# I. Introduction

The global financial market's perception of Bitcoin is undergoing a qualitative change. Initially speculated as "digital gold," it is gradually being viewed as a potential holding asset. The positioning of Bitcoin by major economies and large institutions is shifting from "high volatility risk asset" to "strategic reserve asset." Spot Bitcoin ETFs have been launched in the United States and Hong Kong, with asset scales continuously growing; Trump has returned to the White House, clearly placing blockchain and digital assets at a national strategic level, proposing a strategic Bitcoin reserve and gradually implementing a series of favorable policies; countries including El Salvador and Bhutan have incorporated Bitcoin into their national balance sheets. Meanwhile, publicly traded companies like MicroStrategy and Metaplanet are continuously increasing their Bitcoin holdings and attempting to leverage their purchases through issuing convertible bonds or corporate bonds, trying to seize the opportunity in the new evolution of the monetary system. This is not only a switch in the logic of financial asset allocation but may also be the prologue to a re-drawing of the national strategy and capital power landscape.

This article will analyze the impact of macro variables such as interest rates, inflation, regulation, and the U.S. "strategic Bitcoin reserve" on the differentiation of crypto assets; outline the holding patterns and driving forces of six types of entities: ETFs, national governments, publicly traded and private companies, mining companies, and DeFi. It will further predict the institutional holding changes of Bitcoin from 2025 to 2026, analyze possible market evolution trends based on fixed supply characteristics, summarize Bitcoin's competitive attributes in a multipolar world, and propose a thought path for investors' asset allocation, aiming to provide readers with a panoramic view of "who is hoarding Bitcoin, why they are hoarding it, and where hoarding will push Bitcoin."

# II. Analysis of Institutional Holding Structure

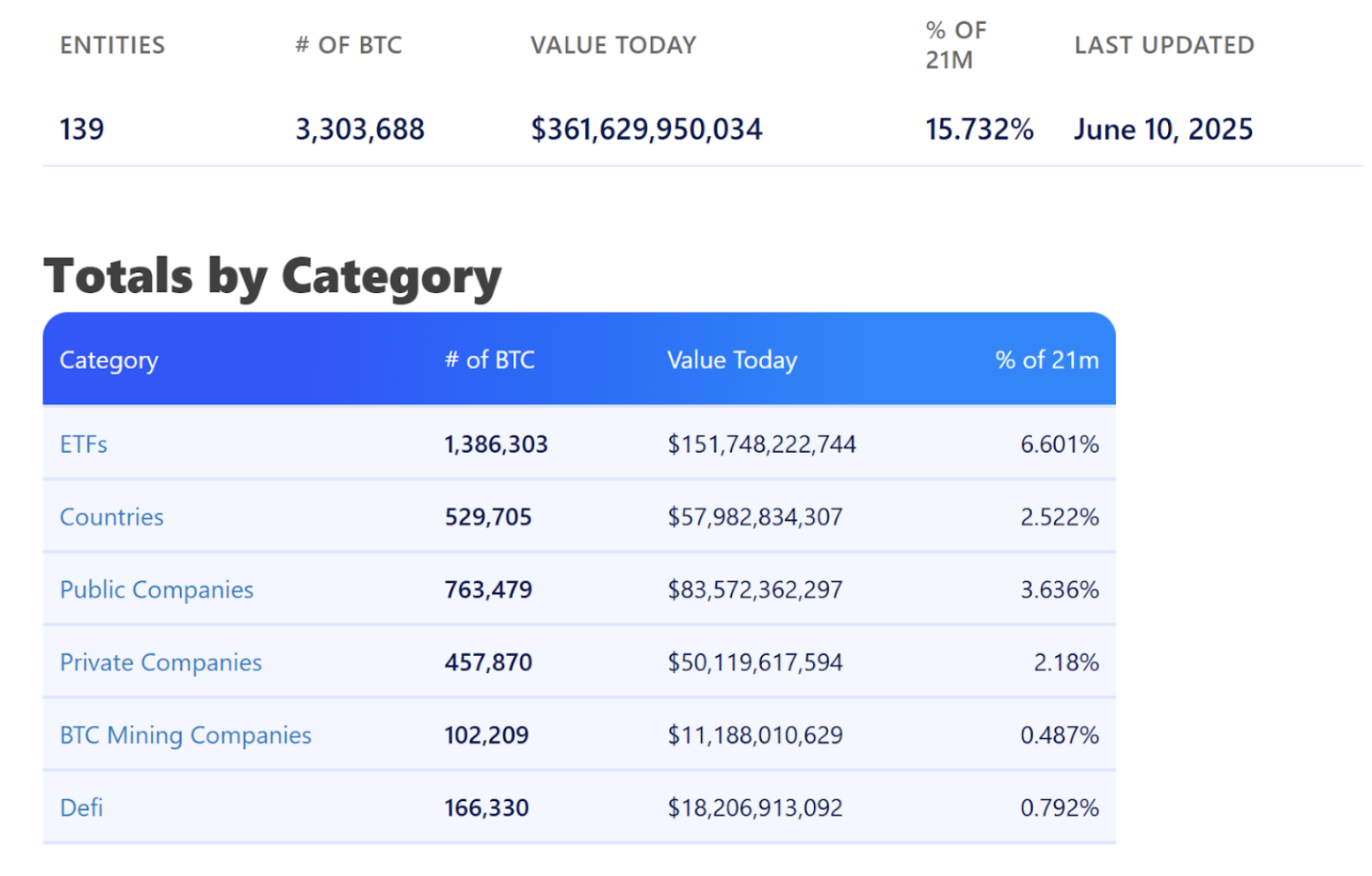

According to Bitbo Treasuries statistics, as of June 10, 2025, a total of 139 institutional entities hold Bitcoin, with a total holding of approximately 3,303,688 BTC, accounting for 15.73% of the total issuance of 21 million, with a total market value of approximately $36.16 billion. Among them, ETF holdings account for 6.60% of the total, becoming the largest circulation channel for Bitcoin, followed by publicly traded companies and national-level institutions. Meanwhile, the entry of private enterprises and DeFi projects has enriched the holding structure and diversified funding sources.

Source: https://bitbo.io/treasuries/

1. ETF Holding Analysis

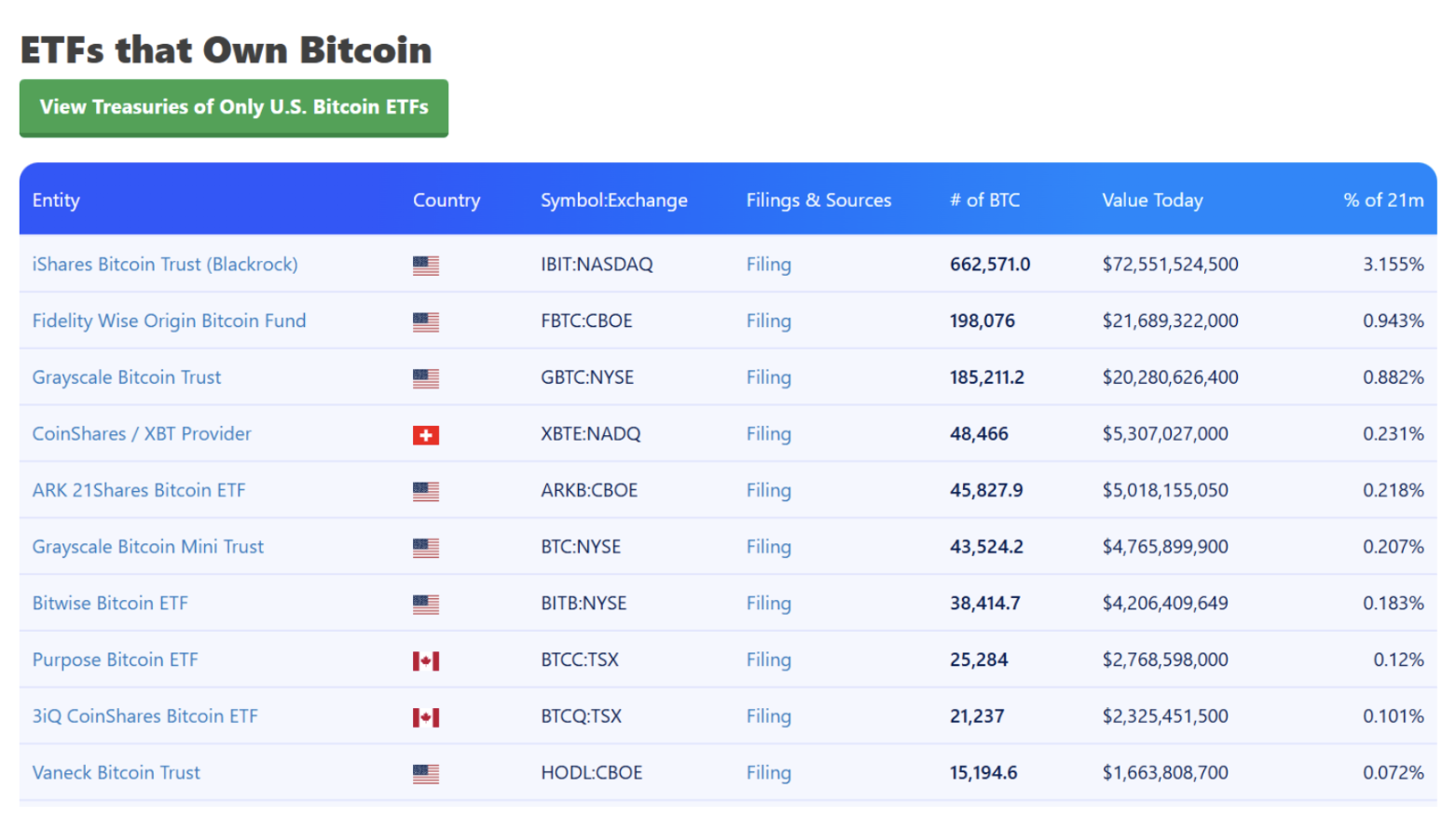

Since 2024, U.S. spot Bitcoin ETFs have been approved and launched one after another, providing institutional investors with a compliant channel and an investment tool that does not require self-custody wallets. As of June 10, 2025, 12 U.S. spot Bitcoin ETFs collectively hold approximately 1.38 million BTC, accounting for 6.6% of the circulating supply, with a market value of approximately $151.7 billion. Among them, BlackRock's IBIT alone accounts for 3.16% of the global supply, making up 55% of all ETF positions; Fidelity's FBTC and Grayscale's GBTC follow closely, locking in nearly 1.8% of Bitcoin supply. Fund flows indicate that after a brief pullback at the end of May, ETFs have once again absorbed net buying: on June 9, there was a net subscription of $392 million in a single day, with IBIT and FBTC contributing over 76% of the increase.

Source: https://bitbo.io/treasuries/#etfs

With wealth platforms like Morgan Stanley and JPMorgan expected to open Bitcoin ETF purchasing permissions in the second half of the year, the market generally anticipates that total ETF holdings may exceed 1.5 million BTC within the year, further strengthening the appeal of the "no wallet" building channel for institutions.

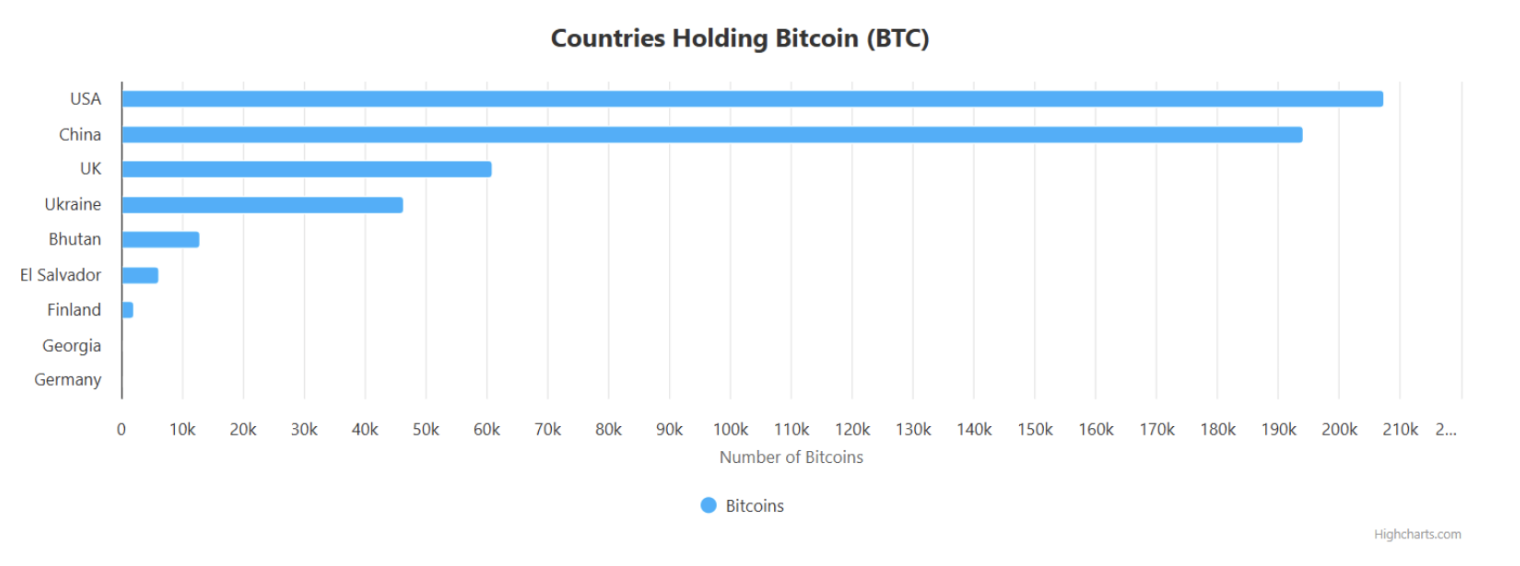

2. National-Level Institution Holding Analysis

In March 2025, the U.S. issued an executive order requiring the Treasury to establish a "strategic Bitcoin reserve" using confiscated Bitcoin and to formulate a budget-neutral strategy to increase BTC holdings, clearly stating that the Bitcoin held by the government "shall not be sold" and will be retained as a long-term treasury asset. On April 29, the Arizona state legislature passed a bill allowing up to 10% of public funds to be invested in Bitcoin. Oklahoma has also proposed establishing a Bitcoin strategic reserve. Additionally, states like Texas and Alabama are following suit, attempting to diversify asset risks through legislation and seize opportunities in the digital economy.

El Salvador continues to actively hoard Bitcoin, holding approximately 6,190 BTC (about $675 million) as of the end of May 2025, referring to it as a "strategic Bitcoin reserve" to combat inflation and enhance financial sovereignty. Furthermore, countries like Switzerland, Poland, and Japan are exploring the feasibility of digital asset reserves.

Source: https://bitbo.io/treasuries/countries/

3. Publicly Traded Company Holding Analysis

At the corporate level, MicroStrategy (now renamed Strategy) is far ahead. As of May 2025, Strategy has accumulated over 582,000 BTC, becoming the largest corporate holder globally. MicroStrategy is building a unique business model by issuing Bitcoin-backed bonds and preferred stocks, having completed three Bitcoin-backed preferred stock issuances in the past five months. On June 11, Strategy's executive chairman Michael Saylor stated in an interview with Bitcoin Magazine that Bitcoin has passed its most dangerous phase and that a bear market will not reoccur in the future. He predicts that Bitcoin's price will reach $1 million and emphasizes that senior U.S. government officials support Bitcoin. He noted that international capital is accelerating its entry into the Bitcoin space, and the next decade may be the last window for acquiring Bitcoin. Michael Saylor frequently shares Bitcoin Tracker-related information through his X account, usually disclosing Strategy's Bitcoin accumulation data the day after he posts Bitcoin Tracker information.

Source: https://x.com/saylor

Additionally, other "high conviction" companies are also hoarding Bitcoin. Marathon Digital holds approximately 49,200 BTC, Riot Blockchain about 19,200 BTC, CleanSpark about 12,500 BTC, Tesla has not increased its holdings since 2022 and currently holds about 11,500 BTC, Hut8 about 10,300 BTC, and Coinbase has also disclosed a reserve of 9,267 BTC, mainly for operations and hedging. Furthermore, the Japanese publicly traded company Metaplanet has seen its market value soar due to continuous Bitcoin purchases.

Source: https://bitbo.io/treasuries/#public

4. Private Company Holding Analysis

Many unlisted fintech companies, family offices, and funds are also laying out Bitcoin. Globally, numerous tech companies and wealthy families have incorporated Bitcoin into their balance sheets. For example, U.S. private equity and hedge funds have been increasing their BTC holdings through over-the-counter channels, with some establishing dedicated Bitcoin trusts. Private mining companies (such as Genesis Mining) also retain mining income in Bitcoin. Some asset management platforms and bank wealth management departments (such as Morgan Stanley and Goldman Sachs) are estimated to invest tens of billions of dollars in Bitcoin allocation in 2025-26. Overall, the private sector shows a strong interest in Bitcoin, driven by motives such as hedging against inflation, diversifying investments, and positioning for the future of the digital economy.

Source: https://bitbo.io/treasuries/#private

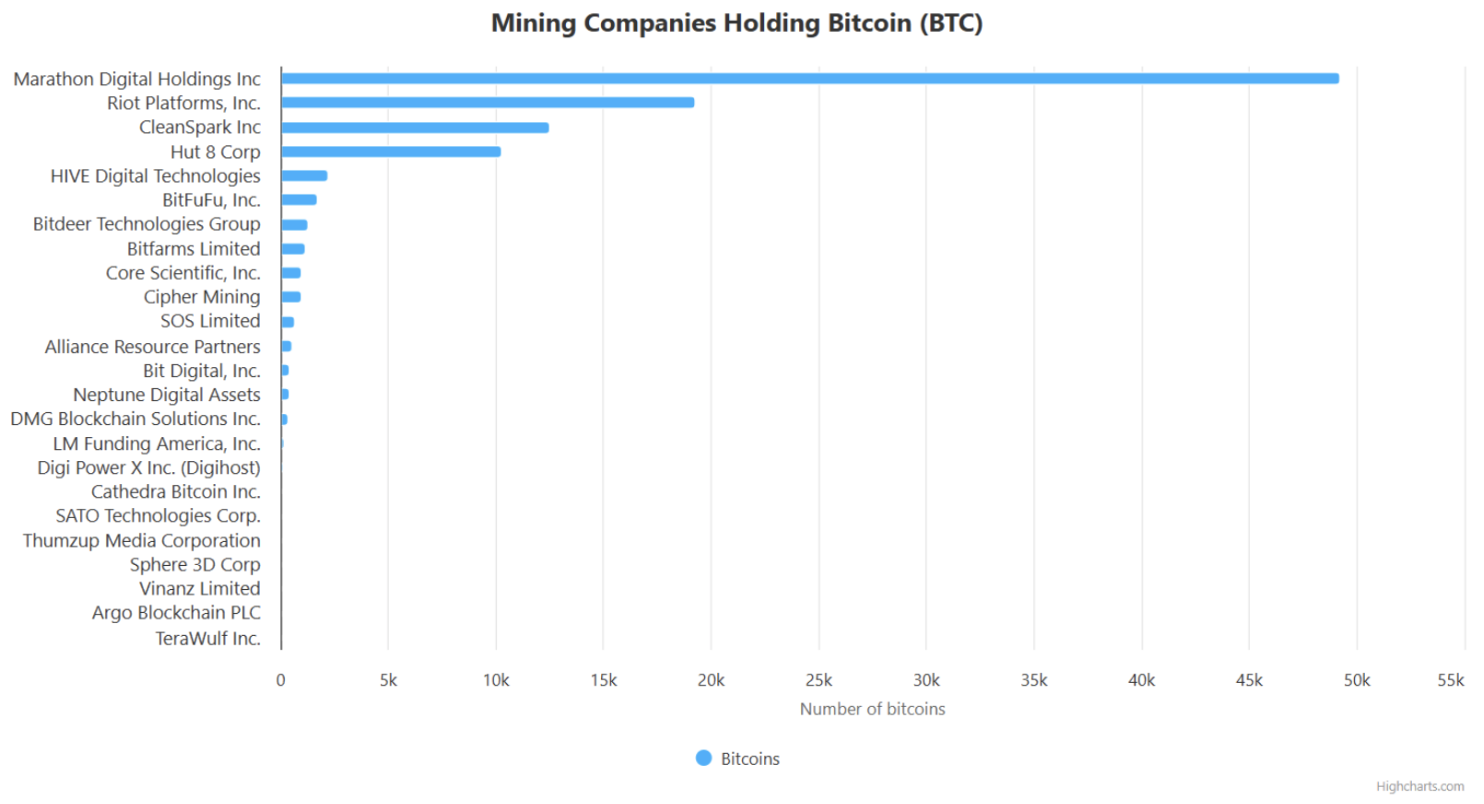

5. Bitcoin Mining Company Holding Analysis

Leading miners are inclined to increase their self-holding ratio of Bitcoin. Several mining companies have indicated that "hoarding Bitcoin" will be their new strategy after the 2024 halving. On one hand, they aim to improve efficiency and output by operating their own mining pools (such as Marathon's MARA Pool), and on the other hand, they reduce immediate liquidation. For instance, Marathon has held nearly 49,200 BTC as of May 2025, without selling any new output in May; most of Riot's output in recent years has also been retained, with holdings close to 19,200 BTC; Hut8 made a one-time increase of 974 BTC at the end of 2024, bringing its Bitcoin reserve's market value to over $1 billion. These mining companies are optimistic about the tightening supply and rising Bitcoin prices post-halving, gradually converting mining rewards into long-term reserves. They actively explore fixed-income channels (such as mining pools or loans) to cover operational costs, reducing the need to finance through Bitcoin sales. Mining executives generally believe that Bitcoin's fixed supply determines that "the more you hoard, the more valuable it becomes," providing a strong motivation for their holdings.

Source: https://bitbo.io/treasuries/miners/

6. DeFi Platform BTC TVL Analysis

wBTC and cbBTC, among other wrapped Bitcoin tokens, allow users to hold Bitcoin across different blockchain networks. According to CoinGecko data, wBTC currently has a market capitalization of approximately $13.6 billion, while Coinbase's cbBTC has a market capitalization of about $4.7 billion. The Bitcoin ecosystem in decentralized finance is also rapidly developing. Various Bitcoin Layer 2 projects are emerging: the Bitcoin staking protocol Babylon has reached a staking volume of 47,600 BTC, with a market value of approximately $5.1 billion. LBTC, as a Bitcoin liquid staking token based on Babylon, allows users to maintain the value of their original assets while participating in DeFi and earning yields, with its market capitalization now reaching $1.9 billion. These protocols are bringing new liquidity tools and yield opportunities to Bitcoin, accelerating the conversion of idle Bitcoin into income-generating assets for institutions.

Source: https://bitbo.io/treasuries/#defi

# III. Analysis of Institutional Bitcoin Accumulation Motivations

From the depreciation of the dollar, inflationary pressures, to the global asset reallocation demand, coupled with supportive policies and regulations, these factors constitute the fundamental motivations behind the institutional "hoarding Bitcoin trend" in 2025, driving various institutions to increase their Bitcoin holdings.

1. Macroeconomic Reasons for Institutional Bitcoin Accumulation

In 2025, a large-scale Bitcoin "hoarding trend" has emerged among global institutions, driven by profound macroeconomic logic and the increasingly mature policy and regulatory environment. With the ongoing changes in the global macroeconomic landscape, the trend of institutions accumulating Bitcoin is expected to continue long-term, further reinforcing Bitcoin's role as a global strategic reserve asset.

Dollar Depreciation and Persistent Inflationary Pressure: In recent years, the continuous pressure on the dollar has become a global consensus. The U.S. government debt has surpassed $36 trillion, with a debt-to-GDP ratio reaching a historic high of 123%, raising concerns among international investors about the long-term stability of the dollar and U.S. Treasuries. At the same time, persistent high inflation globally has significantly reduced the real returns on traditional financial assets. In a high-inflation environment, various institutions are compelled to seek assets that can effectively resist inflation erosion. Bitcoin, due to its scarcity, decentralized nature, and high global liquidity, is gradually being viewed as a safe-haven reserve tool similar to gold.

Gradual Clarification of Policy and Regulatory Environment: The U.S. policy stance has also undergone a dramatic shift, with the White House's newly issued executive order clearly stating that the U.S. "supports blockchain" and believes that "legitimate stablecoins" help maintain dollar sovereignty. Bipartisan proposals have been introduced in Congress to establish a regulatory framework for stablecoins and crypto assets, authorizing financial institutions to create compliant digital asset products. More than 20 states out of the 50 in the U.S. have proposed or are considering legislation related to Bitcoin reserves, covering public fund allocation, tax incentives, and regulatory frameworks. Regulatory bodies such as the SEC and CFTC have also accelerated the layout of crypto regulations by the end of 2024. Overall, the U.S. is evolving from strict regulation to a more lenient and friendly approach, providing greater certainty for institutional investment.

Global Asset Reallocation Wave and Industry Demonstration Effect: The continued low returns on traditional financial assets, with challenges facing investment returns in stocks and bonds, are forcing institutional investors to reallocate assets. Since the beginning of 2025, the rapid increase in the asset management scale of U.S. Bitcoin ETFs has provided institutions with a convenient and compliant investment channel, accelerating the allocation of institutional funds to Bitcoin. Additionally, the high-profile hoarding of Bitcoin by MicroStrategy serves as a significant demonstration effect, leading more and more companies, funds, and even government institutions to follow suit, forming a consensus and collective behavior among institutions holding Bitcoin. This demonstration effect is continuously reinforced by the industry, accelerating the inflow of institutional funds.

2. Microeconomic Reasons for Institutional Bitcoin Accumulation

Government/Sovereign Fund Demand: This reflects a strategic need for countries to diversify sovereign assets, hedge against domestic currency depreciation, and mitigate geopolitical risks. For instance, the U.S. has promoted legislation to establish a Bitcoin "strategic reserve," holding confiscated Bitcoin long-term. Overall, governments currently hold about 2.3% of the total Bitcoin supply, which, while not large, could significantly impact prices if they act collectively.

Publicly Traded Companies and Large Enterprises: At the corporate treasury management level, the demonstration effect of publicly traded companies represented by MicroStrategy is significant. MicroStrategy's founder, Saylor, has repeatedly stated the intention to indefinitely increase Bitcoin holdings, influencing many global publicly traded companies to actively incorporate Bitcoin into their financial assets. The main motivations for companies to accumulate Bitcoin are to hedge against corporate fund depreciation, enhance asset returns, and attract investor attention.

Private Enterprises and Small to Medium-Sized Companies: In addition to large publicly traded companies, some private firms and smaller companies are also actively getting involved. For example, some companies raise funds through equity financing and then turn to purchase crypto assets. Whether tech giants or traditional industry companies, they are allocating Bitcoin on their balance sheets to optimize financial conditions and respond to macro uncertainties.

ETF Issuers and Institutional Asset Management: Since the approval of spot Bitcoin ETFs in the U.S. in 2024, traditional asset management giants have quickly entered the market. BlackRock's iShares Bitcoin ETF (IBIT) surpassed $70 billion in assets under management (AUM) within just one year of its launch, setting a record for the fastest growth in scale; the fund's Bitcoin holdings now account for about 3.15% of the global circulating supply, making it a significant market participant. ETFs provide a convenient channel for institutions and funds that are unwilling to hold Bitcoin directly, attracting a large influx of institutional funds. Meanwhile, traditional asset management companies are also increasing their Bitcoin investment positions to enhance performance, driving significant capital inflows into Bitcoin and pushing prices upward.

Mining Companies: Mining companies earn Bitcoin rewards from mining, with costs far below current market prices. Reports indicate that the mining cost in 2025 is approximately $26,000 to $28,000 per BTC, while the market price is around $100,000. Therefore, during a bull market, miners often prefer to hoard rather than sell. For example, Marathon has continuously purchased Bitcoin from January to May 2025, currently holding 49,200 BTC, making it the second-largest publicly traded mining company by Bitcoin holdings. This hoarding behavior is partly to hedge against the sharp reduction in output due to the halving (after May 2024, block rewards will drop to 3.125 BTC, with an annual inflation rate of <0.5%), and also reflects miners' optimistic expectations for future prices.

DeFi Platforms and Protocols: The decentralized finance sector is also beginning to absorb Bitcoin. Some protocols support Bitcoin as collateral to issue stablecoins or synthetic assets, providing revenue sources for the platforms. Institutional capital entering the DeFi ecosystem accelerates this process. Some institutions are exploring the possibility of combining traditional bonds or real estate with Bitcoin through DeFi. As regulatory frameworks gradually clarify, the demand for compliance in DeFi platforms increases, and incorporating Bitcoin into their ecosystems can enhance stability and attractiveness.

# IV. How Institutional Accumulation Restructures Bitcoin's Price Mechanism

1. Traditional Price Driving Mechanism: In the past, Bitcoin's price movements were primarily driven by retail sentiment and supply-demand fundamentals, characterized by a "bull market expectation + halving cycle" dual driving force. Retail enthusiasm often led to rapid price increases when buying pressure on exchanges surged, while market panic or large sell-offs resulted in sharp declines. Additionally, the halving event, occurring every four years, significantly reduces the new coin supply from miners, often triggering a new bull market after supply tightens.

2. New Logic Driven by Institutions: In the context of large-scale institutional entry, the price mechanism of Bitcoin has changed from the past. The higher the holding rate and the lower the circulating supply, the more stable and elevated the price becomes, and the increase in market capitalization further attracts institutional attention; this feedback loop of "more institutions holding → supply tightens → price rises → market cap expands → attracts more holding" is gradually solidifying:

Structural Supply Tightening: After the halving, Bitcoin's annual inflation rate has dropped to extremely low levels, with 74% of circulating coins on-chain remaining unused for two years, and about 75% of coins having been dormant for the past six months. This means that only a small amount of new and active coins are available for market trading, significantly weakening conventional selling pressure. According to analysis, even a small-scale buying impact can lead to substantial price increases.

Increase in Long-Term Holders' Proportion: As Bitcoin's price rises, many short-term holders gradually take profits and exit, while long-term holders continue to accumulate at high price levels, with many high-position coins effectively transforming into locked coins, enhancing the market's resilience to declines. Overall, the trading proportion of institutions and large holders continues to rise, increasing the proportion of long-term holders and creating a further tightening supply situation.

Institutional Pressure on Circulation: A large number of institutions and large funds are withdrawing Bitcoin from exchanges to cold wallets or trust accounts for long-term holding. Meanwhile, ETFs and asset management institutions continue to buy, further reducing the market's tradable supply. More institutions holding ⇒ reduced circulating supply ⇒ price pushed higher, forming a positive feedback loop where price and market cap mutually reinforce institutional participation.

The driving force in the Bitcoin market has shifted from early short-term speculation and exchange traffic to being dominated by institutional hoarding and supply tightening. In this pattern, Bitcoin's price no longer solely relies on retail sentiment or miner output but is redefined in its valuation through the interplay of institutional holdings and macro value recognition. As analysis points out, the confidence of institutions and long-term holders provides solid support for prices, ushering the Bitcoin market into a new phase characterized by institutionalization and a more imbalanced supply-demand dynamic.

# V. Conclusion and Outlook

The "hoarding trend" of ETFs, governments, and enterprises has profoundly changed Bitcoin's supply-demand structure and pricing logic: fixed increments + long-term locking have led to a continuous reduction in the market's circulating supply; the institutional need to hedge against inflation and diversify reserve assets has created robust and lasting buying pressure on the demand side. With the institutionalization of the U.S. "strategic Bitcoin reserve," the successive implementation of state legislation, and the widespread participation of global sovereign funds, publicly traded companies, and mining enterprises, Bitcoin is accelerating its transformation from a "high volatility risk asset" to a "strategic reserve asset," entering a new era dominated by institutional behavior.

Price Center Elevation: Under the dual pressure of annual new supply being less than 0.5% and continuous net inflows into ETFs, market expectations are shifting from "cyclical bull and bear" to "stepwise elevation." In the baseline scenario, Bitcoin is expected to stabilize in the range of $150,000 to $180,000 by the end of 2025 to mid-2026; if interest rate cuts in the U.S. and Europe coincide with more sovereign funds entering, the upper end of the bull market may extend to $250,000.

Volatility Easing: The increased proportion of institutional holdings is gradually converging the severe volatility of "deep pullbacks—rapid rebounds." On-chain data shows that 74% of circulating coins have not moved for two years, indicating that each institutional-level buying action is raising the bottom and enhancing market resilience.

Deepening Financialization: Spot ETFs are just the beginning; the futures term structure, Bitcoin staking yield curves, and "BTC-denominated bonds" will accelerate improvements, providing traditional funds with richer hedging and yield strategies, further enhancing the depth and effectiveness of the Bitcoin market.

On-Chain Ecosystem Prosperity: Layer 2 solutions and liquid staking protocols such as Babylon, RGB, and BitVM are injecting DeFi and RWA functionalities into Bitcoin, improving capital efficiency and recycling idle institutional BTC, which will help increase the locking rate in the long run.

Risks and Uncertainties: On a macro level, caution is needed regarding sudden tightening of global liquidity, geopolitical black swans, and unexpected expansions of the U.S. fiscal deficit; on an industry level, attention should still be paid to regulatory discrepancies, protocol security incidents, and cash flow pressures on mining companies. In extreme scenarios, prices may experience a temporary pullback of over 30%, but the long-term upward logic is unlikely to be fundamentally disrupted.

Overall, Bitcoin is at the intersection of institutionalization, globalization, and financialization, and the next round of value reassessment has already begun. The period of 2025-2026 may be a critical window for "re-pricing Bitcoin on a higher platform."

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend assessment + value excavation + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional evaluations of potential projects, and all-weather market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selected" and daily news briefings of "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。