but private use is still allowed after reforms in 2025.

In terms of regulatory framework, El Salvador enacted the "Digital Asset Issuance Law" (2024). The National Digital Asset Commission (NCDA) is responsible for regulation and plans to issue licenses. However, the country has not yet established a comprehensive licensing system. Despite the government's active promotion of cryptocurrency taxation, no mainstream exchanges have launched large-scale operations yet.

Argentina

Argentina's severe economic instability and high inflation have driven widespread adoption of cryptocurrencies, prompting the government to gradually improve its regulatory framework, particularly for Virtual Asset Service Providers (VASPs).

Legal Status of Crypto Assets: In Argentina, cryptocurrencies are legal, allowing for their use and trading, but due to constitutional provisions that designate the central bank as the sole issuer of currency, cryptocurrencies are not considered legal tender. Crypto assets can be classified as currency for trading purposes, and contracts can be settled using crypto assets. There is currently no specific legislation in Argentina to clarify the legal status of stablecoins and tokens (such as NFTs and governance tokens).

Regulatory Framework: Although the new government (President Milei) supports cryptocurrencies, there is currently no dedicated cryptocurrency bill. However, Argentina enacted Law No. 27739 in 2024, incorporating Virtual Asset Service Providers (VASPs, referred to as PASV in Argentina) into its legal and financial framework. This framework mandates VASPs to comply with anti-money laundering (AML) and know your customer (KYC) processes to combat money laundering and regulate the industry, aligning with the international standards set by the Financial Action Task Force (FATF).

Licensing: Starting in 2024, VASPs must register with Argentina's financial regulatory body, the Comisión Nacional de Valores (CNV), to provide crypto services. Registration requirements include screening and verifying customer identities, reporting new customer registrations, conducting risk assessments, maintaining detailed records (including transaction and customer data), monitoring suspicious transactions, and establishing internal controls. Entities that fail to comply with regulations will face fines, legal action, or license revocation.

Middle East

United Arab Emirates

Legal Status of Crypto Assets: The UAE has taken a proactive approach to cryptocurrencies and blockchain technology, aiming to position itself as a global hub for fintech and digital innovation. Under a clearly defined regulatory framework, cryptocurrencies are legal in the UAE. The Dubai Financial Services Authority (DFSA) defines crypto tokens as digital representations of value, rights, or obligations that can be used as a medium of exchange, payment, or for investment purposes. It explicitly excludes "excluded tokens" and "investment tokens." Only DFSA-approved crypto tokens are allowed for use in the DIFC, with limited exceptions. The Abu Dhabi Global Market (ADGM) classifies stablecoins as virtual assets when they fall under regulated activities.

Regulatory Framework: The main regulatory bodies in the UAE include:

- Central Bank of the UAE (CBUAE): Regulates financial activities within the UAE, including cryptocurrency trading and banking services, ensuring financial stability and consumer protection. Responsible for overseeing fiat-to-crypto transactions.

- Securities and Commodities Authority (SCA): Regulates financial markets within the UAE, including digital securities and commodities. Collaborates with the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) and the Virtual Assets Regulatory Authority (VARA) in Dubai to maintain consistent standards.

- Virtual Assets Regulatory Authority (VARA): Dubai's dedicated regulatory body for virtual assets, established in 2022. Focuses on compliance, investor protection, and market stability.

- Dubai Financial Services Authority (DFSA): Regulates financial services involving crypto tokens within the Dubai International Financial Centre (DIFC).

- Abu Dhabi Global Market (ADGM): Has a comprehensive regulatory framework for virtual assets, digital securities, and derivatives within its financial free zone, overseen by the FSRA.

This collaborative regulatory approach ensures that digital assets are integrated into the legal system, promoting innovation while preventing abuse.

Licensing: In terms of licensing, Dubai VARA 2.0 (June 2025) introduces several updates, including enhanced controls on margin trading (limited to qualified and institutional investors, prohibiting retail leverage products, requiring strict collateral management, monthly reporting, and mandatory liquidation mechanisms for VASPs), formal recognition of Asset-Referenced Virtual Assets (ARVA), regulation of token distribution (issuance/distribution requires VARA approval, white papers must be transparently disclosed and prohibit misleading advertising), establishment of a structured licensing system for eight core activities (consulting, brokerage, custody, etc.) requiring separate licenses for each activity with clear capital adequacy and risk control requirements, and strengthened oversight measures (expanded on-site inspections, quarterly risk assessments, fines, and criminal referrals, with a 30-day transition period and full enforcement by June 19, 2025); the FSRA of the Abu Dhabi Global Market (ADGM) oversees the implementation of virtual asset regulations, with licensing requirements including clearly defining service types (custody, trading, etc.), meeting capital/anti-money laundering/cybersecurity standards, and submitting business plans. The 2025 revised version simplifies the "Accepted Virtual Assets (AVA)" certification process, grants the FSRA product intervention rights, and prohibits privacy tokens and algorithmic stablecoins; the DFSA regulates financial services related to crypto tokens within the DIFC, requiring tokens to meet regulatory status, transparency, and other identification standards, with stablecoins needing to maintain price stability, segregated reserves, and monthly verification, prohibiting privacy/algorithm tokens, having identified mainstream tokens like Bitcoin and initiated a tokenization regulatory sandbox.

Saudi Arabia

Saudi Arabia has taken a cautious stance on cryptocurrencies, with its regulatory framework influenced by Islamic law principles and the need to maintain financial stability.

Legal Status of Crypto Assets: Saudi Arabia adopts a cautious approach to cryptocurrencies, largely due to restrictions related to Islamic law. The banking system completely prohibits the use of cryptocurrencies, and financial institutions are also banned from engaging in cryptocurrency trading. Private ownership of cryptocurrencies is not prosecuted, but trading and exchange are strictly limited. The Saudi Arabian Monetary Authority (SAMA) issued a warning about the risks of cryptocurrencies in 2018 and tightened the ban on cryptocurrency financial transactions in 2021. Religious interpretations (e.g., fatwas issued by Dar al-Ifta declaring them haram due to fraud and lack of real collateral) have influenced these bans. Some stablecoins or tokens that are linked to real assets are considered halal (permissible).

Regulatory Framework: The Saudi Arabian Monetary Authority (SAMA) and the Capital Market Authority (CMA) emphasize a "cautious approach" to cryptocurrency innovation, balancing technological advancement with the stability of the financial system. In July 2024, Mohsen AlZahrani was appointed to lead SAMA's virtual asset initiative, highlighting its commitment to the controlled integration of fintech innovation. This is part of a broader regulatory shift aimed at avoiding an outright ban while interacting with global trends and regional successes (such as the VARA system in the UAE). SAMA is actively promoting the adoption of blockchain and attracting international financial institutions like Rothschild and Goldman Sachs to participate in tokenization projects. Saudi Arabia is advancing its own digital currency as part of its "Vision 2030." In 2019, SAMA and the Central Bank of the UAE conducted interoperability tests for cross-border CBDC transactions as part of the "Aber Project." Saudi Arabia joined the mBridge CBDC pilot project in 2024. The country is at the forefront of "wholesale CBDC" pilot projects aimed at facilitating domestic settlement and cross-border transactions for financial institutions.

Licensing: The Saudi Capital Market Authority (CMA) announced that regulations for Security Token Offerings (STOs) will be published by the end of 2022, with applications to be submitted through the CMA's digital platform. The CMA's fintech lab, launched in 2017, has been dedicated to creating a conducive business environment for fintech startups. STOs in Saudi Arabia are strictly supervised under the CMA's securities regulations. Key considerations for STOs include registration requirements (detailed documentation, prospectus), disclosure obligations (transparent and accurate information, financial statements, risk factors), and anti-fraud measures. The CMA's regulations also include investor certification requirements, limiting participation in STOs to qualified investors who can independently assess risks. Tokenization of traditional financial assets is a key focus area, requiring a legal framework to address ownership, transferability, and regulatory issues related to tokenized assets, ensuring that smart contracts comply with legal principles.

Bahrain

Legal Status of Crypto Assets: Bahrain is a pioneer in cryptocurrency and blockchain regulation in the Middle East, establishing a comprehensive regulatory framework through the Central Bank of Bahrain (CBB) under the "Capital Market Rules Handbook" and the "Crypto Asset Module" (CRA). It clearly defines crypto assets as encrypted digital representations of value or rights (excluding central bank digital currencies).

Regulatory Framework: The CRA establishes legal and operational standards for crypto asset providers, covering licensing, risk management, consumer protection, and more. In March 2023, revisions strengthened customer asset protection and anti-money laundering measures. The regulations ensure transparent compliance, align with FATF standards, promote innovation through the Fintech Bay and regulatory sandbox, and clarify certain virtual asset business exemptions from regulation.

Licensing: Engaging in regulated crypto asset services in Bahrain requires obtaining a CBB crypto asset license, covering services such as order processing and trading. VASP licenses are categorized into four types, each with different minimum capital requirements and annual fees. Applicants must be Bahraini companies and meet various requirements, including registration, business plans, and compliance. Violations may result in hefty fines, license revocation, or even imprisonment.

Israel

Legal Status of Crypto Assets: Israel does not have comprehensive laws specifically for cryptocurrencies, treating them as assets rather than currency for tax purposes. Profits from sales are subject to a 25% capital gains tax, and crypto-to-crypto exchanges are considered taxable events, with crypto business income taxed as ordinary income. Cryptocurrency transactions are generally exempt from value-added tax, although exchange service platforms may be required to pay it, and mining operations are subject to corporate income tax, with transactions requiring documentation.

Regulatory Framework:

- CMA: Since 2016, it has been the regulatory authority, requiring virtual currency brokers and custodians to be licensed, with a minimum capital requirement of one million new shekels, overseeing stablecoin pilots.

- ISA: Regulates activities related to cryptocurrency securities, issues guidelines for applicable regulations, and in August 2024, will allow non-bank members to provide crypto services, regulating by token type and promoting legislative reform.

- Bank of Israel: In 2023, it published principles for stablecoins, proposing full reserve and licensed regulation, researching the "digital shekel," and initiating testing and challenge activities in 2024.

Licensing: Under relevant laws, crypto service providers must be licensed, requiring them to be Israeli entities, meet capital requirements, and have no criminal record. After revisions by the ISA, non-bank institutions are allowed to conduct crypto business under a "closed garden" model. Anti-money laundering regulations are implemented, and stablecoin pilots are regulated by the CMA.

Africa

Nigeria

Nigeria's cryptocurrency regulatory landscape has undergone a significant transformation, shifting from an initially restrictive stance to a more formal and comprehensive regulatory framework.

Legal Status of Crypto Assets: The Central Bank of Nigeria (CBN) initially imposed restrictions in February 2021, instructing banks and financial institutions to close accounts involved in cryptocurrency transactions, although it did not prohibit individuals from owning cryptocurrencies. However, in December 2023, the CBN lifted the restrictions, allowing banks to provide services to cryptocurrency companies licensed by the Securities and Exchange Commission (SEC). Banks are now required to open designated accounts for Virtual Asset Service Providers (VASPs), conduct extensive KYC procedures, and monitor fund flows. This shift acknowledges the necessity of regulating VASPs. The ISA 2025 (Investment and Securities Act 2025) explicitly defines digital assets as securities and commodities, expanding the SEC's regulatory scope. The SEC's position is that crypto assets are considered securities unless proven otherwise, with the burden of proof on the operators, issuers, or promoters. This encompasses a wide range of digital and crypto assets, including stablecoins, utility tokens, asset-referenced tokens, and electronic money tokens.

Regulatory Framework: Nigeria's regulatory environment has experienced a significant shift from prohibition to regulation. The CBN's initial "ban" was deemed ineffective, pushing transactions to P2P networks and creating regulatory conflicts with the SEC's early recognition of digital assets. The new government's rise may have played a role in this policy shift, prioritizing regulation over prohibition to achieve oversight and taxation. This evolution marks the maturation of a regulatory approach aimed at integrating the crypto economy into the formal financial system for better oversight, risk management (AML/CFT), and potential taxation.

Licensing: The SEC's Digital Asset Rules Handbook, "New Rules for Digital Asset Issuance, Platforms, and Custody" (2022), consolidated by the ISA 2025, provides statutory support for SEC regulation of VASPs. A VASP license is mandatory for any platform facilitating orders, converting cryptocurrencies to fiat, or holding assets for users (including over-the-counter platforms operating via social media). Non-compliance may lead to penalties, including cessation of operations, fines, and prosecution of directors. The SEC has expanded its Accelerated Regulatory Incubation Program (ARIP) to expedite VASP approvals, which is now incorporated into the "Revised Digital Asset Rules" as a registration pathway. The time frame for ARIP must not exceed 12 months. Section 30 of Nigeria's 2022 Anti-Money Laundering Act classifies cryptocurrency operators as reporting entities. Mandatory requirements include registration with the Nigerian Financial Intelligence Unit (NFIU), submitting suspicious activity reports (SARs), monitoring transactions, and risk-based customer classification. Non-compliance may result in fines or enforcement actions.

South Africa

South Africa has adopted a pragmatic and evolving approach to cryptocurrency regulation, viewing it as a financial product and striving to establish a comprehensive compliance framework.

Legal Status of Crypto Assets: In South Africa, the use of crypto assets is legal, but they are not considered legal tender. For regulatory purposes, crypto assets are formally recognized as financial products under the Financial Advisory and Intermediary Services Act (FAIS) of 2002. This classification requires providers of financial services related to crypto assets to obtain a Financial Services Provider (FSP) license.

Regulatory Framework: South Africa's declaration of crypto assets as "financial products" rather than currency provides a clear legal basis for regulation within the existing financial services legal framework. The South African Reserve Bank (SARB) has indicated that "exchange control regulations do not regulate the inflow and outflow of cryptocurrencies within South Africa," suggesting a need for reform. The Intergovernmental Fintech Working Group (IFWG) has also recommended amending Excon to include crypto assets in the definition of capital. The tax stance on cryptocurrencies is clear: income tax and capital gains tax (CGT) will apply. The SARB prefers the term "crypto assets" over "currency."

Licensing: The Financial Sector Conduct Authority (FSCA) is the primary regulatory body for crypto service providers. The licensing process for Crypto Asset Service Providers (CASPs) commenced on June 1, 2023, with existing entities required to submit license applications by November 30, 2023. As of December 10, 2024, the FSCA has approved 248 of the 420 CASP license applications, with 9 being rejected. Licensing requirements include company registration, FSP license application (including a crypto asset subcategory), meeting "fit and proper" requirements, and mandatory anti-money laundering/counter-terrorism financing (AML/CFT) compliance. CASPs were officially designated as responsible institutions under the Financial Intelligence Centre Act (FICA) on December 19, 2022. As responsible institutions, CASPs are required to register with the Financial Intelligence Centre (FIC), implement customer identification and verification (KYC/CDD), appoint compliance officers, train staff, conduct business risk assessments for AML/terrorist financing/proliferation financing, establish and maintain risk management and compliance programs, submit regulatory reports (SARs), and conduct sanctions screening. The FIC has issued directives requiring the implementation of "travel rules" for crypto asset transfers by April 30, 2025. The travel rules apply to all transactions, regardless of amount, requiring broader information for transactions of 5,000 rand and above.

Summary

The global cryptocurrency regulatory landscape is in a state of continuous evolution, exhibiting a notable coexistence of convergence and divergence.

Convergence Trends

Globally, anti-money laundering (AML) and counter-terrorism financing (CFT) have become a common consensus and core requirement in cryptocurrency regulation. The comprehensive nature of the EU's Markets in Crypto-Assets Regulation (MiCA) and its "one license, universal applicability" model are becoming important references for other jurisdictions in formulating their own regulations.

Moreover, regulatory authorities generally prefer to classify crypto assets based on their functions and economic substance rather than adopting a "one-size-fits-all" regulatory approach. This classification includes payment tokens, utility tokens, asset tokens, security tokens, and commodity tokens. This refined asset classification method helps impose regulation more accurately, avoiding over-regulation or under-regulation, and promotes global consensus on asset characterization.

Divergence Trends

Despite the convergence, there remain significant differences in the legal status of crypto assets globally. From outright bans (such as in mainland China and Egypt) to recognition as legal payment instruments (such as in Japan), and being viewed as personal property (such as in the UK) or financial products (such as in South Africa), countries exhibit fundamental legal characterization differences regarding crypto assets. This fundamental divergence means that global crypto enterprises still face complex legal environments and compliance challenges when conducting cross-border operations.

Challenges

The main challenges currently facing global cryptocurrency regulation include:

- Difficulties in Cross-Jurisdictional Coordination: Despite efforts like FATF and MiCA promoting some convergence, countries find it challenging to achieve fully consistent regulation due to their own economic, political, and legal system considerations. This fragmentation leads to regulatory arbitrage, high compliance costs, and the existence of regulatory vacuums.

- Speed of Technological Development vs. Regulatory Lag: The pace of development in blockchain and crypto technologies far exceeds the speed at which traditional legislation and regulatory frameworks are updated. New crypto products, services, and business models (such as DeFi, NFTs, DAOs) are continually emerging, making it difficult for regulators to quickly formulate adaptive and forward-looking regulations.

- Ongoing Balancing Act Between Innovation and Risk: Governments and regulatory authorities are striving to find a balance that encourages fintech innovation to seize opportunities presented by the digital economy while effectively preventing money laundering, terrorist financing, consumer protection deficiencies, and financial stability risks. This balancing act is complex and fraught with uncertainty, requiring ongoing policy adjustments and market feedback.

In summary, global cryptocurrency regulation is evolving towards a more mature and refined direction, but its inherent complexity and dynamism, along with the divergences arising from national circumstances, will continue to be significant contexts for the development of the global crypto market in the coming years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。