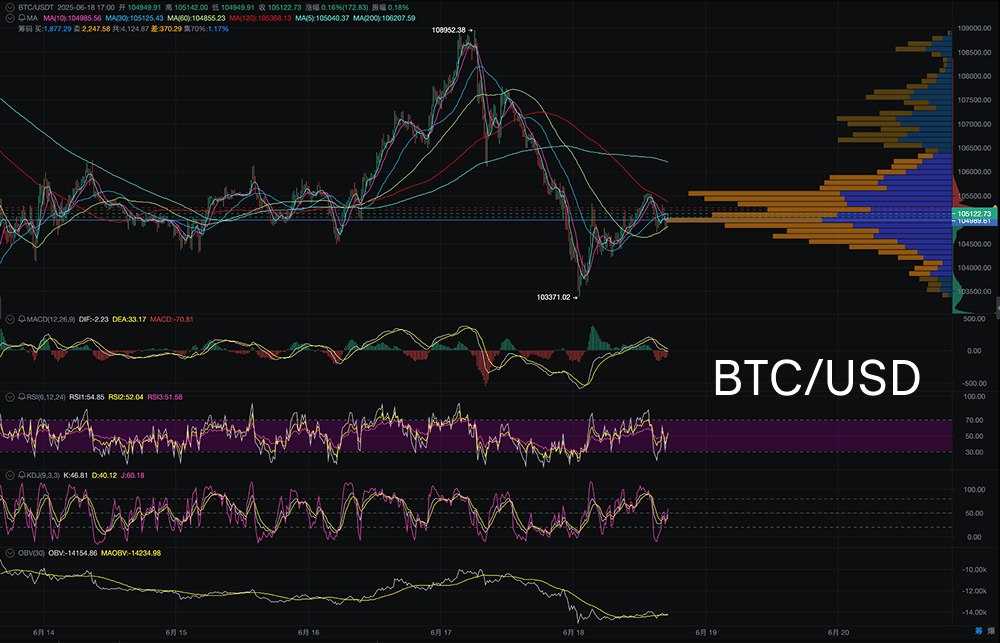

【Chart Source: AiCoin 15m K-line】

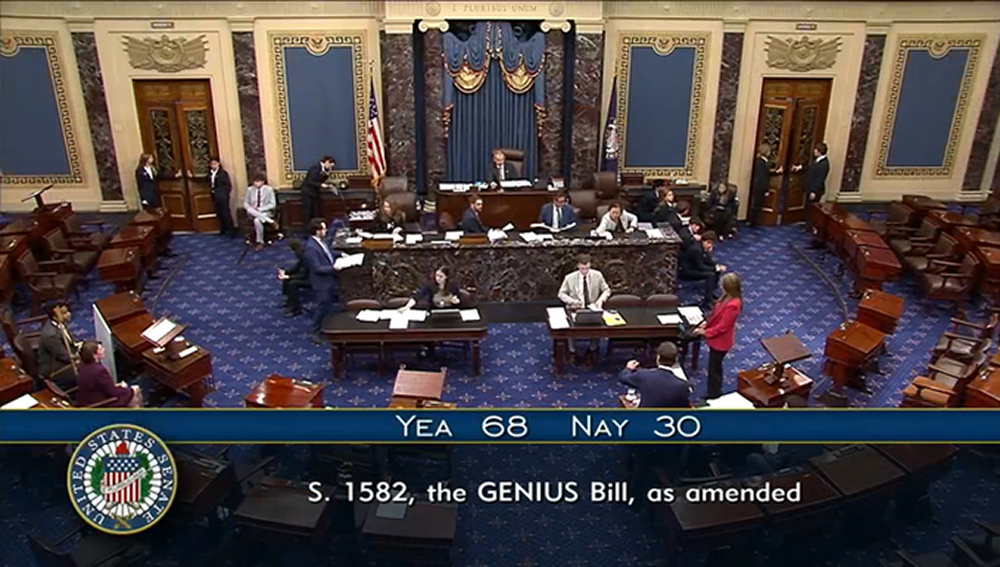

U.S. Regulatory Upgrades Catalyze Market Sentiment

Recently, the U.S. Senate once again passed the procedural agenda motion for the "GENIUS Stablecoin Act" (supporting votes 66:32), opening an important opportunity for the issuance and regulatory framework of stablecoins, and striving for a clearer regulatory path for crypto assets. This policy push releases signals that the "digital dollar" will receive formal recognition from the state, providing long-term support for BTC.

K-Line Pattern: Pullback Confirmation, Building Momentum Upwards

As seen in the chart: the recent high point is around $108,952, and the low point has pulled back to $103,371. This range has formed a clear horizontal accumulation pattern.

On the 18th, after falling from the high point, it stabilized near the MA10/30, showing a "pullback – bottoming – rise" rhythm, consistent with a three-phase upward structure.

Large Capital Dynamics & CME Gap

OBV (On-Balance Volume) is oscillating at a low level during the pullback but has not experienced a cliff drop, indicating that institutional funds are still slowly entering.

The key point is the existence of a CME weekly settlement gap, with the gap range approximately between $104,200–$105,500: the upper gap has not been completely filled, and the market usually has an inertia to "fill gaps," providing technical support for subsequent upward breakthroughs.

If this area continues to receive support, there is a possibility of a follow-up rally towards $110,000–$112,000 or even higher.

Technical Indicator Analysis

MACD: After a delayed drop from the peak, it has formed a "death cross," but still maintains a bullish structure above the zero line, indicating short-term stabilization.

RSI is hovering around the midline (50–55), with no obvious overbought or oversold conditions, suggesting an increased possibility of sideways movement, but does not rule out a rapid upward surge after the accumulation of breakout strength.

The KDJ indicator's J value has fallen and then risen again, signaling a rebound in the medium to short term.

Positive News

The U.S. Senate passed the "GENIUS Act" on Tuesday with a vote of 68 in favor and 30 against, marking the first comprehensive regulatory reform bill for cryptocurrencies in the U.S. The bill, led by Republican Senator Bill Hagerty from Tennessee, will establish a regulatory framework for stablecoins pegged to the dollar, signifying an important breakthrough for the digital asset industry in the legislative field. 18 Democratic senators supported the bill alongside the majority of Republicans, and it will now be submitted to the House of Representatives for further review.

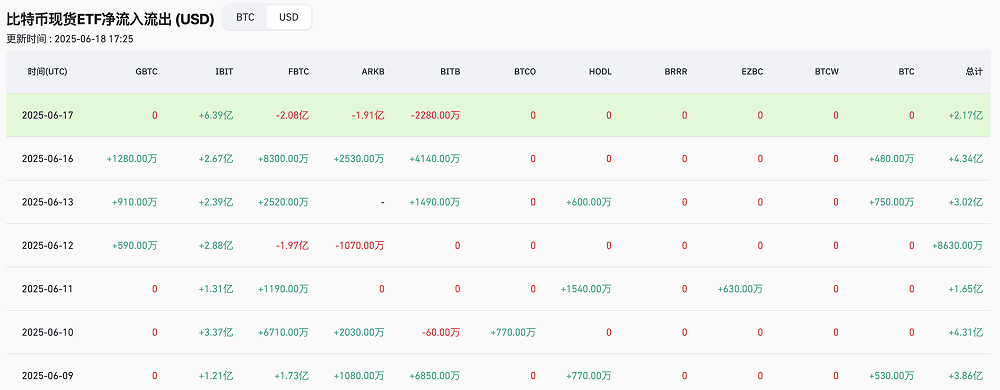

The continuous layout of large institutional funds and the increase in ETF holdings (BTC ETF has seen steady inflows recently), along with clearer stablecoin laws, further enhance institutional confidence.

Comprehensive Conclusion and Market Outlook

Range-bound oscillation is the main trend, with the upward trend still intact.

The pullback to the $103–$104k support area is solid, and after returning to the gap area, the bullish structure is clear. After breaking out, if MACD regains a golden cross, it may further challenge $110–$112k. Funds are still flowing in, and the CME gap remains unfilled.

In the tug-of-war between bulls and bears, the OBV indicates a state of accumulation. If the gap continues to pressure support, the strength of the breakout will increase, and new highs in the short term cannot be ruled out. The short-term is critical, and timing is key.

If in the coming days the pullback confirms support at $104–$105k, and MA10/30, RSI, and KDJ confirm a strengthening trend, bulls are expected to continue to exert force; otherwise, caution is needed for the risk of further downward adjustments if technical indicators form a death cross (target could drop to around $102k). The policy benefits continue to intensify.

The stablecoin bill is nearing its final vote, and if officially passed, it will provide an unprecedented legal identity for crypto assets, boosting the entire market structure and is expected to become a significant positive signal in the second half of the year.

Strategy Suggestions (For Reference Only)

In Conclusion

This round of BTC pullback has solidified the bottom, with no signs of fund withdrawal; if the CME gap is maintained and confirmed, BITC may once again break through $110k and challenge $112,000–$115,000; if U.S. stablecoin regulations continue to advance, the second half of 2025 may see an explosive background akin to X2 or even X3.

However, in the short term, it is crucial to hold the $104–$105k support level. If this range is lost, the probability of a pullback to $102k or even $100k will increase—this may be a good opportunity for the next round of entry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。