Sorting out the regulatory frameworks for stablecoins in the three regions.

Written by: Crypto Salad

In previous articles, the Crypto Salad team provided a detailed introduction to the regulatory frameworks for stablecoins in the United States and Hong Kong from multiple perspectives. In addition to the United States and Hong Kong, many other countries or regions around the world have also established relatively complete regulatory frameworks for stablecoins.

In this article, the Crypto Salad team has selected three of the most representative and internationally influential countries or regions— the European Union, the United Arab Emirates, and Singapore. Using the same analytical framework and thought logic, combined with the Crypto Salad team's experience in blockchain projects, we will outline the regulatory frameworks for stablecoins in these three regions.

The analysis of the regulatory framework for stablecoins in this article will mainly unfold from the following perspectives: regulatory process, normative documents, regulatory authorities, and the core content of the regulatory framework. The specific content framework is as follows:

Table of Contents

(1) European Union

Regulatory process and normative documents

Corresponding regulatory authorities

Main content of the regulatory framework

a. Definition of stablecoins

b. Entry thresholds for issuers

c. Mechanisms for maintaining currency stability and reserve assets

d. Compliance requirements in circulation

e. Special regulatory rules for significant ARTs

(2) United Arab Emirates

Regulatory process and normative documents

Corresponding regulatory authorities

Main content of the regulatory framework

a. Definition of stablecoins

b. Entry thresholds for issuers

c. Mechanisms for maintaining currency stability and reserve assets

d. Compliance requirements in circulation

(3) Singapore

Regulatory process and normative documents

Corresponding regulatory authorities

Main content of the regulatory framework

a. Definition of stablecoins

b. Entry thresholds for issuers

c. Mechanisms for maintaining currency stability and reserve assets

d. Compliance requirements in circulation

(The above image is a comparative diagram of the stablecoin regulatory frameworks in the European Union, the United Arab Emirates, and Singapore, for reference only)

I. European Union

1. Regulatory process and normative documents

The European Union officially released the core normative document "Regulation on Markets in Crypto-Assets" (hereinafter referred to as the "MiCA Regulation") in June 2023. The MiCA Regulation aims to establish a unified regulatory framework for crypto assets to address issues such as regulatory fragmentation among member states.

The relevant rules regarding the issuance of stablecoins in the MiCA Regulation officially came into effect on June 30, 2024, and all enterprises subject to these rules must now fully comply with the relevant regulations.

2. Corresponding regulatory authorities

The European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA) are responsible for formulating the regulatory framework and supervising significant stablecoin issuers and related service providers.

The competent authorities of the member states where stablecoin issuers are located also have some regulatory power over stablecoin issuers.

3. Regulatory framework and main content

a. Definition of stablecoins

Article 18 of the MiCA Regulation classifies stablecoins into two categories:

I. Electronic Money Tokens (EMT)

EMT refers to crypto assets that stabilize their value solely by referencing one official currency. The MiCA Regulation explicitly states that the function of EMT is very similar to that defined in Directive 2009/110/EC regarding Electronic Money. Like electronic money, EMT is essentially an electronic substitute for traditional fiat currency, usable in everyday scenarios such as payments.

II. Asset-Referenced Tokens (ART)

ART refers to crypto assets that stabilize their value by referencing a combination of one or more official currencies.

The distinction between EMT and ART lies not only in the types and quantities of the referenced official currencies. Article 19 of the MiCA Regulation elaborates on the differences between the two:

According to the relevant definitions in Directive 2009/110/EC, holders of electronic money tokens, or EMT, always have a claim against the issuer of electronic money and possess the contractual right to redeem the value of the electronic money they hold at face value at any time. This means that the redemption capability of EMT is absolutely guaranteed by statutory claims.

In contrast, ART does not inherently grant its holders claims against the issuers of such crypto assets, and therefore may not fall under the jurisdiction of Directive 2009/110/EC. Some ARTs do not grant their holders claims to the face value of the referenced currencies or impose restrictions on redemption periods. If ART holders do not have claims against their issuers, or if their claims do not match the face value of the referenced currencies, the holders' confidence in the stability may be shaken.

All subsequent analyses regarding normative aspects will also be conducted from the dimensions of ART and EMT.

Regarding algorithmic stablecoins, the MiCA Regulation does not include algorithmic stablecoins within the regulatory framework for stablecoins. Due to the lack of a clear reserve linked to any real assets, algorithmic stablecoins do not fall under the definitions of EMT or ART as defined in the MiCA Regulation.

From a normative perspective, this effectively means that algorithmic stablecoins are prohibited under the MiCA Regulation. This stance on algorithmic stablecoins in the MiCA Regulation is very similar to the policy directions in the United States, Hong Kong, and other regions. This also indicates that regulatory agencies in various countries maintain a cautious attitude towards algorithmic stablecoins that lack real asset reserves.

Analysis of the relevant regulations regarding ART in the MiCA Regulation

b. Entry thresholds for issuers

According to the relevant provisions of Article 16 of the MiCA Regulation, there are two types of issuers for ART:

The first type is a legal entity or other enterprise established in the EU that has obtained authorization from the competent authority of its member state in accordance with Article 21 of the MiCA Regulation. If an enterprise wishes to apply for authorization from the relevant authorities, the application must include: issuer address, legal entity identifier, articles of association, business model, legal opinions, and other relevant information and documents.

The second type is a credit institution that meets the requirements of Article 17 of the MiCA Regulation. Article 17 of the MiCA Regulation explicitly states that the credit institution must provide various relevant documents to the competent authority within 90 days, including an operational plan, legal opinions, and token governance arrangements.

However, the MiCA Regulation also specifies exemptions for issuer qualifications. When an issuer meets any of the following conditions, it can be exempted from the aforementioned qualifications for ART issuers.

I. The average circulation value of the ART it issues has never exceeded 5,000,000 euros or other equivalent official currency within one year;

II. The ART is issued only to qualified investors and circulates only among qualified investors;

Although the MiCA Regulation exempts the qualification requirements for the above two types of ART issuers, it does not mean that they are not subject to any regulation. In fact, such ART issuers still need to draft a crypto asset white paper in accordance with the relevant provisions of Article 19 of the MiCA Regulation and notify the competent authority of their home member state to complete the filing.

(The above image shows the original text of the relevant provisions of Article 16.2 of the MiCA Regulation)

In addition, the MiCA Regulation imposes stricter regulations on ART issuers with an average circulation value exceeding 100,000,000 euros, requiring them to undertake additional reporting obligations and report the following information to the competent authority quarterly:

The number of holders, the value of issued ART and the scale of asset reserves, the average daily trading volume and average trading amount of the ART for that quarter, and other information.

Finally, the MiCA Regulation also specifies the own funds requirements for all ART issuers. The issuer of ART must always have own funds that are greater than or equal to the highest value of the following three standards:

I. 350,000 euros;

II. 2% of the average amount of reserve assets as described in Article 36;

III. One-quarter of the fixed management expenses from the previous year.

In summary, the MiCA Regulation adopts a relatively flexible "tiered regulation" model for ART token issuers.

ART issuers with an average circulation value not exceeding 5,000,000 euros, or those issued and circulated only to qualified investors, can be exempted from issuer qualification requirements but still need to draft a crypto asset white paper and notify the competent authority.

ART issuers with an average circulation value between 5,000,000 euros and 100,000,000 euros must meet the issuer qualification requirements of the MiCA Regulation, complete the corresponding authorization application, and submit the relevant materials.

ART issuers with an average circulation value exceeding 100,000,000 euros must meet the issuer qualification requirements while also undertaking additional reporting obligations.

All ART issuers, regardless of their token's average circulation value and issuance group, must have sufficient own funds.

(The above image shows the issuer qualification requirements corresponding to different ARTs)

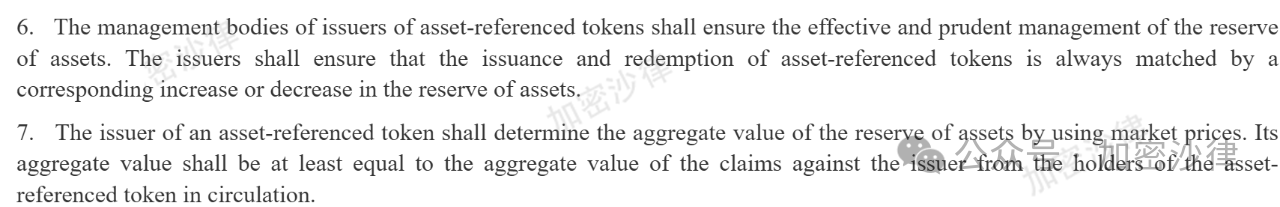

c. Mechanisms for maintaining currency stability and reserve assets

First, Article 36 of the MiCA Regulation explicitly states that ART issuers must always maintain reserve assets, and the reserves and management of these assets must meet the following core conditions:

I. They must cover the risks associated with the assets linked to the ART;

II. They must address liquidity risks related to the permanent redemption rights of holders.

In other words, the reserve assets of ART issuers must, on one hand, avoid and cover the endogenous risks caused by the reserve assets themselves, while also being able to respond to external run risks caused by token holders' redemptions.

However, the MiCA Regulation does not provide explicit regulatory standards regarding the amount and types of reserve assets for ART issuers. Instead, it designates the European Banking Authority to regulate and formulate relevant technical standard drafts to further clarify reserve asset and liquidity requirements.

(The above image shows part of the original text of Article 36 of the MiCA Regulation)

Secondly, ART issuers must ensure that reserve assets are completely segregated from the issuer's own assets and that the reserve assets are entrusted to a third party for independent custody.

Finally, ART issuers may use a portion of their reserve assets for investment, but such investments must meet the following conditions:

I. The investment targets must be high liquidity financial instruments with minimal market risk, credit risk, and concentration risk;

II. The investment should be able to be quickly liquidated, with minimal adverse impact on the price upon exit.

In short, reserve assets can only be invested in compliant financial instruments that carry extremely low risk and extremely high liquidity, thereby minimizing the risks faced by the reserve assets.

d. Compliance in circulation

First, Article 39 of the MiCA Regulation explicitly states that ART holders shall have the right to initiate redemption from the issuer of ART at any time. The ART should also be redeemed at the market price of the reference assets upon the holder's request. At the same time, ART issuers must establish corresponding policy rules regarding the permanent redemption rights of holders, specifying the specific conditions for exercising the redemption rights and the underlying mechanisms for token redemption.

Secondly, the MiCA Regulation also imposes limits on the maximum circulation of ART. If the quarterly transaction volume and daily average total transaction value of a certain ART exceed 1 million transactions and 200,000,000 euros, respectively, the issuer must immediately cease further issuance of that ART token and submit a plan to the competent authority within 40 working days to ensure that the transaction volume and transaction value of the token fall below the aforementioned standards.

This means that the MiCA Regulation sets a hard upper limit on the circulation of ART tokens, which cannot exceed this "ceiling" under any circumstances. This rule is also intended to avoid excessive circulation of ART, which could potentially trigger internal liquidity risks.

e. Special regulatory rules for significant ARTs

Significant Asset-Referenced Tokens (Significant ARTs) refer to ARTs that meet specific criteria, with a total of seven criteria for judgment.

The first three criteria are related to the circulation and market value of the ART itself:

I. The number of holders of the ART is greater than 10,000,000;

II. The market value or reserve asset scale of the ART exceeds 5,000,000,000 euros;

III. The daily average transaction volume and daily average total transaction value of the ART exceed 2.5 million transactions and 500,000,000 euros, respectively;

The last four criteria are related to certain characteristics of the ART issuer:

IV. The ART issuer is designated as a gatekeeper core platform service provider under Regulation (EU) 2022/1925 of the European Parliament and Council;

V. The activities of the ART issuer have international significance, including the use of asset-referenced tokens for payments and remittances;

VI. The interconnectedness of the ART issuer and the financial system;

VII. The ART issuer has also issued other ARTs, EMTs, or provides at least one crypto-asset service.

When an ART meets three of the above seven criteria, the European Banking Authority shall classify the ART as significant ART. The regulatory responsibilities of the ART issuer shall be transferred from the competent authority of the member state where the issuer is located to the European Banking Authority within 20 working days from the notification of the decision, and subsequent supervision shall be conducted by the European Banking Authority.

The reason for distinguishing the concept of significant ART is that Article 45 of the MiCA Regulation explicitly states that significant ART issuers need to undertake additional obligations, including but not limited to:

I. Significant ART issuers shall adopt and implement remuneration policies that promote effective risk management;

II. The issuer of significant ARTs shall assess and monitor the liquidity needs of the tokens to meet the demands of their holders for redeeming asset-referenced tokens. To this end, the issuers of significant asset-referenced tokens shall establish, maintain, and implement liquidity management policies and procedures;

III. The issuer of significant ARTs shall regularly conduct liquidity stress tests on the tokens. The regulatory authority, the European Banking Authority, will also dynamically adjust the liquidity requirements for the ART based on the results of the liquidity stress tests.

Analysis of the relevant regulations regarding EMT in the MiCA Regulation

EMT (Electronic Money Tokens) has stricter entry thresholds and qualification requirements for issuers compared to ART. Only certified Electronic Money Institutions (EMIs) or credit institutions can legally issue EMT under the MiCA Regulation. At the same time, EMT issuers are also required to draft a crypto asset white paper and notify the competent authority regarding that white paper.

In addition, the regulatory requirements for maintaining and managing reserve assets for EMT issuers are quite similar to those for ART issuers, with many overlaps, and will not be further analyzed here.

II. United Arab Emirates

1. Regulatory process

In June 2024, the Central Bank of the UAE issued the Payment Token Services Regulation, which clarifies the definition and regulatory framework for "payment tokens" (stablecoins).

2. Normative documents

The core normative document is the aforementioned Payment Token Services Regulation.

3. Regulatory authorities

The UAE is a federal state composed of seven autonomous emirates, including well-known emirates such as Dubai and Abu Dhabi. Therefore, the regulatory framework for stablecoins in the UAE also features a "federal-emirate" dual-track parallel system.

The Central Bank of the UAE issued the Payment Token Services Regulation and is directly responsible for regulating stablecoin issuance activities at the federal level. However, the jurisdiction of the Central Bank does not include the two financial free zones in the UAE: DIFC (Dubai International Financial Centre) and ADGM (Abu Dhabi Global Market).

Both have independent legal regulatory systems and corresponding regulatory agencies, and thus are not directly governed by the Central Bank of the UAE.

This "federal-emirate" dual-track parallel regulatory system ensures unified federal regulation of stablecoin issuance, ensuring the stable development of the stablecoin industry, while also leaving room for institutional innovation and exploration in the financial free zones. Compared to the chaotic and disordered regulatory system for crypto assets in the United States—where the SEC, CFTC, and Fed take turns appearing, leading to jurisdictional confusion—the UAE's dual-track regulatory system is clearly more coherent and efficient.

4. Core content of the regulatory framework

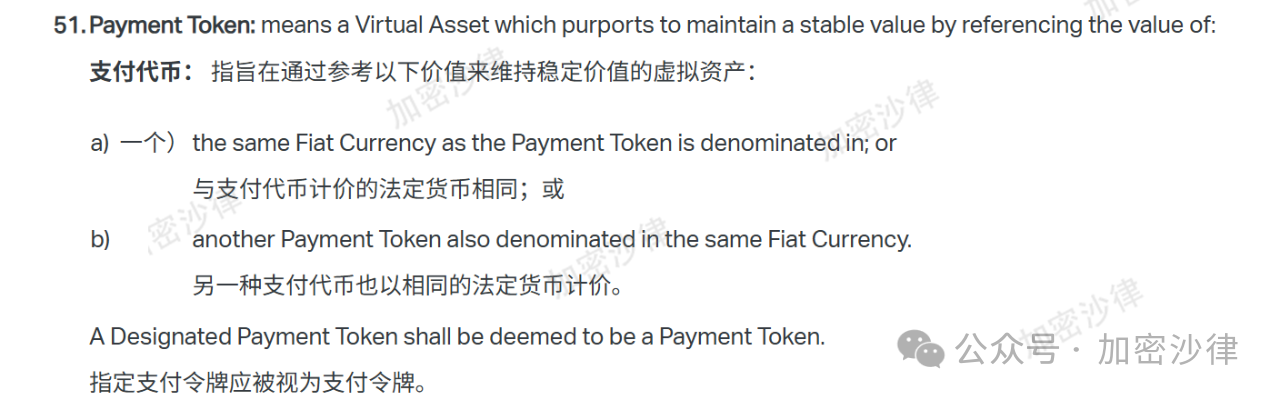

a. Definition of stablecoins

The Payment Token Services Regulation (hereinafter referred to as "this Regulation") does not use the term "stablecoin" but refers to it as "payment tokens." For consistency in the text, it will also be referred to as "stablecoins" hereafter.

The Regulation also clearly defines the concept of stablecoins in Article 1:

"A virtual asset intended to maintain a stable value by referencing the value of a fiat currency or another stablecoin denominated in the same currency."

(The above image shows Article 1.51 of the Payment Token Services Regulation)

It can be seen that compared to the EU's MiCA Regulation and Hong Kong's Stablecoin Regulation, this Regulation has a relatively broad definition of stablecoins.

In addition, Article 4 of this Regulation also clarifies which tokens do not fall under the category of stablecoins regulated by this Regulation.

Exemptions based on token type: Tokens used for reward programs or loyalty tokens that circulate only within specific ecosystems, such as tokens issued in supermarket membership incentive programs, are not subject to this Regulation.

Exemptions based on token usage: Stablecoins with reserve assets of less than 500,000 dirhams and a total number of token holders not exceeding 100 are also not subject to this Regulation.

Compared to the detailed tiered regulatory model of the EU's MiCA Regulation, this Regulation's approach to stablecoin regulation is more concise and straightforward.

It is important to note that this Regulation not only regulates stablecoin issuers but also covers related activities such as conversion, custody, and transfer of stablecoins. The following analysis will focus on the relevant regulations for stablecoin issuers.

b. Entry thresholds for issuers

Stablecoin issuers must meet the following application requirements when applying for a license:

Meet legal form requirements: The applicant must be a corporate entity registered in the UAE and must obtain permission or registration from the Central Bank of the UAE.

Initial capital requirements.

Necessary documents and information.

c. Mechanisms for maintaining currency stability and reserve assets

First, stablecoin issuers must establish effective and robust systems to protect and manage reserve assets, ensuring that:

Reserve assets are used only for specified purposes;

Reserve assets are protected from operational risks and other related risks;

Reserve assets must be protected in all circumstances from claims by other creditors of the issuer.

Secondly, stablecoin issuers must deposit reserve assets in cash in independent custody accounts to ensure the independence and security of the reserve assets. These custody accounts must be designated for holding the reserve assets of the stablecoin issuer.

Finally, this Regulation also provides clear requirements for the maintenance and management of reserve assets:

The value of the reserve assets of stablecoin issuers must be at least equal to the total face value of the fiat currency of the stablecoins in circulation, meaning that sufficient reserves must be maintained. This requirement is consistent with the regulations in the EU and Hong Kong.

Stablecoin issuers must accurately record and verify the inflow and outflow records of the stablecoin reserve assets and regularly reconcile the system's recorded results with the actual reserve assets to ensure consistency between the book value and actual value of the reserve assets.

Stablecoin issuers are required to hire external audit teams for monthly audits and ensure the independence of the audit teams—meaning that the audit teams have no direct association with the stablecoin issuers. The third-party audit team will confirm that the value of the reserve assets is not less than the face value of the fiat currency of the stablecoins in circulation. It can be seen that the auditing requirements for reserve assets in this Regulation are relatively high. Currently, Tether, the issuer of the largest stablecoin USDT, only conducts quarterly audits and does not meet the transparency requirements for audits set forth in this Regulation.

Stablecoin issuers must establish sound internal control measures and procedures to protect reserve assets from misappropriation, fraud, theft, and other risks.

d. Compliance requirements in circulation

The regulation on stablecoins primarily addresses compliance in circulation from the following perspectives:

【Stablecoins only as payment tools, interest-bearing stablecoins not recognized】

First, the regulation clearly states that stablecoins must not pay any interest or other benefits related to the holding period to customers. In other words, stablecoins can only serve as pure payment tools and cannot possess any financial attributes. Therefore, under this regulatory framework, interest-bearing stablecoins (such as the USDY token issued by Ondo) are completely unrecognized. This regulation aligns with the mainstream regulatory stance in various regions.

【Unlimited redemption of stablecoins】

Secondly, stablecoin holders can redeem their stablecoins for the corresponding fiat currency at any time without restrictions. The stablecoin issuer must clearly state the redemption conditions and related fees in the customer agreement. Additionally, stablecoin issuers must not charge unreasonable redemption fees beyond reasonable costs.

【Anti-terrorism financing and anti-money laundering requirements】

Stablecoin issuers, as anti-money laundering obligors, must comply with applicable anti-money laundering/anti-terrorism financing laws and regulations in the UAE and establish comprehensive and effective internal anti-money laundering strategies and internal control measures.

Generally, the anti-money laundering/anti-terrorism financing responsibilities for stablecoin issuers will directly apply the current relevant regulations of the country. For example, stablecoin issuers in Hong Kong are also required to comply with the relevant provisions of the Hong Kong Anti-Money Laundering Ordinance. This essentially incorporates stablecoin issuers into the overall anti-money laundering regulatory framework of the country or region for joint supervision.

【Payment and personal information protection】

Stablecoin issuers should establish relevant policies to protect and maintain the personal data of users they collect. However, stablecoin issuers may disclose the aforementioned personal data to the following institutions under specific circumstances:

Central Bank of the UAE;

Other regulatory agencies approved by the Central Bank;

Courts;

Or other government agencies with access rights.

III. Singapore

1. Regulatory process

In December 2019, Singapore authorities introduced the Payment Services Act, which clarifies the definition of payment service providers, entry thresholds, corresponding licenses, and other related regulations.

The Monetary Authority of Singapore (MAS) issued a consultation document in December 2022 regarding the proposed Stablecoin Regulatory Framework to solicit public opinions. Less than a year later, on August 15, 2023, MAS officially released the Stablecoin Regulatory Framework, which applies to single-currency stablecoins (SCS) issued in Singapore and pegged to the Singapore dollar or G10 currencies.

2. Normative documents

Payment Services Act

Stablecoin Regulatory Framework

The Stablecoin Regulatory Framework serves as a supplement to the Payment Services Act, further clarifying the compliance requirements for stablecoin issuers.

3. Regulatory authority

The Monetary Authority of Singapore (MAS) is responsible for regulation, issuing stablecoin issuance licenses, and compliance supervision.

4. Core content of the regulatory framework

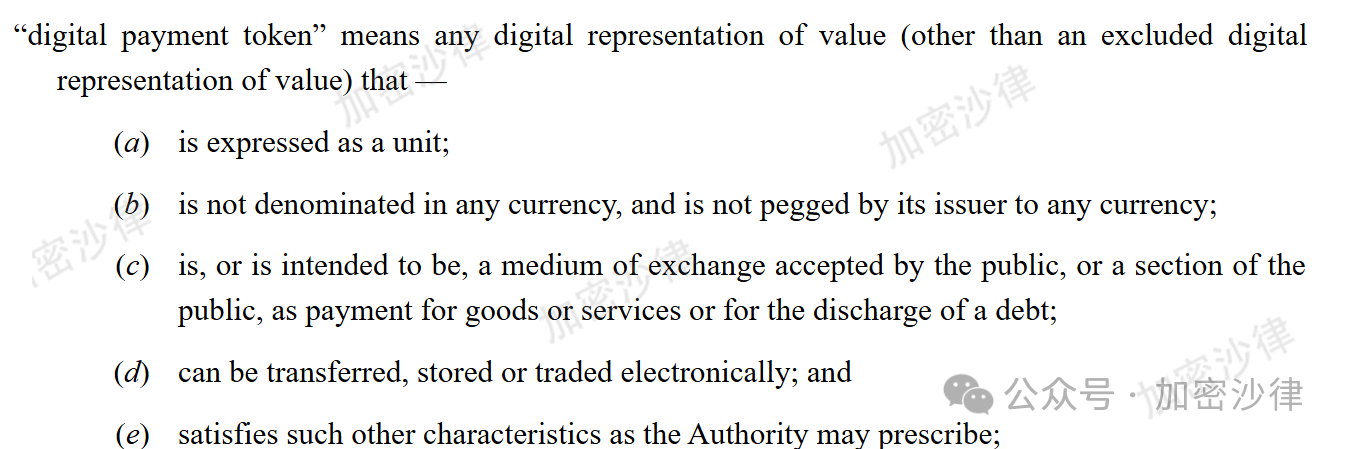

a. Definition of stablecoins

Article 2 of the Payment Services Act defines payment tokens as follows:

(1) Represented in units;

(2) Not priced in any currency, and its issuer does not peg it to any currency;

(3) Is or aims to become a medium of exchange accepted by the public or part of the public for the payment of goods or services or the settlement of debts;

(4) Can be transferred, stored, or traded electronically.

(The above image shows the original text of Article 2 defining digital payment tokens in the Payment Services Act)

Similarly, to ensure the fluency and consistency of the text, the term "stablecoin" will be used in place of "payment token" in the following sections.

The subsequently released Stablecoin Regulatory Framework has a stricter definition of stablecoins, only regulating single-currency stablecoins issued in Singapore and pegged to the Singapore dollar or G10 currencies.

b. Entry thresholds for issuers

If a stablecoin issuer wishes to apply for MAS licensing, they must meet the following three conditions:

Base Capital Requirement: The stablecoin issuer's capital must be at least 50% of annual operating expenses or 1 million Singapore dollars.

Business Restriction Requirement: The stablecoin issuer must not engage in trading, asset management, staking, lending, or other businesses, nor hold shares in other legal entities directly.

Solvency Requirement: Liquid assets must meet the scale required for normal withdrawals or exceed 50% of annual operating expenses.

c. Mechanisms for maintaining currency stability and reserve assets

Regarding the management and maintenance of stablecoin reserve assets, MAS has established the following regulations:

First, the reserve assets of stablecoin issuers can only consist of the following low-risk, highly liquid assets: cash, cash equivalents, and bonds with a remaining maturity of no more than three months.

Moreover, the issuers of these assets must be: sovereign governments, central banks, or international institutions rated AA- or above.

It can be seen that MAS imposes very strict and detailed restrictions on the reserve assets of stablecoin issuers. This is in stark contrast to the regulatory framework in the UAE, which does not impose explicit restrictions on the composition of reserve assets for stablecoin issuers.

Secondly, stablecoin issuers must establish a fund and open segregated accounts to strictly separate their own funds from reserve assets.

Finally, the daily market value of the reserve assets of stablecoin issuers must exceed the circulation scale of the stablecoins to ensure sufficient reserves.

d. Compliance requirements in circulation

Stablecoin issuers are required to fulfill statutory redemption obligations. Stablecoin holders can freely redeem their stablecoins, and stablecoin issuers must redeem the holders' stablecoins at face value within five working days.

This represents the personal views of the author and does not constitute legal advice or opinions on specific matters.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。