Keep a初心, learn to face and move forward with the best posture and state, and grasp the current market situation! Only by respecting the market, understanding the market, and recognizing oneself can one slowly adapt to the market and find a path that belongs to oneself.

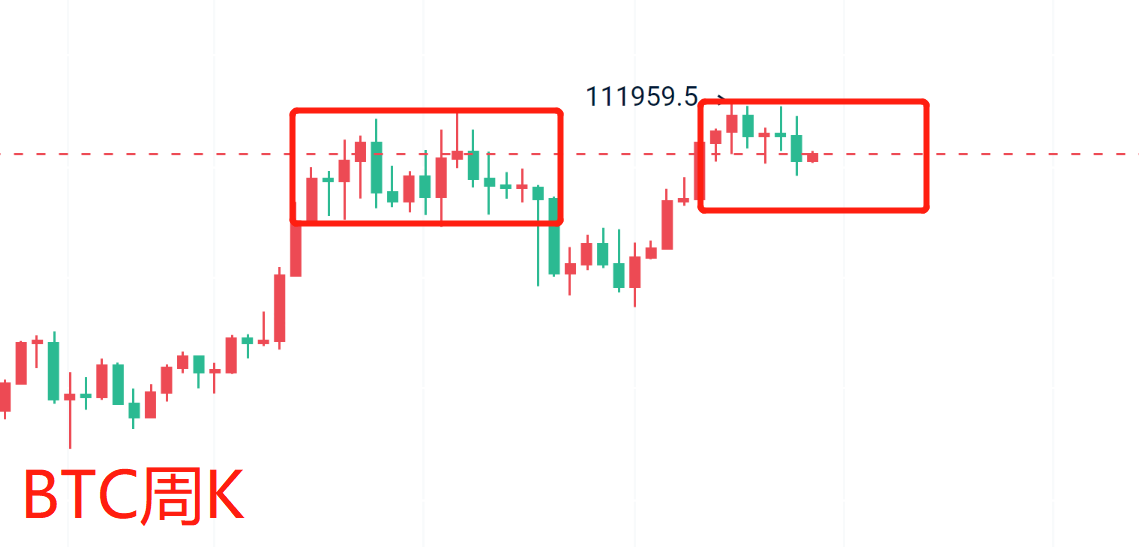

Hello everyone, I am trader Gege. Continuing from last time, the weekend's market continued to decline. After Bitcoin briefly broke the 100,000 mark, it rebounded and recovered. You might say that the weekend's market is related to the escalation of the Israel-Palestine conflict and Trump's involvement, of course, this reason cannot be ruled out. What I want to say is that after last Monday's weekly K close, I updated the article focusing on the technical feedback of the weekly K. At that time, I emphasized that bulls should be cautious, as the overall structure is not favorable for bulls. In Friday's update, I mentioned that once a break occurs, one can refer to previous articles for ideas (these can be reviewed in previous articles for verification). In short, regardless of the news, the technical aspect also provides us with certain guidance and feedback. We need to review past market conditions without getting entangled, and let's talk about the current market situation.

On Monday, as per the usual practice, let's first discuss the weekly K. Bitcoin's weekly level has broken below MA7, so this week we will simply refer to MA7 as a short-term boundary above. If it does not stabilize, we will continue to look for a downward fluctuation. From the overall structure of the K-line, this week is still not favorable for bulls. Although it has currently recovered above 100,000, once the previous K low is lost, it will continue to decline and test near the middle track, and the double top structure will need to further expand and release.

On the daily level, BOLL is in an opening state, and the market has broken below MA60. Once BOLL opens a downward channel, the market will further test near EMA200. Currently, the BOLL downward channel has not been fully confirmed and needs observation, so in the next two days, we will observe whether the K-line can again produce an entity K-line breaking the 100,000 mark. From the 4H level, the overall K-line shape shows that the short-term upper resistance can refer to the previous bottom-top conversion, which is also close to MA60 and EMA200. In summary, the short-term fluctuation area should first refer to 104,000-100,000 for entry.

Ethereum's weekly line has closed with a large bearish candle testing near the middle track, and this line is also the chip area from last August-September. Similarly, for Bitcoin, if the upper MA7 cannot break and stabilize, then it will continue to maintain a weak fluctuation structure. The technical feedback on the daily level is similar to Bitcoin, so I won't elaborate further. The short-term focus is also to refer to Bitcoin's ideas, paying attention to the range of 2380-2180.

Bitcoin: Short at 103800-103300, targeting 2000 USD. Long at 101200-100800, targeting 2000 USD.

Ethereum: Short at 2340-2380, Long at 2200-2180, targeting 100-120 USD.

The suggestions are for reference only. Please manage risk when entering the market, and control profit and stop-loss spaces yourself. Specific strategies should be consulted in real-time.

Alright, friends, we will say goodbye until next time. I wish everyone to do better and have a smooth journey in the crypto world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by/ I am trader Gege, a friend willing to accompany you to rise again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。