Original Title: Circle Goes Public: CRCL Valuation & the Economics of USDC

Original Author: Tanay Ved

Original Translation: johyyn, BlockBeats

Editor's Note: This analysis is based on the recent fluctuations in Circle's market value, the revenue structure of USDC, and its partnerships. The writing background is the renewed market attention on the stablecoin sector following the passage of the GENIUS Act, which saw Circle's market value briefly surpass $63 billion, exceeding the total value of the USDC it has issued. The author analyzes Circle's current revenue structure, its partnership with Coinbase, and cost structure through on-chain data and public documents, pointing out the sustainability pressures and growth concerns behind its high valuation, especially in the context of declining interest rates and increasing competition, and warns about the diversification of its business model.

The following is the original content (reorganized for readability):

Key Points:

Circle's market value skyrockets but valuation remains high: The passage of the GENIUS Act has driven Circle's market value to $63 billion, now exceeding the value of circulating USDC. However, based on its approximately 37 times revenue over the past 12 months and about 401 times net profit valuation, it is increasingly disconnected from its fundamentals.

Coinbase is a core partner and also a major cost: In 2024, Coinbase earned about 56% of the USDC reserve income, which has become a major distribution cost for Circle. Nevertheless, the partnership remains crucial for expanding the scale of USDC through Coinbase's products and ecosystem.

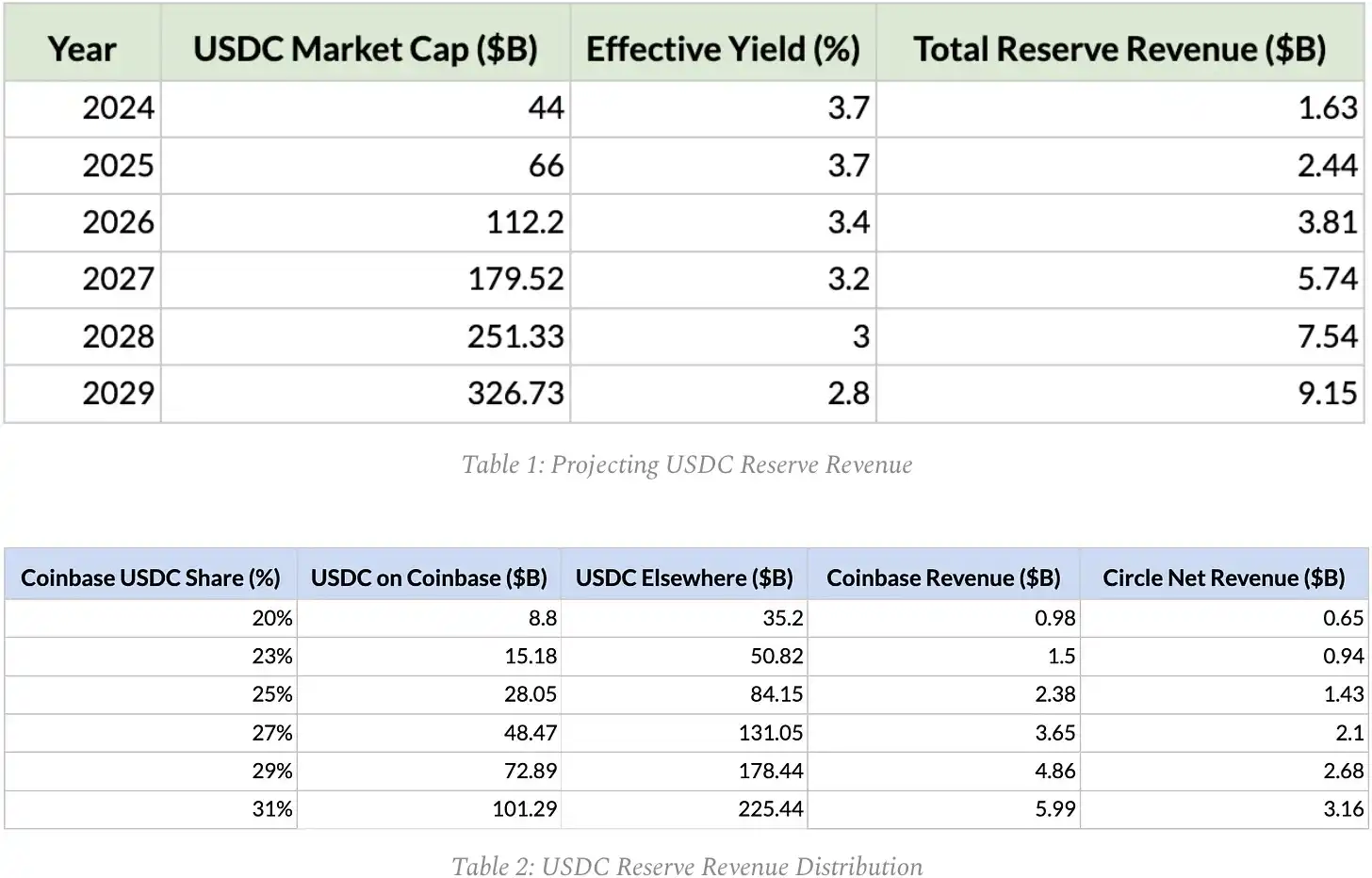

Reserve income is expected to grow but revenue sharing is limited: Based on on-chain data and public documents, Circle's USDC reserve income could grow from $1.6 billion in 2024 to over $9 billion by 2029. However, under the current revenue-sharing terms, Circle may retain less than half of this amount, highlighting the importance of expanding income sources beyond reserves.

Growth under declining interest rates relies on scale expansion and market share competition: As interest rates are expected to decline, Circle's long-term revenue potential will depend on expanding the supply of USDC and increasing market share amid intensifying competition from newly approved issuers.

Introduction

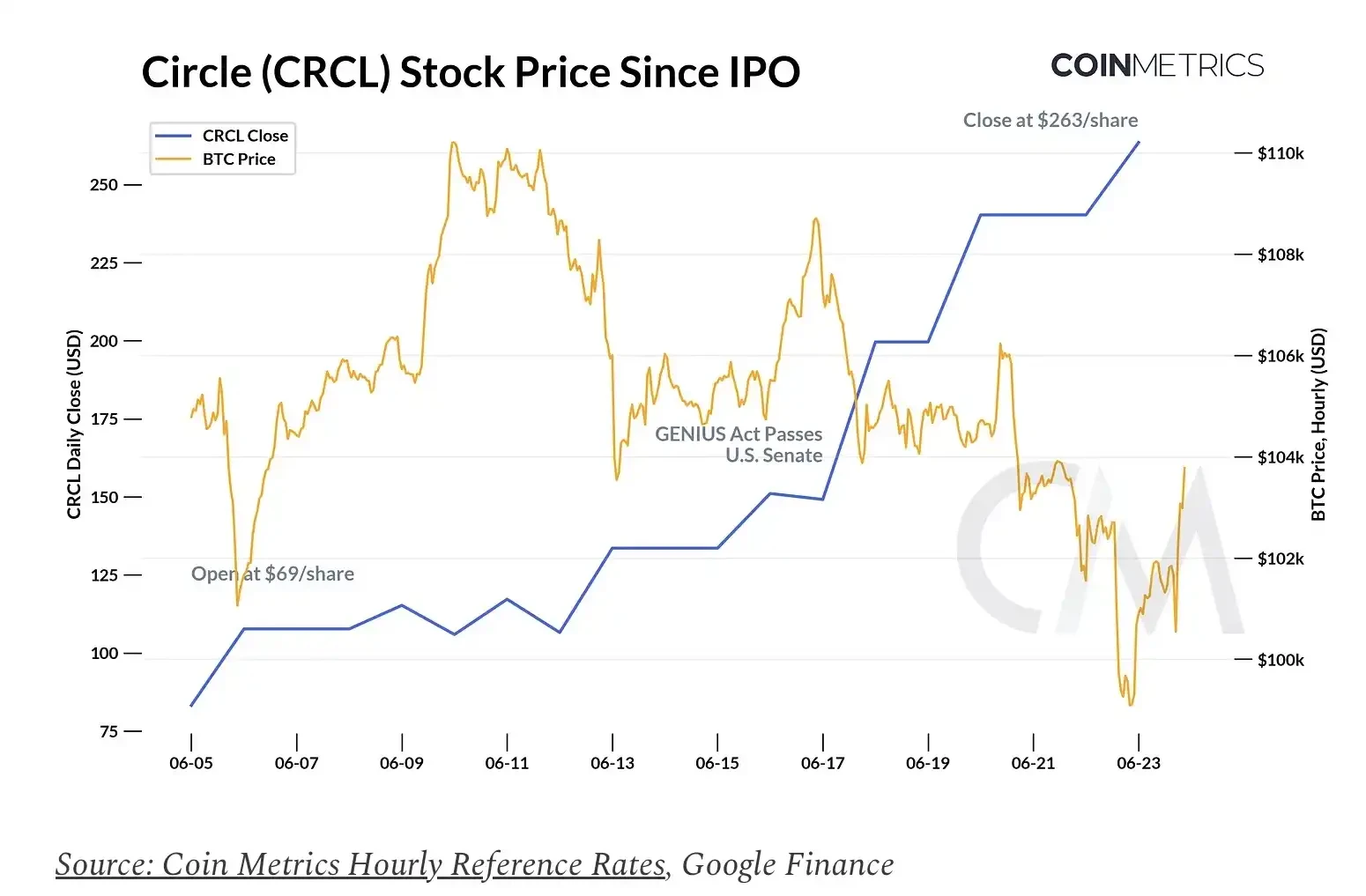

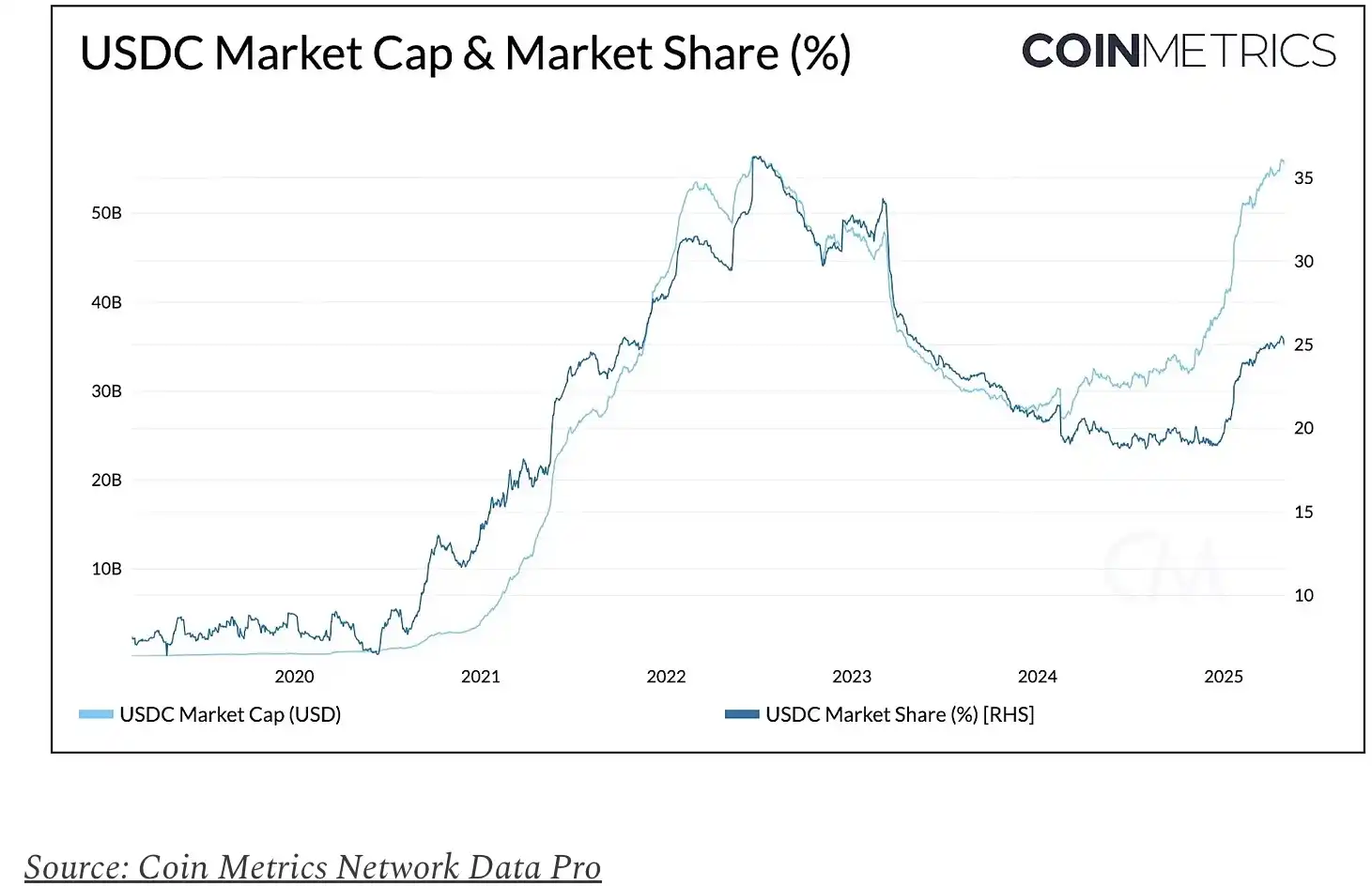

Stablecoins are experiencing an explosive moment, and Circle is in the spotlight. Circle Internet Group, the issuer of the USDC stablecoin (the second-largest stablecoin with a market cap of about $61 billion, holding a 25% market share), went public on the New York Stock Exchange (NYSE) on June 5. Since then, the price of CRCL has surged over 700% from the IPO price of $31 per share to about $263 per share. With a market cap of $63 billion, Circle's current valuation exceeds the reserve size of the USDC it has issued.

Circle's IPO comes at a pivotal time, driven by the passage of the GENIUS Act by the U.S. Senate. Coupled with the growing market demand for compliant digital dollars, Circle is capitalizing on the strong interest in pure stablecoin exposure. Its strong debut has also sparked interest in IPOs from other crypto companies (such as Bullish and Gemini exchanges), stimulated increased public market activity, and reignited attention on the economics of stablecoins.

In this issue of the Coin Metrics Network Status report, we analyze Circle's performance and valuation post-IPO, dissect who is capturing the economic value of USDC, and predict Circle's future revenue potential based on interest rates, USDC adoption rates, and the competitive landscape of the stablecoin market.

Circle (CRCL) Performance

Circle's IPO is one of the most notable tech stock IPOs in the U.S. in recent years. The offering was oversubscribed by more than 25 times, with the stock opening well above the $31 IPO price. Even as the broader crypto market has seen a pullback, CRCL's stock price has continued to rise, pushing Circle's market value to $63 billion.

Valuation Metrics

But is such a high valuation justified by the company's fundamentals? Based on Circle's projected total revenue of $1.67 billion and net profit of $157 million in 2024, $CRCL is currently trading at about 37 times its revenue over the past twelve months (price-to-sales ratio, P/S) and 401 times its net profit (price-to-earnings ratio, P/E). These multiples far exceed comparable fintech companies, such as NuBank (about 27 times), Robinhood (about 45 times), and even Coinbase, which has a more diversified revenue stream and higher profit margins (about 57 times).

Multiple factors seem to be driving this premium. Circle provides the public with a direct investment channel into the growth of digital dollars, benefiting from the GENIUS Act and its first-mover advantage in regulated markets. With the potential market expanding, USDC and Circle are well-positioned to benefit. However, facing a market cap of $63 billion, the narrative-driven enthusiasm seems to surpass its potential fundamentals. Key risks include a heavy reliance on interest income (which could be compressed if U.S. interest rates decline) and increasing competition from banks and fintech companies (the GENIUS Act paves the way for more regulated stablecoin issuers adopting similar business models).

Who is Capturing the Economic Value of USDC?

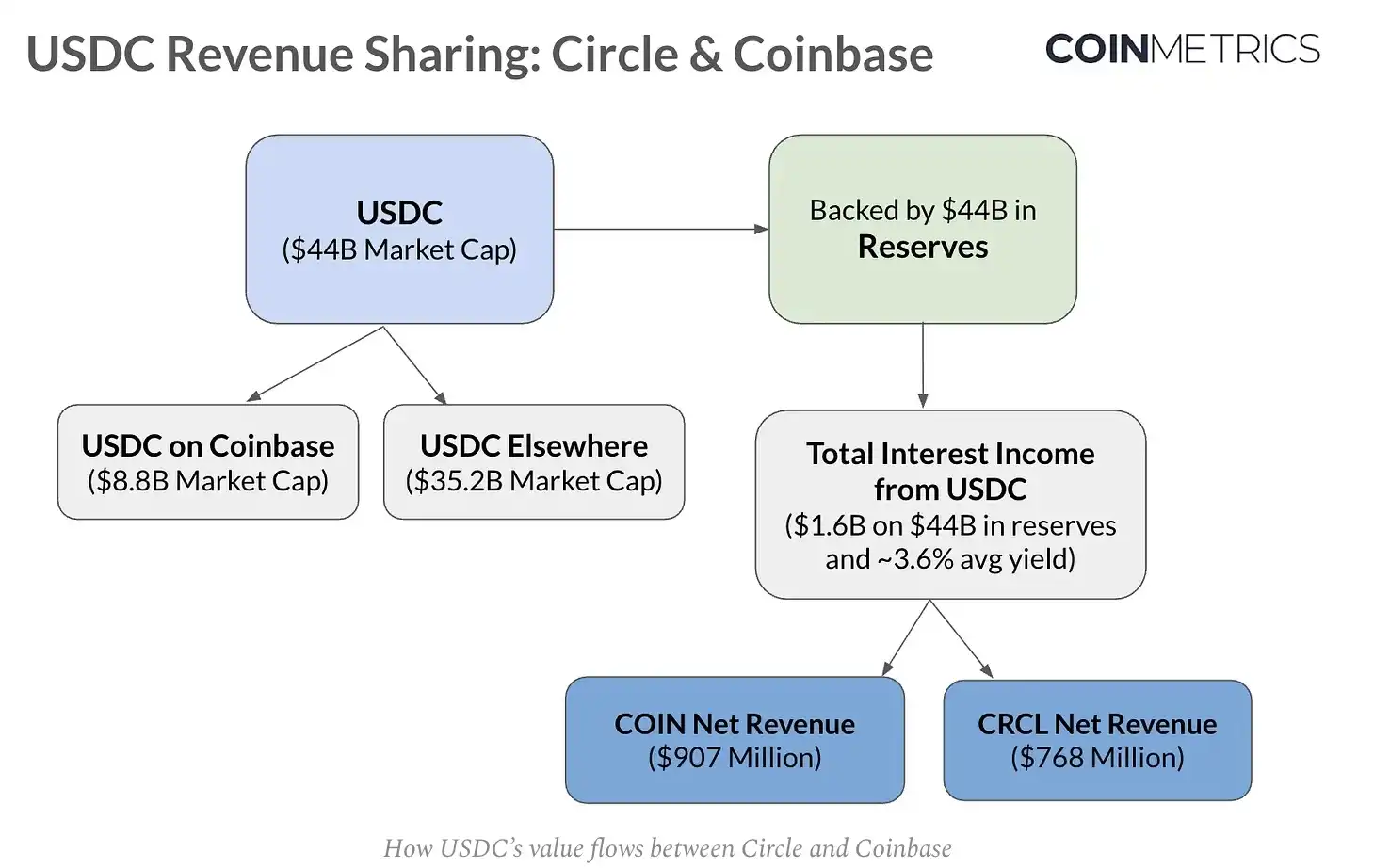

Almost all of Circle's revenue comes from interest income generated by USDC reserves. These reserves are held in cash at banks and in a Circle Reserve Fund managed by BlackRock, which invests in short-term U.S. Treasury securities. By the end of 2024, Circle is projected to generate $1.6 billion in gross income on $44 billion in reserves, implying an effective reserve yield of about 3.6%. However, after paying over $900 million in distribution costs (primarily to Coinbase), Circle retains $768 million in net income from its USDC business.

Circle and Coinbase's Revenue Sharing

Although Circle remains the sole issuer of USDC, it does not capture its entire value. With equity in Circle and a revenue-sharing agreement in place, Coinbase earns:

1. 100% of the interest income generated by USDC held by customers on the Coinbase platform;

2. 50% of the interest income generated by USDC held by customers elsewhere.

Under this arrangement, both parties are incentivized to expand the adoption of USDC. Coinbase has played a crucial role in driving USDC growth, significantly enhancing its distribution capabilities through its exchange, Base Layer-2 network (currently hosting $37 billion in USDC), and new products like Coinbase Payments. According to Circle's S-1 filing, Coinbase's share of USDC has steadily increased from about 5% in 2022 to 12% in 2023, and then to 20% in 2024. By the first quarter of 2025, this share had reached 22% of the total supply, with the company holding a total of $12 billion in USDC across its platforms.

The following diagram illustrates the flow of income generated by USDC in 2024 between Circle and Coinbase. By viewing the USDC reserve income allocated to Coinbase as a cost to Circle, it clearly reflects how value flows from USDC reserves to Circle and is ultimately distributed to Coinbase through the revenue-sharing agreement.

Based on the above predictions, driven by the continued growth of USDC holdings on the platform, Coinbase captures over 50% of Circle's total USDC revenue. Although stablecoin revenue accounts for only about 23% of Coinbase's total revenue, and some of this revenue is returned to users through "USDC rewards," the company still retains considerable upside potential. This interdependent economic relationship raises an important question: Given that Circle's market value has reached 82% of Coinbase's, how should investors conduct relative valuation assessments of the two companies?

Looking Ahead: Forecasting USDC's Interest Income

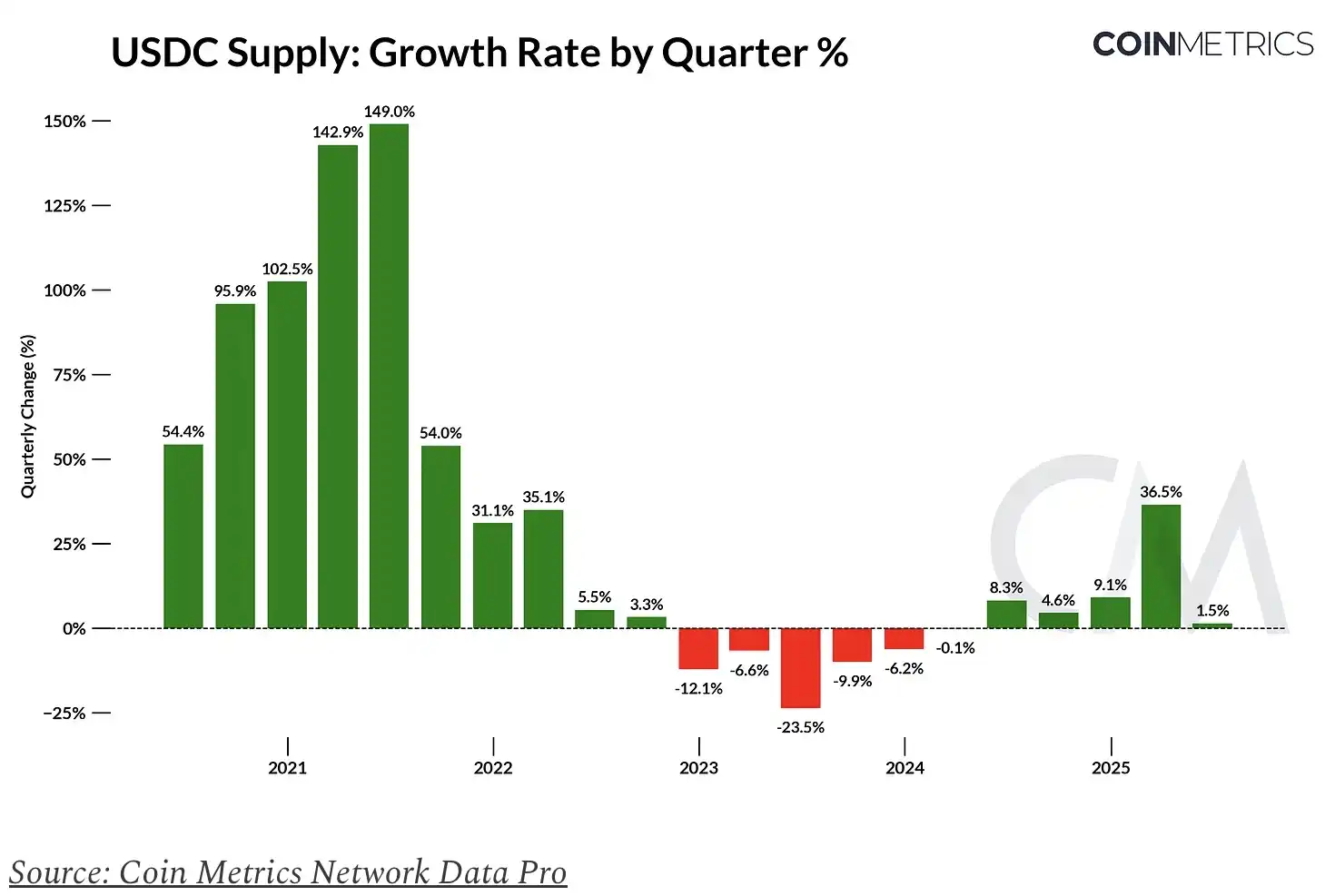

Looking ahead, Circle's revenue trajectory depends on three key variables: the supply of USDC in circulation (influenced by overall stablecoin market growth and its market share), current interest rate levels, and the share of USDC held on the Coinbase platform.

While the historical supply growth of USDC provides a useful benchmark, predicting future supply growth is inherently uncertain. The actual impact of regulatory clarity, the evolution of competitive dynamics, and the real effects of macroeconomic conditions could significantly influence the adoption rate and market share of stablecoins. In light of this, we have constructed a model that gradually slows growth—incorporating short-term tailwinds (such as advancements in stablecoin legislation) while also accounting for long-term headwinds from increasing competition and declining yields.

To better understand the long-term economic model of USDC, a predictive modeling of net income for both Circle and Coinbase through 2029 has been conducted based on these core elements.

In summary, the long-term revenue potential of Circle and Coinbase is closely related to the expansion of USDC supply and the maintenance of market share, which will help hedge against the adverse effects of declining yields. By the end of 2025, the total reserve income generated by USDC is expected to reach $2.44 billion, with Coinbase benefiting approximately $1.5 billion and Circle approximately $940 million.

If the current market dynamics remain unchanged, this income scale could rise to $9.15 billion by 2029, with Coinbase receiving $5.99 billion and Circle $3.16 billion.

It should be noted that this estimate only covers USDC reserve income, which currently accounts for the vast majority of Circle's revenue, and does not include potential upside from emerging business lines (such as the Circle Payments Network). The latter may play an increasingly important role in revenue diversification in the future.

Conclusion

Circle's IPO marks an important milestone in the stablecoin sector, providing investors with a direct opportunity to participate in the growth of the "digital dollar." In the short term, regulatory momentum and Circle's positioning in the compliant market provide favorable support; however, its long-term growth prospects still depend on the expansion of USDC supply, the increase in market share, and the diversification of revenue sources away from reserves.

Currently, the valuation multiples of CRCL are significantly higher than its fundamentals, and whether it can convert regulatory clarity, institutional partnerships, and distribution capabilities into lasting, sustainable growth will be key.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。