Yesterday, the decentralized asset management platform Trident announced the launch of a treasury financing plan for XRP, with a maximum of $500 million, and appointed Chaince Securities LLC as a strategic advisor.

Against the backdrop of waning retail enthusiasm and cooling community discussions, this news has caught the market's attention: why are institutions still choosing to allocate large amounts of XRP as on-chain reserve assets? Does this mean that the retail camp, once referred to as the "XRP Army," is gradually being replaced by institutional funds?

Related reading: "Trident announces a treasury financing plan of up to $500 million for XRP and appoints Chaince Securities LLC as a strategic advisor"

XRP is one of the earliest blockchain projects to enter the public eye, yet it has long endured labels such as "centralized," "litigious," and "lacking innovation." The protracted legal battle with the SEC has lasted five years, with a slowdown in technological iteration and weak community engagement, making it a representative of "old era projects." However, since 2024, XRP's ecosystem has quietly shifted: prices are approaching historical highs again, the XRPL is building infrastructure around sidechains, stablecoins, and DeFi modules, and corporate buying and development investments are gradually warming up. Although these changes are not loud, they are accumulating substantial progress across multiple indicators.

This is not a "redemption" narrative but a structural reconstruction completed in low visibility. This article will observe how XRP navigates a "path that is neither explosive nor extinct" between controversy and silence, starting from capital trends, ecological evolution, and on-chain data.

Is XRP "turning around"?

Strategic Buying: Who is Buying XRP?

Although the mainstream narrative has yet to update, the choices of real-world funds are providing another answer. Despite XRP's "old coin" image in the crypto community still being intact, the flow of funds in reality has quietly shifted.

Over the past year, this project, long viewed as a "centralized legacy," has not faded away; instead, its price has remained stable around $2, maintaining resilience during multiple market corrections. By the end of 2024, XRP's market capitalization briefly surpassed USDT, returning to the top three cryptocurrencies globally; the on-chain TVL also grew from less than $10 million to over $40 million during the same period.

Related reading: "XRP's market cap returns to third in crypto; what is driving its surge?"

Meanwhile, a number of institutions have begun to reassess XRP's asset attributes and include it in their medium- to long-term allocation. On May 30, Hong Kong tech company Webus International launched a $300 million financing plan, using XRP for a global payment system. The next day, Nasdaq-listed energy company VivoPower announced the completion of a $121 million private placement to build an asset reserve mechanism centered on XRP, led by members of the Saudi royal family and Ripple ecosystem executives as advisors. On June 12, Trident DAO launched a treasury plan for XRP with a cap of $500 million, incorporating it into on-chain governance and asset-linked tools.

These real-world cases from the energy, transportation, and Web3 finance sectors indicate that companies' perceptions of XRP are no longer limited to controversial labels or market narratives, but are gradually viewing it as a "low-volatility digital asset" option. Especially with the SEC regulatory case nearing its end and Ripple improving its compliance path, the legal uncertainties surrounding XRP have eased, and its characteristics of low fees and high settlement efficiency align better with cross-border payment and financial allocation needs.

Although technological updates are still underway, these capital movements have formed a non-emotional, medium-term planning asset selection logic. In other words, even if the community still harbors doubts, the other side of the market is already redefining its value through action.

Ecological Reconstruction: No Longer Just a Payment Chain?

After being long defined as a "cross-border payment channel," XRP's ecological structure is undergoing a systematic shift. Over the past year, Ripple has successively launched EVM-compatible sidechains, the US dollar stablecoin RLUSD, and initiated developer activities and payment infrastructure collaborations in several countries.

From its initial remittance network, Ripple is evolving into a multi-layer platform encompassing payments, custody, stablecoins, and project incubation, aiming to provide a complete on-chain financial service stack for institutional clients. As the product structure continues to expand, a number of new protocols built around XRPL have emerged, bringing this traditional public chain into broader scenarios such as on-chain finance, yield management, and asset governance.

By the end of 2024, Ripple launched an Ethereum-compatible EVM sidechain, along with the rollout of the RLUSD stablecoin and mainnet functionality updates, gradually expanding XRPL's infrastructure capabilities. These initiatives have allowed XRP to move beyond payment uses and possess the potential to support on-chain financial applications.

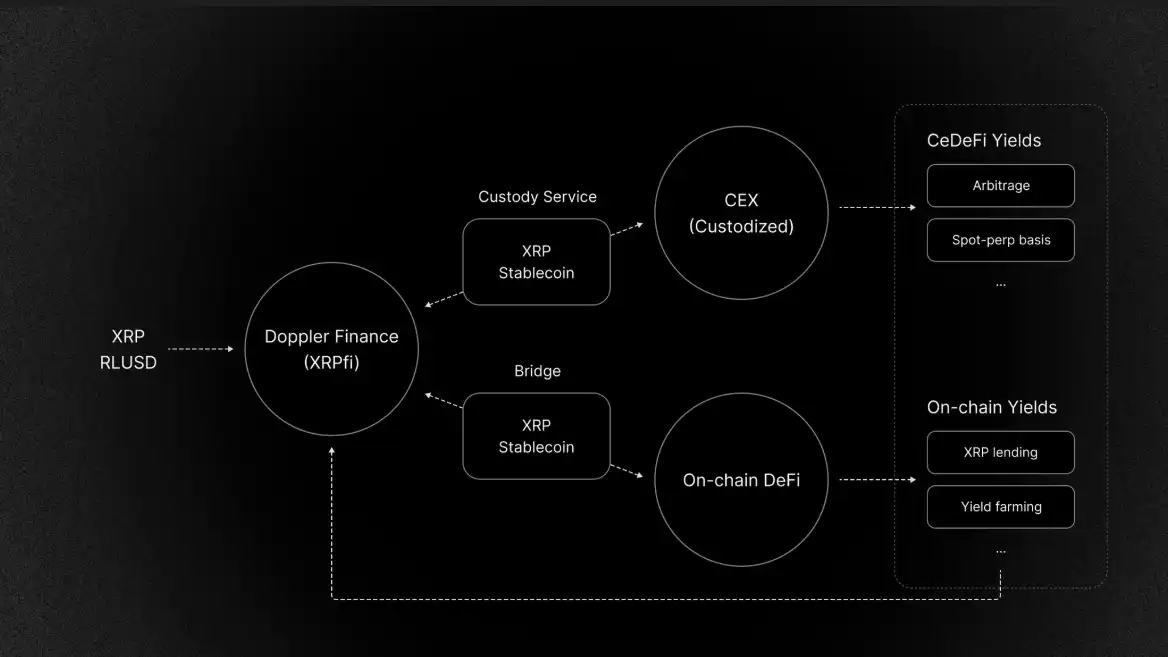

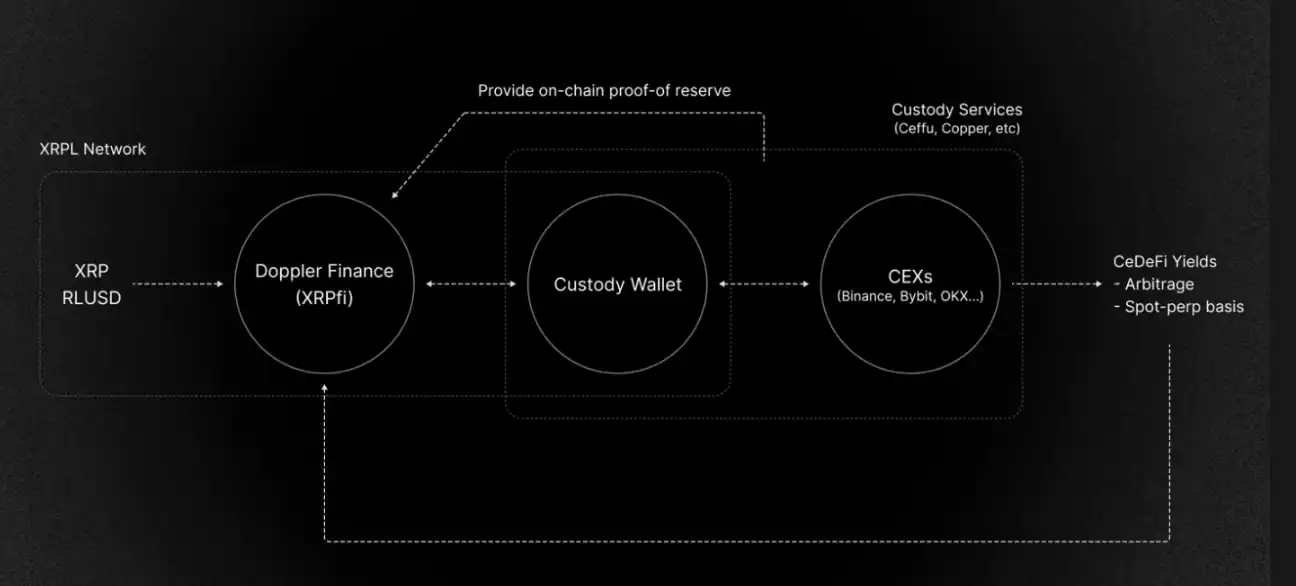

Based on these underlying updates, a new type of on-chain financial structure known as "XRPFi" is beginning to take shape, with the core goal of injecting new on-chain utility into XRP in the context of the native chain's lack of staking and yield mechanisms. Among these, Doppler Finance is currently one of the most representative projects, employing a dual-path architecture of custody and on-chain parallelism to provide yield products and asset management interfaces to holders. According to official data, the platform's current TVL exceeds $30 million, with funds operating through compliant custody channels, allowing users to view asset flows and yield sources.

Doppler Finance's dual-path yield structure, image source: official website

From a product structure perspective, Doppler's yield strategies mainly come from two types of models:

One is structured arbitrage strategies (such as spot-perpetual arbitrage, cross-platform price-neutral arbitrage), focusing on "net increase in XRP quantity" rather than pure dollar returns;

Doppler Finance's CeDeFi yield structure

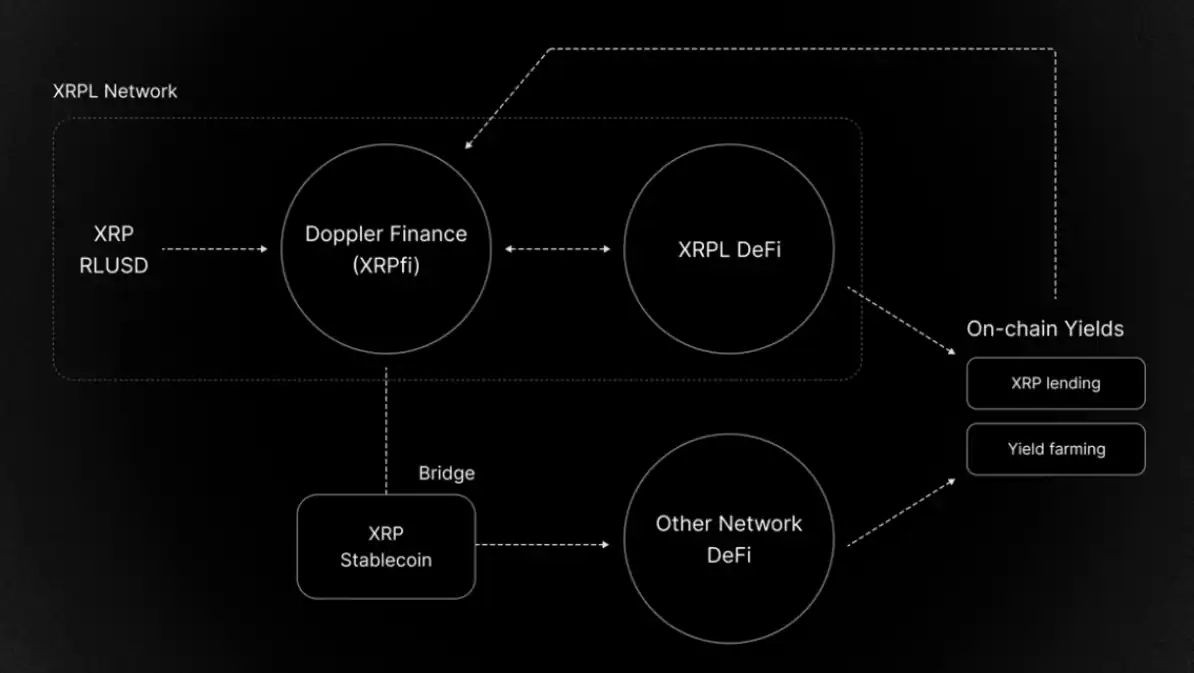

The second is to use XRP as collateral to obtain stablecoins, which are then deployed into high-liquidity DeFi protocols to achieve low-leverage, risk-controlled yields. Additionally, its platform supports staking yields on the Root Network, an upcoming XRPL lending protocol, and one-click staking leverage tools to lower user participation thresholds.

The yield path structure of XRPFi in the on-chain ecosystem

In addition to Doppler, projects such as OnXRP, Magnetic, and Anodos have also emerged on XRPL, built around AMM and lending. Some of these protocols are deployed on XRPL's EVM sidechain, while others utilize sidechains like Root Network for asset mapping. The entire XRPFi ecosystem has not taken the "high TVL sprint" path but is gradually building a DeFi system that adapts to the XRP user structure through sidechain expansion, compliant interfaces, and incentive mechanisms.

According to DefiLlama data, as of June 2025, XRPL's on-chain TVL has surpassed $40 million for the first time, with funds primarily coming from markets in South Korea, the Philippines, Singapore, and parts of Europe.

In terms of trajectory, XRP is currently attempting a "turnaround narrative" similar to that of Tron or Solana—transforming from a payment tool to a foundational protocol for institutional finance. However, unlike the latter two, XRPL has not abandoned its "low fees, high certainty" compliance orientation, but rather maintains a streamlined structure on the main chain while leveraging composable sidechains for expansion.

This "technical layering + application division" model, although progressing slowly, is building new application boundaries for XRP and forming an important foundation for the construction of the XRPFi ecosystem.

Not the Main Character, But Still Alive

Despite the gradual expansion of the ecosystem, XRP's recognition in the mainstream community remains stuck in old impressions. For many crypto-native users, XRP is still a project "lacking consensus."

This emotional gap is particularly evident on social media platforms. In the face of continuous positive news, some users helplessly comment, "Please no more good news, the price has dropped again." This sarcastic remark captures, to some extent, the current reality of the XRP community: continuous construction, yet stagnant sentiment; structural evolution, yet the market remains unfazed.

In summary, XRP may not become the center of the narrative again, nor may it be suitable for short-term investors seeking explosive growth. However, it is still building, still being incorporated into institutional financial systems, and still has developers constructing financial infrastructure. In an industry where the lifecycle of a project generally does not exceed five years, "still alive" in itself may be sufficiently rare and worthy of a second glance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。