In 2025, the trend of Bitcoin as a strategic asset for enterprises has become increasingly significant. Many publicly listed companies worldwide are continuously increasing their Bitcoin holdings, demonstrating a strong confidence in this decentralized digital asset. According to the latest announcements, UK blockchain company Coinsilium Group Limited, Japanese energy consulting firm Remixpoint, and Japanese investment company Metaplanet have recently intensified their Bitcoin reserves, reflecting a profound insight into macroeconomic uncertainties, inflation hedging, and the long-term value potential of digital assets.

Corporate Bitcoin Accumulation: Latest Developments

Coinsilium: Steady Accumulation, Focused on Long-Term Value

On June 16, UK-listed blockchain company Coinsilium Group Limited announced that its wholly-owned subsidiary Forza Gibraltar Limited purchased 6.5577 Bitcoins for £510,000 (approximately $662,609.40), with an average purchase price of £77,770.36 (approximately $105,572.30). As of now, Forza holds a total of 25.2392 Bitcoins, with a total value of approximately £1,962,695.09 (approximately $2,662,609.40).

Remixpoint: Diversified Crypto Asset Layout

On the same day, Japanese listed company Remixpoint disclosed that it added approximately 13.3 Bitcoins worth 200 million yen (approximately $1.386 million) on June 13, with an average purchase price of 15.042 million yen (approximately $104,240). As of June 15, Remixpoint's total crypto asset value exceeded 17.1 billion yen (approximately $118.5 million), including 1,051 Bitcoins, 901 Ethereum, and other cryptocurrencies, with an estimated profit of approximately 1.763 billion yen (approximately $12.22 million) during the period. Remixpoint's crypto asset investment strategy is not limited to Bitcoin but also includes various assets such as Ethereum, Solana, and XRP.

Metaplanet: The Rise of Asia's "MicroStrategy"

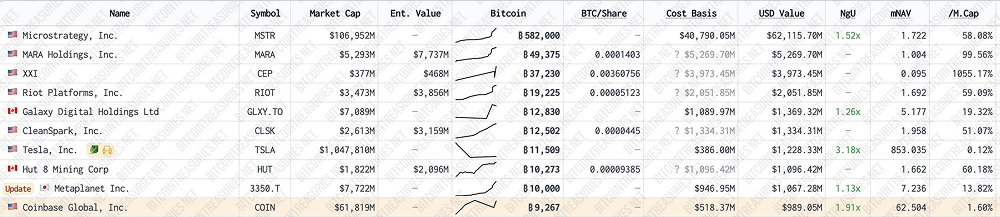

On June 16, according to data from bitcointreasuries, Japanese investment company Metaplanet's Bitcoin holdings officially surpassed 10,000 BTC, reaching a total value of approximately $1 billion, surpassing Coinbase Global (9,267 BTC) and ranking ninth among publicly listed companies globally in Bitcoin holdings, only behind Hut 8 (10,273 BTC). Metaplanet achieved this milestone by purchasing 1,112 Bitcoins on June 16 (average price approximately $105,000), funded by a $210 million zero-coupon bond issued to the EVO Fund. Since launching its Bitcoin reserve strategy in April 2024, Metaplanet has invested over 122 billion yen (approximately $850 million), with an average purchase price of $93,354/BTC. Its annualized Bitcoin yield is as high as 225.4%, making it a benchmark for global corporate Bitcoin investment.

The company plans to hold 100,000 BTC by the end of 2026 and reach 210,000 BTC by 2027, equivalent to 1% of the total Bitcoin supply, showcasing its ambition as "Asia's MicroStrategy."

Driving Factors: Why Are Companies Competing to Accumulate?

1. Macroeconomic Pressure and Hedging Demand

In 2025, the global economy faces multiple challenges: escalating geopolitical risks, rising debt levels in major economies, and declining attractiveness of traditional "safe assets" such as long-term government bonds. Against this backdrop, Bitcoin, with its fixed supply cap of 21 million, decentralized nature, and anti-inflation properties, is gradually being viewed by companies as a strategic reserve asset.

Metaplanet CEO Simon Gerovich noted in a statement on June 6 that the global economy is shifting from traditional capital and labor-driven models to information technology-driven ones. Bitcoin, as an asset with "high scarcity, ease of storage and transfer, and no credit intermediary," is rapidly gaining strategic importance. Remixpoint also clearly stated that its crypto asset investment is a hedging strategy against the depreciation of the yen, reflecting Japanese companies' concerns about the declining purchasing power of their currency.

2. Innovative Empowerment of Capital Markets

The support of capital markets is crucial behind the corporate accumulation of Bitcoin.

Metaplanet raised funds through zero-coupon bonds and moving warrants, reducing financing costs while maximizing shareholder value.

Remixpoint utilized new stock subscription rights to quickly replenish funds.

Coinsilium's steady purchasing strategy relies on its mature Bitcoin reserve policy, ensuring transparent and efficient use of funds.

These innovative financing methods reduce the pressure on companies to directly utilize cash flow while amplifying the potential returns of Bitcoin investments through equity or debt instruments, providing shareholders with higher return potential.

3. Market Sentiment and First-Mover Advantage

The 120% increase in Bitcoin's price in 2024 and the continued rise at the beginning of 2025 (with a price of approximately $107,000 as of June 16) further stimulated corporate enthusiasm for accumulation. Metaplanet's stock price has surged over 1,744% since April 2024, with the number of shareholders increasing from 10,800 at the end of 2023 to 63,600 by March 2025, reflecting the market's high recognition of its Bitcoin strategy.

The success of pioneers has inspired more companies to join. After achieving its goal of "at least 1,000 BTC" on June 13, Remixpoint clearly stated that it would continue to expand its crypto asset reserves. Coinsilium's advisor James Van Straten (also a senior analyst at CoinDesk) pointed out that Bitcoin, as part of corporate asset allocation, is becoming a global trend.

Potential Impacts and Risks

1. Reshaping the Global Financial Landscape

If Metaplanet achieves its goal of 210,000 BTC, it will hold 1% of the total Bitcoin supply, potentially affecting market liquidity and price stability. Additionally, the increase in corporate Bitcoin reserves may prompt more countries to consider including Bitcoin in their strategic reserves. Gerovich has predicted that if the U.S. adopts a Bitcoin reserve policy, countries like Japan and other Asian nations may quickly follow suit.

This centralization trend may also attract regulatory attention. Japan's strict financial regulatory environment has limited retail investors' direct access to the Bitcoin market, and companies providing indirect exposure to Bitcoin through equity may face additional compliance pressures.

2. Market Volatility and Valuation Risks

The extreme volatility of Bitcoin prices brings high returns for companies but also comes with risks. Metaplanet recorded a valuation loss of 7.4 billion yen at the end of March 2025 due to a Bitcoin price correction, although the subsequent market rebound brought an unrealized gain of 13.5 billion yen.

Metaplanet's stock has a "Bitcoin premium" of up to $596,000, meaning that investors indirectly holding Bitcoin through stocks face costs far exceeding the spot price, potentially laying the groundwork for bubble risks. While Remixpoint's diversified crypto asset strategy mitigates the risk of a single asset, the volatility of assets like Ethereum and Solana cannot be ignored. Coinsilium's steady strategy somewhat avoids the risks of excessive leverage, but its smaller reserves may limit its influence in the market.

In Conclusion: Strategic Choices in a New Arena

In the wave of global economic structural transformation, Bitcoin is not only a product of technology but also a new battleground for capital competition. Those who can stand out in this arena may reshape the wealth landscape of the next decade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。