Written by: Luke, Mars Finance

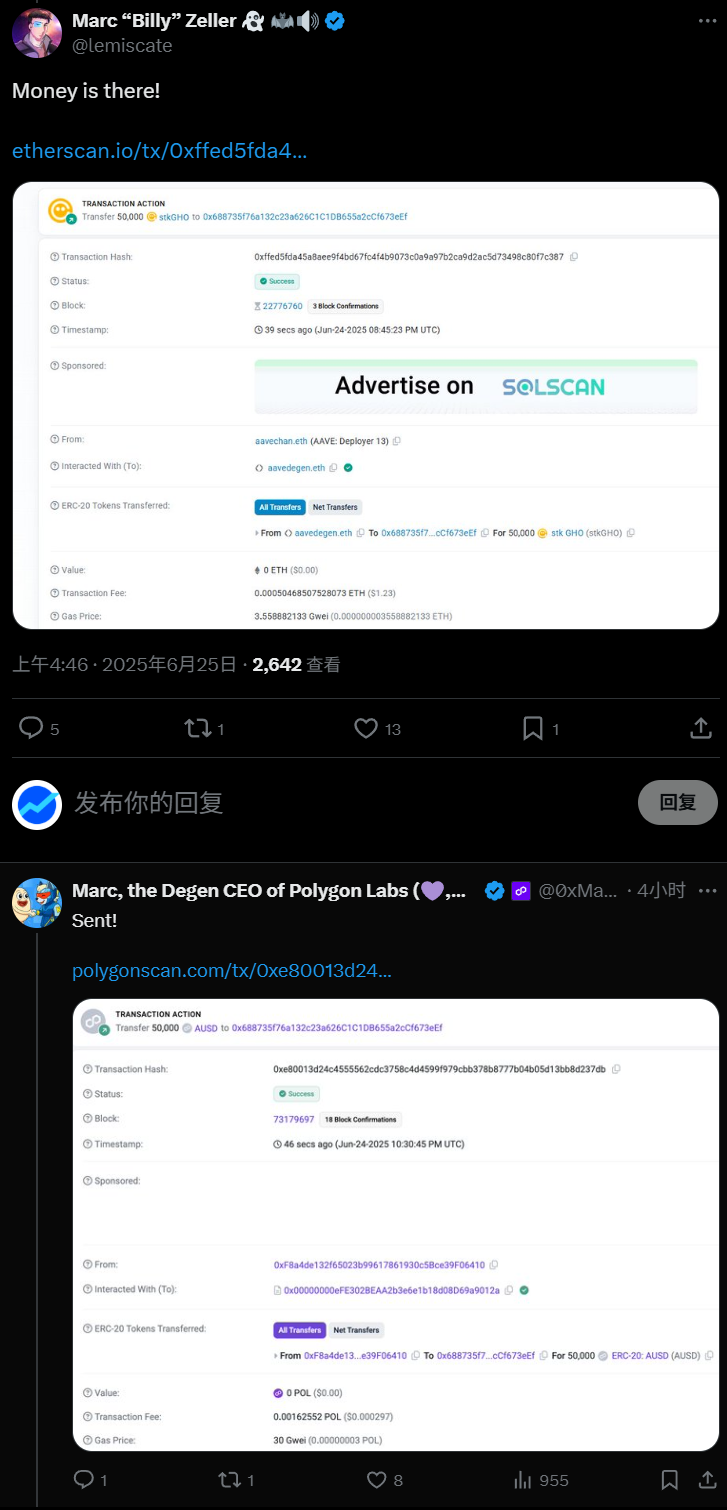

"Money has arrived."

With a screenshot of an Etherscan transaction shared by Marc Zeller on the X platform, a verbal battle regarding the future of the Polygon ecosystem officially escalated into a $50,000 public wager, backed by smart contracts and industry bigwigs. This fund is not just a joke; it has been securely locked in a custody address managed by well-known crypto KOL Cobie.

On June 24, 2025, this wager was officially finalized, featuring two significant figures in the crypto world: Marc Zeller, a core contributor to the Aave ecosystem, and Marc Boiron, the CEO of Polygon Labs.

Their bet brought a fundamental issue troubling the industry into the spotlight: when a leading blockchain ecosystem introduces a second token, does it create new value, or merely erode and dilute the existing value?

The terms of this duel were clearly defined during their verbal sparring, precise and stringent:

- Stake: $50,000 worth of stablecoins.

- Escrow: Well-known crypto KOL Cobie (@cobie).

- Source of Truth: CoinGecko.

- Settlement Time: December 24, 2025, at 8 PM (UTC).

- Winning Conditions: At that time, whether the total market capitalization of POL and the new token KAT is higher than the market capitalization of POL when Polygon officially announced the Katana plan (which was $2.387 billion). If higher, Boiron wins; if lower, Zeller wins.

Behind this wager lies a fierce clash of two entirely different worldviews in the crypto space.

On one side is Marc Zeller, the "guardian" of the Aave ecosystem. As the founder of the Aave Chan Initiative (ACI), he is the most steadfast "risk-averse" figure in the DeFi world. He firmly bears a bearish outlook on Polygon's "dual-token" model, asserting that this approach will only dilute value, ultimately leading to a negative-sum game of "1+11."

On the other side is Marc Boiron, the "empire builder" of Polygon Labs. This ambitious CEO is dedicated to unifying the fragmented blockchain world through the Aggregation Layer (AggLayer) strategy of Polygon 2.0. He counter-argues that clever collaborative design will break the "curse" and achieve a value leap of "1+1>2."

This is not merely a contest of personal reputation and money; it is a public experiment aimed at testing two diametrically opposed philosophies of industry development.

The Trigger: A Long-standing Ideological War

This public showdown is not a spur-of-the-moment decision but rather a volcanic eruption of long-standing ideological conflicts between the two protagonists and the protocols they represent.

The conflict between them first publicly escalated in December 2023. At that time, the Polygon community proposed a controversial initiative: to activate "dormant" assets on its PoS cross-chain bridge to increase treasury income through yield farming. In Boiron and the Polygon community's view, this was a wise move to revitalize assets. However, in Zeller's eyes, it was akin to playing with fire next to Aave's treasury. Aave holds billions of dollars in assets on the Polygon chain, and the cross-chain bridge is precisely one of the most vulnerable links in the entire DeFi world. Zeller quickly initiated a countermeasure in the Aave community, proposing to significantly raise the borrowing costs of related assets on Polygon to economically "punish" what he deemed reckless behavior, firmly stating that "Aave should not bear the costs of Polygon's risk experiments."

This conflict clearly outlines the philosophical chasm between the two sides: Aave, represented by Zeller, prioritizes risk control above all, akin to a banker holding a fortune and advancing cautiously; while Polygon, represented by Boiron, views ecosystem growth as the top priority, like a bold pioneer unafraid of risks.

This long-standing ideological conflict reached a new boiling point on May 28, 2025, when Polygon officially announced that its flagship project, Katana Network, would issue its own token, KAT. Zeller once again invoked his signature "dual-token curse" theory. In the final conversation that solidified the wager, Zeller even sharply mocked Boiron: "This all started six months ago when you guys were doing Pre-PIP (the early version of the Polygon Improvement Proposal); since then, POL's price has been falling, and it's all a result of your own decisions."

This charged accusation undoubtedly reveals the deep-rooted nature of their conflict and adds a personal vendetta aspect to what was initially a purely ideological dispute.

Zeller's Curse: Historical Ghosts and the "Dual-Token Curse"

Marc Zeller's pessimistic conclusion is not unfounded; it is deeply rooted in the bloody lessons of cryptocurrency history. The "curse" he refers to can be termed the "dual-token curse"—the introduction of a second token not only fails to create incremental value but also leads to the destruction of existing value due to community distraction, confusion of value propositions, and increased system complexity. There are two famous historical cases that haunt the crypto world, providing strong support for his argument.

The first, and the most tragic, is the death spiral of Terra/LUNA. In May 2022, this massive ecosystem, which once had a market cap of $40 billion, vanished in just a week. At its core was a dual-token model: the algorithmic stablecoin UST and its governance token LUNA. UST was pegged to the dollar through a clever arbitrage mechanism, but this mechanism turned into an out-of-control printing machine under extreme market pressure. When UST depegged due to panic selling, the arbitrage mechanism required massive minting of LUNA to absorb the selling pressure on UST, causing LUNA's price collapse, which further exacerbated distrust in UST, creating an inescapable "death spiral." This case starkly illustrates that a dual-token system with inherent design flaws has risks that are not linear but exponential, ultimately leading to the annihilation of value as "1+10."

The second case is the "community civil war" between Steem and Hive. Unlike Terra's implosion, this is a story about division. In 2020, dissatisfied with the acquisition by Tron founder Justin Sun, core members of the Steem community chose to "exit" by hard forking, creating a brand new blockchain called Hive. This fork essentially represented a split of the community and assets. The original network effect was divided, liquidity was diluted, and development power was scattered. Although a Terra-style collapse did not occur, the once-unified community was torn apart, and the original value was split between two competing tokens, perfectly illustrating the "value dilution" effect in Zeller's argument.

These two cases, one concerning systemic collapse and the other community division, point to the same conclusion: dual-token models are prone to failure. However, Boiron and Polygon's rebuttal is precisely based on this: the birth of Katana is neither to maintain a fragile algorithm nor a product of community division. It is a deliberate and strategically designed ecological expansion with clear hierarchy and synergy within a grand strategic blueprint. Therefore, simply applying the failures of the first two cases to Polygon may be a misguided approach. This wager is, in fact, testing a brand new, unproven third multi-token model.

Boiron's Blueprint: Breaking the Curse with "Aggregation"

In response to Zeller's historically rooted pessimistic conclusions, Marc Boiron presents a vast, intricate, and ambitious future blueprint—Polygon 2.0. The core of this system is designed to fundamentally address all the issues raised by Zeller.

First, Polygon will upgrade its core token from MATIC to POL, giving it a new designation as a "super productive token." This is far more than just a name change. Traditional PoS tokens, like MATIC, can only be staked on one chain to earn that chain's rewards. In contrast, POL's design allows holders to stake it while simultaneously providing security and validation services for countless chains within the Polygon ecosystem, playing various roles such as transaction ordering and generating zero-knowledge proofs. This means that POL's value is no longer merely tied to the rise and fall of a single chain but is directly linked to the prosperity of the entire Polygon "value internet." It can continuously capture value from the economic activities of all chains within the ecosystem, like a pump.

Secondly, the "nervous center" of this blueprint is the Aggregation Layer (AggLayer). If past cross-chain bridges resembled bumpy country roads connecting two independent nations, then AggLayer is like the central terminal of a super international airport. It can unify the liquidity and state of all Layer 2 networks connected to it, enabling near-instantaneous and trustless atomic cross-chain transactions. This fundamentally resolves the cross-chain security issues that Zeller was most concerned about and lays the foundation for a unified, seamless user experience.

Finally, there is another main character in this wager—Katana. In Polygon's grand narrative, Katana is not a "second son" competing for resources with POL but a carefully selected "strategic special forces." Its sole mission is to showcase the powerful capabilities of AggLayer to the world. Katana's design is highly disruptive; it allows only one leading protocol in each DeFi track to exist on a chain (such as Sushi in the DEX field), thereby highly concentrating liquidity and avoiding the common liquidity fragmentation issues seen on general chains. At the same time, it will inject strong economic incentives into these exclusive partner protocols through token incentives and real yields.

This design reveals a deep strategic intention of Polygon: Katana plays a strategic "showroom" role. Its primary value lies not in how high its own market capitalization can soar, but in whether it can successfully prove that AggLayer is a viable technical paradigm capable of attracting massive liquidity and top projects. If Katana becomes a hit, it will serve as the brightest billboard for AggLayer, drawing countless projects to join Polygon's aggregated ecosystem. This powerful network effect will theoretically, in turn, greatly boost the demand for the POL token. The story Polygon is trying to tell is not the "A+B A" that Zeller fears, but rather an exponential growth myth of "(A+B) → A++."

Lessons from the Ghosts of the Past: Can Polygon Cure Cosmos's "Value Capture Disease"?

The theory is rich, but reality is stark. Whether Polygon's grand blueprint can be realized has a crucial historical reference point—the Cosmos ecosystem.

Cosmos can be regarded as the "spiritual mentor" of Polygon's aggregation vision. It was the first to propose a network composed of countless sovereign, interconnected "application chains." However, despite the emergence of many star projects like dYdX and Celestia within the Cosmos ecosystem, which have their own independent and large market-cap tokens, the value generated by these successes has been difficult to effectively flow back and be captured by the ecosystem's core token, ATOM. This is known as the "value capture dilemma" of Cosmos. A research report from Coinbase pointed out that the prosperity of the Cosmos ecosystem has historically rarely benefited ATOM holders.

This is precisely where Polygon's design shines and is key to whether it can break the "dual-token curse." Polygon's strategy is not a blind replication of the Cosmos model but a thoughtful correction aimed at addressing the "value capture disease" of Cosmos.

The core "prescription" it offers is a mandatory, institutionalized value-sharing mechanism. The most direct aspect is that Katana will directly airdrop 15% of its total token supply, KAT, to POL stakers. This initiative establishes a strong and formal economic link between the new project and the core token right at the beginning of ecological expansion. In the Cosmos ecosystem, application chains can develop freely without "taxing" ATOM holders; whereas in Polygon's aggregated ecosystem, this "tax" is institutionalized in the form of airdrops.

This creates a powerful "golden shovel" effect: holding and staking POL equates to having the tool to mine the future value of all new projects in the entire ecosystem. This generates direct and sustained buying demand for POL, as rational investors will anticipate that all projects graduating from the "Aggregation Layer breakthrough plan" will follow the same rules.

Therefore, the real highlight of this wager is no longer whether "Polygon will repeat the historical mistakes," but rather whether "Polygon has already designed a solution that can successfully address the value capture dilemma of Cosmos."

Final Predictions: Who Will Laugh Last?

Now, all the cards have been revealed, and it is time to make the final predictions for this year-end showdown.

The reasons supporting Marc Zeller are compelling: the weight of history. Markets are often short-sighted and averse to complexity; within a short six-month window, investors may be more inclined to punish the complexity of a new model rather than pay a premium for its long-term vision. The ghosts of Terra and Cosmos still linger in investors' minds, and any slight disturbance could trigger pessimistic associations in the market.

The reasons supporting Marc Boiron lie in the intricacy of his design and the grandeur of his narrative. Polygon's entire strategy can be said to be designed to counter all of Zeller's arguments. The mandatory airdrop mechanism may ignite FOMO in the market in the short term, leading to a strong narrative-driven rally.

However, the key variable determining the outcome of this wager is that seemingly ample yet incredibly tight time window—six months. For a grand project aimed at reshaping the underlying blockchain infrastructure, six months is but a fleeting moment. The true value and network effects of AggLayer are unlikely to be fully realized before the end of 2025.

Thus, the outcome of this wager is less about the complete realization of fundamentals and more about a race between short-term market sentiment and narrative power.

My final prediction is that Marc Zeller has a slightly higher chance of winning this wager.

The inertia of history is powerful. To completely reverse the market's pessimistic view of the "dual-token model" within just six months and fully convince the market of Polygon's complex and novel value proposition, Katana needs to achieve immediate and indisputable success. This requires not only technical perfection but also exceptional marketing and community mobilization. Against the backdrop of a potentially tightening macro environment and market liquidity by the end of the year, this is undoubtedly a daunting task. A more likely scenario is that Katana successfully launches, but the combined market capitalization of POL and KAT, after an initial hype, falls back and struggles to steadily surpass the benchmark of $2.387 billion at the precise moment of December 24.

But this does not mean Polygon's failure. On the contrary, it may just be a misalignment regarding "time." Boiron and Polygon are betting on the industry landscape of the next few years, while Zeller is betting only on the market sentiment of the next six months.

Regardless of who ultimately pops the champagne, this wager will be recorded as an extremely interesting footnote in the history of Web3 development. It forces us to think about how ecosystems should expand and how value should be captured—fundamental questions. The true outcome may not be clear until 2026 or 2027, when applications truly flourish on AggLayer. And by then, the winner will be the entire crypto industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。