On June 17, Eyenovia, a digital eye care technology company (stock code: EYEN), announced that it has signed a securities purchase agreement to conduct a PIPE (Private Investment in Public Equity) of $50 million to qualified institutional investors. This will be used to establish its first cryptocurrency reserve program, targeting the Hyperliquid native token HYPE, with the $50 million investment amount far exceeding the company's market value of $20 million.

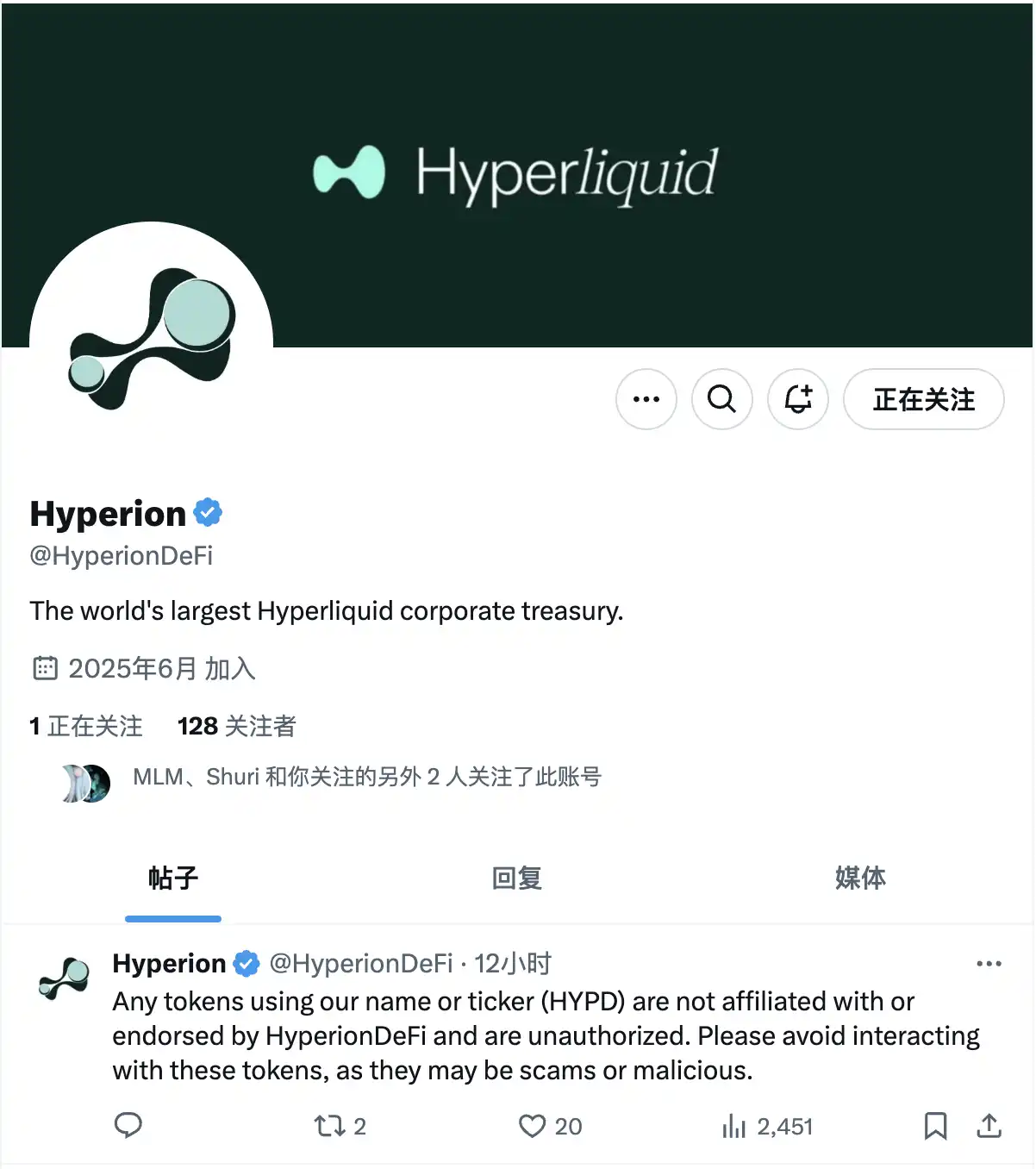

To drive this strategic transformation, the company simultaneously appointed Hyunsu Jung as the new Chief Investment Officer (CIO) and board member, and announced that the company name will be changed to Hyperion DeFi, with the stock code updated to HYPD. As the first publicly listed company in the U.S. to use an on-chain exchange token for a "microstrategy" plan, what exactly is Eyenovia? Who is the driving force behind it, Hyunsu Jung? And with more and more companies utilizing crypto tokens for "rebirth," will $Hype be a better choice?

Eyenovia's Lifeline Amidst Delisting

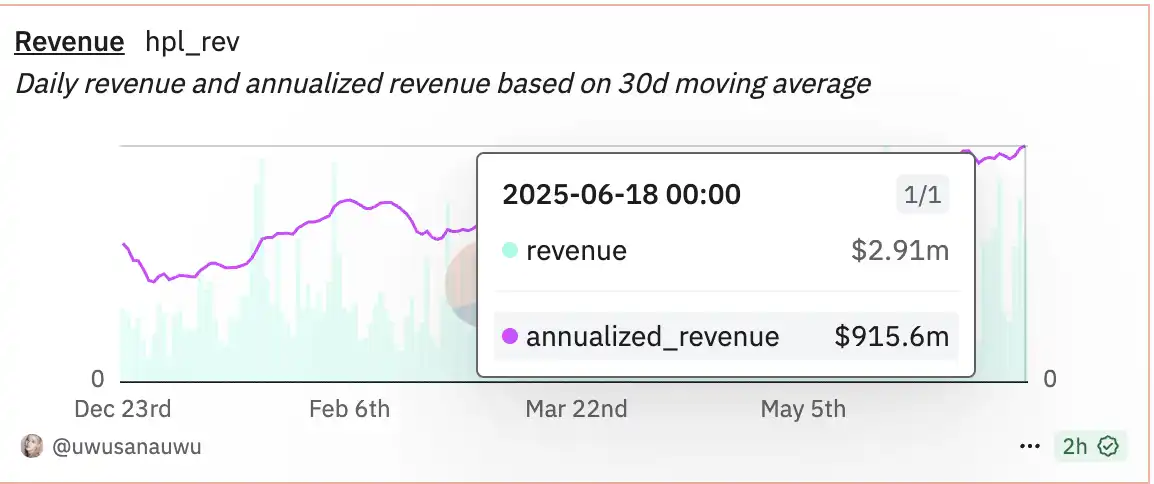

With the recent activity of Hyperliquid, its mainnet's Total Value Locked (TVL) has surged into the top 10 of public chains, and the market capitalization of $HYPE has risen to 11th among all cryptocurrencies, with the number of participants gradually increasing. The platform's daily transaction fees can maintain between $2-3 million, and its annual revenue is nearing $100 million.

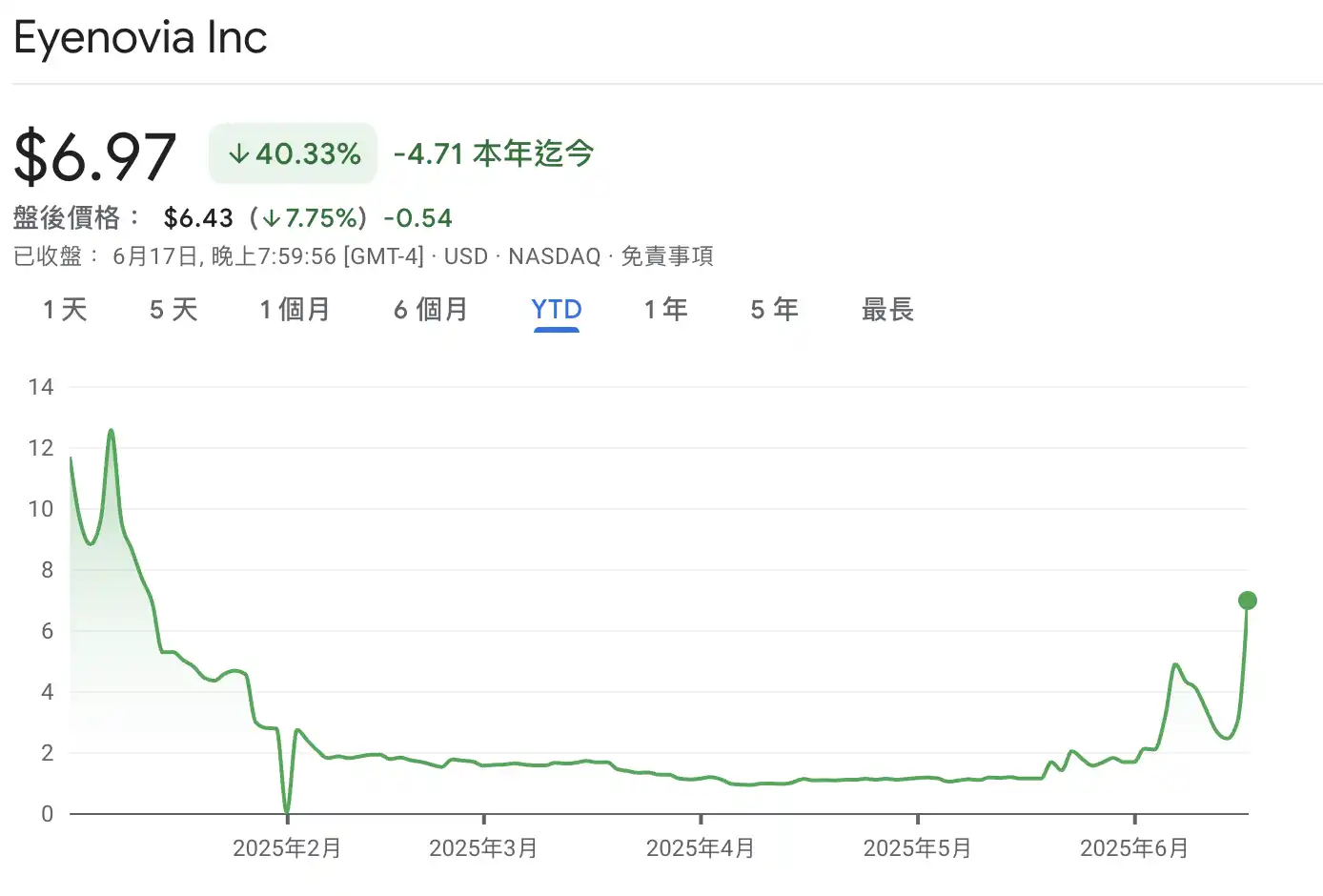

However, the other main player in the partnership, Eyenovia, has not fared as well. Since its listing at $800 in February 2018, it has plummeted to a low of $1 by April 2025. Eyenovia's core business is an ophthalmic company centered on a device-driven micro-dosing delivery platform, with product directions covering pupil dilation, postoperative inflammation reduction, and treatment of myopia in children.

Eyenovia's main product Optejet

The company reported only $56,000 in revenue for the entire year of 2024, with a net loss of $50 million and liabilities exceeding $10 million. With cash flow depleted and failures in new product trials, Eyenovia is facing imminent delisting. The HYPE reserve strategy has provided Eyenovia with a "lifeline," and after the news broke, Eyenovia's stock price soared 134% in a single day.

The Arrival of Crypto Executive Hyunsu Jung

Previously, Eyenovia had no connection to blockchain or related industries, which is why the appointment of Hyunsu Jung as Chief Investment Officer (CIO) with 500,000 shares of common stock as an incentive has drawn attention. According to public information, Hyunsu Jung previously served as a senior advisor at Ernst & Young's Parthenon, and has also worked as an investment analyst at GoldenTree Asset Management and as an asset management analyst in New York City.

His formal entry into the blockchain field was at DARMA Capital, an investment advisory firm founded by Andrew Keys (one of the co-founders of Consensys) in 2018. DARMA's philosophy is to help clients hold ETH long-term while enhancing returns and controlling risks through DeFi tools. It offers Ethereum staking custody and validation node services, combining restaking and LST strategies to generate additional returns.

In December 2023, he joined Aligned as a partner. Aligned is an infrastructure solution for mining and high-performance computing, staking, and liquidity provision. Its founder, Neal Kaufman, previously worked at McKinsey and, like the core team of Hyperliquid, graduated from Harvard University, graduating as a Baker Scholar (top 5% of the class).

His work in the product department at DARMA and at Aligned has accumulated a wealth of relevant experience and connections for executing Hyperliquid DeFi's "microstrategy."

There isn't much information available about Hyunsu on public websites, but Max, a core member of the Hyperliquid ecosystem, shared his 10-year connection with Hyunsu Jung: "It has been nearly ten years since Hyunsu and I were broke exchange students in Edinburgh; it has also been five years since we roomed together in San Juan and ventured into cryptocurrency."

A suspected Hyperion account, shared by community member Max.

On-Chain Hyper Microstrategy: Stake HYPE for Passive Income

Eyenovia stated that this transaction is only open to institutional investors. The company will issue 15.4 million shares of convertible preferred stock and 30.8 million common stock warrants, with both the conversion price and exercise price set at $3.25 per share. If all warrants are fully exercised, Eyenovia is expected to raise up to $150 million in additional funds.

While it cannot be guaranteed that all warrants will be exercised, if the transaction goes smoothly, Eyenovia could acquire and stake over 1 million $HYPE.

The official announcement states that the purchase of over 1 million HYPE will be entrusted to Anchorage Digital for custody. Just a few days earlier, on June 12, the Canadian listed company Tony G Co-Investment saw its stock price soar over 800% within an hour after purchasing 10,000 $Hype, leveraging just $430,000 to unlock a market value of $57 million.

Eyenovia's CEO Michael Rowe stated, "We are excited to join the growing number of companies adopting similar strategies to realize the diversification, liquidity, and long-term capital appreciation potential represented by cryptocurrency. After a thorough review of all available options, the board and I unanimously believe this transaction is in the best interest of our shareholders."

Jung added, "I am honored to join the Eyenovia team to help lead this groundbreaking cryptocurrency funding strategy, which is built around what we believe to be the most robust digital asset, HYPE. We believe Hyperliquid is one of the fastest-growing and highest-revenue blockchains in the world."

These two statements suggest that Eyenovia's strategy may not only be to purchase Hype but also to build a complete strategic system around it. According to the HIP-3 protocol on Hyperliquid, allowing nodes to "list tokens" requires staking at least 1 million $Hype, enabling token deployers to earn 50% of the total market fees and configure custom fees based on that.

Regarding how to construct a Hyperliquid version of a microstrategy, community member Telaga proposed his vision, believing that the on-chain structure of HyperStrategy is gradually emerging as a decentralized extension of the holding logic of MicroStrategy. Rather than being a simple asset allocation model, it is a set of "strategy protocol systems" that embed liquidity, yield, leverage, and capital structure into on-chain financial infrastructure.

Telaga's HyperStrategy concept views the native token $HYPE on Hyperliquid as a high-volatility digital asset similar to BTC. The difference is that $HYPE does not exist as a narrative of digital gold but participates in the entire protocol ecosystem as an on-chain economic engine with endogenous cash flow. Therefore, HyperStrategy has designed a structured exposure and yield compounding treasury mechanism, allowing users and institutions to obtain long-term stable on-chain returns through staking, lending, trading, and market-making.

Specifically, the treasury is funded by external users, primarily deposited in the form of USD stablecoins. After the funds are deposited, users receive two types of on-chain certificates: one is a Convertible Debt Token (CDT), representing principal rights; the other is an Options NFT, symbolizing future profit options or repurchase rights. This design allows user assets to have liquidity while binding long-term value growth expectations through contract structures.

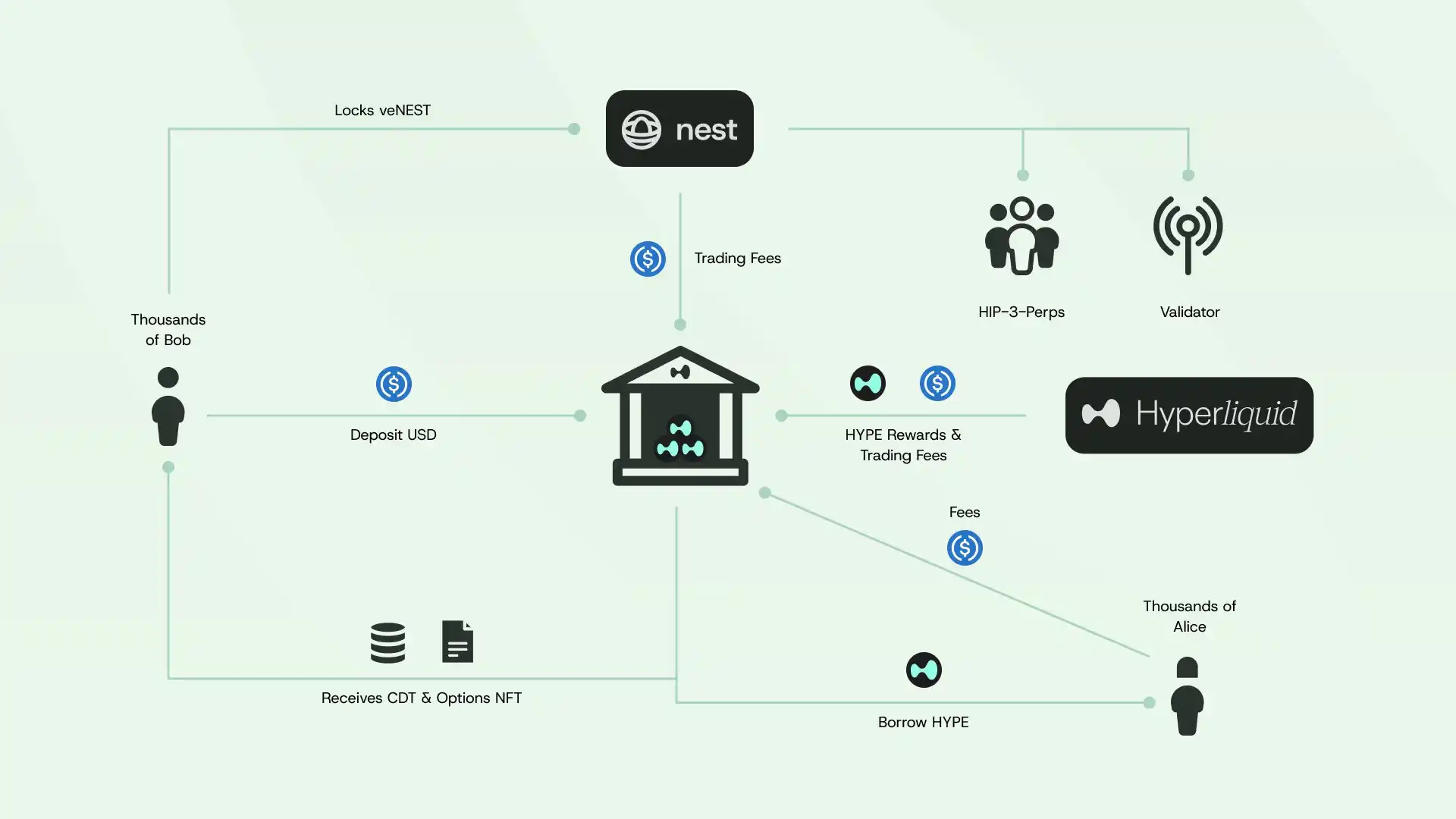

Once the funds enter the treasury, the protocol will deploy this portion of stablecoins into multiple yield modules. The primary strategy is to lend out $HYPE to other users through an on-chain lending system, earning interest in the process. Additionally, the treasury can participate in trading and liquidity provision on the Hyperliquid platform, collecting trading fees and platform incentives. Alternatively, it can stake $HYPE as a validator node to earn rewards generated by the network's operation. In more advanced configurations, funds can also be invested in Nest's trading protocol, obtaining additional profit sharing through LP market-making and locking veNEST. Meanwhile, HyperStrategy also integrates on-chain derivatives protocols, such as HIP-3 perpetual contracts, further enhancing the efficiency of fund utilization.

In the revenue recirculation mechanism, the treasury will periodically collect and consolidate income from staking rewards, trading fees, lending interest, and other sources. The protocol will use the revenue for buybacks, reinvestments, or to execute repayments of CDT and fulfill Options NFT obligations according to the rules. Some designs may also introduce NAV (Net Asset Value) growth logic, making the entire strategy system more aligned with the transparency and stability of traditional asset management institutions.

Following Eyenovia, on June 20, the U.S. listed company Everything Blockchain Inc. (EBZT) also incorporated HYPE into its portfolio, announcing plans to invest $10 million in five major blockchains, including Hyperliquid (as well as Solana, XRP, Sui, and Bittensor), to create a multi-token staking treasury aimed at institutional adoption trends. EBZT's official statement indicated that this strategy would make it the first U.S. public company to directly return staking rewards to shareholders, expecting to generate approximately $1 million in staking rewards annually after deployment, with plans to reward investors through dividends in the future. From this perspective, it seems that using a compound yield on-chain treasury to reward investors may be more sustainable than simply buying tokens for speculation.

Why HYPE?

The gameplay of HyperStrategy differs from BTC; it is not merely about increasing $HYPE holdings at a single point but rather constructing an on-chain treasury capable of generating compound yields over the long term. This structure transforms holding behavior from being merely "static holding" into a configurable, manageable, and dividend-paying on-chain asset operation model. For traditional listed companies like Eyenovia entering Hyperliquid, such strategy protocols not only provide a starting point for on-chain exposure but also create a complete financial model with liquidity, cash flow, governance rights, and potential capital appreciation.

The protocol economy formed around $HYPE seems to be providing a foundational experimental ground for on-chain financial operations, fund management, and balance sheet construction. Of course, some community members believe that with Coinbase and Robinhood announcing the issuance of perpetual contracts in the U.S. region, the pressure faced by Hyperliquid, which primarily serves large holders from the U.S., is unprecedented.

Can Hyperliquid continue to maintain its current growth model? Will the "on-chain microstrategy" succeed, or is it merely a way to "exit liquidity"? Rhythm BlockBeats will continue to monitor this situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。