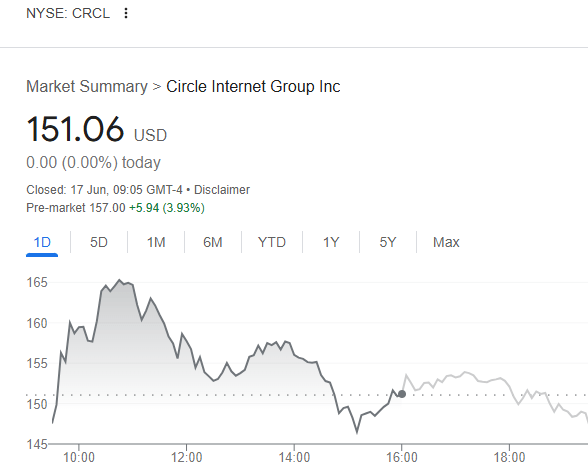

On June 16, stablecoin issuer Circle’s stock surged to $165.60, a new all-time high, before receding to close the day just above $151. The new all-time high briefly brought CRCL’s gains since it debuted on Nasdaq to more than 500%, making its listing one of the most successful in 2025 so far.

Interest in Circle’s stock, initially shown by the upsizing of its initial public offering (IPO) and now CRCL’s rally, is seen reflecting growing investor interest in the stablecoin business. Circle’s listing success is also seen kick-starting a wave of IPOs by companies seeking to cash in on investor interest in the stablecoin issuing business.

However, some observers, including Arthur Hayes, co-founder of Bitmex, warn that Circle’s phenomenal run since listing may be hard to follow. In fact, in his latest blog post, Hayes warns that the next wave of stablecoin listings will be “Circle copycats” with the respective issuers’ stocks “more overvalued on a Price/AUC ratio than Circle.” Hayes asserts that such copycats will “never eclipse” Circle, the No. 2 stablecoin issuer after Tether, in revenue generation.

The warning by Hayes, whose family office has interests in Circle’s rival Ethena, comes amid increased talk of traditional financial institutions, giant tech firms and social media companies weighing launching their own stablecoins. As has been reported, Airbnb, Apple, Google, Meta and X are some of the prominent firms interested in the stablecoin business. Indeed, Meta did attempt to launch a digital asset called Libra, but this was ultimately thwarted by the then-U.S. government.

Since coming into office, the Trump administration has, however, moved to remove legal barriers and regulations seen to be stifling the digital asset’s growth in the U.S. Furthermore, the U.S. Congress, seen by some as the most pro-crypto ever, is on course to pass legislation to legitimize stablecoins and the digital asset industry. Many observers believe this will see more companies that are inspired by Tether and Circle racing to launch stablecoins.

Meanwhile, Hayes suggested that the chances of another stablecoin issuer seeing its stock as overvalued as Circle’s is very slim. However, that is not going to stop them from attempting to hoodwink the investing public into parting with their money, Hayes warns.

“The promoters will tout meaningless TradFi credentials in a bid to convince investors that they have the relationships and ability to disrupt the legacy banks in global dollar payments by partnering with them or using their distribution channels,” Hayes explained.

He added that the upcoming stablecoin legislation may enable Circle copycats to “create some fugazi algorithmic stablecoin Ponzi”if it gives more freedom “in terms of what backs a stablecoin and whether they can pay yield to holders.” Still, Hayes warns against shorting these copycats’ respective stocks, as this may result in steep losses.

“But do not go short. These new stocks will rip the faces off of shorts. The macro and micro are in sync,” Hayes warned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。