Use CiaoTool to issue tokens without coding

Build liquidity pools on Raydium V2

Complete LP Token burn (lock liquidity)

On-chain verification, market release, and market cap management suggestions

I. Tool and Environment Preparation

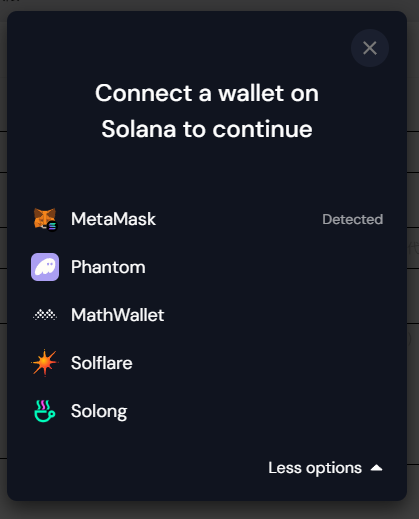

Wallet Installation: Recommended Phantom or MetaMask for connecting CiaoTool and Raydium.

SOL Balance: Reserve at least ≥2 SOL: for token issuance (≈0.075), pool creation (≈0.7), LP burn (≈0.2), and to cover Gas and subsequent activity costs.

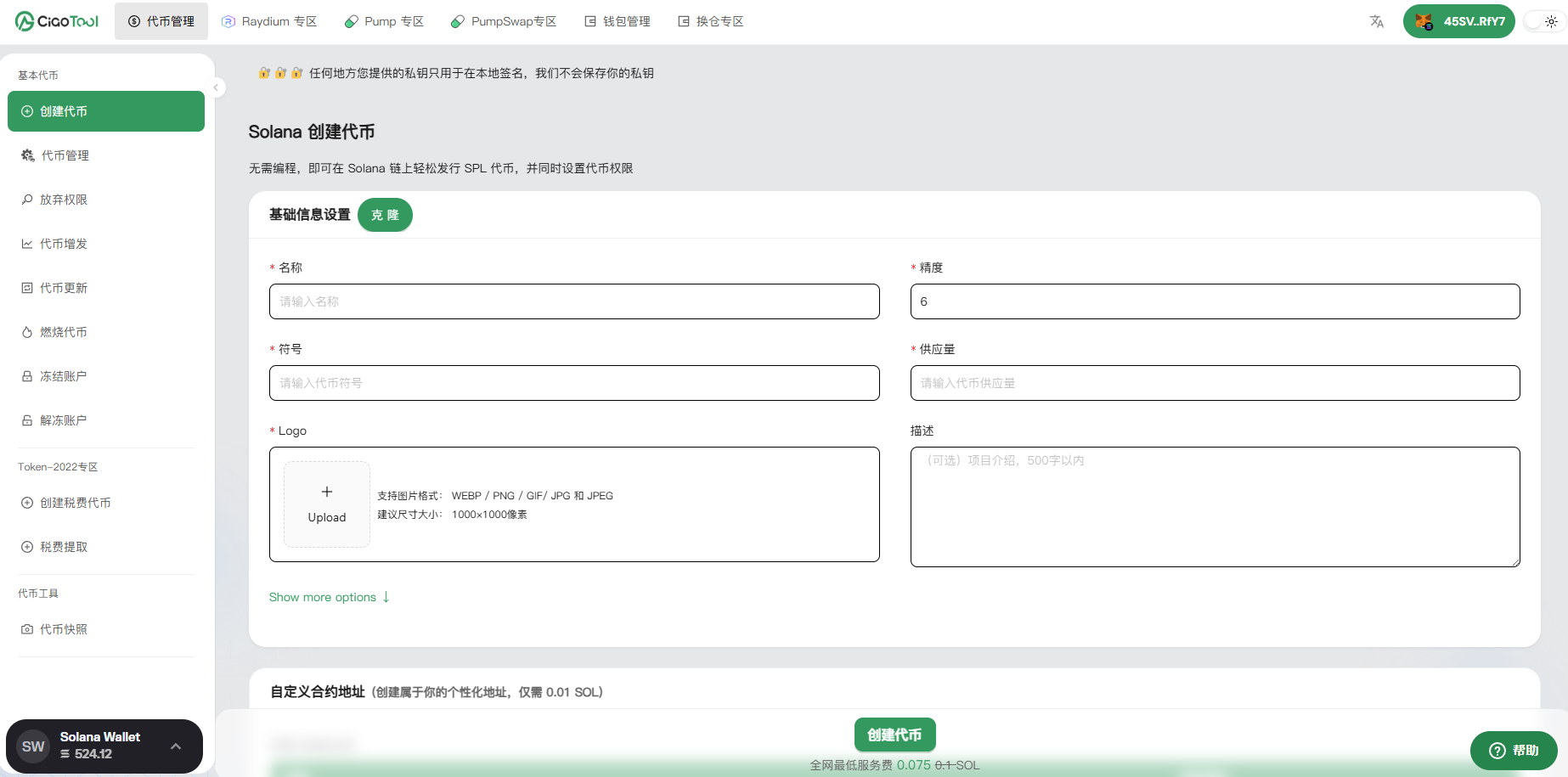

Access CiaoTool: It has one-click token issuance and liquidity management features.

II. One-Click Token Issuance with CiaoTool

2.1 Function Overview

CiaoTool supports code-free creation of SPL Tokens, including metadata settings, permission management, and minting functions.

2.2 Detailed Operation Steps

Operation

Description

Open Interface

Visit CiaoTool → Click on Token Management → Create Token

Fill in Information

Enter Token name, symbol, total supply, precision, logo, etc.

Connect Wallet

Connect using MetaMask, Phantom, etc.

Submit Confirmation

Pay ≈0.075 SOL + Gas; confirm the transaction.

On-chain Execution

Mint and ATA settings are completed, and assets are credited to the wallet account.

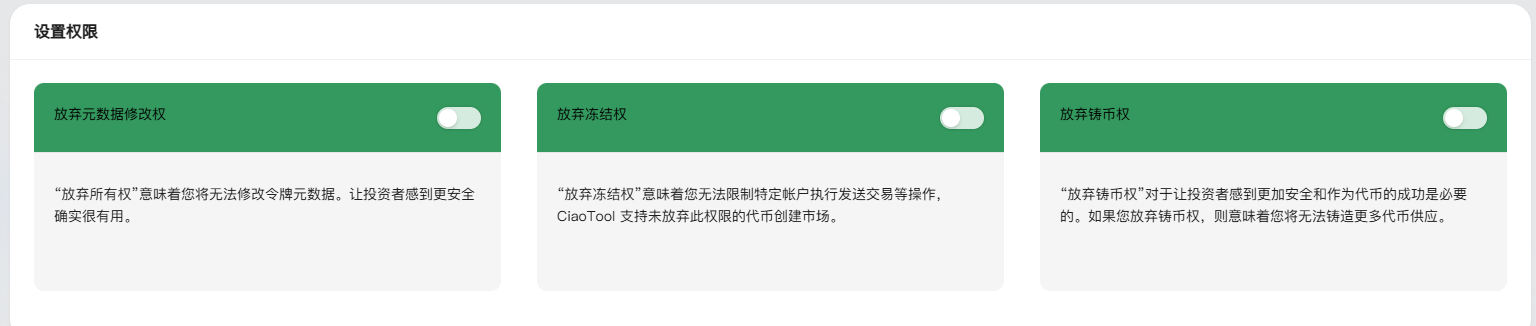

III. Permission Setting Suggestions

After token issuance, the following permissions are granted by default:

Metadata Modification Rights: Can modify token metadata

Freeze Rights: Can freeze accounts

Minting Rights: Can issue additional tokens later

It is recommended to revoke the above permissions immediately to enhance community trust:

Before creating the token, you can manually disable these permissions.

If already created, you can view and revoke them in the permission management module of CiaoTool.

If freeze rights are not revoked, you may not be able to create a pool on Raydium.

IV. Creating Liquidity Pools on Raydium V2

4.1 Generate OpenBook Market ID

Create in CiaoTool or Raydium to support matching and on-chain trading.

Creation fee: ≈0.3–0.6 SOL

4.2 Raydium V2 Pool Creation Process

Open the Raydium official website → Liquidity

Connect your wallet, select Token-mint and pairing assets (SOL or USDC).

Click Create → Continue

Enter Base Token, Quote Token, Fee Tier

Enter price, quantity, and ratio

Confirm the transaction to obtain LP Token.

4.3 Pool Parameter Suggestions

Slippage: Set to 0.5–1% to avoid being affected by low liquidity.

Launch Time: You can set a future time to synchronize with the activity launch.

Asset Amount: It is recommended to have $200–500 USD equivalent liquidity to prevent initial price crashes.

V. LP Token Burn (Burn Pool)

5.1 Significance of Burn

Burning LP Tokens indicates that the project locks liquidity, enhancing user trust.

This can be executed via CLI or third-party tools:

base

spl-token burn <LP_ACCOUNT> <AMOUNT>

You can also use tools like Solauncher, KeyGlowMax.

🔒 After burning, LP cannot be redeemed, and the pool is permanently locked.

VI. On-Chain Verification and Visualization

Mint Total Supply Verification: Use Explorer to check totalSupply.

Pool Lock Verification: Check Burn TX to confirm LP is 0; funds in the pool can still be traded.

Market Platform Launch: Submit to Dexscreener, Ave, Birdeye, etc., to enhance visibility.

VII. Suggestions for Future Market Cap Management

Bot or Tool to Stabilize Price: CiaoTool provides a market cap management module, and CiaoAI supports bot operations.

Community Airdrops and Snapshots: Use CiaoTool for snapshot airdrops to enhance community participation.

Transparent Communication: Publish lock and burn TX to increase investor trust.

VIII. Summary Flowchart

CiaoTool → Create Token → Mint + Metadata + On-chain Minting + Revoke Permissions

↓

Obtain Market ID → Raydium V2 CreatePool → On-chain Pool Creation

↓

Obtain LP Token → Burn LP → LP Burn + Lock Pool

↓

On-chain Verification + Submit Market Data + Bot Market Cap Stabilization

IX. Final Thoughts

This article provides an in-depth operational process from zero to LP burn, covering tool selection, parameter suggestions, risk warnings, and on-chain search paths, suitable for issuing meme coins, testing projects, and new project teams to quickly launch.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。