Selected News

Buidlpad: The investment phase of Sahara AI community has ended, raising over $74.5 million

Binance Alpha mainstream trading users have been on the brink of losses for nearly 30 days

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

POLYHEDRA

Today's discussion about POLYHEDRA mainly focuses on the sharp decline of its network token $ZKJ, which plummeted over 80% due to abnormal on-chain transactions and liquidity manipulation. This crash is related to large holders withdrawing liquidity, triggering a liquidation cascade, compounded by a large-scale token unlock. To stabilize the market, Binance announced adjustments to the calculation method of Alpha Points. This incident has sparked widespread discussion about the sustainability of liquidity mining and the risks of speculative trading.

BYBIT

Today's topic around BYBIT mainly revolves around the announcement of its first on-chain decentralized exchange (DEX) "Byreal" deployed on Solana. Byreal is expected to launch at the end of the month and is seen as part of the trend of integrating CEX (centralized exchanges) with DeFi (decentralized finance). CEXs like Coinbase, Binance, and BYBIT are actively launching "on-chain CEX" solutions. Byreal adopts a mixed model of RFQ and CLMM routing, aiming to enhance liquidity and trading efficiency. The community is widely concerned about how this initiative will affect the competitive landscape between CEXs and DEXs, believing it will help bridge the gap between traditional finance and DeFi.

BNB

Today's Twitter discussion about BNB mainly focuses on its role within the Binance ecosystem, particularly the performance of liquidity pools related to Binance Alpha. Recent high-frequency trading of ZKJ and KOGE tokens on Binance Alpha has caused significant volatility, leading to a sharp price drop. This event highlights the risks of liquidity mining and the potential for market manipulation. Additionally, discussions mention the practicality of BNB as a Father's Day gift, its stable trading fees, and its use in various DeFi projects. Overall sentiment is mixed, with some users concerned about its long-term value while others are optimistic about its potential as a strategic asset for Binance.

COINBASE

Coinbase has become a focal topic for sponsoring a U.S. military parade, eliciting mixed reactions from netizens. Some view this move as aligning with American patriotism and a strategic public relations operation; others criticize it as contrary to the decentralized spirit advocated by the crypto community. Furthermore, Coinbase's recent actions in integrating DEX trading and validation pools are interpreted as key steps towards further developing a CeFi + DeFi integration, solidifying its core position in the crypto industry.

Featured Articles

Since May, $Launchcoin has explosively achieved a 300-fold increase, and the ICM (Internet Capital Market) concept it represents has swept through major on-chain communities, becoming a new direction for market capital. However, traders quickly realized that many high-market-cap leading tokens (such as $goonc and $startup) are narrative-driven projects lacking real product support, which goes against the original intention of the Believe platform.

Additionally, with incidents of project deletions and founders going missing, the market has raised questions about the sustainability of the ecosystem represented by $Launchcoin. Subsequently, some quality projects have gradually emerged with clear product logic and stable operational rhythm as the coin price warms up, not only regaining community trust but also boosting the sentiment of the platform token $Launchcoin, allowing its market cap to surpass $200 million again. Therefore, deeply exploring projects within the Believe ecosystem that truly possess growth potential has become a key path to finding Alpha. This article will focus on five potential projects and provide analysis and summary.

No hacking skills required. No internal permissions needed. Just public blockchain data and a few lines of Python scripts. This is the stablecoin privacy paradox of 2025. Stablecoins are achieving great success. The data is shocking: the use of stablecoins on Base is no longer a niche experiment. Analysis from Token Terminal shows that in just the first quarter of 2025, the total trading volume of L2 reached approximately $3.81 trillion—setting a historical record, surpassing the early growth curve of mainstream credit card networks. Against this backdrop, this article discusses the privacy issues in the stablecoin sector.

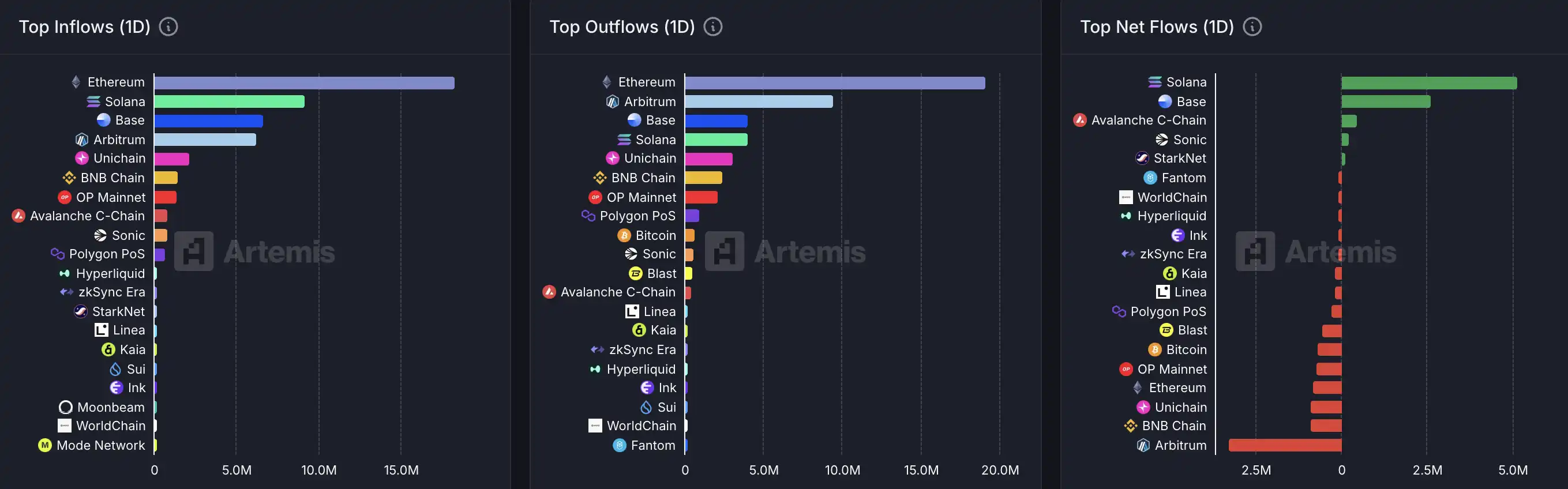

On-Chain Data

On-chain capital flow situation on June 16

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。