Israel vowed to intensify its strikes against Iran as the war between the two countries enters its seventh day. The beginning of the conflict last week coincided with a precipitous drop in the price of bitcoin ( BTC) which has since treaded water around the $104K threshold.

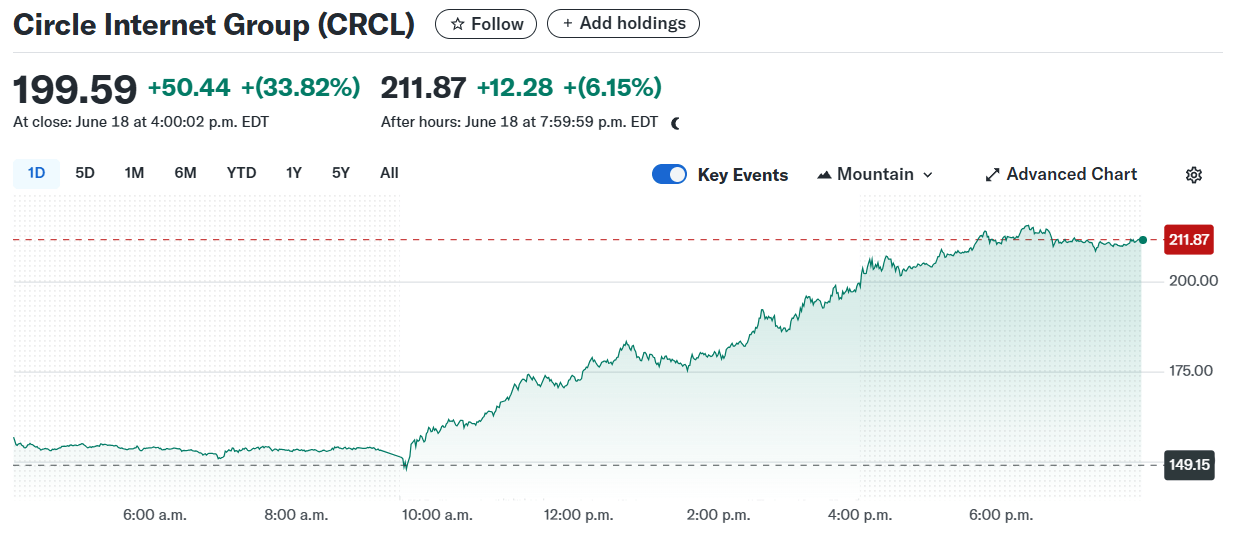

The broader crypto market barely budged on Thursday, shedding 0.09%, and stocks were mixed, with the S&P 500 and Dow down 0.03%, and 0.10% respectively, while the Nasdaq edged up 0.13%, according to data from CNBC at the time of reporting. Interestingly, stablecoin issuer Circle (CRCL) and crypto exchange Coinbase (COIN) both on the Nasdaq, were up 33.82% and 16.32% respectively when markets closed on Wednesday after the U.S. Senate passed the GENIUS Act on Tuesday.

(Circle was up 33.82% following approval of the GENIUS Act by the U.S. Senate / Trading View)

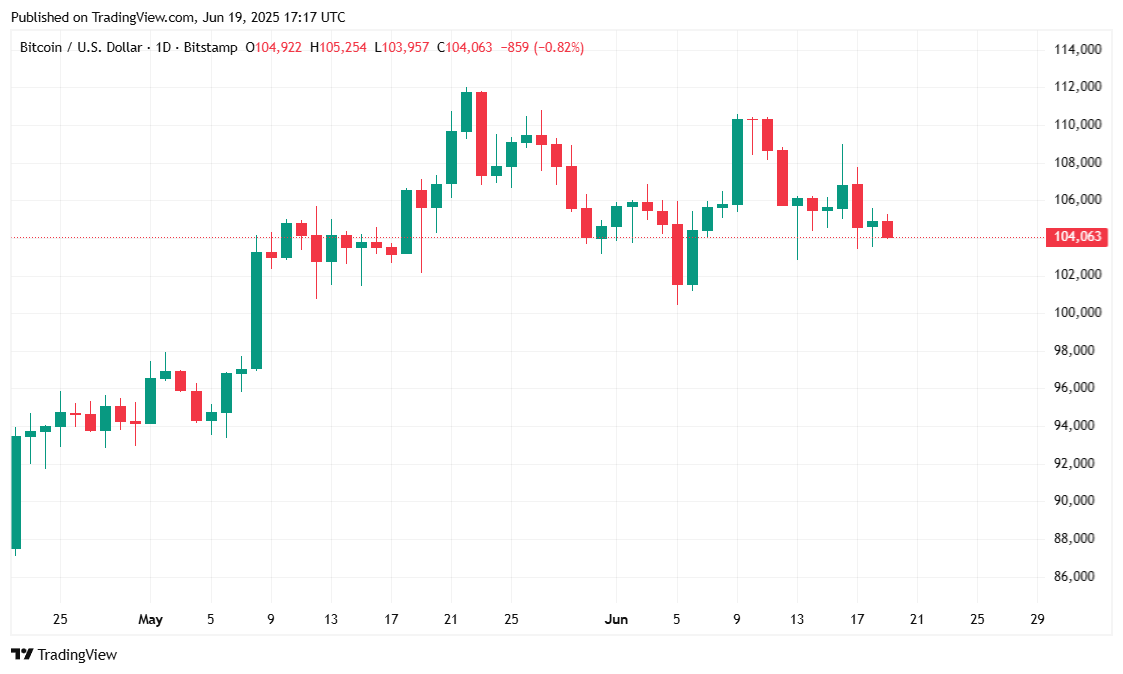

But while Circle and Coinbase were enjoying a jump in prices, bitcoin appeared stalled as Iranian missiles struck Israel’s Soroka Medical Center in Beersheba, prompting a dire warning from Israeli Defense Minister Israel Katz.

“The cowardly Iranian dictator sits deep inside his fortified bunker and launches deliberate attacks at hospitals and residential buildings in Israel,” Katz said. “The Prime Minister and I have instructed the IDF to intensify strikes against strategic targets in Iran.”

Bitcoin slipped marginally by 0.18% over the past day to trade at $104,116.58 at the time of reporting. Price action remained largely muted within a 24-hour range between $103,602.26 and $105,250.89, capping off a 3.50% decline over the past seven days. The lack of direction suggests investors are being cautious as conflict in the Middle East deepens.

( BTC price / Trading View)

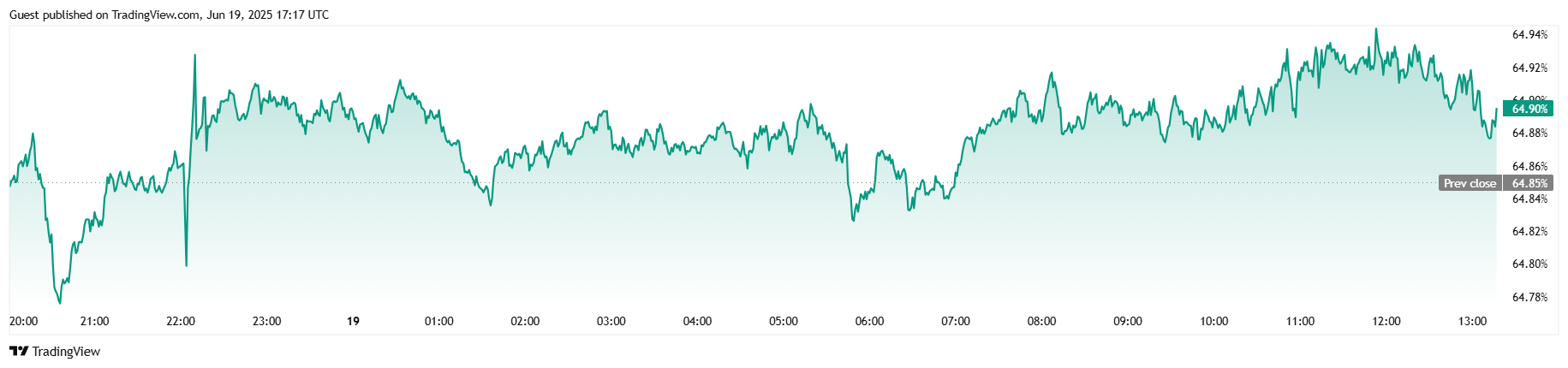

Trading volume echoed the geopolitical trepidation, falling 14.60% to $40.43 billion, indicating reduced participation across spot and derivative markets. Bitcoin’s market capitalization also dipped slightly by 0.17% to $2.06 trillion. However, BTC dominance rose by a modest 0.06% to 64.90%.

( BTC dominance / Trading View)

Futures markets saw open interest slip by 0.13% to $69.15 billion, reflecting a mild pullback in speculative positioning. Coinglass data shows $23.97 million in total liquidations over the past 24 hours, with long positions taking the lion’s share of that figure. There was $15.47 million in long liquidations versus $8.50 million in shorts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。