In the Crypto market of June, the hottest topic was not Bitcoin, nor altcoins or memes, but Circle (CRCL). Since its IPO, it has surged over 7 times, breaking into the global market and becoming a rare "crypto stock leader" in the US stock market. However, as hot money from traditional finance and the cryptocurrency market flowed into Circle, Cathie Wood, known for her bets on tech growth, chose to go against the trend by reducing her holdings in CRCL and increasing her position in Coinbase (COIN).

According to Ark Invest Daily data, ARK Invest, led by Cathie Wood, reduced its holdings by 415,844 shares of CRCL on June 23, with a total value of approximately $109.5 million based on the closing price that day. At the same time, it increased its holdings in Coinbase by 20,701 shares, now valued at about $7.14 million. Additionally, on the 23rd and 24th, it continued to increase its stake in Shopify, which has deep cooperation with Coinbase, buying a total of 146,487 shares, now valued at approximately $16.76 million.

Ark Invest currently has an investment scale in Coinbase close to $900 million and about $500 million in Shopify. Together, these two account for approximately 12% of ARK's investment portfolio.

ARK's list of increases and decreases on June 23, source: Ark Invest Daily

The surge in CRCL reflects a long-term optimism for stablecoin payment tracks, but Coin, as the intersection of its underlying settlement ecosystem, on-chain network, and user traffic, seems closer to the "ontology" of this narrative. Moreover, Coinbase is also one of Circle's largest shareholders, holding about 50% of its equity. With this collection of "advantages," is Coinbase's value underestimated?

Comparison of the increase in CRCL (top) and COIN (bottom)

Cooperation with 200 Financial Institutions?

On June 24, during the recently concluded semi-annual monetary policy report hearing of the US House Financial Services Committee, the Federal Reserve finally relented, with Chairman Powell stating that "banks can provide banking services to the cryptocurrency industry and engage in related businesses, provided that the safety and soundness of the financial system is ensured."

The next day, on the 25th, Coinbase's founder and CEO Brian Armstrong announced the launch of Coinbase's new infrastructure, Crypto-as-a-Service (CaaS), and stated that they have already partnered with approximately 200 banks, brokerages, fintech companies, and payment institutions worldwide.

This CaaS system covers a complete process from asset custody, trading, lending, stablecoin integration to on-chain tokenization. For banks, Coinbase provides a regulatory-compliant, scalable, and flexible wallet system and asset management tools, with custody solutions that offer vault-level security and support for self-managing private keys.

On the trading side, Coinbase supports access to CFTC-regulated crypto perpetual contracts, helping banks build compliant spot and derivatives businesses. More importantly, Coinbase offers trade financing capabilities without prepayment and provides complete upstream and downstream services for stablecoin usage, from payments to foreign exchange settlements to on-chain issuance, achieving full-cycle integration.

For brokerages and exchanges, Coinbase also offers institutional-grade custody services and one-stop trading execution capabilities, allowing partners to access cross-platform liquidity through Coinbase Prime, along with real-time pricing services and inquiry trading. It also supports trade financing, stablecoin integration, and staking yield infrastructure, with a white-glove service desk specifically designed for high-net-worth and complex orders.

Base Chain and USDC, Coinbase's Right and Left Arms

Earlier this month, on June 13, Coinbase announced several positive developments. First, it announced a partnership with Shopify to support USDC payments on the Base chain in over 30 countries, marking the first real integration of stablecoins into mainstream e-commerce platforms. At the same time, Coinbase officially integrated the DEX routing on Base into its main application, allowing users to complete on-chain transactions without leaving their CEX accounts.

Coinbase is currently one of Circle's largest shareholders, holding nearly 50% of its equity, and is also the sole issuing partner of USDC. Coinbase is standardizing the use of USDC, promoting it as a settlement tool for cross-border and local payments. Through real-time settlements, floating capital management tools, and fiat currency access services, Coinbase is helping traditional payment institutions upgrade to a new generation of platforms that support crypto payments. Notably, Coinbase's integration of USDC is not limited to the asset level but has partnered with leading e-commerce platforms like Shopify, significantly promoting the adoption of USDC in the real e-commerce system.

The foundation of all the above layouts is Coinbase's Ethereum Layer 2 public chain, Base. Coinbase's various initiatives encourage customers to deploy tokenized assets and DeFi applications on Base, backed by a compliant exchange, low fees, and support for fast, round-the-clock settlements, providing an ideal environment for traditional institutions to test on-chain business. Since USDC accounts for 90% of the stablecoin supply on the Base chain, the more active the Base chain is, the broader the adoption of CIRCLE will be.

The proportion of stablecoins on Base, with USDC exceeding 90%, source: DUNE

As Coinbase is currently re-integrating on-chain liquidity, compliant payments, and high-frequency trading into a complete ecosystem, and combining them in a "regulatory-approved" manner, the current Coinbase may not just be a compliant exchange or an ETF target; it is building an operating system that is gradually being adopted by mainstream finance through CaaS and Base.

Deribit + CFTC Perpetual License, Big Money for Big Business in "Derivatives" Compliance

Due to the high costs of compliance, for Coinbase, which has limited revenue models, the decline in trading fees and institutional business in the last quarter has become a foregone conclusion. However, derivatives, especially "legitimate US market perpetual contracts," represent an untapped incremental market.

Therefore, Coinbase has taken a series of measures, the most important of which was its announcement in June to launch 24/7 perpetual futures contracts compliant with the Commodity Futures Trading Commission (CFTC) requirements in the US within this year. Prior to this, on May 9, Coinbase had initially launched Bitcoin and Ethereum futures trading in the US through its CFTC-regulated exchange, Coinbase Derivatives, LLC (formerly the CFTC-regulated derivatives trading platform FairX). In May, Coinbase also completed the acquisition of Deribit, one of the largest cryptocurrency options exchanges globally, thus entering the competition in the top derivatives market.

Deribit has a strong influence in non-US markets (especially Asia and Europe), and the acquisition gives Coinbase a dominant position in Bitcoin and Ethereum options trading, accounting for about 80% of global options trading volume, with daily trading volume exceeding $2 billion. Additionally, 80-90% of Deribit's client base consists of institutional investors, and its expertise and liquidity in the Bitcoin and Ethereum options market are highly favored by institutions, making it a perfect fit for Coinbase's compliance advantages and already established institutional ecosystem.

After a long period without exchanges launching compliant derivatives following compliance clean-up in the US market a few years ago, the US market has always been seen as a "sweet spot" for exchanges. However, for "American players," CME only serves institutions, Binance cannot comply, and protocols like Hyperliquid, which have taken about 20% of Binance's derivatives market share, are the main choices for most US traders. However, this market may also be "swallowed" by Coinbase, as it is the only US platform that simultaneously possesses user scale, compliance qualifications, and a technical stack, making it the exclusive channel for "legally opening contract trading" in the US market.

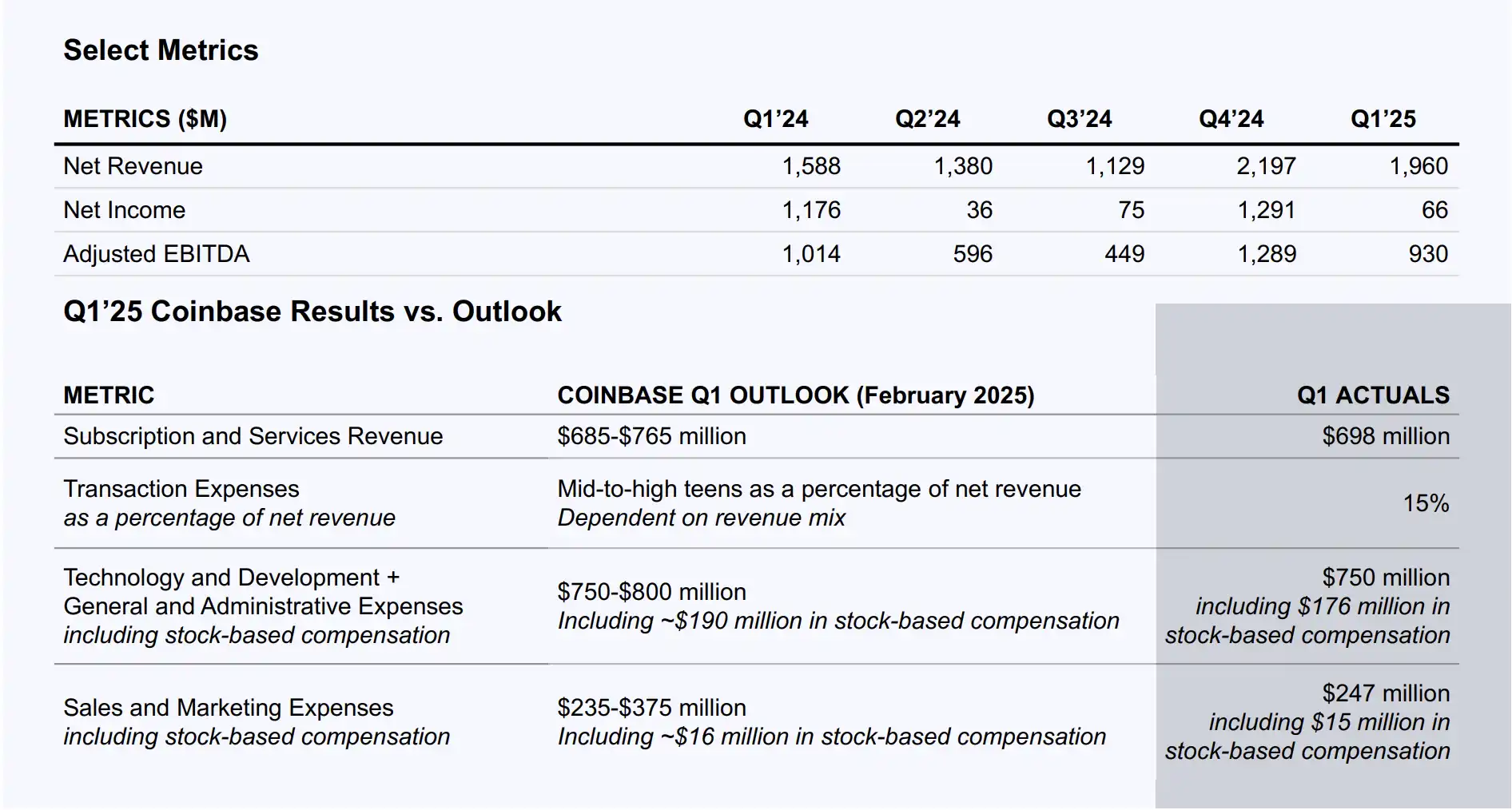

This series of operations is a response to the decline in the previous quarter's financial report, where its earnings per share (EPS), revenue, and platform revenue all fell collectively. Compared to spot trading, which is more affected by market fluctuations, contract trading is a more "stable" source of income.

The Value of Coinbase Lies Not in Its Current Price, but in Its Structure

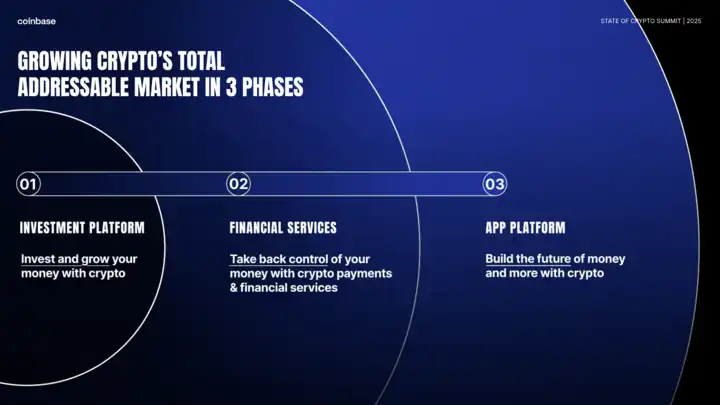

Although Coinbase only receives a small portion (about 34%) of the 60% interest income from USDC, the economic landscape covered by its on-chain settlement, payment gateways, and DEX routing is broader than that of CRCL. ARK's reallocation behavior also confirms this logic; reducing CRCL is a way to secure profits, while increasing positions in Coinbase and other surrounding ecosystems bets on its on-chain ecosystem integration capabilities. Coinbase also recently announced its next phase goal: "to focus on driving the mass adoption of cryptocurrency" and has divided its development into three stages.

The first stage is to view cryptocurrency as a new type of investment platform, starting with Bitcoin and gradually expanding the asset list.

The second stage is a complete overhaul of existing financial services, not just replacing old systems with new interfaces, but rebuilding a new financial system centered on crypto-native principles from the ground up. This includes DeFi lending backed by Bitcoin and cross-border payment services based on stablecoins, emphasizing users' freedom and power to regain control of their assets.

In the third stage, Coinbase aims to evolve the platform into the infrastructure for the next generation of internet applications, allowing value to flow "directly" to true creators and users.

As Base handles traffic entry, DEX provides asset liquidity, USDC binds payment scenarios, and perpetual contracts capture high-frequency trading, Coinbase's form has transcended that of an exchange itself; it now resembles a "compliant on-chain App Store."

Value discovery often does not occur because something is cheap, but because the structure is right. And Coinbase may just be that asset with the right structure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。