Circle is undoubtedly the most fervent representative in the cryptocurrency stock sector since June, with a price increase of over 500% since its IPO on June 5.

On June 18, CRCL's stock price hit an all-time high, with a market capitalization reaching $48.4 billion. According to data from Yahoo Finance, Circle currently has approximately 36.34 million shares in circulation, accounting for 17.94% of its total share capital (Shares outstanding: 202.55 million shares). Based on the closing price of $199.59 on the 18th, the corresponding market capitalization is approximately $7.253 billion.

The rise in Circle's stock price has also stimulated a corresponding increase in Coinbase's stock price, marking the first time since COIN's IPO that it has diverged from the surge in cryptocurrency prices and trading volumes.

With Circle's stock price reaching new highs, institutions have begun to gradually take profits.

ARK Profits $96 Million, Just from Gains

Reports indicate that Circle plans to issue 24 million shares, raising $624 million, corresponding to a target valuation of $6.7 billion. ARK Invest subscribed for $150 million, while BlackRock, led by Larry Fink, invested $60 million, with these two institutions collectively accounting for about 35% of this fundraising round.

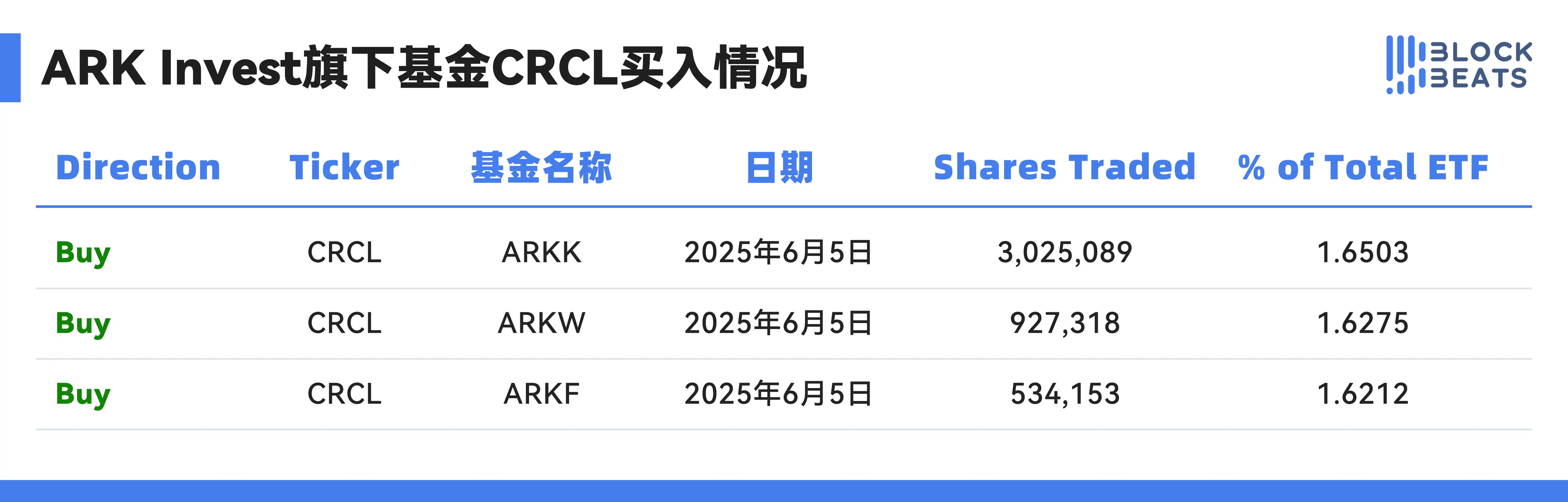

On June 5, ARK Invest purchased nearly 4.5 million shares of CRCL on the first day of Circle's listing, with a total value of approximately $373 million based on the closing price.

On June 16, as CRCL's price broke through $160 to set a new historical high, ARK Invest sold a total of 342,658 shares of Circle Internet Group Inc. through its three exchange-traded funds (ETFs). Among them, the ARK Innovation ETF (ARKK) reduced its holdings by 196,367 shares, the ARK Next Generation Internet ETF (ARKW) reduced by 92,310 shares, and the ARK Fintech Innovation ETF (ARKF) reduced by 53,981 shares; the total value was approximately $51.7 million.

On June 17, as CRCL's stock price rebounded and broke through $160 again, ARK Invest's three ETFs sold over 300,000 shares of CRCL, generating $44.76 million in revenue.

Despite selling over 600,000 shares, ARK Invest still holds nearly 4 million shares of Circle stock, valued at approximately $371 million, accounting for 6.13% of its ETFs. This means that based on the current stock price, ARK's two sell-offs this week only realized profits from their current CRCL holdings.

Related Reading: The Crypto Bull Market, All in U.S. Stocks: Circle's Journey from $31 to $165 in Ten Days

Missing Out, Selling High, Can Crypto Traders Short Circle Now?

"Circle's market capitalization has risen to $40 billion, while the USDC it issues is only $60 billion." A seasoned trader expressed on social media, reflecting the complex mindset of crypto traders regarding CRCL's recent performance. The wild surge of CRCL since its listing not only mirrors the collective sentiment of the crypto market but also reveals the differences in understanding and strategies among various trading groups.

Those familiar with the operational logic of USDC should have been the earliest beneficiaries, but in this round of IPO frenzy, a rare split has emerged—some "held their noses and bought," while others "understood the logic but found the valuation too high," ultimately missing out on the rise. Meanwhile, more traditional stock investors, due to information barriers and narrative differences, rushed into CRCL, with bullish sentiment driving the price sky-high.

"No one dared to go all in on CRCL, which may be a regret for a long time," crypto trader yuyue wrote, "Before a legitimate IPO of USDT in U.S. stocks (which is almost impossible) or USD1 surpassing USDC and completing an IPO (which is unlikely in the short term), Circle will firmly occupy the leading position in this narrative."

"My consistent success in U.S. stocks has been defeated by this cryptocurrency stock!" Twitter user "Sweet Pear" self-deprecatingly remarked, "Ever since Circle went public, I've been thrown into chaos; the logic I used to play stocks no longer applies, and instead, I have to use the logic of trading cryptocurrencies, which makes it all confusing. Now, U.S. stocks feel like a chaotic mess to me." For Sweet Pear, the fundamentals of Circle do not support this round of price increase, yet the short-term trend cannot be explained by conventional models.

Some traders attribute the short-term surge to a circulating market capitalization of less than 18%, comparing it to the extremely small market conditions of WLD at the time, which once again provides crypto traders with a lesson: "Fundamentals and short-term trends are two different things."

Others choose to bet on the Beta effect, with crypto KOL Taiki writing before Circle's listing: "Companies like CRCL are essentially pricing anchors for stablecoins; if it is worth $10 billion, then the valuations of ENA and MKR must be recalculated." Taiki aims to capture the spillover effect by increasing his holdings in DeFi blue-chip assets. Now, CRCL has soared to a market capitalization of $40 billion, while the performance of ENA and MKR is clearly not on par with CRCL.

Another group of people who have not participated has a simpler reason—too well-informed. Lin Jie from Deribit once bluntly advised her family not to touch CRCL, believing that "Circle's revenue structure is singular and has long been a red ocean; BlackRock's BUIDL and Trump's USD1 will squeeze their market share." Her judgment is not emotional but stems from a profound understanding of the stablecoin ecosystem. However, she also admits, "In the crypto space, knowing too much can sometimes become a burden."

Unlike crypto traders who repeatedly scrutinize valuation and fundamentals, U.S. stock investors are more willing to listen to stories. As crypto KOL Kay stated on X, U.S. stock traders buying CRCL see "the supreme leader's national strategy, replacing VISA, charging towards 2000," while the so-called real users in the crypto space see "high compliance costs with no profits, a high risk of losses during interest rate cuts, and issuance relying on massive subsidies, with a reasonable valuation of 30-50."

Previously, Jack Zhang, co-founder and CEO of Airwallex, sparked market discussions by questioning the actual use of stablecoins on X, and he has now stated, "It's time to short Circle."

But is it really time now?

The narrative surrounding Circle's stock is not prepared for crypto traders. A Coinbase x Circle maxi, Chris, believes that thinking Circle is too expensive is a form of "self-indulgence" among crypto traders, "You think it's a cryptocurrency revolution in finance, but the financial industry has not only joined the crypto space but has also revolutionized it."

Some view Circle's listing as a potential signal for a bull market peak, similar to how the day of Coinbase's listing coincided with the peak of the last Bitcoin bull market. However, others have raised objections: "The level of this bubble is far less than in 2021; altcoins have already been severely washed out, and BTC.D remains high."

More critically, CRCL is a traditional IPO, subject to a 180-day internal lock-up period, limiting short-term selling pressure, unlike the $COIN case where insiders could cash out directly. Many hedge funds were unable to enter on the first day of CRCL's listing and could only "chase high" in the secondary market. Some short-selling institutions are also facing extremely high annualized funding rates (over 5%), making it difficult to exert substantial pressure.

As Arthur Hayes stated: "Should you short Circle? Absolutely not. You can choose not to buy, but don't short it. Emotional premiums are the most terrifying accelerators of volume."

Perhaps Circle's market capitalization is not worth believing in right now. But what it represents—a stablecoin platform supported by BlackRock, Fidelity, Visa, Coinbase, and others—has crossed the compliance red line and entered the mainstream U.S. stock market. Its valuation does not come from the consensus of the crypto space but from the stock market's repricing of "compliant fintech platforms."

Hayes believes Circle is severely overvalued, but the price will continue to rise because this listing marks the beginning of the current stablecoin frenzy, not the end.

Related Reading: Arthur Hayes: Stablecoin IPOs are a "dead end," but I advise you not to short them

In a time when traditional payment giants have not yet entered the market on a large scale, when USDT is unlikely to IPO, and USD1 is still under policy observation, Circle may be the only vehicle for this narrative. "There is no real future because the distribution channels for new entrants are closed; shove this idea into your foolish head and trade this hot potato like it's a piece of crap. But don't short it; these new stocks will leave shorts bleeding."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。