FX168 Financial News (Asia-Pacific) reports that the decentralized finance platform Hyperliquid (HYPE) has announced the launch of Tether Gold perpetual futures, with HYPE's monthly increase exceeding 55%. Market analysis suggests that unless the price falls below $40, HYPE's outlook remains bullish.

Traders can now operate Tether Gold (XAUt) through Hyperliquid's proprietary trading platform, which is issued by the USDT stablecoin issuer Tether.

Source: X

Tether Gold is a tokenized version of precious metals, backed by actual gold reserves held by the issuing company. It also grants holders ownership of the asset.

Currently, traders can access synthetic assets through Hyperliquid, which will be used solely for speculative purposes.

Hyperliquid has become a popular choice among traders as it operates on a separate blockchain specifically designed to support its perpetual futures and spot trading platform.

This allows the protocol to customize its design and infrastructure according to the platform's needs. Compared to centralized exchanges (CEX), Hyperliquid's fees are quite competitive, and its supporters believe its design will lead a new wave of completely decentralized and more transparent trading solutions for users.

According to CoinMarketCap data, Hyperliquid is already the largest decentralized exchange (DEX) by trading volume in the derivatives market, with a 24-hour trading volume of $7.42 billion.

HYPE continues to reflect the growing usage of Hyperliquid, with speculation that its price may break into triple digits. The token did not face significant selling pressure at the beginning of the week, and most derivatives traders remain optimistic.

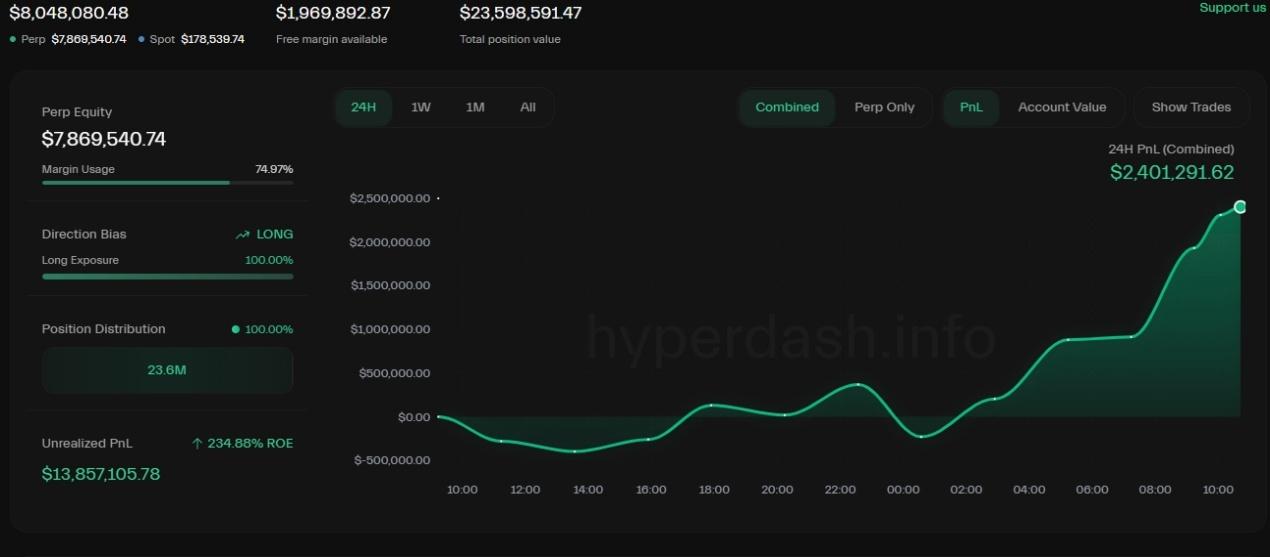

A top whale bullish on the token has realized over $13.93 million in unrealized gains, ranking 58th on the trading leaderboard, with profits increasing over 121% last month and realized gains exceeding $10 million in the past 30 days.

Source: hyperdash.info

HYPE's potential continues to attract whale investors from Hyperliquid and other exchanges. HYPE's open interest has consistently grown over the past few days, now exceeding $1.89 billion. The long-short ratio remains balanced as traders remain cautious about potential pullbacks.

However, HYPE still carries risks, as its trading volume primarily comes from local exchanges, with almost no other price discovery tools.

Currently, Hyperliquid's daily and past 30-day earnings rank first among decentralized protocols. Hyperliquid's earnings stand at $65.3 million, with trading volume and activity continuing to grow.

In recent days, well-known trader James Wynn from Hyperliquid has abandoned his large positions in favor of holding a small long position in BTC, using 40x leverage. Wynn's trading has raised some questions, with some believing his positions are hedged through other markets or anonymous accounts. Wynn does not hold any HYPE tokens.

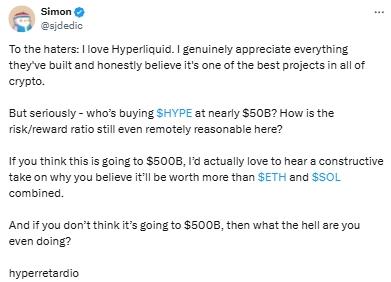

Crypto influencer (KOL) Simon (@sjdedic) wrote in a post on X: "To those who hate it, I love Hyperliquid. I genuinely appreciate everything they do and truly believe it is one of the best projects in the cryptocurrency space. But seriously—who would buy 'hype' at nearly $50 billion?"

He continued: "How can the risk-reward ratio here still be reasonable? If you think Hyperliquid will rise to $500 billion, I really want to hear why you think its value will exceed the total of ETH and SOL, and provide constructive feedback. If you think Hyperliquid won't rise to $500 billion, then what are you doing?"

Source: X

HYPE Technical Analysis: The Uptrend Should Continue Until It Breaks Below $40

FXEmpire analyst Alejandro Arrieche stated that the $40 level will provide the riskiest entry point for later buyers, as HYPE's uptrend has shown some signs of fatigue.

He noted that for those willing to take risks, this is the right choice, as they have already gained over 10%.

"However, our most favorable entry point has yet to be reached. If a pullback occurs, the $28 level remains the most attractive entry point for speculation, as it is a key resistance level during the token's significant rise to its current level," he added.

HYPE has remained above $40 for the past few days, climbing to its current price during last Friday's liquidity grab, which trapped shorts and dispersed them that day. The trading volume was quite high, confirming the existence of a short trap.

Meanwhile, due to buying pressure and strong investor interest in HYPE, the relative strength index (RSI) has successfully maintained near or above overbought levels for quite some time.

At this point, unless there are strong signs of a bearish breakout, betting on the winning horse is not a good idea.

Alejandro finally mentioned that as long as the daily closing price remains below $40, another attempt to break below this level could succeed. If this occurs, a retest is expected, and once a reversal is confirmed, it will be the best entry point. Currently, HYPE seems determined to conquer the $50 level.

Source: FXEmpire

Related: Pump.fun and its founder's account have been affected by a large-scale ban on X platform

Original article: “Hyperliquid Enters Tether Gold Perpetual Futures, Could HYPE Be the Dark Horse of the Next Altcoin Season?”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。