When people misunderstand the two, it often triggers Rug events.

Written by: Dino

Translated by: Luffy, Foresight News

Historically, financial capital has been the dominant perspective through which we measure and exchange value. Financial capital includes cash, equity, and other liquid or investable instruments, flowing through the banking system, investment funds, and public markets, where it is priced, traded, and optimized for investment returns.

However, the value in today’s economic system is no longer limited to the financial level.

Attention capital arises from the scarcity of attention. In an information-saturated world, what people choose to focus on and think about becomes a valuable resource.

Social capital is built on trust, reputation, and influence, representing the value accumulated from interpersonal networks and relationships, reflected in others' perceptions of your credibility, capabilities, and alignment of values.

Thanks to artificial intelligence and blockchain, we are entering a new era. In this era, attention can be easily quantified, traded, and speculated upon, while social capital can also be staked, reduced, and mortgaged. These are no longer abstract concepts but programmable primitives. They are giving rise to two new types of markets.

Attention ≠ Social Capital

It is crucial to clarify the distinction between attention and social capital:

Attention capital concerns what people see, click on, or react to at the moment, reflected through short-term engagement metrics such as impressions, views, likes, and shares, driven by viral spread and trends.

Social capital reflects what people truly trust, respect, or wish to associate with; it not only needs to be "earned" but also "recognized." It accumulates slowly, relying on sustained behavior and community validation.

The key point is that attention is more easily manipulated. Bots, clickbait, emotional provocation, or meme hype can enhance visibility without substantial content; whereas social capital is extremely difficult to fabricate, requiring time, reputation, and actual investment.

What kind of capital are you trading?

Some platforms operate entirely based on attention capital, such as:

Pump.fun is built entirely around viral reflection, with token appeal relying on short-term memes, influencer promotion, and cultural hotspots, belonging to a purely attention market characterized by high liquidity, high sensitivity to hype, and reflexivity. The recent Loud! experiment is an extreme case.

Noise allows users to speculate on popular crypto projects, tokenizing "mind share" (rather than belief). Noise is built on Kaito — Kaito popularized the concept of "mind share" in the crypto industry, claiming its scoring integrates X interaction data based on reputation weight, seemingly closer to social capital. However, many are skeptical, pointing out that a large proportion of the mind share leaderboard may not reflect genuine high-quality community engagement.

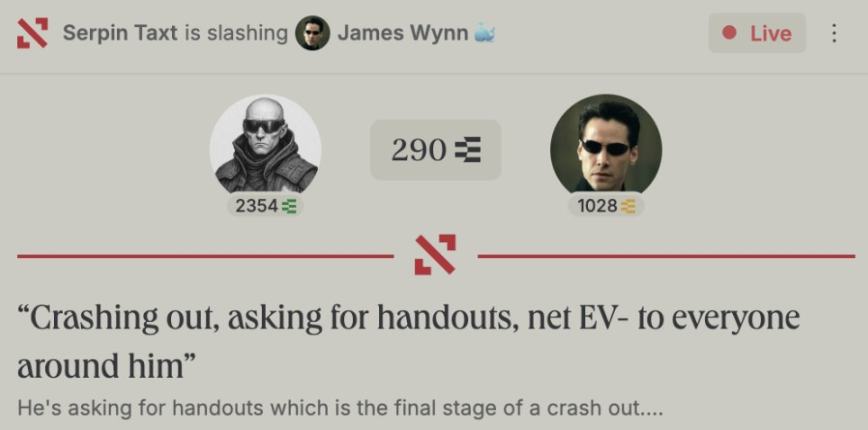

Ethos is a true social capital market. Users can stake ETH to endorse others, binding trust to economic consequences. If someone misbehaves, their endorser's stake will be reduced. This gives trust financial significance and reputation costs. Ethos also introduces market mechanisms that allow users to go long or short on reputation.

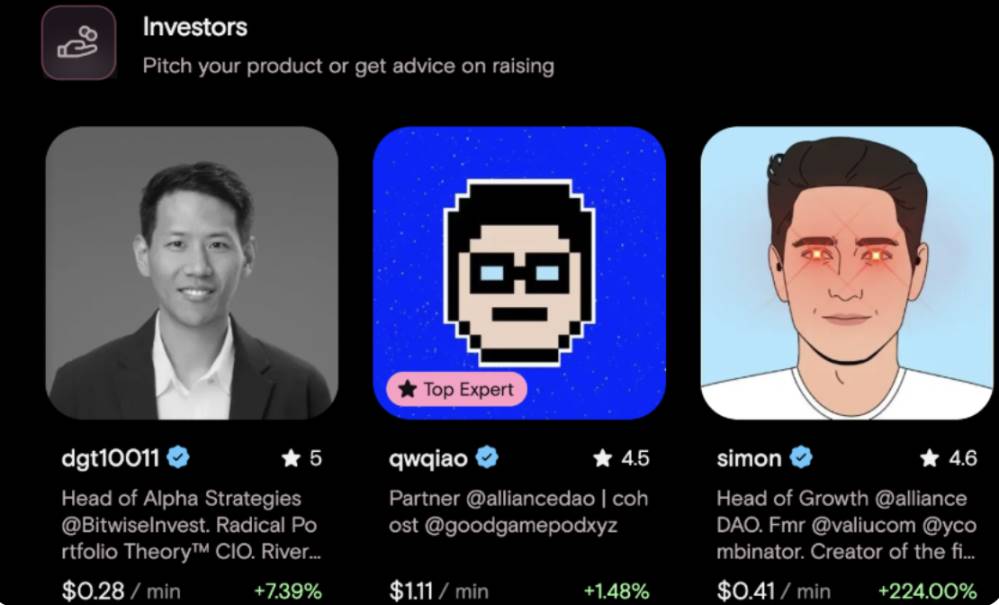

Time.fun occupies a mixed space: asset value primarily derives from social capital, but also includes some attention capital. Users can purchase opportunities to interact with well-known crypto founders, builders, and investors; its value proposition is not based on "who is popular," but on "whose time is worth acquiring," thus primarily belonging to the social capital market.

Fantasy.top and Pump Pals also belong to the mixed domain: asset value primarily derives from attention capital, containing some social capital. These two platforms assess the social performance and engagement of influential cryptocurrency figures and adult entertainers (the former focuses on X, while the latter focuses on Instagram, OnlyFans, and PornHub). Although the nature of "performance" varies across platforms, social performance and interaction can temporarily be equated with "attention."

It is noteworthy that both incorporate some reputation metrics in their scoring systems. If long-term reputation and consistency are more important than original metrics in determining value, they may shift towards the social capital market. For example, Fantasy.top could incorporate Ethos reputation scores, and Pump Pals could analyze core fan interaction continuity over specific periods.

The Importance of Distinction

In the wave of cultural financialization, many platforms seem to facilitate trust-based outcomes, but in reality, they are merely driving attention-based outputs. This leads to misaligned incentives, distorted pricing, and systems that collapse under hype pressure.

When people misjudge attention capital as social capital, it often triggers "rug events." A person may appear trustworthy, but in reality, they have merely garnered a lot of attention. Reputation markets can help people discern this noise.

When people misinterpret "performative trust" as "real trust," it can also lead to rug events. A person may seem trustworthy because they use the right buzzwords, align with popular values, or indicate a certain relationship, but in reality, they may not be as trustworthy as they appear. Verifiable behavior and staking guarantee mechanisms can help reveal a person's true credibility.

Of course, when those with real trust decide to exchange social capital for financial or attention capital, rug events can occur. Reduction mechanisms cannot completely solve the problem, but they can influence behavior through "reward and punishment mechanisms."

Attention and social capital are fundamentally different, with varying behavioral patterns. They often require different primitives, mechanisms, and safeguards. Recognizing this difference allows builders to design more sustainable and ethical systems, ensuring that viral spread does not masquerade as trust.

Why is this important now?

The attention economy is rapidly showing cracks: people are increasingly realizing that "mind share alone is far from enough." Too many hollow trends, too much debris left after hype cycles.

But this frustration is not the end of the story; it is the beginning of a more complex narrative. When attention capital and social capital are viewed as independent yet complementary forces, new markets will be unlocked. These markets can not only attract attention but also cultivate trust. Attention provides surface signals, while social capital offers depth and foundation that are worth believing in.

Imagine a platform that integrates Kaito scores, Ethos scores, and other forms of contextual reputation scoring. Imagine seeing these contexts in all the applications you use daily, allowing you to gain a comprehensive understanding of the dynamics of financial, attention, and social capital. There are many experiments worth trying that can serve as checks and balances, helping improve decision-making, filter noise, and foster more responsible, human-centered collaborative systems.

If we can achieve this, we can not only create better social tools but also redefine value in the digital age.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。