Original Title: "Caught in the BTC Invisible Manipulator Conspiracy Theory? Unveiling Tether's Bitcoin Strategic Panorama"

Original Author: Nancy, PANews

At the center stage of the 2025 Bitcoin Conference, Tether CEO Paolo Ardoino stood in front of an image of Wukong, stating, "Bitcoin is my Wukong, it is our friend."

This seemingly emotional expression is, in fact, a microcosm of Tether's strategic core. As the issuer of the world's largest stablecoin USDT, Tether is embedding itself into multiple layers of the Bitcoin ecosystem in a builder's posture, from reserve asset allocation to mining operations, from ecological investments to infrastructure development. Tether is delving deep into the nerve center of the new global financial order.

Due to Tether's deep penetration into the Bitcoin system, its actions have also sparked an increasing number of conspiracy theories and heated discussions overseas, questioning whether it artificially inflates Bitcoin prices by continuously issuing USDT, creating a "closed-loop bubble" sustained by Bitcoin reserves, gold backing, and USDT issuance.

Establishing Bitcoin Reserve Strategy, Labeled as the Only Major Buyer

Since May 2023, Tether announced it would regularly allocate up to 15% of its realized net operating profit to purchase Bitcoin. Tether expects that its current and future Bitcoin holdings will not exceed the shareholder capital buffer and will further strengthen and diversify its reserves. As of the first quarter of 2025, Tether held Bitcoin worth approximately $7.66 billion, a significant increase from the previous quarter.

The "Gold + Bitcoin" dual-reserve mechanism is Tether's hedge against the risks of sovereign fiat currencies and has brought substantial financial returns. Ardoino recently disclosed that Tether currently holds over 100,000 Bitcoins and more than 50 tons of gold. In 2024 alone, Tether's net profit reached $13.7 billion, with investments in gold and Bitcoin contributing approximately $5 billion in profits. Ardoino has stated that they hold gold not to challenge Bitcoin, but to challenge the centralized fiat currency system.

However, WhaleWire founder Jacob King pointed out, "Relying on continuous money printing and taking over, Tether is the only major buyer in the entire Bitcoin market. It raises Bitcoin prices by issuing new USDT and then sells the excess, purchasing dollars and gold as reserves to prove its legitimacy." He referred to this model as the "ultimate house of cards," suggesting that once stablecoins face regulation or Bitcoin demand dwindles, the entire system may become unbalanced.

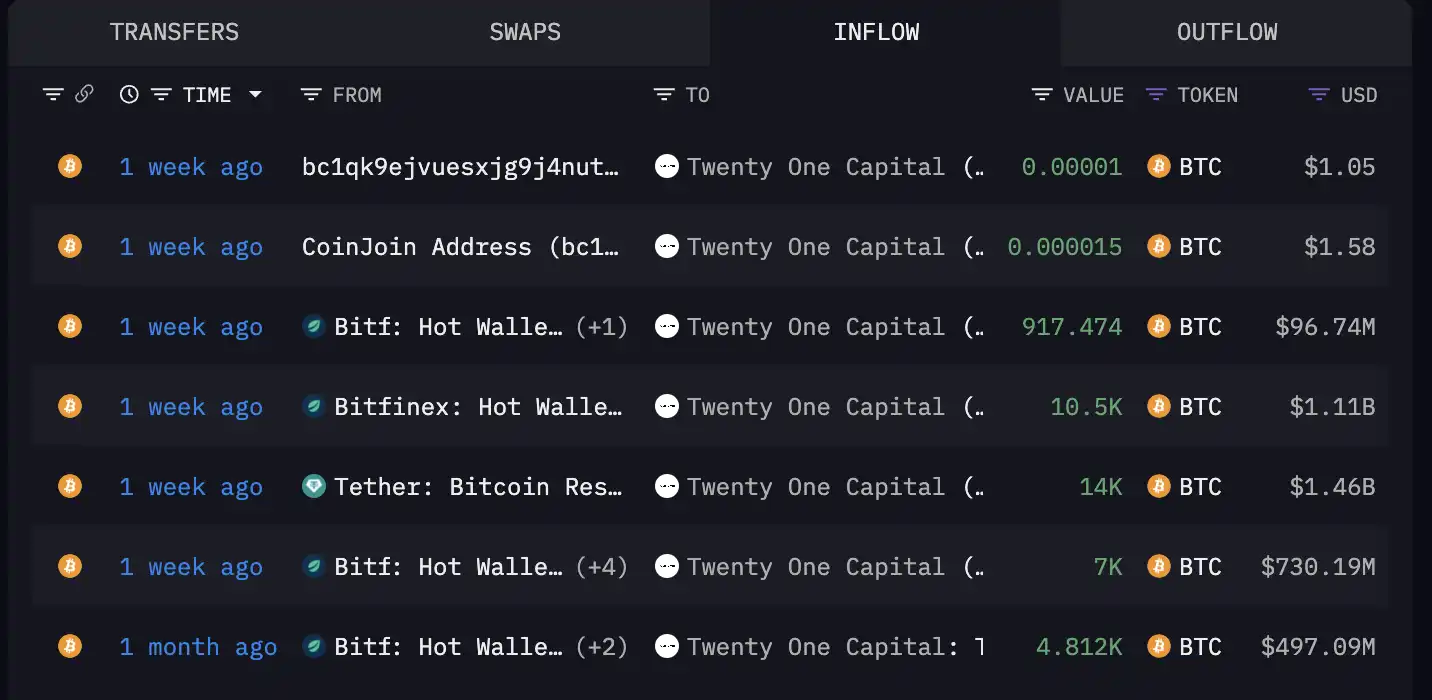

Tether's ambitions regarding Bitcoin extend far beyond merely hoarding coins. In April of this year, Tether, in collaboration with SoftBank and Cantor, jointly initiated the establishment of a crypto investment joint venture, Twenty One Capital, aimed at creating a global Bitcoin asset acquisition and management platform with a total scale of $3 billion. This platform is seen in the industry as Tether's structural layout to rival MicroStrategy. In this joint venture, Tether holds 42.8% of the equity and 51.7% of the voting rights, effectively holding the dominant position. Cantor holds a 5% stake in Tether, with its CEO Brandon Lutnick being the son of U.S. Commerce Secretary Howard Lutnick.

"Jack Mallers (CEO of Twenty One Capital) has a close relationship with Tether and Bitfinex; his other company, Strike, has long had a close relationship with Tether. They claim to have significant market demand, but most of the Bitcoin in their reserves comes directly from Tether. This is a 'shell operation' in a larger liquidity trick." Jacob King stated on social media that if stablecoins face U.S. regulation in the future, Tether will struggle to continue inflating, and the recent massive net outflows from Bitcoin spot ETFs indicate that institutions are rapidly retreating.

On-chain data shows that the Bitcoin reserves of Twenty One Capital come from Tether, which recently injected over 37,000 BTC through five transfers, worth nearly $4 billion. Tether's investment of over $770 million in the video platform Rumble has also established its own Bitcoin treasury, claiming Bitcoin has the potential to serve as an inflation hedge.

Building Mining Farms and Strategic Investments, Aiming to Become One of the World's Largest Miners

Tether's ambitions extend far beyond asset reserves. As early as 2023, Tether launched a renewable energy-driven Bitcoin mining project in Uruguay, utilizing the local abundant clean energy resources (such as hydropower and wind energy) to create an efficient and sustainable mining base. Subsequently, it participated in El Salvador's volcanic energy plan, becoming a capital force driving one of the world's largest geothermal Bitcoin mining farms. Tether has continued to expand its energy map in Latin America, with cumulative investments of $500 million in Uruguay, Paraguay, and El Salvador to build vertically integrated mining bases.

"The so-called Bitcoin investment in El Salvador is actually a carefully crafted illusion. The Bitcoins in its treasury were directly transferred from Bitfinex and Tether. Tether even personally drafted all of El Salvador's Bitcoin legislation. However, many people have not noticed that El Salvador has quietly abandoned the implementation of Bitcoin as legal tender. Tether and its internal network cannot support all of this because there is no real market demand." Some of Jacob King's statements lack clear evidence, but in February of this year, El Salvador did officially cancel Bitcoin's status as legal tender through a Bitcoin law, and merchants and institutions are no longer required to accept Bitcoin, nor can it be used for tax payments. Polls show that the vast majority of the public have not benefited, and the economic situation has not improved.

In addition to building its own mining farms, Tether is also actively expanding its global mining footprint through investments and acquisitions. To date, it has invested in companies such as Bitdeer, Northern Data Group, Blockstream, and Swan Mining, covering chip procurement, server manufacturing, data center construction, and enterprise-level computing power hosting, becoming an important player supporting Tether's Bitcoin mining layout.

This year, Tether took a further step by announcing its deployment of computing power to the OCEAN mining pool, promoting the construction of decentralized Bitcoin mining infrastructure. At the same time, Tether recently announced plans to open-source its Bitcoin mining software, allowing new miners to enter the market without relying on expensive third-party suppliers.

According to Ardoino's disclosure at the Bitcoin 2025 conference, Tether has invested over $2 billion in energy and infrastructure, with actual investments in Bitcoin mining being even more substantial. It is expected that by the end of this year, Tether will become the world's largest Bitcoin miner, a prediction that encompasses all publicly listed companies.

Full-Stack Layout from Bitcoin On-Chain Issuance to Cultural Penetration

Tether is advancing its full-stack strategic layout, continuously expanding the boundaries and influence of the Bitcoin ecosystem. For example, on the technical front, in addition to Ethereum, TRON, and other chains, Tether issues USDT to Bitcoin-related protocols through Omni, Liquid, Lightning, RGB, and supports popular Bitcoin sidechain networks like Plasma, which is expected to natively support USDT; in terms of wallet tools, Tether AI has launched a self-custody wallet WDK, which natively supports Bitcoin and USDT, allowing enterprises, applications, websites, and even AI agents to connect, further lowering the threshold for Bitcoin financial infrastructure; in the payment ecosystem, Tether has donated to the open-source project BTC Pay Server to support the ongoing development and optimization of its open-source crypto payment processor.

On the cultural and educational front, Tether has co-hosted the Plan B Summit with the city of Lugano, Switzerland, sponsored local football clubs, and introduced the Bitcoin brand image into European stadium culture; at the same time, leveraging the Tether Education Program, it has established partnerships with multiple universities worldwide to promote the dissemination of Bitcoin knowledge and cultivate the next generation of crypto natives. Twenty One Capital will also focus on the dissemination of Bitcoin-related knowledge in the future, creating educational content and video media, as well as developing a series of financial and consulting services related to Bitcoin.

"For me, the most important thing is that I can contribute to building a more accessible, resilient, and useful Bitcoin ecosystem. If I can play a role in infrastructure, technology, and education, that is enough. The story of Bitcoin has never been about any one person, but about the global community's dedication to an idea—building the future steadfastly, even in the lows, even when misunderstood. If I can play a role in helping more people join the ecosystem and empowering them with sovereignty and security tools, that will be a mission worth remembering," Ardoino recently stated in an interview with Bitcoin News.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。