Original Title: : : [Issue] X and Polymarket - Info Finance's New Challenge

Original Author: Simon Taylor

Original Translation: Block unicorn

Introduction

Every fintech company will become a stablecoin company. Despite the hype, skepticism, hope, and concerns surrounding stablecoins, I believe we have crossed an important watershed. We are transitioning from the "Banking as a Service" (BaaS) era to an era where stablecoins serve as infrastructure. B2C, B2B, and infrastructure companies centered around stablecoins will shape the industry over the next decade.

This shift will be ten times more intense than the fintech boom of the past decade. We are moving towards a new layer of infrastructure. People still view stablecoins as a new payment channel, but when they see it as a platform that transcends all other layers, we will fully transition to a stablecoin-native ecosystem. Stablecoins are a platform.

Key Points of This Article:

· The previous era: Banking as a Service (BaaS) and its implications for stablecoins

· Why stablecoins are an infrastructure layer (and not just a new channel)

· The gold rush of stablecoins and regulatory unlock

· Full-stack application scenarios

· Strategic positioning and future outlook

1. Lessons from BaaS to Stablecoins

As the saying goes, fools rush in. We have just witnessed this in BaaS. The financial services era of the 2010s was characterized by companies adopting mobile-first distribution and cloud-first infrastructure.

We saw a generation of new infrastructure providers built specifically for financial services. Every department and IT system of banks can now be accessed via APIs. This includes customer onboarding, anti-fraud, anti-money laundering (AML), credit card services, and in some cases, even customer service. This enabled new companies to launch mobile apps, wallets, and "accounts," allowing them to acquire and serve customers at a cost far lower than existing enterprises.

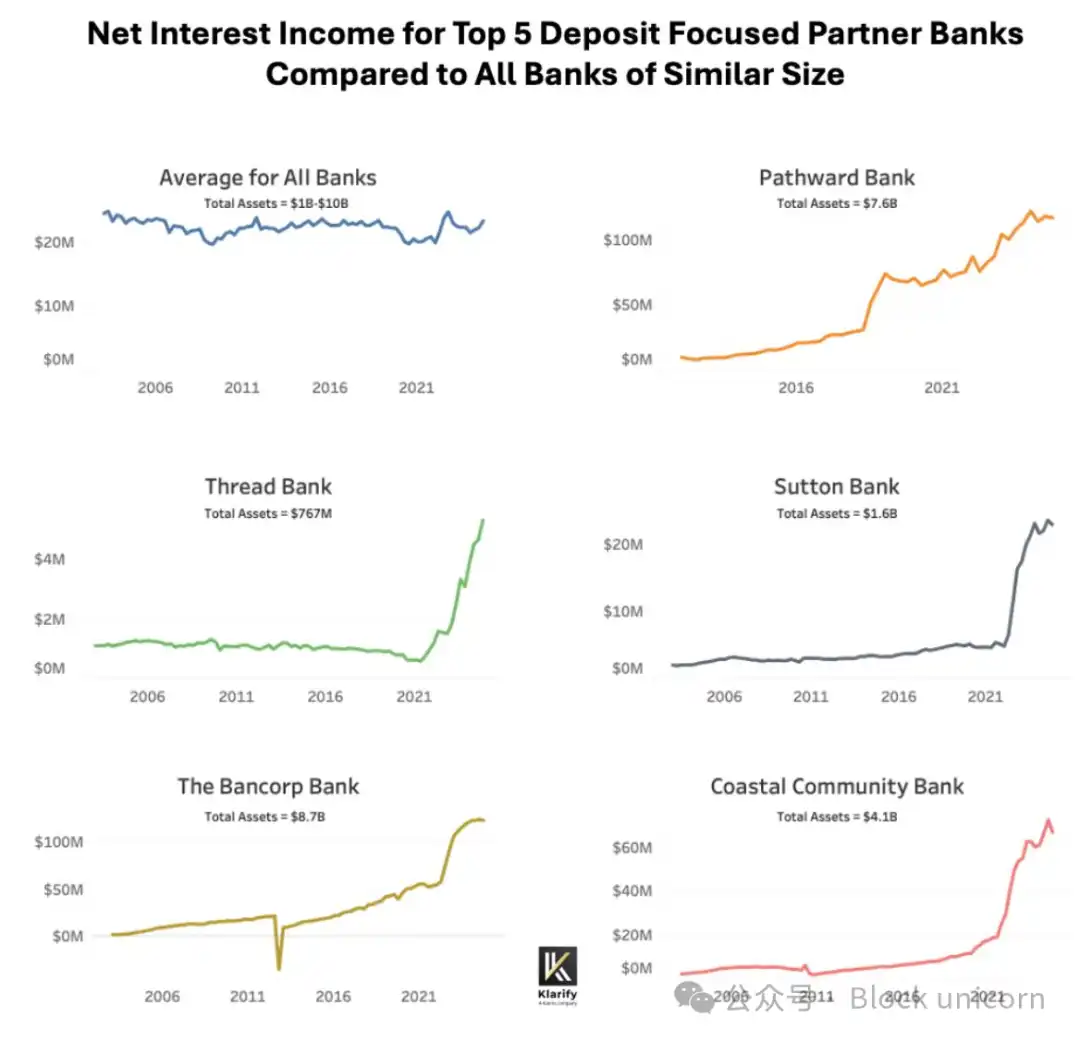

By combining APIs, mobile, and cloud technologies, fintech companies also benefited from a few "sponsoring banks" that saw opportunities to provide banking channels, store funds, and transfer money in this new space. Some banks succeeded greatly due to their "ease of collaboration."

Image Source: Klaros Partners

For fintech companies, their initial business model was:

· Generating revenue through interchange fees

· Reducing customer acquisition costs (CAC) through frictionless digital onboarding

As the saying goes: show me the incentives, and I'll show you the results. Some (but not all) fintech companies optimized conversion rates, and when you do that, many of the norms of financial services appear as friction. For example, requiring customers to provide multi-page documents for "Know Your Customer" (KYC) checks or monitoring transactions for international terrorism risks, while the vast majority of customers are domestic.

When I wrote "BaaS is dead" in March 2023, we had already seen ominous signs. Account opening is a critical moment for both parties to catch criminals. If you view account opening as a checkbox process that must be completed with minimal friction, then a minimalist interpretation of the Bank Secrecy Act/Anti-Money Laundering (AML) rules will lead to a high-conversion account opening process. Over the past two years, this has allowed fraud and money laundering to occur remotely on a large scale, attacking the system's weakest points. — Excerpt from "BaaS is Dead"

If you are a bad actor, attacking small new banks and digital banks is easy. But the results are not good. On April 22, 2024, when blockchain-as-a-service (BaaS) provider Synapse went bankrupt, thousands of customers lost their life savings. Fintech applications could not access these funds, and the underlying banks could not track or verify the flow of funds.

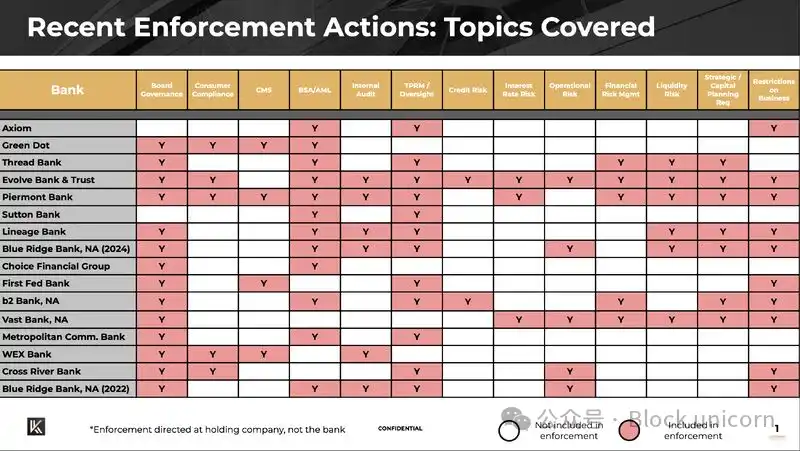

This incident made headlines in mainstream media, and within the banking industry, regulators issued a series of consent orders, finding banks deficient in:

· Third-party risk management (i.e., API providers and fintech companies)

· Anti-money laundering (i.e., the controls of these companies may be inconsistent)

· Board governance (i.e., whether management is held accountable)

Image Source: Klaros Partners

The consequences of these failures are enormous. If you cannot stop funds from flowing to bad actors, criminals will be rewarded, thus funding human suffering. However, the lesson here is not that BaaS or fintech is bad; far from it.

Today we have:

· The ability for immigrants and low-income individuals to open free accounts

· The ability to approve loans using cash flow (the funds you have), meaning more people can avoid bankruptcy

· Good consumer management cards

· Embedded loans for markets, small and medium enterprises, and vertical SaaS

Successful large financial brands have reshaped the industry. Cash App, Venmo, Chime, Affirm, Revolut, Monzo, Nubank, Stripe, Adyen, and your favorite brands have become household names in their markets and industries. Fintech has fundamentally changed the way finance is distributed and raised the standard for user experience.

We have simply learned some lessons along the way. The scale of investment in stablecoins and cross-border activities could lead to any collapse having epic consequences. While I know we cannot completely prevent bad things from happening, I hope that those companies centered around stablecoins can learn from the mistakes and successes of the BaaS era and not be blinded by the impending gold rush.

2. Regulatory Unlock and Surge in Funding

2.1 Regulatory Unlock

The current draft of the "GENIUS Act" could change everything. According to the draft, if you are a licensed stablecoin issuer, you can treat stablecoins as cash equivalents on your balance sheet. This is significant. Take prepaid cards as an example. They require funds transfer licenses, return rules, and consumer protection requirements. Cash is like the money in your pocket. It is much simpler to hold and manage. Stablecoins can inherit this simplicity.

2.2 The Gold Rush of Stablecoins

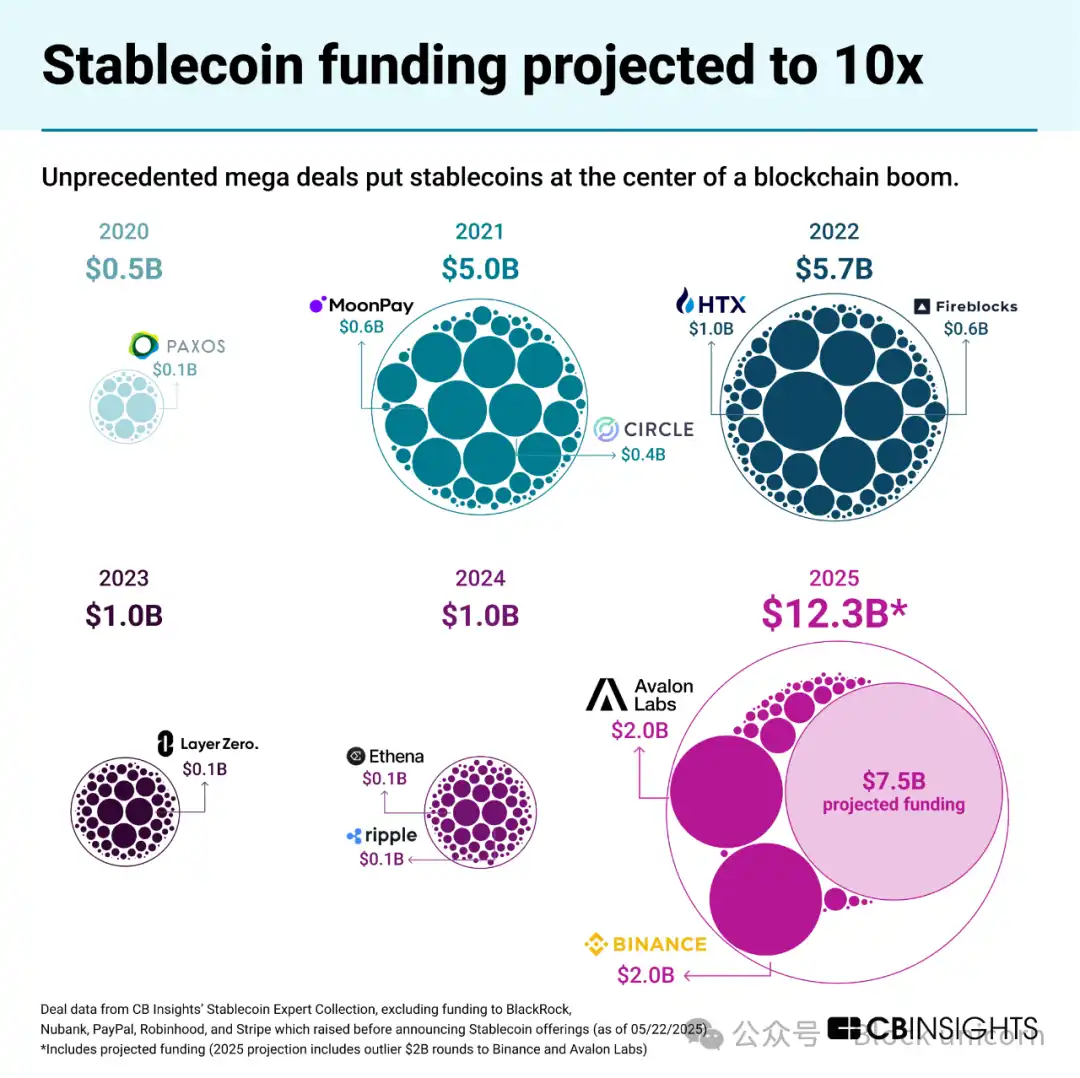

Funding for stablecoin-related businesses is expected to grow tenfold year-on-year.

Funding situation for stablecoin-related businesses

If the "GENIUS Act" passes, a new regulated stablecoin channel and a new narrow banking category called licensed payment stablecoin issuers (PPSIs) will emerge. This means that every entrepreneur, venture capitalist, payment company, shadow bank, and even large banks will take action to defend or seize this new opportunity.

3. Argument: Stablecoins as a Platform

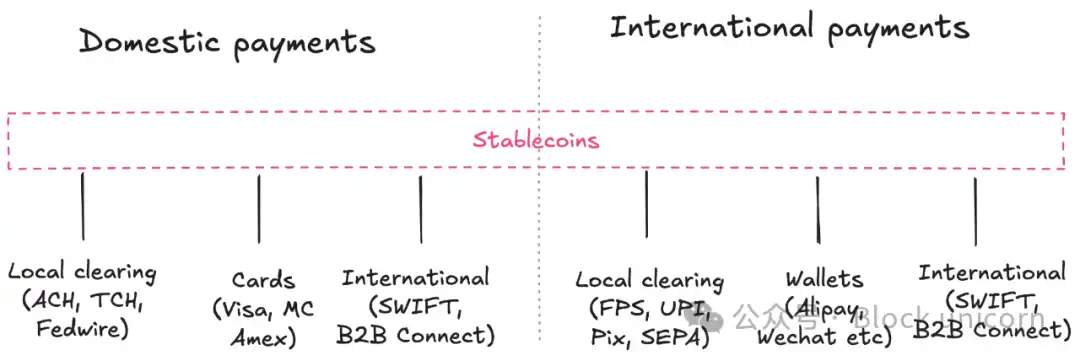

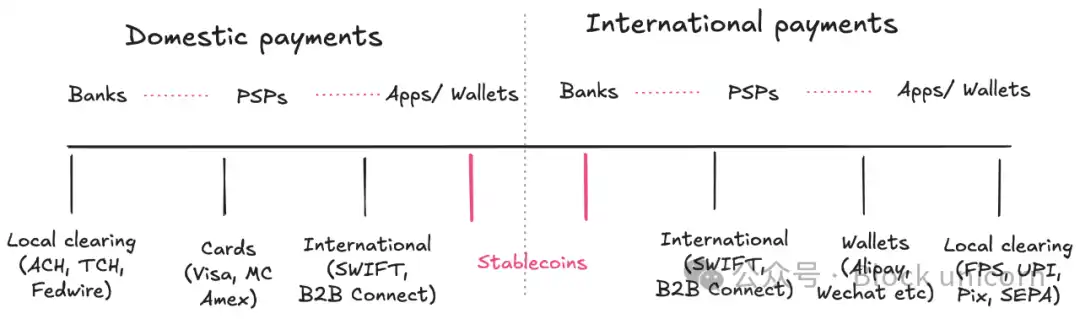

Today, stablecoins are used as alternative cross-border payment channels, and in the future, they may become domestic payment channels. But if you only see these, you are missing the bigger picture. Stablecoins are also a platform that transcends channels like SWIFT, ACH, PIX, and UPI, becoming the infrastructure that connects all these channels. This will unlock new use cases and opportunities.

Ultimately, stablecoins will create an abstraction layer above existing payment channels, just as the internet did for telecom operators. Similarly, the entire industry will become "stablecoinized," just as we have seen with video, messaging, and e-commerce. This network layer will ultimately eliminate intermediaries and reduce costs. — Excerpt from "Stablecoins are not cheaper; they are better"

I envision it as follows:

Stablecoins as a platform

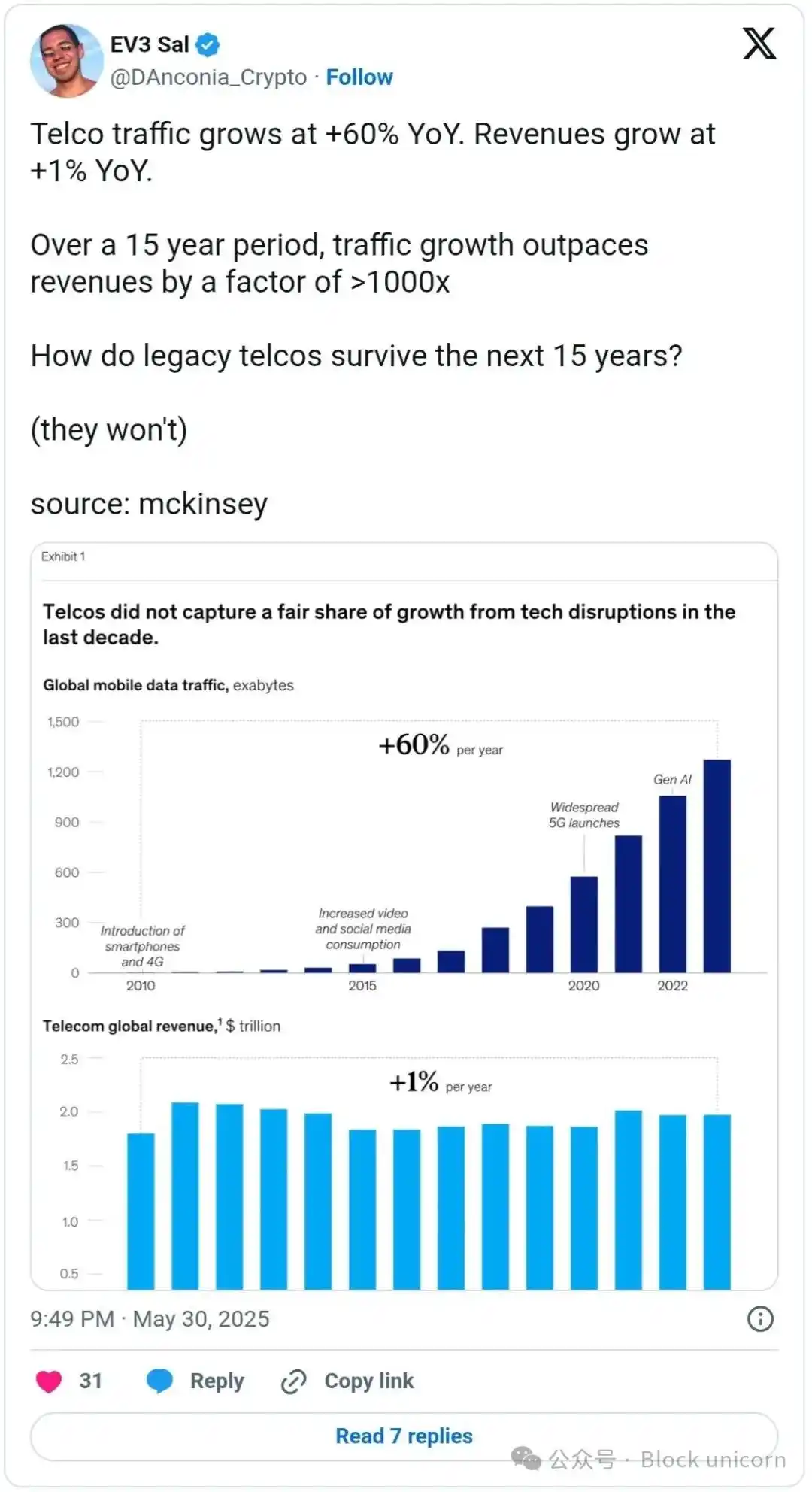

This is what platform disruption looks like. Telecom traffic grew 60% year-on-year, while revenue grew 1% year-on-year. In 15 years, traffic growth exceeded revenue growth by more than 1000 times.

Existing enterprises that cannot adapt to the new platform layer will be commoditized. The impact of stablecoins on payments is akin to the impact of the internet on telecom — creating a platform layer that commoditizes the underlying infrastructure. We can see this infrastructure layer gradually emerging in every payment process and business model. Here’s how it works.

4. How Stablecoins Function Throughout the System

Yes, stablecoins currently operate as alternative payment channels. But that is just the foundation. Most people see them as payment channels in the diagram below, rather than as a platform:

Stablecoins as payment channels — they are not just that, but much more.

The real opportunity lies in the functionalities they can achieve as infrastructure.

4.1 Stablecoins for International Payments — Starting Point

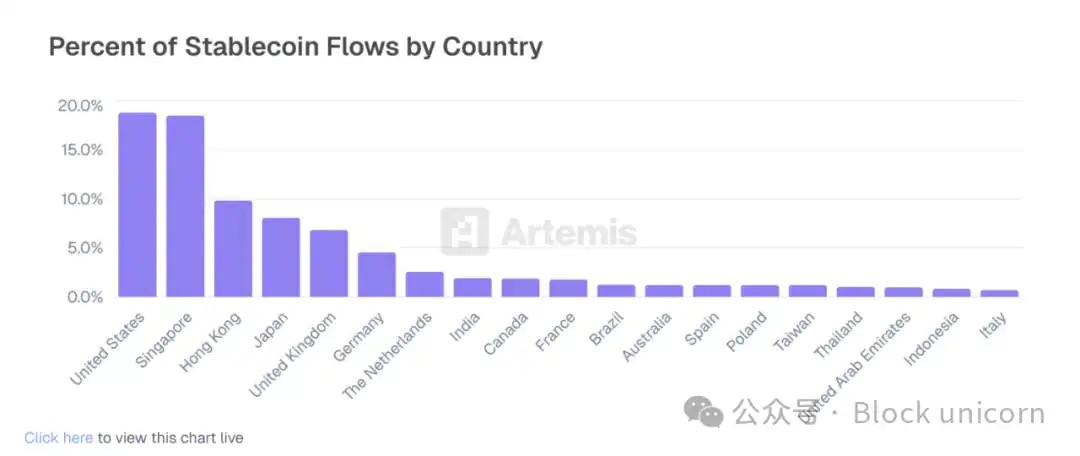

Undoubtedly, the primary use case for stablecoins is cross-border payments. The main currency routes are from Asian countries, followed by the US to Latin American countries (Mexico, Brazil, Argentina).

G20 Dominates Payment Activities to Global South through Tron and Tether

There are various types of cross-border payments. Let’s delve into each payment process.

B2B Early Adoption Use Cases:

· Scale-up enterprises for market expansion (e.g., SpaceX): Used for financial management, vendor payments, and inter-company payments.

· International payroll and payments (e.g., Deel, Remote): Contractors and employer representatives will pay to stablecoin wallets.

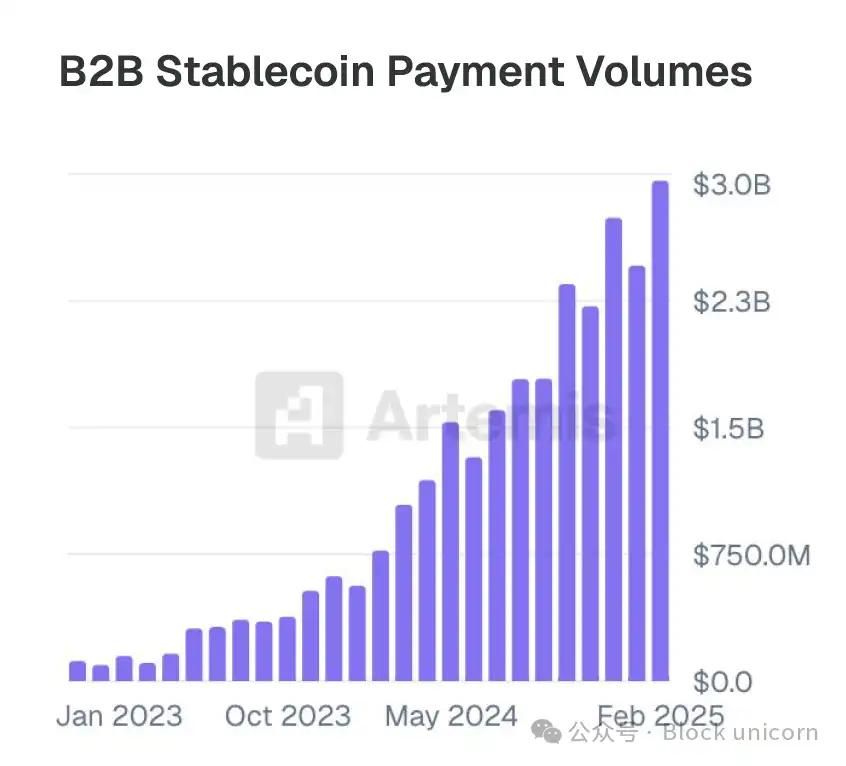

Artemis surveyed over 30 companies engaged in stablecoin business and found that B2B as a category is growing 400% year-on-year (and accelerating), making it the fastest-growing category. (Note: The transaction volume shown in the diagram below is only a part of the overall market)

As the growth curve shows, this is significant growth. Currently, the last-mile liquidity and foreign exchange spreads are bottlenecks, but new companies like Stablesea, OpenFX, and Velocity are entering the market to change this situation.

Consumer cross-border stablecoin use cases include:

· Remittances and P2P (e.g., Sling Money): Customers use stablecoins for cross-border remittances, which are faster and often cheaper.

· Stablecoin-linked cards: Also known as "dollar cards," these allow consumers in the Southern Hemisphere to purchase services from Netflix, ChatGPT, or Amazon.

Artemis's survey also shows that P2P and stablecoin-linked cards are growing over 100% year-on-year, with at least $1 billion in transaction processing volume (TPV) in their sample. Stablecoins are becoming a feature of new banks (like Revolut and Nubank), and while their current use cases are still narrow, they may expand in the future. Applications like Revolut, which initially started with remittances and P2P, are well-positioned to leverage this new channel.

Currently, the foreign exchange spreads for local currency transactions are often high, and liquidity is low. But this situation is changing. The landscape for domestic payments is still forming, but it is fascinating.

4.2 Stablecoins for Domestic Payments (Future Direction)

Domestic B2B use cases include:

· Stablecoins for round-the-clock earnings (e.g., ONDO or BUIDL): Currently, crypto-native finance departments convert stablecoins into tokenized government bonds to avoid converting to fiat currency. If this round-the-clock functionality can be implemented in enterprise resource planning (ERP) systems, it could be very attractive for any corporate finance officer.

· Stablecoins as an alternative to FBO structures (e.g., Modern Treasury): A feature of U.S. regulation is that, as a non-bank institution, transferring funds on behalf of clients often requires a "For the Benefit Of" (FBO) structure. These accounts are complex to set up. Modern Treasury's stablecoin product allows finance teams to set up payment processes for clients without the need for an FBO structure.

· Stablecoin-native B2B accounts (e.g., Altitude): Accounts offered by Wise or Airwallex can be stablecoin-native. These accounts use USD as the primary currency but provide operational front-ends to manage invoices, expenses, and finances.

Domestic consumer use cases are still in the early stages, including:

· Stablecoin-native "checking" accounts (e.g., Fuse): Similar to the consumer experience of Wise, Revolut, or remittance apps, but with a default global perspective. These services are currently appearing in Southern Hemisphere countries but could represent a new, low-cost model for consumer fintech projects.

· Prepaid card programs: Since stablecoins may have cash equivalency, finance officers can obtain programmable currency that is recorded on the balance sheet like cash but is as liquid as digital payments, without managing complex prepaid debt issues.

· P2P stablecoins: Zelle, Venmo, Pix, and Faster Payments dominate their domestic markets, but if stablecoins become another development model, these applications may only need to support it as a front-end.

4.3 Finance and Infrastructure (Hidden Layer)

The hidden layer is the infrastructure. Banking technology itself is becoming the native technology for stablecoins.

· Stablecoin issuance as a service (e.g., Brale, M^0): Banks and non-bank institutions may want to create their own stablecoins to attract deposits or avoid fees charged by other issuers.

· Stablecoins as side cores (e.g., Stablecore): Banks may want to create a record system that interacts with stablecoins, independent of their traditional platforms. "Side cores" can achieve this while still reconciling with the main core.

· Stablecoins providing BaaS-like infrastructure (e.g., Squads Grid): Offering developers simple APIs to quickly create consumer, B2B, or embedded financial products.

Most companies in the market severely underestimate developers' love for the convenience of stablecoins. For companies like Stripe, convenience has always been the secret to success. You can imagine other possibilities. As a thought experiment, consider stablecoins as a global, programmable record system where everyone can reconcile and view. Each wallet address can be assigned to known front-ends or wallet creators, allowing these companies to collaborate immediately when KYC or AML issues arise.

4.4 Strategic Positioning of Stablecoins

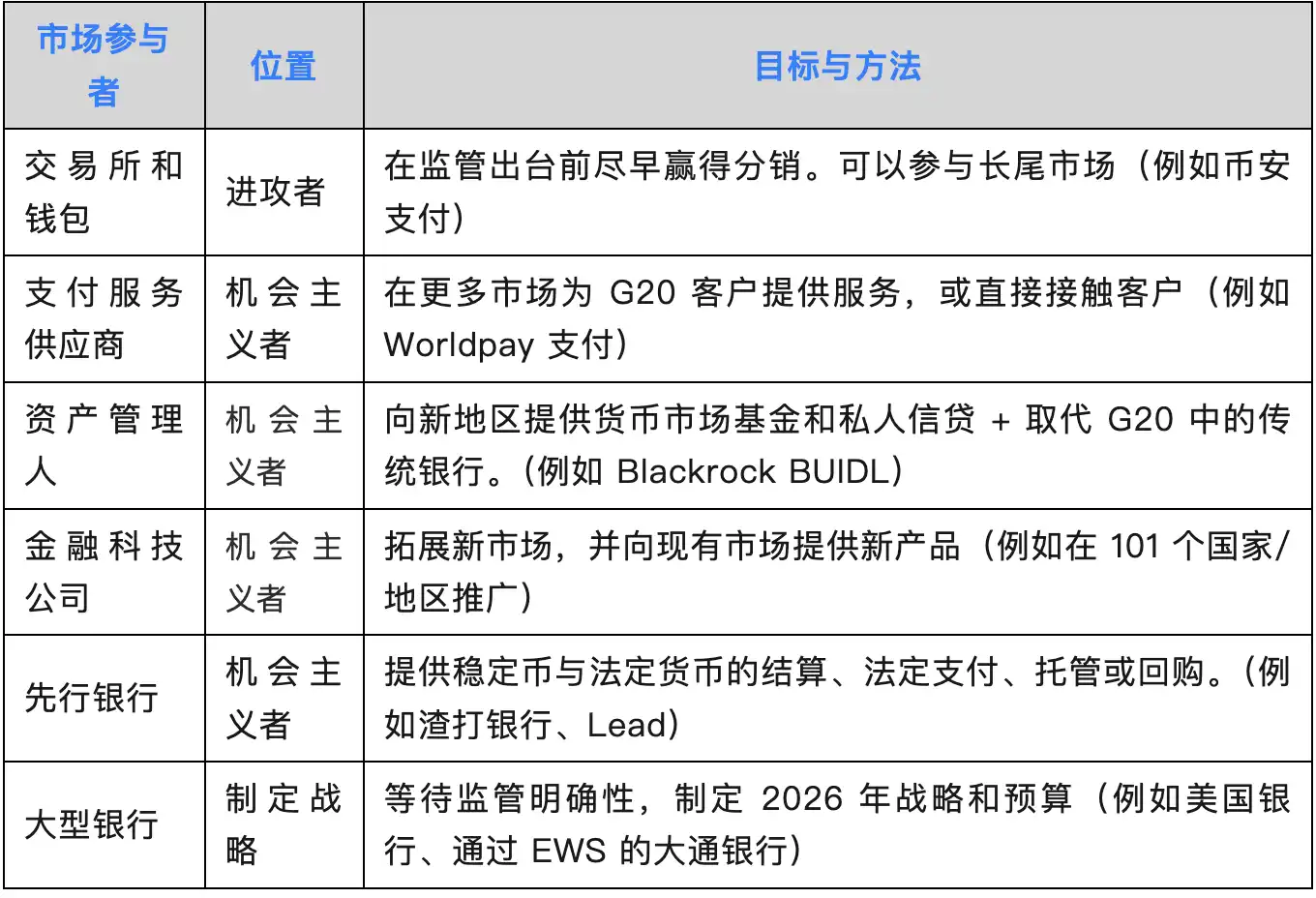

The current market has attackers, opportunists, and participants who are still observing and formulating strategies. Currently, the vast majority of activity occurs on new platforms like crypto exchanges and wallets, but opportunists are companies that are now positioning themselves to leverage stablecoins as a new payment channel:

Here are my thoughts on who is which:

Attackers:

· Asset management companies: BlackRock, Franklin Templeton, and Fidelity rely on banks for wire transfer settlements. Since the financial crisis, they have taken market share from banks in credit and money market funds. Stablecoins connect all of this through an instant, round-the-clock settlement layer.

· Payment companies like Stripe, WorldPay, and Dlocal are expanding the number of markets they can operate in and the types of payment processes they offer. "Financial accounts" are eroding the core business of large currency center banks, but they typically target newer customer segments.

Defenders:

· Large banks: JPMorgan, Bank of America, Citibank, and other U.S. banks have early discussions about launching their own stablecoins. I believe this may be to capture market share in this new domestic and cross-border payment "channel," just as banks have dominated P2P payments through Zelle; they may "inevitably" also dominate this new channel.

· Small banks: They have begun lobbying against stablecoins. Stablecoin issuers, asset management companies, and large banks may siphon deposits from their low-yield checking accounts, leading to the greatest losses for small banks.

There will be a group of opportunistic banks, similar to what we see in the sponsoring bank business, that will gain significant opportunities through the disruption of stablecoins. The reality is that opportunities vary by use case. Startups are exploring new payment processes, while payment service providers (PSPs) are expanding market access through existing processes. In the future, asset management companies and banks will find their positioning in the market, likely closer to their existing core businesses.

5. Criticism, Concerns, and Why Most Are Exaggerated

I summarize the criticisms as follows:

· Criticism: Stablecoins will trigger bank run scenarios. Rebuttal: This assumes algorithmic stablecoins like Terra, rather than the government bond-backed licensed payment stablecoin issuers (PPSIs) under the "GENIUS Act."

· Criticism: Large tech companies will form a monetary oligopoly. Rebuttal: This is a reasonable concern, but the framework makes it unlikely that large tech companies will issue stablecoins directly—they will use stablecoins rather than issue them. Becoming a PPSI presents high regulatory barriers for them.

· Criticism: This will lead to deposit outflows from community banks. Rebuttal: Money market funds have already been causing this. Community banks that adapt to provide stablecoin services will thrive.

· Criticism: "This is cryptocurrency," implying it is filled with crime and scams. Rebuttal: It is time to discard this view. The future of finance is on-chain, and institutional capital is building the infrastructure. There are real, novel risks such as key management, custody, liquidity, integration, and credit risk that should be focused on.

· Criticism: Stablecoins are just regulatory arbitrage because "holding USDC should be as hard as holding dollars." Rebuttal: Fintech itself achieved regulatory arbitrage through the Durbin Amendment. Developing on stablecoins is easier, but there is also a complete licensing regime.

I believe this debate will continue. Stablecoins will drive the next era of finance, and our outlook for the future is just beginning.

6. Finally, Why Every Company Needs a Stablecoin Strategy

Everything we do today can lead to the native integration of stablecoins, at which point finance will gain superpowers. We can build instant, global, round-the-clock finance. We can recombine financial Lego blocks and make them more developer-friendly. The BaaS era taught us that new infrastructure creates enormous opportunities and significant risks. Companies that learn from the successes and failures of that era will win in the stablecoin-centric era.

Every company needs a stablecoin strategy. Every fintech company, every bank, and every finance team needs one. Because this is not just a new payment channel. It is the platform layer upon which everything else will be built. I urge every reader to build based on the lessons of the past. Crashes are inevitable, and things will go wrong; that is also a given. This includes how you will protect yourself when things inevitably crash.

Build cool things. And stay safe.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。