Original Title: ALERT: Altcoin founders are dumping their tokens to buy bitcoin.

Original Author: Anthony Pompliano, well-known crypto KOL

Original Translation: xiaozou, Jinse Finance

After nearly a decade of navigating the Bitcoin and crypto industry, you would think you’ve seen everything that could possibly happen, but occasionally something new comes along that leaves you speechless. This was exactly how I felt when I watched a recent video of Cardano founder Charles Hoskinson speaking yesterday. Hoskinson discussed selling altcoins from the Cardano treasury to buy Bitcoin.

This video was eye-opening for three reasons. First, Hoskinson essentially admitted that his altcoins cannot compete with Bitcoin in the long run. The only way to create long-term economic value is to sell altcoin assets and buy Bitcoin. This seems to indicate that altcoin founders have realized that Bitcoin is here to stay.

Secondly, Hoskinson appears to understand that Bitcoin treasury companies are launching speculative attacks on Bitcoin. These companies are buying Bitcoin by selling their stocks, and thus altcoin foundations also have the ability to sell altcoins in exchange for Bitcoin. This theory of "speculative attack," promoted by Pierre Rochard in 2014, has become one of the most important concepts driving Bitcoin adoption in recent years.

The third point may be the most intriguing—Bitcoin treasury companies have performed so well that it cannot be ignored. Take Metaplanet as an example; Simon Gerovich, Dylan LeClair, and their team have created one of the best-performing stocks globally. In just over a year, the company grew its Bitcoin holdings on the balance sheet from zero to 10,000 coins. Such a pace of development is astonishing.

Imagine you currently hold hundreds of millions of dollars in altcoins, yet you watch them continuously depreciate against Bitcoin. Naturally, you would start to consider that selling altcoins to invest in Bitcoin might enhance your asset value. This is no different from selling depreciating dollars or stocks of public companies. We are witnessing this speculative attack permeate every corner of the financial world.

Everyone is eager to acquire Bitcoin and is willing to sell any asset to obtain more Bitcoin. This has always been the core assertion of Bitcoin believers—that hard money will eventually absorb capital like a black hole—witnessing this theory manifest globally is truly exhilarating.

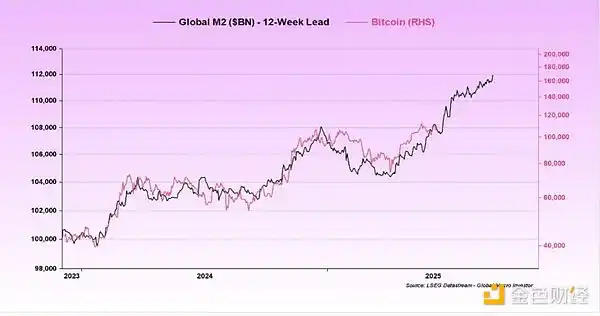

If you think Bitcoin is nearing the peak of this cycle, remember: Bitcoin has a long way to go to catch up with the global M2 money supply. Raoul Pal recently pointed out that "89% of Bitcoin's price movements are related to global liquidity."

This means Bitcoin could reach the $150,000 mark in the coming months, but after all, no one has a crystal ball to predict the future, so let’s wait and see. Bitcoin is infiltrating Wall Street in various new ways, and people are doing everything they can to hoard this digital asset. Launching a speculative attack—especially when you hold altcoins—might be a wise choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。