Original Title: "SignalPlus Macro Analysis Special Edition: Escalate to De-Escalate?"

Original Source: SignalPlus

Geopolitical tensions escalated further over the weekend, with U.S. bombers launching rapid and precise strikes on three deep nuclear facilities within Iran. U.S. reports indicate significant damage to the facilities, but there has been no official confirmation on whether nuclear materials have been destroyed or evacuated in advance.

The market instinctively sold off risk assets, and cryptocurrencies, as the only asset class that continued trading over the weekend, were naturally the first to be affected. At the onset of the attacks, BTC fell about 4% from above 102k to around 99k. It is worth noting that cryptocurrencies continue to be viewed as frontier/high-risk assets in the eyes of traditional financial investors.

Due to the escalation, the market was initially concerned about a severe risk reaction at Monday's opening, but such worries quickly dissipated during the Asian morning session. A viewpoint gradually emerged in the market suggesting that this action might represent a successful "escalate to de-escalate," meaning that key displays of military force could drive progress in negotiations. Additionally, the practical difficulties of blocking the Strait of Hormuz (as most of Iran's oil and gas exports flow to China) also alleviated market concerns about uncontrollable spikes in oil prices.

The price performance during Monday's morning session seemed to confirm this viewpoint, with U.S. stock futures nearly recovering to last Friday's levels, oil prices stabilizing at around $75 per barrel, and spot gold giving back previous gains, while the dollar against the Israeli new shekel also fell back to pre-conflict lows.

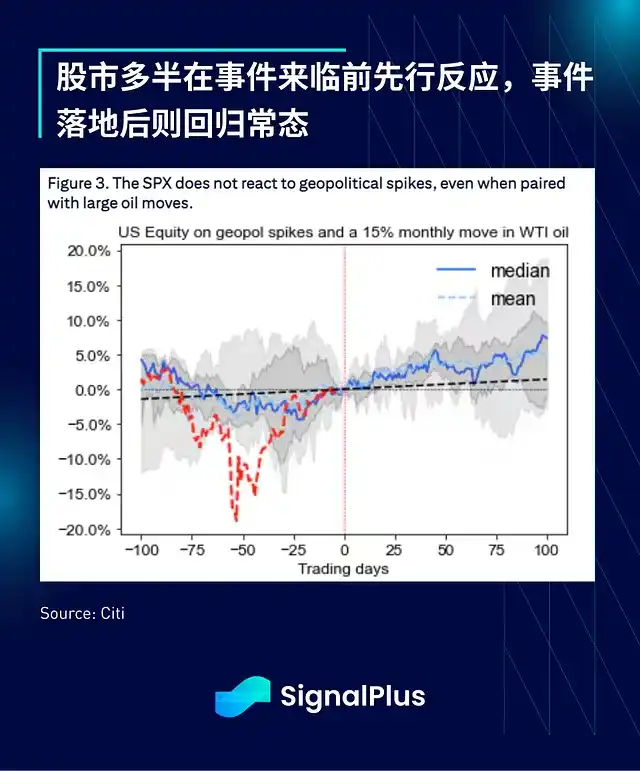

Generally speaking, geopolitical pressures tend to be temporary and only have a short-term impact on the stock market. A recent study by Citigroup shows that the SPX index often reacts negatively before geopolitical event risks escalate, but once the events actually occur, performance is usually not poor. If we believe that the stock market has a certain level of efficiency and can forward-looking reflect known and foreseeable unknown risks, such a conclusion is reasonable. Unless there is an unimaginable large-scale destructive weapon attack or other extreme sudden events, we expect the risk market to gradually adapt to this round of conflict and refocus on ongoing tariff negotiations and economic development.

In the interest rate market, despite ongoing discussions about the U.S.'s massive interest expenditures and potential inflation risks, implied volatility for interest rates has fallen to mid-term lows, indicating that the market does not expect developed country central banks to take substantial action. The overall trajectory of forward interest rates remains stable, and bond traders have returned to normal operations.

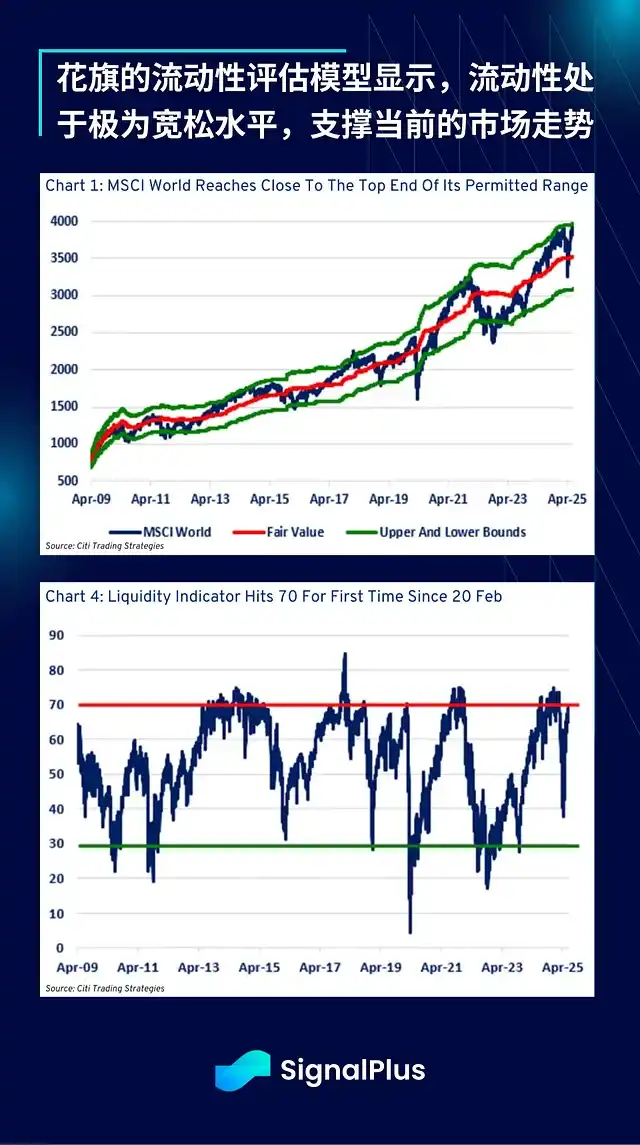

Meanwhile, according to the majority opinion on Wall Street, current market liquidity (i.e., financial conditions) remains quite ample, allowing risk assets (such as stocks) to continue climbing the "wall of worry." Despite experiencing Liberation Day, the ongoing Russia-Ukraine conflict, and tensions between Israel and Iran, the SPX index has still managed to rebound strongly.

Although macro observers may still hold a pessimistic stance in the long term, investors are voting with real capital. Amid various warning signs, risk sentiment remains clearly bullish, and the overall economy continues to operate, with corporate profits steadily rising.

Unfortunately, the cryptocurrency market is not the same. BTC fell 4%, touching around $98.9k, while ETH plummeted about 10% to $2,150, marking the lowest intraday price since early May. With the news of the Iranian airstrikes, cryptocurrencies, as the only assets still trading, were naturally sold off, resulting in over $1 billion in futures positions being liquidated over the weekend.

Despite stocks, crude oil, and gold prices reversing their weekend trends in the morning session, cryptocurrency prices struggled to rebound in sync. Investors remained in long positions during the conflict, and the volatility over the past month has been severe, while cryptocurrency prices have failed to effectively break through since the first quarter, with BTC also struggling to surpass February's highs.

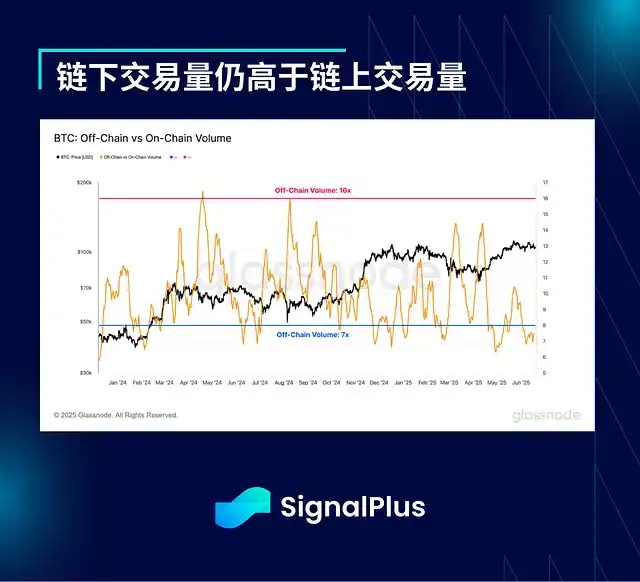

Glassnode conducted an excellent analysis last week, showing that while the TradFi community has shown strong interest in BTC, on-chain trading activity has significantly slowed. In short, mainstream investors are attempting to gain BTC exposure through traditional tools (such as ETFs and futures), leading to active off-chain (OTC) trading. However, since FTX, on-chain activity has not recovered, as evidenced by the lackluster performance of DeFi and altcoins, along with the absence of new narratives (aside from stablecoins/RWA).

Similarly, the power law distribution phenomenon in the cryptocurrency space is becoming increasingly common. On one hand, BTC's market capitalization dominance continues to rise, while on the other hand, its own on-chain transfer activity is becoming more concentrated in large wallets. According to Glassnode data, the proportion of transactions exceeding $100,000 has risen from 66% in 2022 to 89% today, further confirming the view that "whales" dominate the market, while the influence and participation of smaller accounts are diminishing.

Unfortunately, as the cryptocurrency industry matures and accelerates its institutionalization, this trend is likely to continue, which may be an unavoidable outcome.

Additionally, as BTC becomes a mainstream asset class, it must naturally adhere to the operational rules of other macro assets, which are dominated by the largest participants in terms of capital volume, with off-chain trading being far more active than on-chain trading. Long-term observers point out that this cycle is different from past ones, lacking the heat of altcoins or the rise of new narratives, but this was actually anticipated. TradFi participants are more inclined to engage in the market through familiar tools (off-chain), and self-custody and on-chain narratives hold limited appeal for this group. However, since they possess far larger capital than native users, their behaviors and preferences will increasingly dominate price trends.

This change in macro correlation can be observed through the significant increase in open interest in BTC futures. The sharp fluctuations in BTC futures open interest since the fourth quarter of 2024 are the main reason we are seeing more frequent liquidation gaps (like last weekend). Off-chain activity and futures-driven price movements imply a higher macro correlation, with the influence of native cryptocurrency momentum becoming weaker.

Meanwhile, the activity of cryptocurrency options trading has also significantly increased in this cycle. The overall market's daily trading volume has risen from $1.5 billion in 2024 to a recent high of $5 billion, indicating that increasingly mature market participants are adopting more options strategies to manage risk.

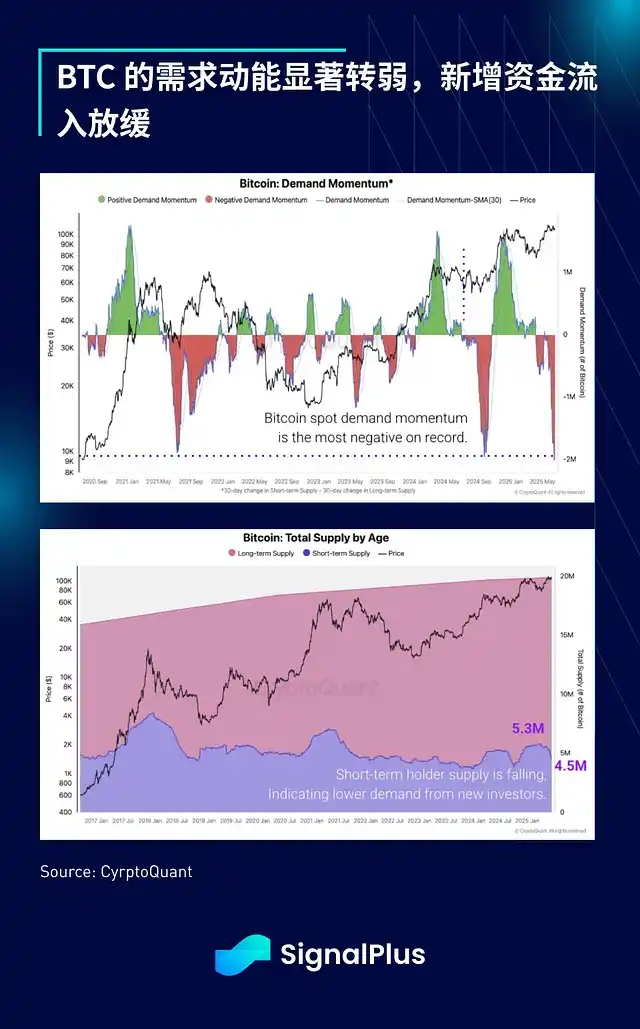

Returning to the current moment, BTC's demand momentum appears weak. According to CryptoQuant data, its demand momentum index has hit a historical low. Even with a series of favorable policies (such as the Genius Act, Hong Kong's stablecoin policy, etc.), prices still cannot effectively break through previous highs, and the supply from short-term holders (i.e., new capital) seems to be slowing down.

In the volatility market, price changes indicate that traders were caught off guard by this volatility, with implied volatility suddenly spiking from a previous one-sided downward trend. There has been significant buying of put options, especially for ETH, indicating that market participants are seeking downside protection while holding long deltas, suggesting that there may be further downward pressure in the market in the short term.

Looking ahead, we believe the market will soon digest and move past this geopolitical event, and we may even see some form of peaceful breakthrough in the situations involving Russia and Iran, as well as substantial progress in tariff negotiations. The market will naturally rise due to these developments, but the focus will also shift back to valuation issues. The current SPX index already reflects a +12% earnings growth expectation to $296 (equivalent to a 20x forward P/E ratio), while the U.S. economy seems to be slowing down (employment indicators, CEO layoff expectations, etc.).

As we have always maintained, we do not recommend going against the current upward trend of the stock market, but we believe this rebound is nearing its end, and the focus should now be on risk reduction. In the cryptocurrency market, given the recent price performance, we are more concerned that the market may experience a larger adjustment, clearing out the recent chasing high capital and floating chips. We are also wary of the numerous listed companies incorporating BTC into their corporate holdings as a form of "financial engineering," which may instead signal negative FOMO.

Stay calm, manage risks, and may a clear mind prevail over the current situation. Good luck to everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。