In the global wave of companies rushing to incorporate Bitcoin into their balance sheets, Metaplanet's name is rapidly rising as one of the most representative case studies in the Asian market. As a Japanese listed company that has transformed from the traditional hotel industry, Metaplanet now holds over 11,000 Bitcoins and has carved out its own roadmap in terms of market capitalization growth, financing structure design, and tax efficiency optimization.

Strategic Transformation: An Offensive from a Retreat

Metaplanet did not originate from the "crypto world." Its predecessor, Red Planet Japan, originally operated love hotels but faced a cash flow crisis after the pandemic, leading to a near-total shutdown of operations in early 2024. The management's choice to pivot to Bitcoin was not driven by industrial synergy but was a typical "bankruptcy-style transformation": cleaning up the shell, financing, and telling a new story.

CEO Simon Gerovich has clearly stated that their strategy is inspired by MicroStrategy—using Bitcoin as a core reserve asset to hedge against yen depreciation and inflation, following a route of "super financial asset-liability balance sheet allocation."

The key is the decisiveness in execution: in April 2024, they made their first purchase of 117.7 BTC, and subsequently continued to increase their holdings, utilizing debt financing, options structures, and even collaborating with institutions like SBI VC Trade to create a corporate structure that offers both Bitcoin exposure and tax efficiency.

Japan's Tax System and the Arbitrage Window of "BTC Proxy Rights"

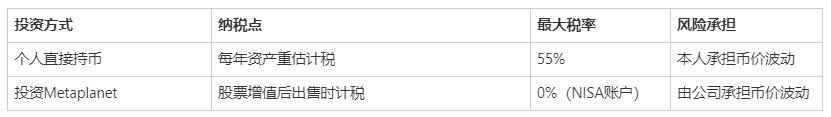

Metaplanet's transformation has garnered unexpected market resonance in Japan, primarily because it has established a Bitcoin investment channel that avoids personal tax burdens. In Japan, individuals holding Bitcoin directly face a tax rate of up to 55%, and regardless of whether they realize gains, they must pay taxes upon asset revaluation. This effectively closes off the space for high-net-worth investors or retail investors to hold Bitcoin long-term.

Metaplanet's model allows individuals to gain indirect Bitcoin exposure by purchasing its stock (which can be included in tax-exempt NISA accounts), thus avoiding high tax burdens.

This not only explains why its number of shareholders has surged to 50,000 but also why a number of traditional financial investors are willing to bypass ETFs and choose this "MicroStrategy-like" company.

Financing, Leverage, and Speculation: Is the Risk Underestimated?

Metaplanet has moved from an initial investment of 1 billion yen in Bitcoin to now spending over 10 billion yen and holding more than 10,000 BTC. Its funding sources do not come from its main cash flow but are highly reliant on debt financing and financial derivative structures:

This model is somewhat similar to MicroStrategy, but the financial structure adopted by Metaplanet is more aggressive, especially against the backdrop of extremely low interest rates in the Japanese financial market, creating a leveraged holding engine through "zero interest + derivatives + market speculation heat."

The question is: Does the market truly understand the potential fragility of this structure?

Metaplanet's current mNAV indicator remains in a healthy range, but this is contingent on Bitcoin maintaining its strength. If the price of Bitcoin were to significantly decline, this "buying Bitcoin with debt financing" strategy could face a double whammy:

- BTC price drops → asset shrinkage → mNAV falls below threshold

- Stock price drops → refinancing ability deteriorates → unable to continue increasing holdings

At the same time, a large portion of Metaplanet's shareholder structure consists of retail investors entering through NISA accounts, who lack sufficient understanding of Bitcoin's cyclical volatility and the risks of the debt structure, making their emotions easily reversible. Therefore, rather than viewing Metaplanet as an "institution that is bullish on Bitcoin in the long term," it is more accurate to see it as a "structural leveraged speculation vehicle"—albeit wrapped in the guise of a "public company" and "tax efficiency."

Has the market underestimated all of this? At this stage, where the Bitcoin bull market has not yet reversed, perhaps no one is willing to burst this bubble.

Globalization Path and Regulatory Game

Metaplanet is clearly not satisfied with "playing financial structures" in Japan; it has taken a step towards globalization.

- Preparing for a U.S. listing: CEO Gerovich met with NYSE and NASDAQ officials in March 2025, aiming to switch boards in the future to attract international capital.

- Establishing a Florida subsidiary: Operating BTC assets in the U.S. through Metaplanet Treasury Corp to avoid Japanese regulations and tax burdens.

At the same time, the company is also attempting to bind its brand to "Bitcoin culture"—renaming hotels to "Bitcoin Hotels," launching BTC yield indicators, and promoting staking businesses. However, these extended businesses are still in the "storytelling" phase, and what truly supports the valuation remains the price of BTC itself and market sentiment.

Opportunity or Amplifier?

Metaplanet's story is not just about "the company buying Bitcoin and making a lot of money," but rather an arbitrage structure in a misaligned era—capitalizing on the gaps in Japanese regulation, tax systems, and extremely low financial market interest rates.

It is both an arbitrageur of Japan's tax system and an amplifier of the global Bitcoin bull market.

In the coming years, whether it will become the Asian version of MicroStrategy or a martyr after the bubble bursts remains uncertain. However, it is clear that Metaplanet is not a neutral financial tool; it is an accelerator of Bitcoin price volatility and an experiment in institutional speculation under high leverage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。