Dogecoin (DOGE) recovered from an intraday low of $0.164 to close near $0.171, posting a 4.7% bounce in line with broader market weakness. The move suggests institutional buyers may be quietly accumulating at lower levels as market participants brace for continued volatility.

News Background

- Dogecoin’s rebound comes in the wake of intense selling pressure sparked by escalating geopolitical tensions between Israel and Iran. The sharp market-wide correction, which triggered mass liquidations, briefly pushed DOGE down more than 7% intraday on Wednesday.

- Meanwhile, macroeconomic headwinds persist. The U.S. Federal Reserve continues to maintain restrictive monetary policy, keeping rates at 4.25%–4.50% while actively reducing its balance sheet — a dynamic that has historically weighed on riskier bets such as DOGE.

- Still, the memecoin remains one of the most liquid assets in the crypto space, with daily turnover near $1.37 billion and market cap holding above $24.7 billion.

- Elsewhere, technical indicators show DOGE entering oversold territory, and social sentiment data from LunarCrush reveals an 86% positive tone across 16,000+ mentions, suggesting continued community conviction even amid price volatility.

DOGE’s near-term outlook may hinge on regulatory developments, including a potential U.S. spot ETF decision, as well as continued adoption on DeFi platforms such as Coinbase’s Base network where wrapped DOGE is gaining traction.

Price Action

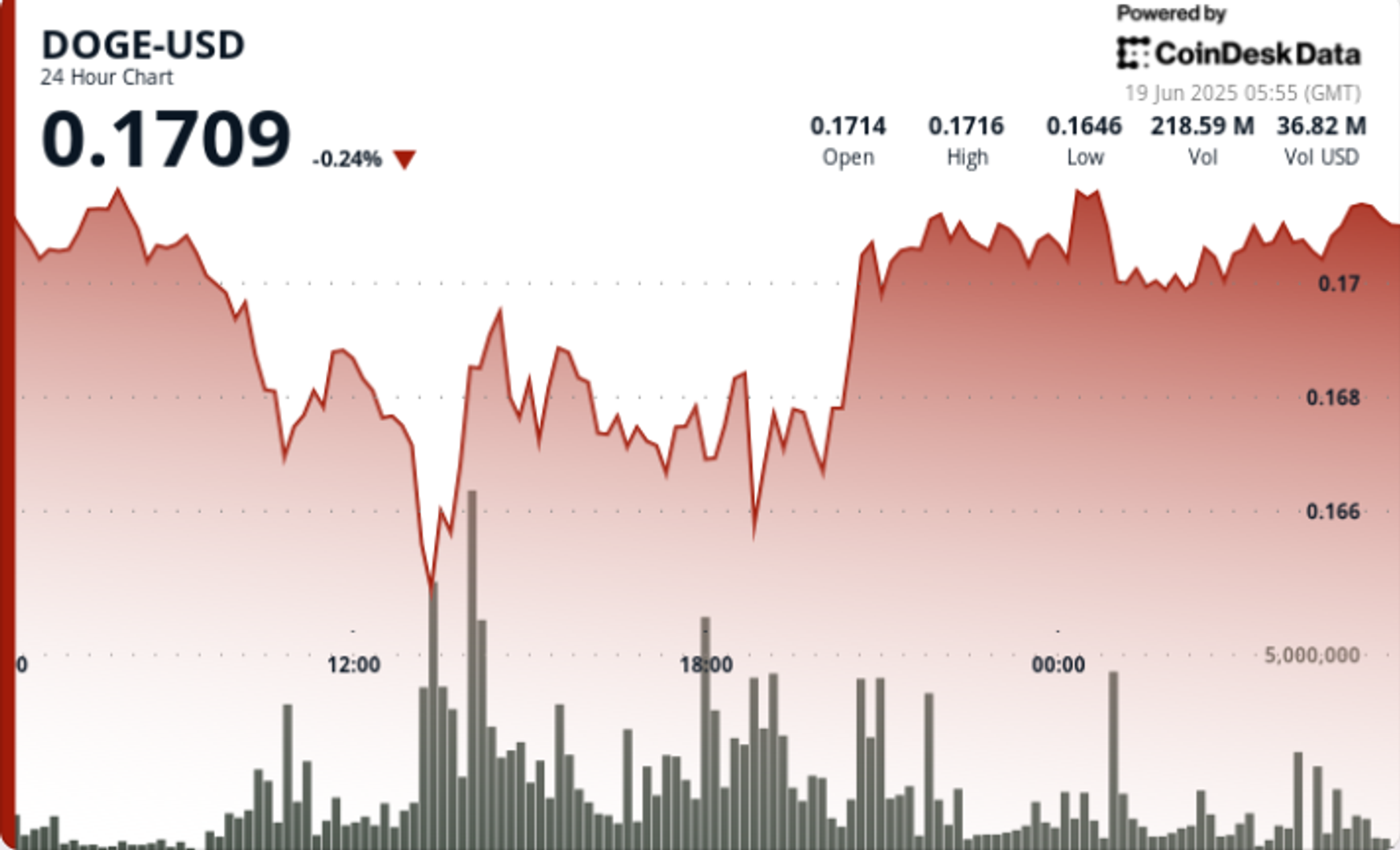

DOGE saw its sharpest decline during the 13:00 hour, dropping to $0.164 on a 591M volume spike — the highest of the day.

The strong bounce that followed pushed prices back above $0.171, where the memecoin found near-term equilibrium.

Price action has since consolidated in a tight band between $0.170 and $0.1696, with small volume bursts suggesting accumulation at lower levels.

Technical Analysis Recap

- DOGE posted a 4.7% recovery, rising from $0.164 to $0.171.

- Major liquidation-driven selloff occurred at 13:00, with volume peaking at 591M units.

- Volume-based support established at $0.164; resistance remains firm near $0.172.

- Recent candles show signs of accumulation, particularly during the 02:00–02:02 period (3.4M volume).

- RSI at 33.29 suggests DOGE may be nearing oversold territory.

- Price is consolidating just above short-term support of $0.1696.

- If DOGE breaks above $0.1750, the next resistance zone lies at $0.1820; failure to do so could trigger a retest of $0.1640 or even $0.150 in a risk-off environment.

- Technical patterns point to a descending triangle — typically a bearish signal — but reduced volatility suggests stabilization.

Disclaimer: Portions of this article were generated with the assistance of AI tools and reviewed by CoinDesk’s editorial team for accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。