Coinbase (NASDAQ: COIN) has seen its stock price soar recently, jumping 12.1% in a single day on June 24, closing at $344.65, marking a new high since December 2024, with a cumulative increase of about 33% over the past week.

As the leading cryptocurrency exchange in the United States, Coinbase's strong performance is attributed not only to the overall recovery of the crypto market but also to regulatory breakthroughs, increased institutional investment, and the synergy of its internationalization strategy, which has ignited market optimism about the crypto industry.

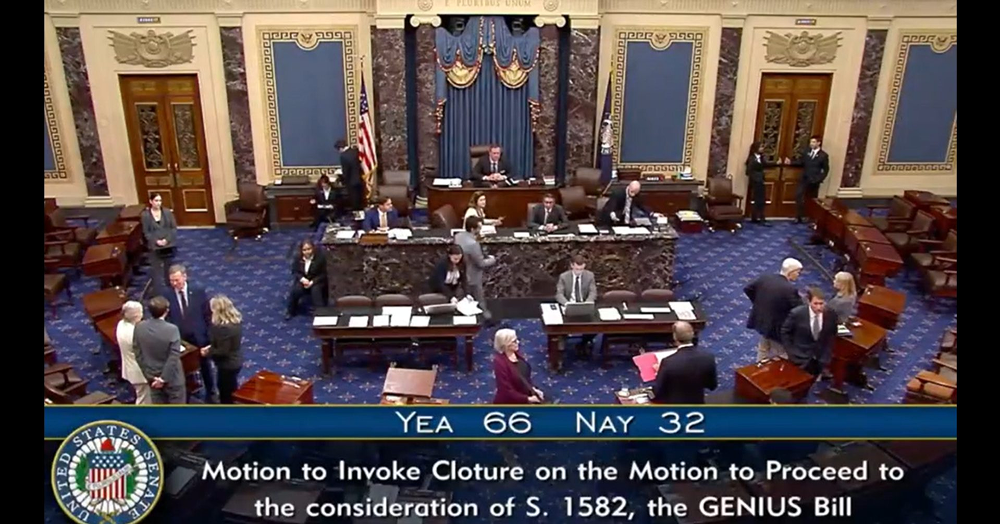

GENIUS Act: A Milestone in Stablecoin Regulation

On June 17, the U.S. Senate passed the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) with an overwhelming vote of 68-30, establishing the first federal regulatory framework for stablecoins. The act requires issuers to maintain 100% reserves, disclose reports monthly, and undergo annual audits, clearing regulatory uncertainties for the stablecoin market, which is currently valued at approximately $260 billion.

For Coinbase, this is a shot in the arm. As a co-founder of USDC (the second-largest stablecoin), Coinbase shares 50% of its reserve earnings with Circle and retains all revenue from USDC transactions on its platform. On June 25, Crypto Times noted that the passage of the GENIUS Act would drive institutional adoption of stablecoins in payments and cross-border transactions, with Coinbase as a key infrastructure provider set to benefit directly. The day after the act was passed (June 18), Coinbase's stock price surged 16.32%, closing at $295.29, and continued to climb thereafter.

However, on June 24, The Block reminded that the act still requires approval from the House of Representatives, and there are existing differences between the two chambers regarding regulatory details, posing some implementation risks. Coinbase's optimistic outlook needs to closely monitor subsequent legislative developments.

Ark Invest Increases Holdings: Institutional Confidence Ignites the Market

Support from institutional investors has injected strong momentum into Coinbase's stock price. On June 24, CoinDesk reported that Ark Invest, led by Cathie Wood, increased its holdings by 4,198 shares of Coinbase stock, bringing the total value of its holdings to $159 million, accounting for 7.82% of its portfolio. This move is seen as a firm endorsement of Coinbase's long-term potential, triggering a market follow-up effect.

On June 25, FX Leaders analyzed that Ark Invest's increase in holdings coincided with the passage of the GENIUS Act and the approval of MiCA licenses, significantly amplifying market sentiment. On June 24, Coinbase's stock price reached $348.55 during trading, setting a new high for the year.

On June 24, X platform user @2140io warned that Coinbase's price-to-earnings ratio had risen to 57, with a market capitalization nearing $70 billion, indicating that risks are accumulating, and investors should be cautious of the pullback pressure from high valuations.

MiCA License: A Strategic Breakthrough in the European Market

On June 20, CNBC reported that Coinbase received a MiCA license from the Luxembourg financial regulator (CSSF), becoming the first U.S. cryptocurrency exchange approved under the EU's Markets in Crypto-Assets Regulation (MiCA). This license allows Coinbase to provide a full suite of crypto services across the 27 EU countries, as well as Iceland, Liechtenstein, and Norway, covering approximately 450 million potential customers.

On June 25, Crypto Times pointed out that the MiCA license marks a significant advancement in Coinbase's internationalization strategy. Previously, Coinbase had obtained partial licenses in Germany, France, and other locations, and the MiCA framework integrates these into a unified regulatory system, significantly reducing compliance costs. Luxembourg, as the most mature financial center for blockchain law in Europe, has become Coinbase's regional hub. Following the announcement of the license, Coinbase's stock price rose over 3% and further surged 12% on June 24. On June 24, The Block added that exchanges like Gemini and OKX are also applying for MiCA licenses, and Coinbase needs to consolidate its first-mover advantage through service innovation.

Crypto Market Recovery: Geopolitical Easing Fuels the Fire

The overall recovery of the crypto market provides solid support for Coinbase. On June 25, Crypto Times reported that the prices of Bitcoin and Ethereum have recently rebounded, partly due to the easing of geopolitical tensions. On June 24, U.S. President Trump announced a "comprehensive ceasefire" between Israel and Iran, ending the so-called "12-day war," significantly improving the sentiment for global risk assets.

As the largest cryptocurrency platform by trading volume in the U.S., Coinbase directly benefits from the increased market activity. On June 24, FX Leaders data showed that its daily trading volume grew by about 15% compared to the previous week, leading to a corresponding rise in trading fee revenue. On June 25, CoinDesk added that Coinbase's recently launched stablecoin payment product, "Coinbase Payments," has partnered with platforms like Shopify, further strengthening its competitiveness in the payment sector.

Analyst Outlook and Risk Warnings

Market optimism about Coinbase is reflected in analyst ratings.

On June 25, X platform user @dwj_eric cited a Benchmark report that raised Coinbase's target price from $301 to $421, maintaining a "buy" rating, believing it will benefit from the GENIUS Act and the potential CLARITY Act (which provides a comprehensive regulatory framework for digital assets). On June 24, FX Leaders noted that Coinbase's stock price has rebounded back into an upward channel since its low of $143 in April, with a year-to-date increase of 33.8%.

At the same time, on June 24, FX Leaders warned that Coinbase's stock price is approaching key resistance levels at $312 and $350, and may face profit-taking pressure in the short term. On June 24, The Block mentioned that some industry insiders questioned Coinbase's choice to obtain the MiCA license in Luxembourg, which may raise suspicions of "regulatory arbitrage," and attention should be paid to subsequent EU regulatory developments. Additionally, Coinbase's high volatility (with 64 instances of over 5% fluctuations in the past year) also reminds investors to remain cautious.

Conclusion: Coinbase on the Rise Amid Hidden Currents

The meteoric rise of Coinbase's stock price is a result of the resonance of favorable regulations, institutional endorsements, market recovery, and internationalization strategies. The GENIUS Act injects certainty into the stablecoin market, the MiCA license opens a new chapter for growth in Europe, Ark Invest's increased holdings ignite market enthusiasm, while the recovery of the crypto market provides fundamental support.

On June 24, X platform user @EttoroSummer revealed that Coinbase is applying for SEC approval to launch on-chain stock tokenization trading, which, if approved, would directly challenge traditional brokerages like Robinhood and further expand its business boundaries.

However, high valuations, regulatory uncertainties, and competitive pressures are challenges that Coinbase must face. Investors chasing the trend need to remain rational and closely monitor the final legislative progress of the GENIUS Act, competitive dynamics in the EU market, and technical resistance levels of the stock price. Whether Coinbase can continue to lead at the intersection of crypto and traditional finance is worth ongoing observation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。