In the week in which it clocked more than 40 days above $100,000, bitcoin (BTC) ended the week at $103,355, about 1.3% lower. While the escalating conflict between Israel and Iran and the attendant risks spooked markets, BTC, like other traditional assets and markets, was largely unshaken.

In fact, as the conflict intensified at the start of the week, BTC trended upward, peaking at just under $109,000 on June 16. However, some 24 hours later, the cryptocurrency had dropped to $103,645 before recovering to trade between $104,000 and $105,000 for the three days that followed.

During the week, the U.S. Jerome Powell-led Federal Reserve predictably voted to keep interest rates unchanged, a decision that once again enraged the U.S. President. However, reports quoting Federal Governor Christopher Waller hinting at a rate cut in July propelled BTC past $106,000 on June 20. The resurgence was, however, short-lived as the top cryptocurrency slumped to $103,000 a few hours later.

Like BTC, several other large-cap digital assets closed the week in the red, with Hyperliquid’s 19% reverse the highest of any top 20 digital asset. Not even the flurry of news about companies adding HYPE to their respective treasury could halt a slide that began shortly after it went past the $45 mark on June 16.

AVAX and SUI were the next biggest losers, dropping 9.9% and 10% respectively, followed by DOGE, which was 9.2% down. ADA, which traded around $0.83 on May 23, ended the week at $0.5744, or 8.6% lower.

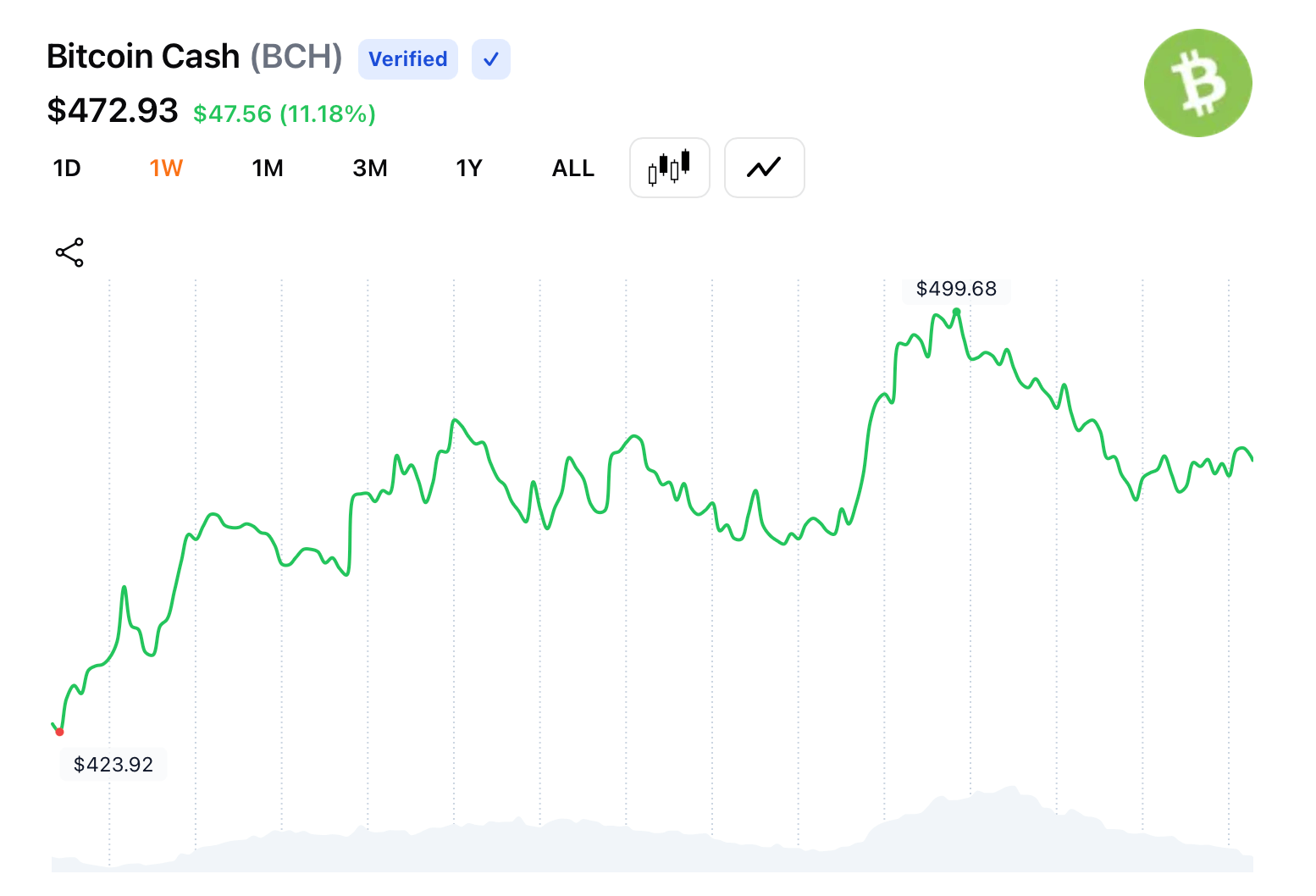

Meanwhile, BCH led the gainers this week after it rose by nearly 10% to close at just over $476. Since its June 5 low of $382.22, BCH is now up by nearly 24%, making it one of the best-performing top 20 digital assets in June so far.

Other notable gainers in the week include WBT, which went up by over 25%; SEI (28%); and KAIA (26%). SNTR was the biggest gainer of the week after rising by nearly 800%, while ZKJ was the biggest dropper after falling by 85%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。