Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

Sun Yuchen is making significant strides on the path to mainstream capital markets.

Tron Lands on the US Stock Market

On the evening of June 16, Beijing time, news began to circulate about "Tron seeking to go public in the United States." As people were puzzled about how an entity that has already issued tokens and has a structure leaning towards the crypto circle could navigate the compliance listing process, various sources began to disclose more details.

The Financial Times reported that Tron will achieve its listing through a reverse merger with SRM Entertainment, which is already listed on Nasdaq (stock code: SRM). This transaction is being managed by Dominari Securities, an investment bank based in New York, which has ties to Donald Trump Jr. and Eric Trump.

Shortly thereafter, SRM Entertainment officially announced that it has signed a $100 million stock investment agreement with a private investor, and SRM Entertainment will use these funds to launch a treasury strategy around TRX (similar to the BTC treasury strategy of Strategy). Dominari Securities will serve as the exclusive placement agent for this issuance.

According to the terms of the agreement, SRM Entertainment will issue a total of 100,000 shares of Series B convertible preferred stock (which can be converted into 200 million shares of common stock at a conversion price of $0.50 per share) and 220 million warrants (which can be exercised to purchase a total of 220 million shares of common stock at an exercise price of $0.50 per share). If all warrants are exercised, the total value of this strategic investment will reach $210 million, aiding SRM Entertainment in building a substantial TRX treasury strategy.

Additionally, SRM Entertainment announced that Tron founder Sun Yuchen has been appointed as a company advisor, and the company plans to change its name to Tron Inc — which also confirms the previously circulating rumors of a "reverse merger listing."

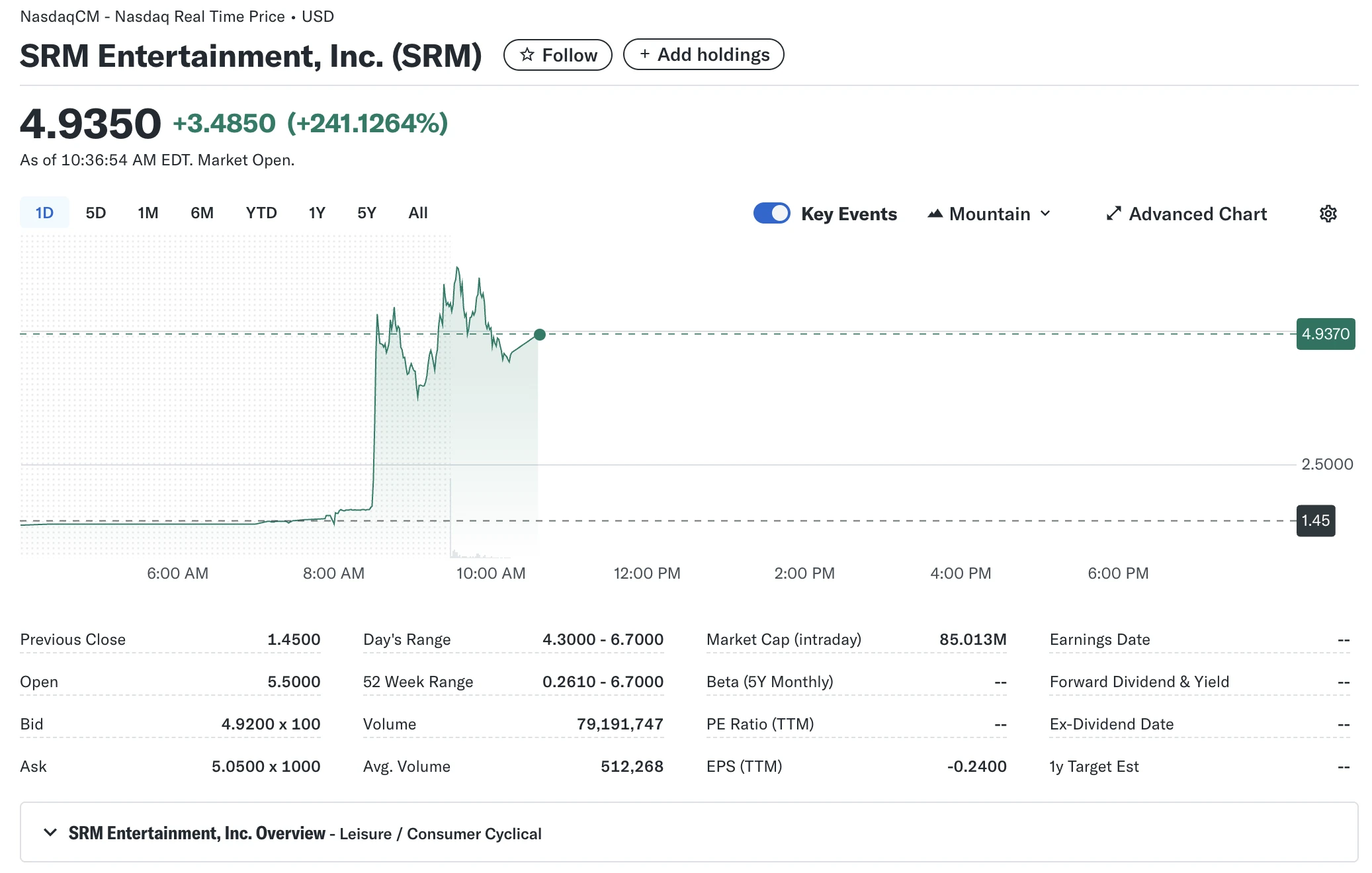

After the official announcement of the transaction, both the price of TRX and the stock price of SRM were boosted. According to OKX market data, after the announcement, TRX briefly surged to 0.295 USDT, and as of June 16 at 22:35, it was reported at 0.279 USDT, with a 24-hour increase of 2.5%; the US stock market showed that SRM skyrocketed after opening, reaching 4.935 US dollars as of June 16 at 22:35, with an increase of 241.13%.

Sun's "Counterattack to the Mainstream" Journey

It is hard to imagine that just two years ago, Sun Yuchen faced regulatory scrutiny from the SEC, and now he has not only become an advisor to the Trump family project World Liberty Financial (WLFI) but also the "top brother" of the "TRUMP" themed dinner. Now, Tron is closely following in the footsteps of Circle, about to become another native cryptocurrency project listed on the US stock market.

On March 22, 2023, when Gary Gensler, the "crypto Voldemort," was at the helm of the SEC, it announced a lawsuit against Sun Yuchen and his three companies, Tron, BitTorrent, and Rainberry, accusing them of selling unregistered securities and manipulating the market through a large number of wash trades. Over the following year, although there was no substantial progress in the legal case, it clearly affected the operations of Sun Yuchen and his related projects in the United States and other jurisdictions.

However, everything changed with Trump's victory in November 2024. Under Trump's "embrace crypto" policy, the regulatory clouds surrounding cryptocurrencies quickly dissipated, and Trump himself and his family launched several crypto projects such as TRUMP and WLFI — and the ever-shrewd Sun Yuchen seized the opportunity to "reverse his fate."

In November 2024, the Trump family project WLFI announced that Sun Yuchen would join as an advisor, and just a day earlier, Sun Yuchen had announced a $30 million investment in WLFI. Then in January 2025, Sun Yuchen announced an additional investment, raising the total investment to $75 million. In return, WLFI has included TRX in its investment portfolio, making multiple purchases.

In February 2025, the SEC (by this time Gary Gensler had stepped down, and pro-crypto Paul Atkins was about to take office), the Tron Foundation, and Sun Yuchen submitted a joint motion requesting a federal judge to suspend the lawsuit against Sun Yuchen and Tron to seek a possible settlement.

In March 2025, Sun Yuchen appeared on the cover of Forbes English edition, with the headline introducing him as "the crypto billionaire who helped the Trump family earn $400 million."

In April 2025, Sun Yuchen attended the Token 2049 summit with Eric Trump, further strengthening their cooperative relationship — it is worth mentioning that rumors suggest Sun Yuchen now only stays at Trump-branded hotels when traveling…

Also in April, the TRX ETF made its first appearance in market discussions — asset management company Canary announced it had submitted a staking version TRX ETF application to regulators.

In May 2025, the "TRUMP" themed dinner was held at the Trump National Golf Club in the suburbs of Washington, D.C., where the top 220 TRUMP token holders by weighted holdings were invited to participate in the dinner. Sun Yuchen attended as the "top brother" of the largest holder and received a limited edition Trump Tourbillon watch personally gifted by Trump.

In June 2025, just as people were becoming desensitized to the flirtation between Sun Yuchen and the Trump family, Sun Yuchen once again dropped the bombshell of "Tron listing on Nasdaq."

Looking back at the significant changes surrounding Sun Yuchen and Tron over the past few years and especially in the last six months, and considering the implied shifts in the era behind them, it is hard not to marvel at the changing times.

Once, Sun Yuchen often presented himself as an ambassador of a small country, and people joked that he had more strange titles than Daenerys Targaryen from "Game of Thrones." Now, he has truly stood at the center stage of the US capital market by his own efforts.

Whether criticized or praised, we cannot ignore this "financial myth" of the new absurd era — the remarkable Gates Sun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。