Original Author: Ignas, DeFi Researcher

_

Translation by|Odaily Planet Daily (@OdailyChina)

Translator|CryptoLeo (@LeoAndCrypto)

Editor’s Note: DeFi researcher Ignas has published a tutorial article on "How to find unlaunched token Alpha protocols," introducing how crypto users can find Alpha through tools and data websites. As a DeFi OG, the tools Ignas provides are quite comprehensive, including not only familiar ones like Nansen and DefiLlama but also some niche yet very useful tools. Odaily Planet Daily compiles the content as follows:

Are you still motivated to look for Alpha projects lately?

I once mentioned that my motivation to seek new projects has diminished. This might be the most noticeable change since I entered the crypto space in 2018. Even during previous bear markets, I didn’t feel this fatigued.

I wonder if I’m the only one feeling this way, or maybe I’m just too lazy or bored? While that’s not entirely the case, I am more cautious about allocating most of my funds to new protocols compared to before. In the last bull market, capital flowed more freely, and profits were relatively easy to achieve. But now it’s different; the bear market hasn’t arrived, yet there’s less capital. The risk-reward ratio has also changed: while hacks and exploits are less common now, the airdrop rewards for the vast majority of projects have decreased.

Funds are distributed among many protocols, and none of them offer particularly high returns. I feel there are too many new projects that only make incremental improvements without any real innovation from 0 to 1. This applies not only to DeFi protocols but also to L1 and L2. So how can we be motivated to explore Kraken's Ink or Soneium L2? If there are no innovative, value-adding protocols, only airdrops and liquidity mining rewards. It’s hard to know which projects are worth your time. Perhaps I’m not the only one feeling this way.

But we cannot stop searching for those few excellent projects that might become the next Aave, Ethena, or Pendle. The question is how to know which protocols are worth your time? Where can you find them? Therefore, in this article, I will share some tools, methods, and resources to help you find protocols that already have a certain level of influence, divided into three categories:

Mindshare

On-chain adoption

Smart account usage

1. Kaito

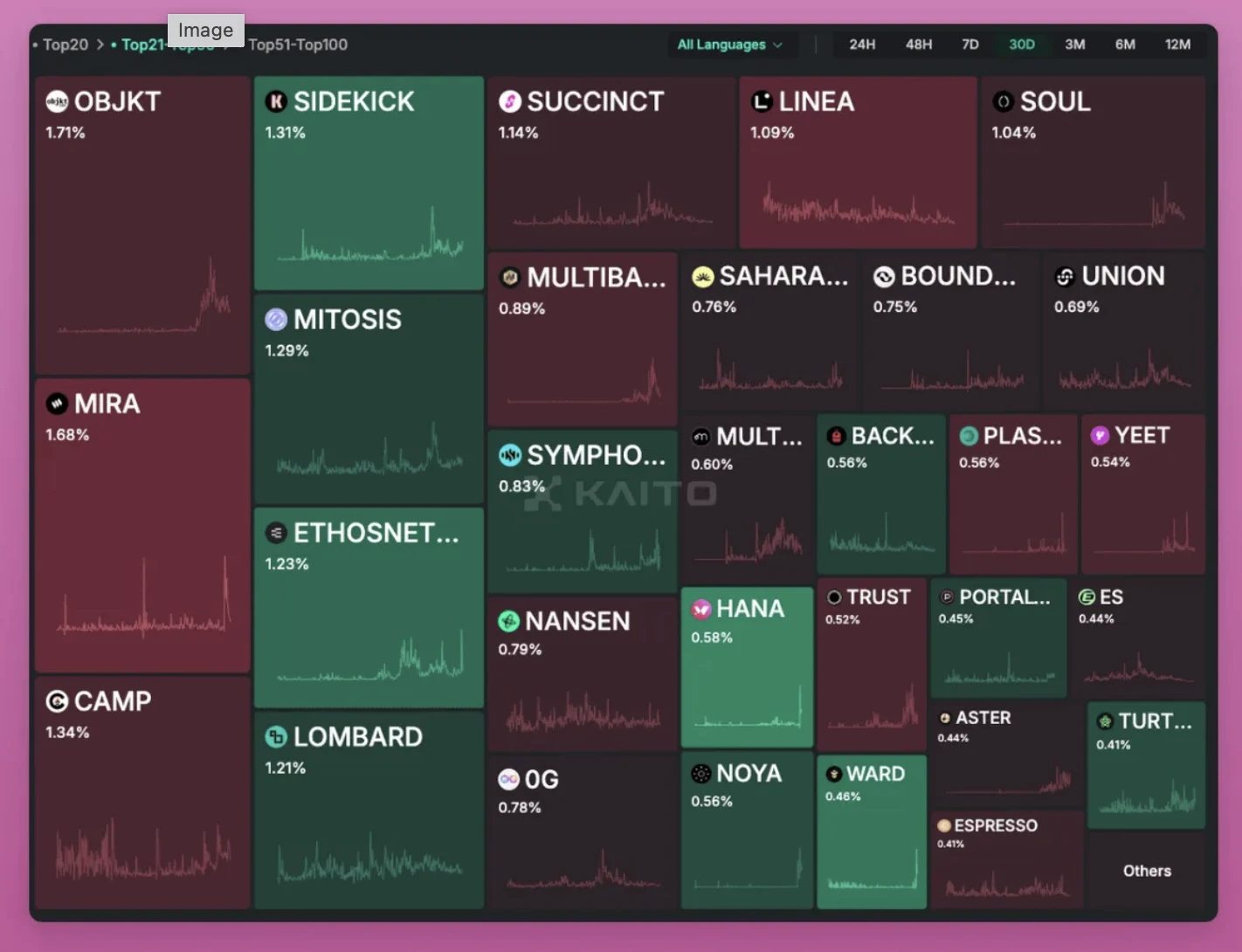

Kaito's flagship portal costs $1,099 per month (which drops to $750 for a two-year plan), but fortunately, Kaito offers a free dashboard that lists popular projects by Mindshare, most of which have not launched tokens. Screenshots of the top 20 projects are often shared, but how many of the projects ranked 21-50 can you recognize?

You can visit yaps.kaito.ai to research projects that catch your attention.

For example, Multipli generates returns through native assets (BTC), stablecoins, and RWA. I expect it to launch a low-circulation, high (or slightly high) FDV token, as it has the backing of VCs like Pantera, Sequoia, and The Spartan Group. Multipli currently has a TVL of $70.3 million, which is a balancing point; although it is currently in the second quarter, its implied risk is not too low, and the dilution effect will not be too strong.

Kaito is great, but critics argue that it distorts the market because KOLs are often incentivized to promote specific projects. If you are one of them, you might consider using the second tool, which employs a different algorithm to broaden your project search.

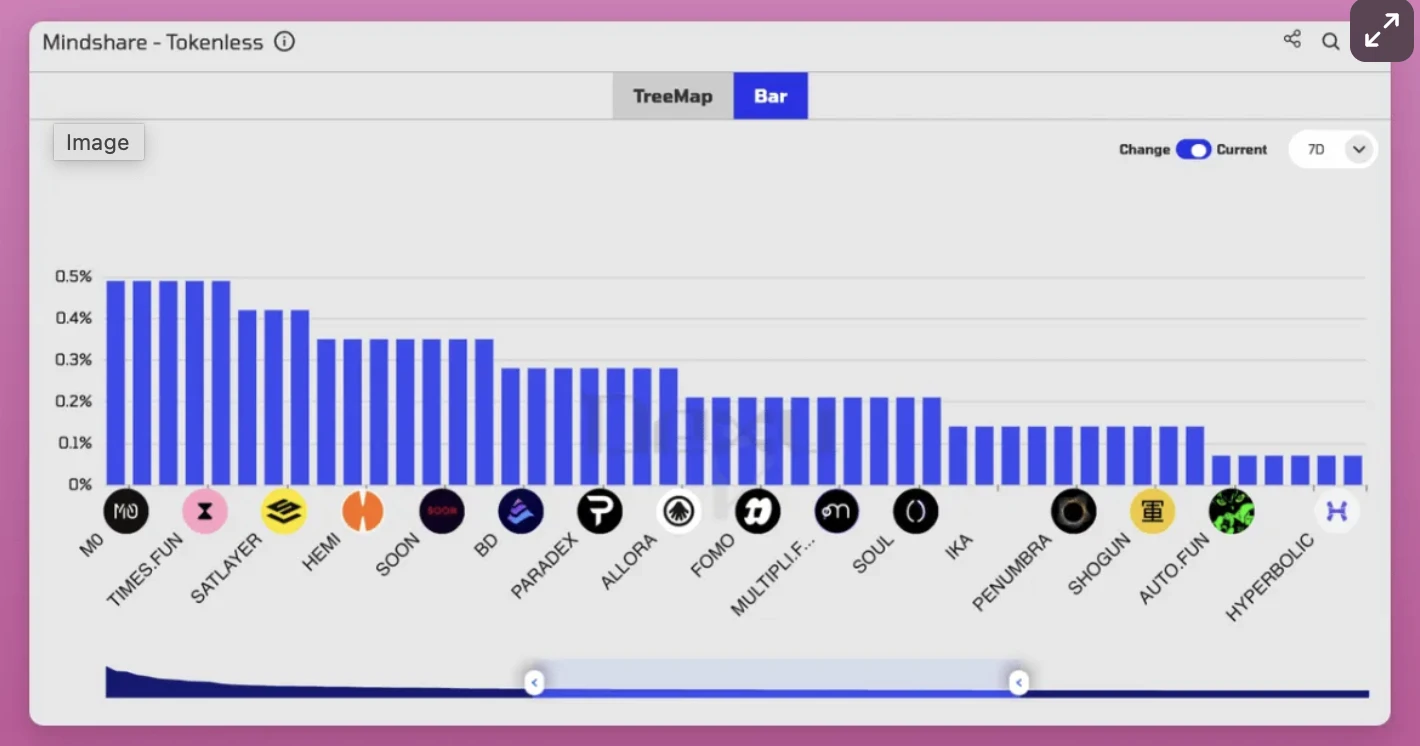

2. Dexu AI

“Get mindshare, sentiment, narrative performance, original tweets, CT smart account statistics, etc.”

Here’s a brief guide on how to use Dexu to find tokenless projects:

Method 1:

Go to “Dexu AI, Sector analysis, Social”;

Try different analysis areas: mindshare, sentiment analysis, X smart followers, etc.;

Select different time periods and zoom in/out using the slider.

Method 2:

Go to “Projects - Hot Projects”

Scroll down to “Project Rankings - Top 5000”;

Lower the “Seniority” filter percentage to find newer projects and increase the “Network” participation percentage to filter out projects with lower engagement.

Project Example: Time.Fun

Two standout use cases:

Pay to send DMs to cryptocurrency founders and key opinion leaders, with a higher response rate

Guess which individuals will have a higher demand for DM messages.

I bet its airdrop value will be quite good, as the Solana team/founders actively use and promote Time.Fun, and it has the backing of investors like Coinbase Ventures and Alliance DAO.

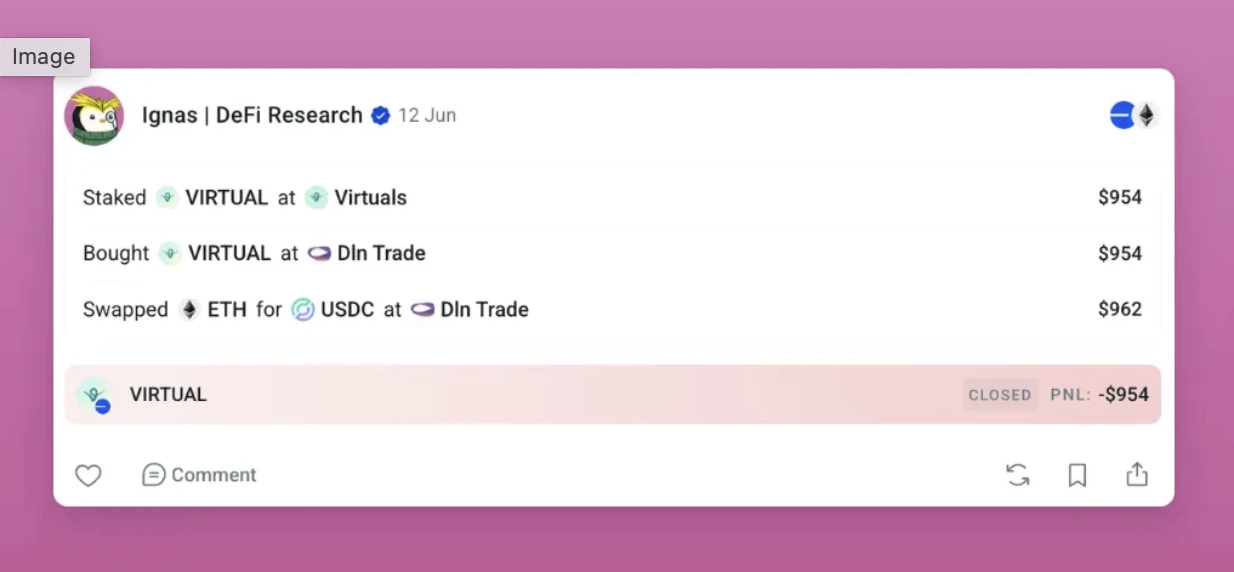

3. 0xPPL

0xPPL is one of my favorite crypto tools, but it seems few people know or use it. 0xPPL is a social media platform, but unlike regular X-style posts, you can see how the people you follow use their wallets. While Kaito and Dexu focus on followers and mindshare, 0xPPL shows how they act with their wallets. The wallet search team at 0xPPL does an excellent job of linking wallets to key opinion leaders (KOLs). You can see that most transactions are token buys/sells, and you will also see deposits to protocols.

How to use: Log in with your X account and link a wallet with transaction history to immediately see the transactions of your followers. If you follow many airdrop bloggers, you will have the opportunity to learn about the protocols where their linked wallets are actually investing, rather than just gaining attention through discussions.

Additionally, I can clearly see that the team is working hard to optimize this application every day. Every detail is meticulously polished, and they focus on small details to enhance the user experience.

4. Nansen

Nansen is very suitable for multiple functions, and I have previously shared how to use Nansen and other tools to achieve hundredfold returns. However, I also really like two other features of Nansen:

First, Nansen has launched a points program. You can earn points by subscribing to Pioneer or Professional, staking on Nansen, or referring friends. The InfoFi narrative is very popular, and Nansen is an established player in this field.

Additionally, you can understand capital flows through the popular contracts feature.

I like to remove the DEX and liquidity pool features (if you are an active LP, you will love this feature), set the minimum TVL to $5 million, and choose a contract duration of 30 days.

Here are the results:

YielFi's vyUSD stablecoin offers a 16% annualized return (total TVL of $32 million, please invest cautiously, but they offer points);

Plasma is receiving a lot of attention, but deposits are closed;

Liquity's new BOLD stablecoin is continuously growing (while the overall market stagnates, LQTY continues to rise).

And the Steer protocol: Automated, multi-position liquidity management for DeFi. It has launched on 27+ chains and 32 DEXs, such as Quickswap, Camelot, and Sushiswap.

Why it’s worth paying attention to:

No need to manage your own concentrated liquidity;

Higher LP returns;

A variety of market-making strategies;

Steer has raised $1.5 million in seed funding from Druid Ventures, Republic Capital, and Big Brain Holdings.

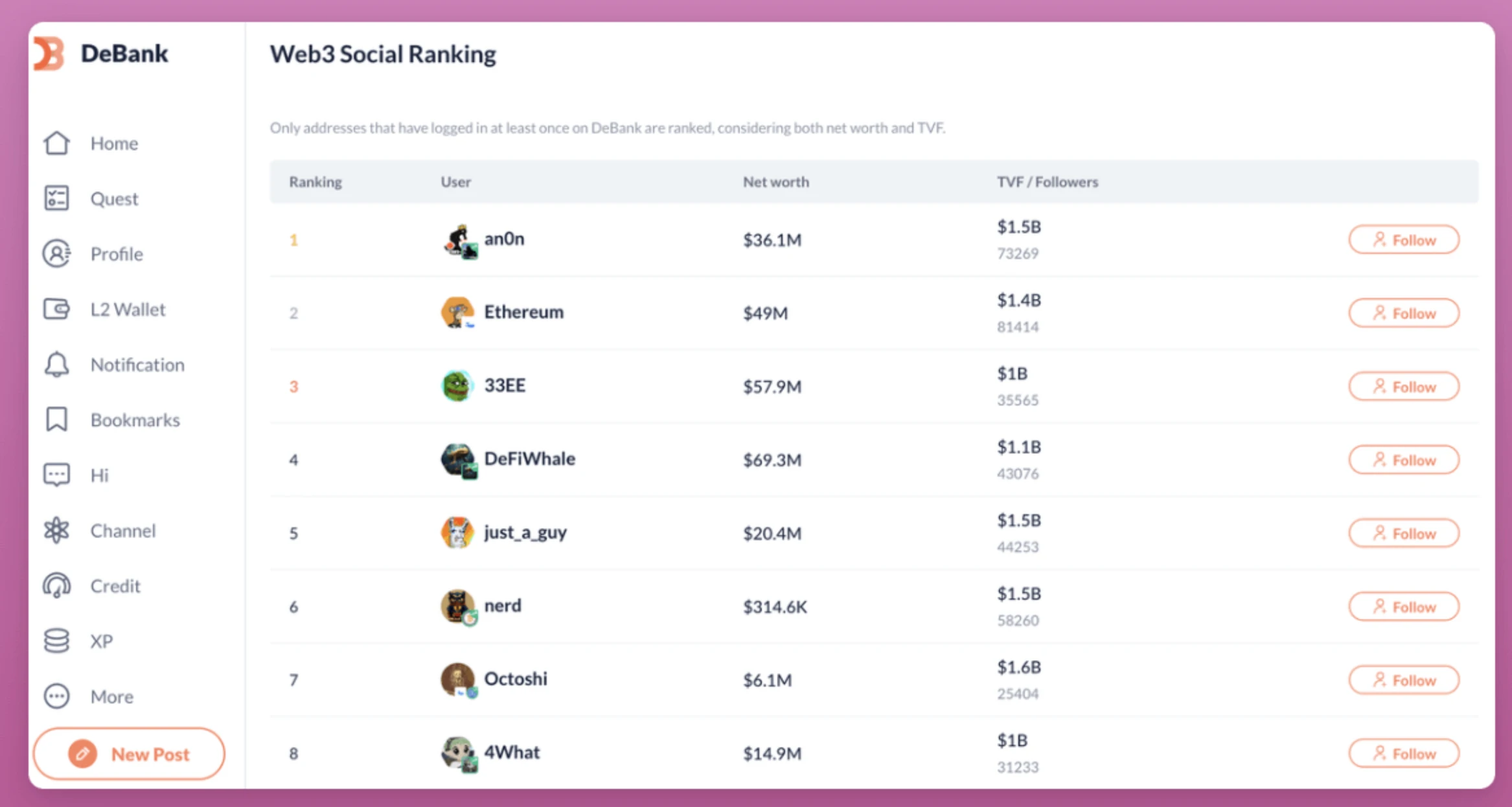

5. DeBank

It feels like DeBank's market share on X has decreased because its flagship product has been integrated into the Rabby wallet, but using DeBank's profile tracking feature alone can still uncover a lot of Alpha opportunities:

Go to the DeBank page;

Web3 social ranking;

Check accounts to see what they are currently investing in.

Finding accounts and protocols that align with your investment style is worth the effort; you can learn how investors utilize their funds, which may be more effective than browsing the latest news on X.

While writing this article and checking DeBank, I discovered LAGOON: a vault strategy provider with a TVL of $70 million. ETH can earn 9% annually, DYOR!

6. DefiLlama

DefiLlama is well-known to everyone, so this section will be summarized briefly. When I consulted Patrick Scott, the growth director of DefiLlama, he shared the following two suggestions:

Go to DefiLlama, airdrops;

Switch: Hide forked protocols. (You can add TVL filters)

Check each protocol one by one to see which ones meet your criteria.

Another small tip: Identify popular chains like HyperEVM and look for protocols on that chain through TVL.

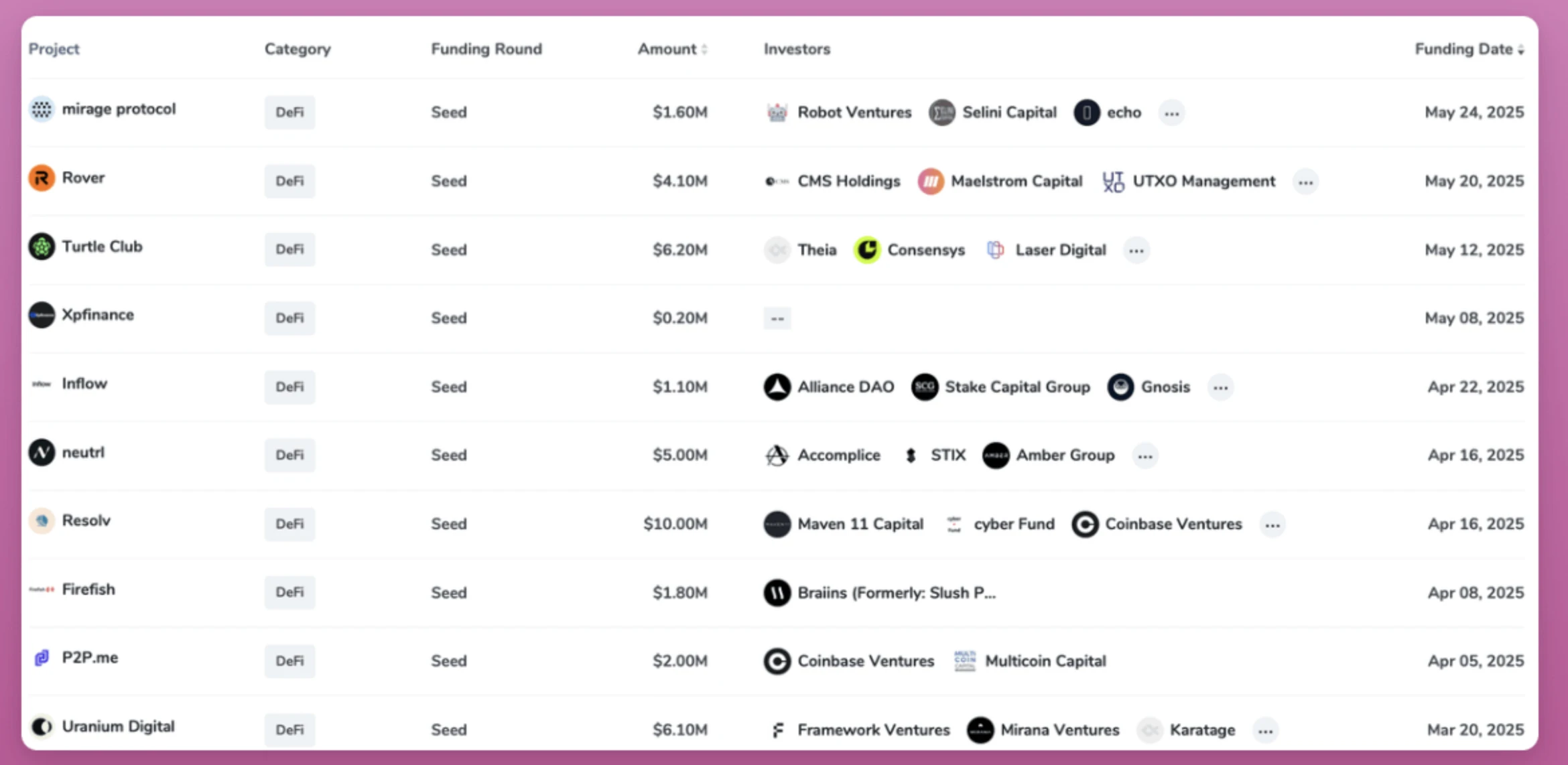

7. Focus on Financing (Coincarp)

In this cycle, there has been a historical high of resentment towards VCs, but well-funded protocol projects are excellent opportunities for yield farming. I have always believed that low-circulation, high FDV tokens are ideal for yield farmers because the project team has the funds to provide initial liquidity for the token TGE.

Among the many financing query tools, I like Coincarp, which is free and easy to use.

I usually filter for "DeFi" and select "Seed" as the earliest stage of protocols.

You can clearly see the main investors and the amount of funds they have raised.

The number of seed round financings announced in the DeFi space recently is surprisingly low. Only 4 protocols received funding in May, and only 5 in April.

Turtle Club: A rewards platform that provides additional earnings for the cooperative protocols you use (such as cashback in DeFi).

Here’s how it works:

Log in through the package (no deposit required);

Turtle tracks your liquidity pool/staking status on the cooperative platform;

You will receive additional rewards and TURTLE tokens.

Why it’s important:

No additional risk—funds always remain in your wallet;

Additional earnings on top of existing returns;

Early users receive more rewards.

Conclusion

These are the 7 useful tools shared by Ignas. If you want to be an early discoverer and investor in quality projects, in addition to the tools we commonly use, several other niche tools may become essential for you in the future. The crypto space is not just about trading needing to "Buy The Rumors, Sell The News"; it also applies to project searching. When a project is discussed by most people, it may be difficult to achieve significant results by participating then; only by actively seeking can you discover early Alpha and gain more returns than others in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。