US Dollar Index Hits Three and a Half Year Low, Trump Reiterates Call to Replace Fed Chair; Long-term Holders of BTC Increase!

Macroeconomic Interpretation: The US dollar index fell below the 97 mark today, reaching a new low since March 2022. The continued weakening of the dollar is driven by the strong appreciation of major currencies such as the renminbi—both onshore and offshore renminbi exchange rates have surpassed the 7.16 mark, hitting a nearly seven-month high. This profound change in the currency landscape is prompting global capital to accelerate its search for non-dollar-denominated value storage methods, leading to increased attention on Bitcoin's "digital gold" attributes.

The uncertainty in geopolitical and economic policies further reinforces this trend. Regarding the situation in the Middle East, the US Senate has urgently adjusted the schedule for a confidential briefing on Iran, highlighting bipartisan dissatisfaction with the government's communication mechanisms and escalating geopolitical risks. Meanwhile, the Fed's policy is in a delicate position: if it continues to pause interest rate cuts in July, it may intensify Trump's intention to replace the Fed chair. The expectation of challenges to the authority of such policies will further weaken the dollar's credibility, driving risk-averse funds towards decentralized assets.

Several key signals for Bitcoin indicate that a new explosive market phase is about to begin. On the technical charts, a classic bullish flag pattern has quietly formed—this is a brief consolidation phase following Bitcoin's previous rapid rise, typically indicating a buildup for a new offensive. Currently, Bitcoin needs to effectively break through resistance levels to confirm the validity of this pattern; if successful, mid-term prices are expected to reach higher levels.

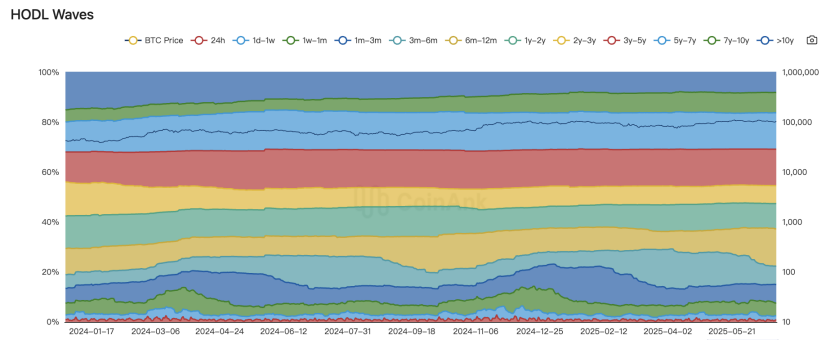

The core strength supporting this technical expectation comes from the continuous accumulation of on-chain capital. Historical data reveals a key pattern: large-scale accumulation by long-term holders (LTH) often serves as a leading signal for explosive Bitcoin market movements. At the two key points of $28,000 and $60,000, the significant increase in LTH holdings catalyzed price breakthroughs to $60,000 and $100,000, respectively. Currently, at the $100,000 mark, the LTH/STH holding ratio is showing a growth trend again. If we refer to the accumulation patterns of the previous two cycles, which lasted about 4-8 weeks, and combine it with a conservative estimate of a 1.6 times increase, the next target for Bitcoin is also worth looking forward to.

On the institutional side, although some executives at Strategy recently cashed out about $40 million in stock at a high point, founder Michael Saylor's 19.6 million shares of Class B stock remain intact. This phenomenon of internal selling versus the founder's steadfastness reflects both the market's demand for periodic profit-taking and the core capital's firm confidence in Bitcoin's long-term value.

The evolution of liquidity patterns on exchanges also confirms the increase in market activity. The latest data shows that Binance maintains a leading liquidity depth of about $8 million within a ±$100 price range for Bitcoin, followed closely by Bitget and OKX. In the Ethereum and altcoin sectors, the former demonstrates liquidity in fine price ranges. This improvement in infrastructure provides a solid guarantee for large-scale capital inflows and outflows.

The latest report from the Bank for International Settlements (BIS) adds theoretical support. The institution points out that stablecoins have not met the key tests of singularity, elasticity, and integrity, and thus cannot serve as a pillar of the monetary system. This authoritative conclusion indirectly confirms the unique value of non-stable crypto assets like Bitcoin—amid significant flaws in both traditional financial systems and emerging stablecoins, Bitcoin, with its scarcity and decentralized characteristics, is becoming an important safe haven for global capital.

In summary, the convergence of the technical breakout threshold, the firm accumulation of long-term capital, the weakening of dollar credibility, and the macro backdrop of escalating geopolitical risks collectively form the "golden triangle" for Bitcoin to challenge historical highs. When the bullish flag pattern confirms a breakout, long-term holders complete their accumulation, and the dollar index remains under pressure, the path for Bitcoin's ascent will become exceptionally clear. This new chapter of a bull market driven by technical, capital, and macro factors has already begun.

BTC Data Analysis:

According to CoinAnk data, Bitcoin's price remains around $107,000, with the holding ratio of long-term holders (LTH) and short-term holders (STH) showing a recovery trend. Looking back at past market cycles, similar accumulation phases typically last 4 to 8 weeks. If we combine this with a conservative prediction model of a 1.6 times increase, Bitcoin's future price is expected to rise further. Historical data indicates that significant increases in LTH holdings often precede price breakthroughs; for instance, at the $28,000 and $60,000 levels, the increase in LTH holdings catalyzed price jumps to $60,000 and $100,000, respectively.

From a research perspective, the growth in the LTH/STH ratio reflects a restoration of market confidence, with LTH continuously accumulating and reducing circulating supply, supporting Bitcoin's upward potential. However, caution is needed regarding key resistance levels such as $99,900, which may trigger profit-taking; strong buying pressure is required to absorb selling pressure to maintain the upward trend. If STH demand can match LTH supply, Bitcoin is likely to break through the $100,000 mark, further boosting the sentiment across the entire crypto market. Historical cycle analysis has pointed to a target of $126,000, suggesting potential upward space, but external risks such as regulatory changes or liquidity fluctuations must be considered. For the crypto market, a strong breakout by Bitcoin will uplift altcoins and derivatives trading volumes, reinforcing bull market expectations, but short-term pullback risks such as miner sell-offs or macro factors need close attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。