Original Title: "Under the Shadow of War, Has the Crypto Market Once Again Become a Frightened Bird?"

Original Author: 1912212.eth, Foresight News

In the early hours of June 13, Bitcoin dropped from $108,000 to $102,664, marking a rare seven consecutive declines on the four-hour chart. Ethereum fell from around $2,800 to $2,455, experiencing an unusual nine consecutive declines on the four-hour chart. Many altcoins also suffered significant declines due to the overall market impact.

In terms of open contract data, Coinglass reported that $1.12 billion was liquidated across the network in 24 hours, with $1.04 billion in long positions liquidated. The largest single liquidation occurred on Binance's BTCUSDT, valued at $201 million.

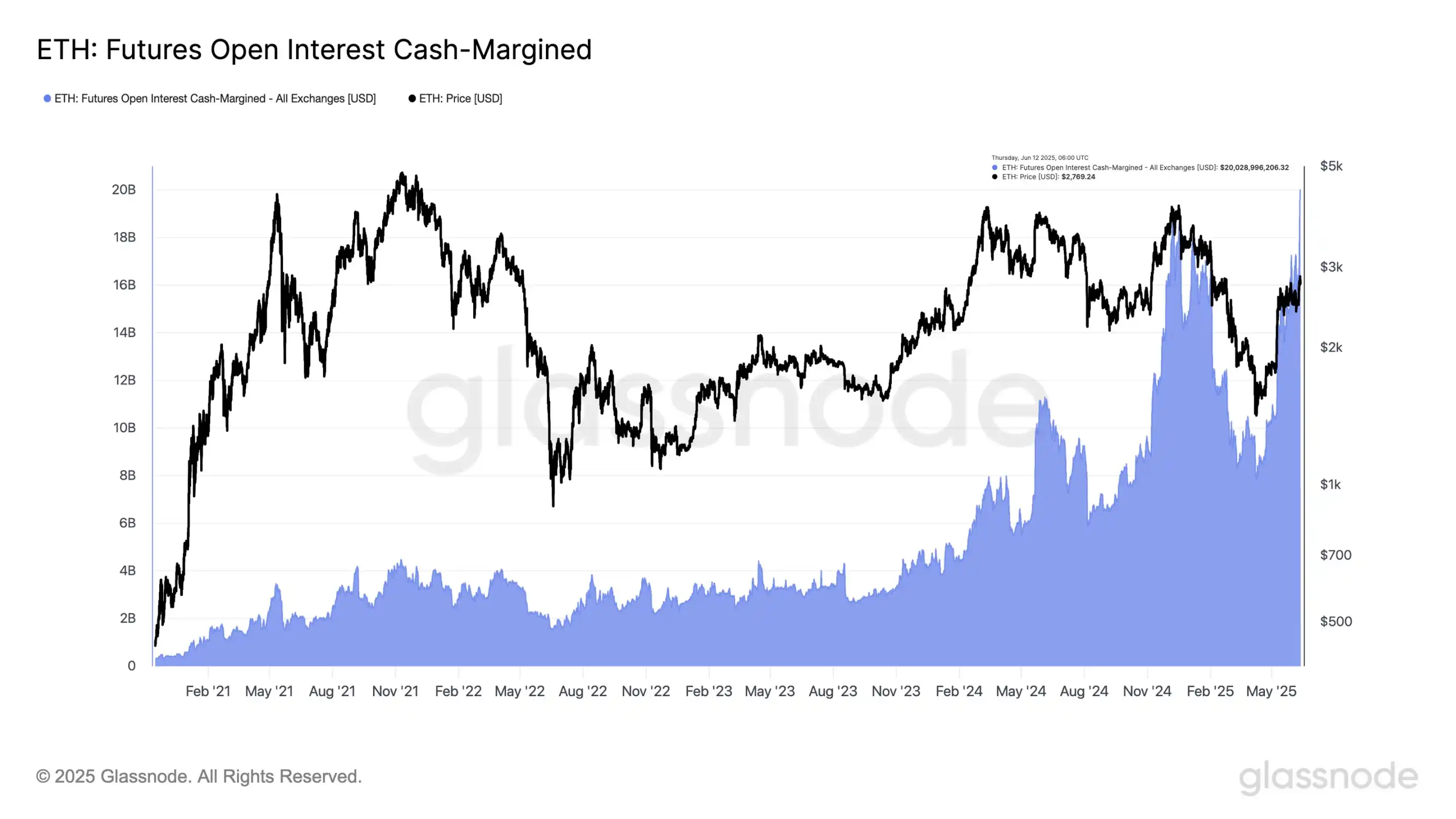

On June 12, glassnode monitoring data showed that Ethereum's open contracts had just reached a historical high, surpassing $20 billion. Although the ETH price slightly retreated from the $2,800 level, the market leverage continued to accumulate as traders increased their leverage using stablecoins.

Additionally, after "ETH Microstrategy" listed company SharpLink Gaming submitted documents to the SEC regarding "PIPE investors selling their holdings," its stock price plummeted by about 70% in after-hours trading, negatively impacting ETH as well.

The company submitted an S-3ASR registration statement, which allows for the resale of up to 58,699,760 shares related to its private equity investment (PIPE) financing by more than 100 shareholders. The market initially interpreted this statement as indicating that PIPE investors had sold their holdings. However, the company's board chairman, Joseph Lubin, stated on the X platform that the market "misread" the S-3 document, which was merely a pre-registration of shares for potential resale. This is a standard procedure following PIPE transactions in traditional finance and does not represent actual sales.

The significant increase in futures open contracts indicates that the main driving force behind this round of price increases is not spot buyers but leveraged futures traders. In contrast to Bitcoin, which is still dominated by spot demand, Ethereum's trend has shown divergence. Recently, there has been a surge in bullish options buying, combined with the gamma hedging effect, which poses a clear gap risk for ETH. The market has become increasingly fragile and sensitive to changes in momentum.

As the market anticipated Ethereum to lead a strong rebound for altcoins, it once again turned downward. What exactly happened?

Military Conflict Erupts Between Israel and Iran

In the early hours of the 13th local time, the Israeli Ministry of Defense announced that Israel had launched strikes against Iran. Israeli Defense Minister Katz stated that Israel had conducted airstrikes on Iran. Katz mentioned that after launching a preemptive strike against Iran, Israel expects to soon face missile and drone attacks. According to Xinhua News Agency, Israeli Prime Minister Netanyahu stated on the 13th that the Israeli military's strikes against Iran would "last for several days."

Currently, Israel has entered a state of emergency nationwide. CNN cited Israeli sources reporting that Israel is preparing for significant retaliation from Iran, which is expected to be larger in scale than previous Iranian attacks on Israel. Sources indicated that Israel intends to continue attacking Iran until it believes the nuclear threat from Iran has been eliminated, although there are some doubts within Israeli security agencies about whether this goal can truly be achieved through unilateral Israeli action. Israel's main targets include three areas: Iran's nuclear facilities, military assets, and key figures in the Iranian military.

Iran's state television has just reported unverified claims that General Salami, commander of Iran's paramilitary Revolutionary Guard, may have been killed in the Israeli attack. The television station added that another senior guard official and two nuclear scientists may also have died. The report did not provide further details.

Internationally, Brent crude oil and WTI crude oil futures both rose over 8%. Nasdaq futures briefly fell by as much as 2%, S&P 500 index futures dropped 1.8%, and Dow futures fell 1.6%. Spot gold briefly rose above $3,420 per ounce, gaining nearly 1% during the day.

Federal Reserve Has Yet to Cut Interest Rates

Since the Federal Reserve cut interest rates in December 2024, it has not shown any signs of easing its stance on rate cuts. U.S. President Trump has also expressed his frustration. Recently, he has frequently stated on social media that he hopes the Federal Reserve will lower interest rates, saying, "We have a lot of short-term debt, and I prefer long-term low-interest debt. If we lower rates by 1%, it means paying 1% less."

"I suggest the Federal Reserve cut rates by 200 basis points." Powell has not backed down on this. The market expects Powell to be dismissed, but Trump has simultaneously stated, "I will not fire Federal Reserve Chairman Powell; he just needs to lower rates, and our inflation data looks good." Hedge fund giant Paul Tudor Jones indicated that President Trump will choose a "very dovish" Federal Reserve chairman.

Recently, after the release of CPI data and the U.S. May core PPI, traders expect the Federal Reserve to cut rates twice this year, starting in September. In the current tightening liquidity environment, any slight disturbance can easily trigger a significant market decline.

Frequent Black Swan Events

The international market has been quite unstable recently. On June 12, an Air India Boeing 787 passenger plane crashed while en route to the UK, marking the first accident for this model. Multiple media outlets reported that the number of casualties exceeded 240, causing Boeing's stock price to drop by over 6% in response to the news.

Previously, after a heated argument between Tesla founder Musk and President Trump, the situation has recently concluded with Musk admitting fault. According to Reuters, President Trump praised Tesla during an event at the White House regarding California's electric vehicle regulations, stating, "I like Tesla… I discussed electric vehicles with Musk," and he added, "Musk really likes me."

Riots in Los Angeles continue, with curfews imposed in some areas. The Global Times reported that at least 378 people have been arrested in Los Angeles since last Saturday. The mayor of Los Angeles announced on the evening of the 10th local time that a curfew would be implemented from 8 PM that day until 6 AM on the 11th in certain areas of downtown, with the duration of the curfew to be determined after assessment. Meanwhile, the verbal sparring between President Trump and California Governor Newsom continues. Protests against the enforcement actions targeting illegal immigrants are spreading from Los Angeles to other parts of the U.S.

Subsequent Market Trends

HashKey Capital investment manager Rui tweeted, "The liquidity of altcoins has reached a freezing point. Aside from the new lows in trading volume from market makers, there are no buy or sell orders on the books, causing prices to naturally decline slowly. No one is taking the good news, and the buy orders on exchanges are only robots for thirty seconds; new coins start to decline as soon as they are listed. Whether up or down, the cycle of altcoin markets has shortened significantly; if you can't catch it, it's time to clock out."

Trader Million ERIC tweeted that after the oversold signal for Bitcoin, it only rebounded slightly before continuing to decline, with the price range to watch in the future being around $101,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。